by Calculated Risk on 3/05/2011 11:52:00 AM

Saturday, March 05, 2011

Summary for Week ending March 4th

The U.S. expansion seems to be slowly improving; however there are several downside risks, notably higher oil prices. Let’s start with employment:

The BLS reported that payroll employment increased 192,000 in February and that the unemployment rate declined to 8.9%. If we average the last two months together - the 63,000 payroll jobs added in January and the 192,000 payroll jobs in February - there were 127,500 payroll jobs added per month. That is a barely enough to keep up with the growth in the labor force. Private payrolls were a little better at an average of 145,000 per month, as state and local governments continued to lay off workers (something we expect all year).

The decline in the unemployment rate from 9.0% to 8.9% was good news, especially since the participation rate was unchanged at 64.2%. More welcome news included the decreases in the number of long term unemployed, a slight decline in the number of part time workers for economic reasons, and the decline in U-6 to 15.9% - although the levels are still very high.

Some disappointing news was that the average workweek was unchanged at 34.2 hours, and average hourly earnings only ticked up 1 cent. It is interesting to note that construction has now added payroll jobs in 2011. I think construction will add payroll jobs this year for the first time since 2005.

Overall this was a small step in the right direction, but the overall employment situation remains grim: There are 7.5 million fewer payroll jobs now than before the recession started in 2007 with 13.7 million Americans currently unemployed. Another 8.3 million are working part time for economic reasons, and about 4 million more workers have left the labor force. Of those unemployed, 6 million have been unemployed for six months or more.

We were once again reminded last week of several potential downside risks to the U.S. economy as oil prices increased, and the European financial crisis is starting to make news again. Also state and local government cutbacks negatively impacted the employment report – with more to come.

A key focus remains on the Middle East and North Africa, and especially on the tragic events in Libya. These events have pushed U.S. oil prices to around $104 per barrel and have raised questions about the possible drag of higher oil prices on the U.S. economy.

The European financial crisis has been on the back burner, but yields are still elevated and there are key Euro Zone meetings scheduled in March. I expect this to be front page news again soon.

State and local governments reduced employment by 30,000 in February, and several state budgets were in the news, especially the ongoing Wisconsin political battles.

These are all risks to 2011 economic growth.

But most of the other economic news was positive. Growth in manufacturing continues to be strong. The ISM manufacturing index matched the May 2004 level - the highest since 1983, and the employment index was the highest since December 1973. The ISM non-manufacturing index index was also strong at 59.7%, with the employment index indicating faster expansion in February at 55.6%.

Auto sales continued to increase, reaching an estimated 13.44 million in February on a seasonally adjusted annual rate basis (SAAR). That is up 28% from February 2010, and up 6.8% from the sales rate last month (Jan 2011). This is the highest sales rate since August 2008, excluding Cash-for-clunkers in August 2009.

There was some weakness, construction spending declined in January (no surprise), and personal consumption expenditures in January were weak, but overall the expansion seems to be improving.

Below is a summary of economic data last week mostly in graphs:

• February Employment Report: 192,000 Jobs, 8.9% Unemployment Rate

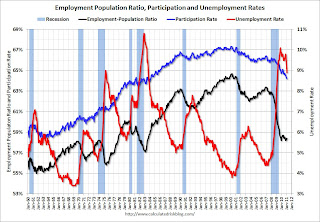

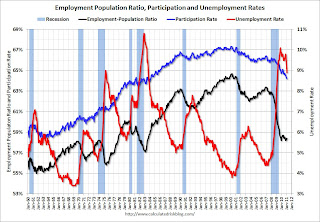

The first graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

The unemployment rate decreased to 8.9% (red line).

The Labor Force Participation Rate was unchanged at 64.2% in February (blue line). This is the lowest level since the early '80s. (This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.)

The Employment-Population ratio was unchanged at 58.4% in February (black line).

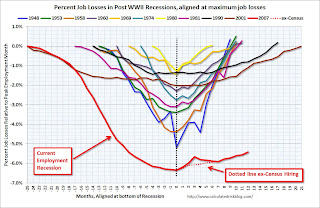

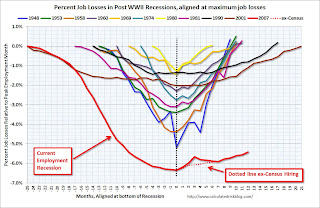

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

The third graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the start of the recession.

