by Calculated Risk on 1/24/2011 05:54:00 PM

Monday, January 24, 2011

Political Grandstanding

There have been a few recent "policy" discussions that I haven't mentioned - because they are all about political posturing with no real substance.

A couple of examples:

• The Debt Ceiling. The deficit and the debt are real issues, but the "debt ceiling" debate is political posturing. Professor Hamilton recently wrote: Debt ceiling politics

If you have a concrete proposal to raise tax revenue or cut spending, then put it on the table. But if you simply want to grandstand on the debt ceiling as if it were a stand-alone issue, it is clear that you have nothing but contempt for the voters.• A recent article in the NY Times about "discussions" on state bankruptcies. Not Gonna Happen. Economix has California’s state treasurer, Bill Lockyer response: State Bankruptcies? ‘Ludicrous,’ He Says

“It’s a cynical proposal, intended to incite a panic in response to a phony crisis,” Mr. Lockyer said in a conference call with journalists. “Killer bees, space aliens, and now it’s the invasion of the bankrupt states.”The state budget issues are serious. And the U.S. debt and deficit issues are serious too. But I've ignored the "debt ceiling" and "state bankruptcy" discussions for a reason - they are nonsense.

Regarding the FOMC: How long is an "Extended Period"?

by Calculated Risk on 1/24/2011 03:33:00 PM

This is an update to a post I wrote in April 2010. Once again people are asking if the Fed will raise rates this year? It is unlikely.

That reminds me of a question Catherine Rampell at the NY Times Economix asked: How Long Is an ‘Extended Period’?

My short answer: Longer than many analysts expect.

We can compare to the "considerable period" language in 2003:

• June 25, 2003: Lowered Rate to 1%, Unemployment Rate peaked at 6.3%So "extended period" is probably 6+ months after the language changes. The FOMC will meet this week, and there has been no hint that the "extended period" language will change. The next meeting will be on March 15th and the next two day meeting is near the end of April.

• August 12, 2003: “the Committee believes that policy accommodation can be maintained for a considerable period.” Unemployment rate at 6.1%

• December 9, 2003: Last statement using the phrase "considerable period". Unemployment rate at 5.7%

• January 28, 2004: the Committee believes that it can be patient in removing its policy accommodation. Unemployment Rate 5.7%

• May 4, 2004: “the Committee believes that policy accommodation can be removed at a pace that is likely to be measured.” Unemployment Rate 5.6%

• June 30, 2004: FOMC raised the Fed Funds rate 25 bps. Unemployment Rate 5.6%

Based on past experience - as I noted last year - it is unlikely the Fed will raise rates until the unemployment rate is below 8%, and therefore I think it is very unlikely the Fed will raise rates this year.

Moody's: Commercial Real Estate Prices increased 0.6% in November

by Calculated Risk on 1/24/2011 11:37:00 AM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index increased 0.6% in November. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales and there are a large percentage of distressed sales - and that can impact prices and make the index very volatile.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are up 2.8% from a year ago and down about 42% from the peak in 2007.

CoStar reported that CRE prices declined in November, and that the commercial market is bifurcated (even trifurcated) with trophy properties doing well, but prices for other properties still declining.

DOT: Vehicle Miles Driven increased in November

by Calculated Risk on 1/24/2011 10:40:00 AM

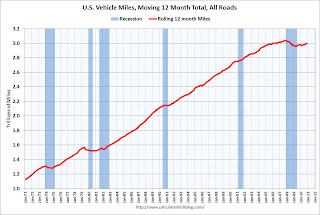

The Department of Transportation (DOT) reported that vehicle miles driven in November were up 1.1% compared to November 2009:

Travel on all roads and streets changed by 1.1% (2.6 billion vehicle miles) for November 2010 as compared with November 2009. Travel for the month is estimated to be 241.8 billion vehicle miles.

Cumulative Travel for 2010 changed by 0.7% (19.0 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the rolling 12 month total vehicle miles driven.

On a rolling 12 month basis, vehicle miles driven have only increased 1.2% from the bottom of the recession.

Miles driven are still 1.3% below the peak in 2007. This is another indicator of a sluggish recovery.

Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 36 months - another record that will be broken soon.

Survey: Sales of Distressed Homes increased in December

by Calculated Risk on 1/24/2011 09:00:00 AM

From Campbell/Inside Mortgage Finance HousingPulse: Distressed Property Index Surged in December

One of the biggest developments in December was a sharp jump in the HousingPulse Distressed Property Index or DPI ... Last month’s DPI was 47.2% and reflected the share of total home sale transactions that involved distressed properties. December’s level was up from 44.5% in November and nearly matched the 47.5% peak in the index reached in September ...The NAR reported an increase in distressed sales in December too:

Distressed property sales were not distributed evenly around the country. In California, a state hit hard by the foreclosure crisis, an incredible 66% of all transactions tracked in December involved distressed properties. The combined area of Arizona and Nevada similarly suffered, with 62% of transactions being distressed. However, in the oil-producing states of Texas, Oklahoma, and Louisiana, only 29% of transactions were distressed.

