by Calculated Risk on 1/22/2011 08:42:00 AM

Saturday, January 22, 2011

Unofficial Problem Bank list increases to 937 Institutions

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 21, 2011.

Changes and comments from surferdude808:

The OCC finally released its actions through the middle of December 2010 as we have been waiting for the past two weeks. By and large, the OCC actions were the conversion of Formal Agreements to Consent Orders for six national banks with only one new entrant. The major changes this week result from the publication of nine actions issued by the Illinois Department of Financial & Professional Regulation. We applaud the transparency of the Illinois Department as they are the only state banking authority that publishes its safety & soundness enforcement actions against banks.

This week there are 11 additions and seven removals. The changes result in the Unofficial Problem Bank List having 937 institutions with assets of $409.4 billion, compared with 933 institutions and assets of $410.4 billion last week.

The seven removals include the four failures this week -- United Western Bank, Denver, CO ($2.1 billion Ticker: UWBK); CommunitySouth Bank and Trust, Easley, SC ($441 million Ticker: CBSO); The Bank of Asheville, Asheville, NC ($195 million Ticker: WFSC); and Enterprise Banking Company, McDonough, GA ($101 million). The other removals are Pacific Valley Bank, Salinas, CA ($172 million Ticker: PVBK), which announced in a press release that the FDIC had terminated its Consent Order and two problem banks that were acquired in unassisted transactions in December 2010 -- First National Bank of Chester County, West Chester, PA ($1.1 billion); and ShoreBank, Pacific, Ilwaco, WA ($180 million).

The new additions from the OCC and OTS are Amfirst Bank, National Association, McCook, NE ($254 million); and The Oculina Bank, Fort Pierce, FL ($133 million), respectively. The Illinois Department issued actions against Edens Bank, Wilmette, IL ($259 million); and eight banking subsidiaries of Metropolitan Bank Group, Inc. -- Archer Bank, Chicago, IL ($608 million); North Community Bank, Chicago, IL ($502 million); Plaza Bank, Norridge, IL ($374 million); Metropolitan Bank and Trust Company, Chicago, IL ($323 million); Chicago Community Bank, Chicago, Il ($297 million); The First Commercial Bank, Chicago, IL ($278 million); Citizens Community Bank of Illinois, Berwyn, IL ($218 million); and Community Bank of DuPage, Downers, IL ($61 million).

Next week, we anticipate for the FDIC to release its actions for December 2010, until then try to practice safe banking.

Friday, January 21, 2011

Report: Fannie-Freddie Report to be released mid-February

by Calculated Risk on 1/21/2011 09:17:00 PM

From Nick Timiraos at the WSJ: Fannie-Freddie Report Likely to Be Late

The administration now plans to release the report by mid-February ... once a final report is released it is likely to contain two or three proposals for what should replace Fannie and Freddie ...There is no easy solution. Some limited and explicit guarantee is probably what will happen.

One of the proposals will outline a way for the government to continue backing certain mortgage-backed securities, while another will discuss how to structure a market with no government guarantees. ... any transition period could take between 15 and 20 years, according to Barclays.

Bank Failure #7 for 2011: United Western Bank, Denver, Colorado

by Calculated Risk on 1/21/2011 07:11:00 PM

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of United Western Bank, Denver, Colorado

As of September 30, 2010, United Western Bank had approximately $2.05 billion in total assets and $1.65 billion in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $312.8 million. .... United Western Bank is the seventh FDIC-insured institution to fail in the nation this year, and the first in Colorado.That makes four today - and this one with two billion in assets.

Bank Failure #4 to #6 in 2011

by Calculated Risk on 1/21/2011 06:09:00 PM

From the FDIC: FDIC Creates the Deposit Insurance National Bank of McDonough to Protect Insured Depositors of Enterprise Banking Company, McDonough, Georgia

As of September 30, 2010, Enterprise Banking Company had $100.9 million in total assets and $95.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $39.6 million. Enterprise Banking Company is the fourth FDIC-insured institution to fail in the nation this year, and the second in Georgia.From the FDIC: Certusbank, National Association, Easley, South Carolina, Assumes All of the Deposits of CommunitySouth Bank and Trust, Easley, South Carolina

As of September 30, 2010, CommunitySouth Bank and Trust had approximately $440.6 million in total assets and $402.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $46.3 million. ... CommunitySouth Bank and Trust is the fifth FDIC-insured institution to fail in the nation this year, and the first in South Carolina.From the FDIC: First Bank, Troy, North Carolina, Assumes All of the Deposits of the Bank of Asheville, Asheville, North Carolina

As of September 30, 2010, The Bank of Asheville had approximately $195.1 million in total assets and $188.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $56.2 million. ... The Bank of Asheville is the sixth FDIC-insured institution to fail in the nation this year, and the first in North Carolina.No buyer for Enterprise Banking ...