The third graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the start of the recession.

Here are the employment posts yesterday with graphs:

Employment Summary and Part Time Workers, Unemployed over 26 Weeks

Duration of Unemployment, Unemployment by Education, Diffusion Indexes

And some analysis on the participaton rate: Participation Rate Update

To see all the graphs: Employment Graph Gallery

• Personal Income and Outlays Report for January

This graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

This graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

Real PCE declined in January after increasing sharply in Q4. Note: The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter - so this still shows growth over Q4.

• ISM Manufacturing Index increases in February

From the Institute for Supply Management: January 2011 Manufacturing ISM Report On Business®. PMI at 61.% in February, up from 60.8% in January, matching the level in May 2004 - the highest since 1983.

From the Institute for Supply Management: January 2011 Manufacturing ISM Report On Business®. PMI at 61.% in February, up from 60.8% in January, matching the level in May 2004 - the highest since 1983.

Here is a long term graph of the ISM manufacturing index.

This was a strong report and above expectations. The new orders and employment indexes were especially strong, with employment at 64.5, the highest since January 1973.

• ISM Non-Manufacturing Index indicates expansion in February

The February ISM Non-manufacturing index was at 59.7%, up from 59.4% in January. The employment index indicated faster expansion in February at 55.6%, up from 54.5% in January. Note: Above 50 indicates expansion, below 50 contraction.

The February ISM Non-manufacturing index was at 59.7%, up from 59.4% in January. The employment index indicated faster expansion in February at 55.6%, up from 54.5% in January. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was a solid report, except for prices, and slightly above expectations of 59.5%.

• U.S. Light Vehicle Sales 13.44 million SAAR in February

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.44 million SAAR in February. That is up 28% from February 2010, and up 6.8% from the sales rate last month (Jan 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.44 million SAAR in February. That is up 28% from February 2010, and up 6.8% from the sales rate last month (Jan 2011).

This graph shows light vehicle sales since the BEA started keeping data in 1967.

This is the highest sales rate since August 2008, excluding Cash-for-clunkers in August 2009.

Note: dashed line is current estimated sales rate. The current sales rate is finally off the bottom of the '90/'91 recession - and there were fewer registered drivers and a smaller population back then.

This was well above the consensus estimate of 12.7 million SAAR. But, with rising oil prices, the automakers might be under pressure in March.

• Private Construction Spending decreased in January

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

From the Census Bureau: "Residential construction was at a seasonally adjusted annual rate of $245.6 billion in January ... Nonresidential construction was at a seasonally adjusted annual rate of $244.4 billion in January ..."

Residential spending is 64% below the peak in early 2006, and non-residential spending is 41% below the peak in January 2008.

This is the first time since December 2007 that private residential construction spending has been higher than non-residential spending. Not by much, but that is something I've been expecting.

• Other Economic Stories ...

• Prepared testimony from Fed Chairman Ben Bernanke: Semiannual Monetary Policy Report to the Congress

• ADP: Private Employment increased by 217,000 in February

• DOT: Vehicle Miles Driven increased in December

• Fed's Beige Book: Economic activity continued to expand at a modest to moderate pace.

• From Fed Chairman Ben Bernanke: Challenges for State and Local Governments

• Unofficial Problem Bank list increases to 962 Institutions

Best wishes to all!

Unofficial Problem Bank list increases to 962 Institutions

by Calculated Risk on 3/05/2011 09:08:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Mar 4, 2011.

Changes and comments from surferdude808:

It almost was a safe & sound banking week as the FDIC did not close a single institution; however, the OTS did not stop issuing enforcement actions.

This week there were one removal and three additions to the Unofficial Problem Bank List. The List now stands at 962 institutions with assets of $417.9 billion, up from 960 institutions and assets of $413.8 billion last week.

The one removal was a terminated action against The Felton Bank, Felton, DE ($81 million Ticker: SHBI), which merged without assistance into CNB, Centerville, MD.