...

Campbell Surveys predicts the surge in home buying may not last. “January and February are typically the slowest months of the year for home buying,” explained Popik. “And we’ll still have a backlog of foreclosed homes coming on the market during the winter, so prices may come under pressure, too.”

Distressed homes rose to a 36 percent market share in December from 33 percent in November, and 32 percent in December 2009.There will probably be more distressed sales in a few months as banks resume foreclosures.

Sunday, January 23, 2011

Housing Bust and Mobility

by Calculated Risk on 1/23/2011 09:36:00 PM

Here is topic we've been discussing for several years ...

From Douglas Hanks at the Miami Herald: S. Florida job-market mobility stuck at home

[Joe] Farkas, 53, sees his underwater mortgage as something of a career anchor, too. He would pursue jobs across the country if it weren't for the financial hit he'd take by selling the house for a loss.As I wrote several years ago, less worker mobility is kind of like arteriosclerosis of the economy. It lowers the overall growth potential. And how about this comment:

``There would be a lot more for me to choose from, a lot more for me to pursue,'' said Farkas ...

``I've had discussions with people who say, I'm willing to [relocate],'' said Berger, senior vice president of client relations for Octagon Technology Staffing. The first question I ask is: `How long have you owned your home?' If it's since '99, great. If it's 2005, that's a problem.''This mobility problem will be with us for years.

Earlier:

• Here is the busy economic schedule for the coming week.

• Here is the Summary of last week

FOMC Preview

by Calculated Risk on 1/23/2011 02:33:00 PM

There will be a two day meeting of the Federal Open Market Committee (FOMC) on Tuesday and Wednesday of the coming week. The FOMC statement will be released on Wednesday around 2:15 PM ET, and I expect no changes to the Fed Funds rate, or to the program to reinvest principal payments, or to the Large Scale Asset Purchase program (LSAP, aka "QE2").

The only questions are: 1) will the statement will be more positive than in December, and 2) how many members, if any, will dissent.

• The key portions of the December statement will remain the same. I don't expect the sentence "likely to warrant exceptionally low levels for the federal funds rate for an extended period" to be changed any time soon. There might be some minor changes to the first paragraph to mention the recent improvement in economic data, but the second and third paragraphs will probably remain the same as in December:

... Currently, the unemployment rate is elevated, and measures of underlying inflation are somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. ...• The voting committee members will change this month, and there may be more dissenting votes. The regional Federal Reserve Bank presidents serve one-year terms as voting members of the FOMC on a rotating basis (the NY Fed president is a permanent voting member).

... The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month. ...

This means Kansas City Fed president Thomas M. Hoenig will not be a voting member this year. Hoenig was the lone dissenting vote at every meeting in 2010.

Regional voting members this year include Charles L. Evans, Chicago, Richard W. Fisher, Dallas, Narayana Kocherlakota, Minneapolis and Charles I. Plosser, Philadelphia. Both Plosser "The Scope and Responsibilities of Monetary Policy" and Fisher "The Limits of Monetary Policy" have expressed reservations about QE2. So there might be two dissenting votes this week.

Summary for Week ending January 22nd

by Calculated Risk on 1/23/2011 05:05:00 AM

Note: here is the busy economic Schedule for Week of January 23rd.

Below is a summary of the previous week, mostly in graphs.

• December Existing Home Sales: 5.28 million SAAR, 8.1 months of supply

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December 2010 (5.28 million SAAR) were 12.3% higher than last month, and were 2.9% lower than December 2009.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Although inventory decreased from November to December, inventory increased 8.4% YoY in December. This is the largest year-over-year increase in inventory since January 2008 and this is something to watch closely over the next few months.

Although inventory decreased from November to December, inventory increased 8.4% YoY in December. This is the largest year-over-year increase in inventory since January 2008 and this is something to watch closely over the next few months.

The bottom line: Sales rebounded in December to just above Tom Lawler's forecast. This was probably due to a combination of low mortgage rates, falling house prices - especially for distressed properties, and investor buying at the low end.

Inventory remains very high, and the year-over-year increase in inventory is very concerning.

• Housing Starts Declined in December

Total housing starts were at 529 thousand (SAAR) in December, down 4.3% from the revised November rate of 553 thousand, and up 11% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 529 thousand (SAAR) in December, down 4.3% from the revised November rate of 553 thousand, and up 11% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts decreased 9.0% to 417 thousand in December - the lowest level since early 2009.

This graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with slight ups and downs due to the home buyer tax credit.