The three additions were First Place Bank, Warren, OH ($3.2 billion Ticker: FPFC); Continental Bank, Plymouth Meeting, PA ($515 million); and First Community Bank of America, Pinellas Park, FL ($471 million Ticker: FCFL). Perhaps during the coming week there will not be a failure nor a new addition.

Friday, March 04, 2011

Misc: Oil, Gasoline, Libya

by Calculated Risk on 3/04/2011 08:17:00 PM

• Libya

From McClatchy: Huge explosion levels key Libyan rebels' arms depot

From al Jazeera: Live Blog - Libya March 5

From the NY Times: Battle in Libya for Strategic Town Kills at Least 13

• Ronald White at the LA Times: California's average gas price is highest in U.S., $3.845 a gallon

On Friday, California drivers paid an average of $3.845 for a gallon of regular gasoline, up more than 3 cents from the day before. With that increase, California became the state with the most costly gas, according to AAA's daily fuel-price survey, toppling Hawaii, which was close behind at an average price of $3.836. Alaska came in third at $3.80.Ouch. U.S. oil prices closed at $104.42 per barrel.

Here are the earlier employment posts (with graphs):

• February Employment Report: 192,000 Jobs, 8.9% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education, Diffusion Indexes

• Participation Rate Update

• Employment Graph Gallery

Participation Rate Update

by Calculated Risk on 3/04/2011 03:54:00 PM

Last year I looked at some of the cyclical and long term trends for the participation rate: Labor Force Participation Rate: What will happen?. I concluded that most of the decline in the participation rate is due to changes in demographics - not cyclical. I also noted that it is possible that long term trends, especially more older workers participating in the labor force, combined with some cyclical improvement, could push the participation rate up a little over the next few years, and then the participation rate would start declining again.

What happens to the participation rate is an important question. If the Civilian noninstitutional population (over 16 years old) grows by about 2 million per year - and the participation rate stays flat - the economy will need to add about 100 thousand jobs per month to keep the unemployment rate steady at 8.9%.

If the population grows faster (say 2.5 million per year), and/or the participation rate rises, it could take significantly more jobs per month to hold the unemployment rate steady. As an example, if the working age population grows 2.5 million per year and the participation rate rises to 65% (from 64.2%) over the next two years, the economy will need to add 200 thousand jobs per month to hold the unemployment rate steady.

That is why forecasting the participation rate is important - and why reports of the number of jobs needed to hold the unemployment rate steady are all over the place (and can be very confusing - and I'm guilty of using different numbers).

Here is a look at some the long term trends (updating graphs through February 2011):

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

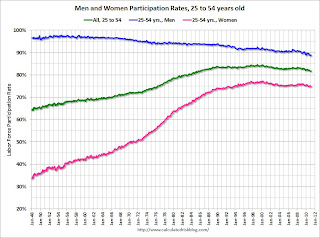

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

The participation rate for women increased significantly from the mid 30s to the mid 70s and has mostly flattened out. The participation rate for men has decreased from the high 90s to 88.8% in February 2011. (up slightly from January)

There will probably be some "bounce back" for both men and women (some of the recent decline is probably cyclical), but the long term trend for men is down.

This graph shows that participation rates for several key age groups.

This graph shows that participation rates for several key age groups.

There are a few key long term trends:

• The participation rate for the '16 to 19' age group has been falling for some time (red). This fell to a record low 33.5% in February.

• The participation rate for the 'over 55' age group has been rising since the mid '90s (purple), although this has stalled out a little recently (perhaps cyclical).

• The participation rate for the '20 to 24' age group fell recently too (perhaps more education before joining the labor force). I expect the sharp decline over the last couple of years to turn around quickly as the job market improves.

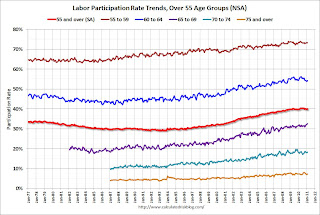

The third graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The third graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The participation rate is generally trending up for all older age groups. And this might push the overall participation rate up over the next 5 years. After that the 'over 55' participation rate will probably start to decline as the oldest baby boomers move into even older age groups.

I've been expecting some small bounce back in the participation rate, but my guess last year was probably too high. I know some analysts who think that it will just stay flat for a few years before declining again. This will be a key number to watch over the next few years.

Here are the earlier employment posts (with graphs):

• February Employment Report: 192,000 Jobs, 8.9% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Duration of Unemployment, Unemployment by Education, Diffusion Indexes

• Employment Graph Gallery

Duration of Unemployment, Unemployment by Education, Diffusion Indexes

by Calculated Risk on 3/04/2011 01:35:00 PM

By request, here are a few more graphs ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

In general, all four categories are trending down. The less than 5 week category appears to be back to normal (fits with the initial weekly claims data).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are now trending down.

This is a little more technical. The BLS diffusion index for total private employment was at 68.2 in February, the highest level since May 1998. For manufacturing, the diffusion index decreased to 64.2.

This is a little more technical. The BLS diffusion index for total private employment was at 68.2 in February, the highest level since May 1998. For manufacturing, the diffusion index decreased to 64.2. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The level of both indexes was a clear positive in the February employment report.

What we want is a large number of high paying jobs added each month, spread across many industries. What we got was some improvement in jobs added, although not high paying jobs - but fairly widespread.

Best to all

Here are the earlier employment posts (with graphs):

• February Employment Report: 192,000 Jobs, 8.9% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Employment Graph Gallery

Employment Summary and Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 3/04/2011 10:25:00 AM

Here are a few more graphs based on the employment report ...

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the start of the recession.

In the previous post, the graph showed the job losses aligned at maximum job losses.

In terms of lost payroll jobs, the 2007 recession is by far the worst since WWII, and the "recovery" for payroll jobs is one of the slowest.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 8.3 million in February. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined slightly to 8.34 million in February from 8.407 million in January.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 15.9% in February from 16.1% in January. Still very high, but improving.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.993 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 6.21 million in January. This is still very high.

Summary

This wasn't a great report. Heck, it wasn't a "good" report. But it was a little better than most recent reports.

If we average the last two months together, the 63,000 payroll jobs added in January and the 192,000 payroll jobs in February, that gives 127,500 payroll jobs per month. And that is a barely enough to keep up with the growth in the labor force. Private payrolls were a little better at an average of 145,000 per month, as state and local governments continued to lay off workers (something we expect all year).

The decline in the unemployment rate from 9.0% to 8.9%, was good news, especially since the participation rate was unchanged at 64.2%. Note: This is the percentage of the working age population in the labor force.

The decreases for the long term unemployed, and for the number of part time workers for economic reasons, and the decline in U-6 to 15.9% is all welcome news - although the levels are still very high.

The average workweek was unchanged at 34.2 hours, and average hourly earnings ticked up 1 cent. Both disappointing.

It is interesting to note that construction has now added payroll jobs in 2011. I think construction will add payroll jobs this year for the first time since 2005.

Overall this was a small step in the right direction.

• Earlier Employment post: February Employment Report: 192,000 Jobs, 8.9% Unemployment Rate

February Employment Report: 192,000 Jobs, 8.9% Unemployment Rate

by Calculated Risk on 3/04/2011 08:30:00 AM

From the BLS:

Nonfarm payroll employment increased by 192,000 in February, and the unemployment rate was little changed at 8.9 percent, the U.S. Bureau of Labor Statistics reported today.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

...

The change in total nonfarm payroll employment for December was revised from +121,000 to +152,000, and the change for January was revised from +36,000 to +63,000.

Click on graph for larger image.

Click on graph for larger image.The unemployment rate decreased to 8.9% (red line).

The Labor Force Participation Rate was unchanged at 64.2% in February (blue line). This is the lowest level since the early '80s. (This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.)

The Employment-Population ratio was unchanged at 58.4% in February (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring. The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was about at expectations for payroll jobs. Adding January and February together gives 255,000 jobs or about 127 thousand per month. I'll have much more soon ...

Thursday, March 03, 2011

Misc: Fed Watch, Merle Hazard, Employment and more

by Calculated Risk on 3/03/2011 10:00:00 PM

• Earlier Employment Situation Preview: Some Improvement, but Still Grim.

• From Tim Duy's Fed Watch: Game Changers?