There was an increase in permits, especially for multi-family units.

• AIA: Architecture Billings Index highest since December 2007

The American Institute of Architects (AIA) reported the December ABI score was 54.2, up from a reading of 52.0 in November. This graph shows the Architecture Billings Index since 1996. The index showed expansion in December (above 50) and this is the highest level since December 2007.

The American Institute of Architects (AIA) reported the December ABI score was 54.2, up from a reading of 52.0 in November. This graph shows the Architecture Billings Index since 1996. The index showed expansion in December (above 50) and this is the highest level since December 2007.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end mid-year or so.

• NAHB Builder Confidence Remains Unchanged In January

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged at 16 in January.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts.

This shows that the HMI and single family starts mostly move in the same direction although there is plenty of noise month-to-month. The HMI has mostly moved sideways - with some minor ups and downs - for over 2 years at a very depressed level.

• Other Economic Stories ...

• NMHC: Is the recovery real for apartments?

• Apartments: "Consensus has a high price"

• From the NY Fed Empire State Manufacturing Index shows "conditions improved" in January

• From the Philly Fed: January 2011 Business Outlook Survey

• From David Leonhardt at Economix: The Deficit We Want

• A hint of good employment news?

• Unofficial Problem Bank list increases to 937 Institutions

Best wishes to all!

Saturday, January 22, 2011

Schedule for Week of January 23rd

by Calculated Risk on 1/22/2011 06:27:00 PM

The key economic report for the coming week is the Q4 advance GDP report to be released on Friday. There are also two important housing reports to be released early in the week: Case-Shiller house prices on Tuesday, and New Home sales on Wednesday. There is also a two day FOMC meeting ending on Wednesday.

Morning: Moody's/REAL Commercial Property Price Index (CPPI) for November.

9:00 AM: S&P/Case-Shiller Home Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November. The consensus is for prices to decline about 1.0% in November; the fifth straight month of house price declines.

This graph shows the seasonally adjusted Composite 10 and Composite 20 indices through October (the Composite 20 was started in January 2000).

This graph shows the seasonally adjusted Composite 10 and Composite 20 indices through October (the Composite 20 was started in January 2000).Prices are falling again, although still above the lows set in early 2009. The Composite 20 index should be close to the post-bubble low in November.

10:00 AM Regional and State Employment and Unemployment (Monthly) for December 2010

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January. The consensus is for the index to be slightly lower than last month at 22 (above zero is expansion).

10:00 AM: 10:00 FHFA House Price Index for November. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Conference Board's consumer confidence index for January. The consensus is for an increase to 54.2 from 52.5 last month.

9:00 PM: 2011 State of the Union Address

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index increased slightly at the end of last year, and has declined slightly early this year.

10:00 AM: New Home Sales for December from the Census Bureau. The consensus is for an increase in sales to 300 thousand (SAAR) in December from 290 thousand in November.

This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

This graph shows New Home Sales since 1963. The dashed line is the current sales rate.New home sales collapsed in May and have averaged only 289 thousand (SAAR) over the last seven months. Prior to the last seven months, the record low was 338 thousand in Sept 1981.

2:15 PM: FOMC Meeting Announcement. No changes are expected to either interest rates or QE2.

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last few months. The consensus is for a slight increase to 409 thousand compared to 404 thousand last week.

8:30 AM ET: Chicago Fed National Activity Index (December). This is a composite index of other data.

8:30 AM: Durable Goods Orders for December from the Census Bureau. The consensus is for a 1.5% decrease in durable goods orders after decreasing 1.3% in November.

10:00 AM: Pending Home Sales Index for December. The consensus is for a 1% increase in contracts signed. It usually takes 45 to 60 days to close, so this will provide an early indication of closings in February.

11:00 AM: Kansas City Fed regional Manufacturing Survey for January. The index was at 21 in December.

8:30 AM: Q4 GDP (advance release). This is the advance release from the BEA, and the consensus is that real GDP increased 3.5% annualized in Q4.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for January). The consensus is for an increase to 73.1 from the preliminary reading of 72.7.

Best Wishes to All!

EU's Juncker: Not Taboo for Greece and others to buy-back debt

by Calculated Risk on 1/22/2011 02:39:00 PM

From Reuters: Don't rule out debt buy-back idea: Juncker (ht Rajesh)

European leaders should not shy away from a proposal to buy back the bonds of troubled euro member states but should not rely too much on rich countries, Eurogroup Chief Jean-Claude Juncker said.I'm not sure if this proposal will go anywhere, but many analysts like the idea of Greece buying their debt with money from EFSF.

"It would be wrong to create taboos but we cannot overstretch the strong countries," Juncker said in an interview with German magazine Der Spiegel seen by Reuters on Saturday ahead of publication.