All in all, incoming data reinforce my sense that the upside and downside risks to the forecast are intensifying, which could make for a very interesting few months. ... The possibility of some real game changing developments is at hand. At this moment, I think the balance of risks are now on the upside, but am very, very conscious of how quickly that balance can change in the wake of a commodity price shock. I would be wary about letting the depth of this recession interfere with your read of the data, just as wary as you should be about letting the data tempt you from thinking it is time to push stimulative policies into reverse.CR: There are several downside risks: higher oil prices or even a supply shock, the European financial crisis, state and local government fiscal issues, and two sides of the inflation coin (inflation spreads or policymakers overreact). We live in interesting times!

• Some interesting thoughts on retail space, from the WSJ: As Big Boxes Shrink, They Also Rethink

Major big-box retailers have been shifting to smaller stores—and scratching around for more profitable ways to fill under-used spaces as they go about reinventing themselves.• Last month Paul Solman at PBS NewsHour Making Sen$e had a lyric contest. Here is the song from Merle Hazard to Paul Simon's The 59th Street Bridge Song (Feelin' Groovy)

Some are becoming landlords, turning excess space over to other businesses.

Hotels: RevPAR up 12.1% compared to same week in 2010

by Calculated Risk on 3/03/2011 07:23:00 PM

• Earlier Employment Situation Preview: Some Improvement, but Still Grim. Note: Several analysts have upped their forecasts this afternoon.

Here is the weekly update on hotels from HotelNewsNow.com: STR: Orlando reports strong weekly increases

Overall, the U.S. hotel industry’s occupancy increased 8.4% to 59.9%, ADR was up 3.4% to US$99.38, and RevPAR finished the week up 12.1% to US$59.54.Note: RevPAR: Revenue per Available Room.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate.

The occupancy rate really fell off a cliff in the 2nd half of 2008, and then 2009 was the worst year for the occupancy rate since the Great Depression. The occupancy rate started to improve in the Spring of 2010, and was above the 2008 rates later in the year.

The occupancy rate was fairly low in January and February, but appears to be improving recently.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Update on European Financial Crisis and Bond Yields

by Calculated Risk on 3/03/2011 04:47:00 PM

The European financial crisis has been simmering in the background, but will probably become front page news again this month. There are several meetings schedule in March, starting tomorrow in Helsinki, and then a special eurozone debt crisis summit on March 11th.

Also the European Banking Authority has now launched the next round of bank stress tests.

The EBA’s Board of Supervisors agreed to launch the 2011 EU-wide stress testing exercise with National Supervisory Authorities on 4 March 2011. The stress test, which will be conducted on a large number of European banks, involves a series of detailed technical steps and, as a consequence, will take several months to run. It will be run against a baseline and an adverse macro economic scenario in order to assess the solvency of the banks involved in the exercise against hypothetical adverse economic events. The adverse macro-economic scenario, designed by the ECB, will incorporate a significant deviation from the baseline forecast and country-specific shocks on real estate prices, interest rates and sovereigns. This is in line with the EBA’s micro-prudential objective of analysing institution-specific prudential soundnessAnd I should mention that European Central Bank President Jean-Claude Trichet said today "Strong vigilance is warranted with a view to contain upside risks to price stability." and many view that wording as suggesting a rate hike is coming at the next meeting.

The EBA will provide the banks with details of the scenarios by the end of this week, after which there will be a period of discussion and feedback. The EBA plans to publish the macro-economic scenarios along with the sample of banks involved, on 18 March 2011. ... the EBA anticipates being able to publish the broad principles of the stress test methodology in April. Following a vigorous peer review, the EBA will publish the final results of the exercise in June.

Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of March 2nd):

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the Atlanta Fed:

Most peripheral European bond spreads (over German bonds) continue to be elevated, particularly those of Greece, Ireland, and Portugal.Here are the Ten Year yields for Ireland, Portugal, Spain, Greece, and Belgium (ht Nemo) All moving up some more today ...

Since the January FOMC meeting, the 10-year Greece-to-German bond spread has widened by 102 basis points (bps), through March 1. Similarly, the spread for Ireland is 37 bps higher; it is 39 bps wider for Portugal but has actually declined somewhat for Spain.