Europe: Merle Hazard on PBS Next Week

by Calculated Risk on 1/21/2011 04:26:00 PM

Merle will be performing on PBS Making Sense with Paul Solman next week. He has written several songs about European countries. Should be fun ...

Monday: Spain

Tuesday: Ireland

Wednesday: Italy

Thursday: Germany

Friday: Greece

Hotels: RevPAR up 7.6% compared to same week in 2010

by Calculated Risk on 1/21/2011 12:55:00 PM

The last four weeks have been tough for hotel occupancy with only a small increase over the very low levels for the same period a year ago (includes the holidays). Here is the weekly update on hotels from HotelNewsNow.com: STR: US results for week ending 15 Jan.

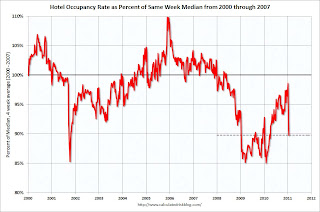

In year-over-year comparisons, occupancy increased 4.5 percent to 49.9 percent, average daily rate was up 3.0 percent to US$97.59, and revenue per available room finished the week up 7.6 percent to US$48.70.The following graph shows the four week moving average of the occupancy rate as a percent of the median occupancy rate from 2000 through 2007.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Note: I've changed this graph. Since this is the percent of the median from 2000 to 2007, the percent can be greater than 100%.

The down spike in 2001 was due to 9/11. The up spike in late 2005 was hurricane related (Katrina and Rita). The dashed line is the current level.

This shows how deep the slump was in 2009 compared to the period following the 2001 recession. This also shows the occupancy rate improvement has slowed sharply over the last 4 weeks (only about 90% of the median from 2000 to 2007).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

A hint of good employment news?

by Calculated Risk on 1/21/2011 11:17:00 AM

Twice a month Gallup polls approximately 30,000 adults on unemployment. This survey is Not Seasonally Adjusted (NSA).

Before I get to the data, this is a reminder that the employment series really needs a seasonal adjustment. Every year, even in good employment years, the U.S. economy loses 2.5 to 3.0 million payroll jobs (net) in January. This is because of various seasonal factors, like seasonal retail layoffs, and the headline BLS report is seasonally adjusted (SA).

A good example is the strong employment period from 1995 through 2000. Over those 6 years, U.S. payroll jobs declined 2.6 million on average every January (NSA), and the BLS reported a gain of just under 200 thousand jobs on average (SA). Quite a seasonal factor!

The same pattern is evident in the unemployment rate; the NSA rate is always sharply higher than the SA rate in January. So keep that in mind when looking at the following from Gallup: U.S. Unemployment Steady at 9.6% in Mid-January

Unemployment, as measured by Gallup without seasonal adjustment, remained at 9.6% in mid-January, the same as at the end of December. This marks a one-percentage-point improvement from 10.6% in mid-January 2010.This suggests a sharp drop in the seasonally adjusted unemployment rate in January (although the timing and methods are different between the two surveys).

In January 2010, the BLS reported the unemployment rate as 10.6% (NSA) and the headline was 9.7% (SA). Gallup also reported the NSA rate at 10.6% for the mid-January 2010.

If the Gallup poll is even close, then the headline seasonally adjusted BLS number might be well below the 9.4% reported last month. Of course if the unemployment rate declines because the participation rate falls further - that isn't really good news.

Use this with caution. There isn't much of a track record of using the Gallup survey to predict the BLS report. But it might be a hint of good news.

BofA: $1.2 Billion Q4 Loss

by Calculated Risk on 1/21/2011 08:51:00 AM

From Nelson Schwartz at the NY Times DealBook: Bank of America Posts 4th-Quarter Loss of $1.2 Billion

The earnings report was complicated by a series of one-time gains and losses, most notably a $4.1 billion charge for mortgage repurchase claims, including the impact of an agreement late last month with Fannie Mae and Freddie Mac, the government-sponsored mortgage giants, to buy back troubled loans. In addition, Bank of America took a noncash charge of $2 billion to reflect a write-down of goodwill on its acquisition of Countrywide ...Here is some information from the presentation on foreclosures:

Foreclosures

• Resumed foreclosure sales in most non-judicial states in early December, starting with vacant and non-owner occupied properties; expect to resume sales in remaining states in 1Q11

• Maintaining a deliberate and phased approach

• Remain committed to ensure no property is taken to foreclosure improperly

• Review of our foreclosure process shows the basis for our decisions has been accurate

• Process areas identified for improvement

Delinquency Statistics for Completed Foreclosure Sales

• 78% of borrowers had not made a mortgage payment for more than one year

• Average of 585 days in delinquent status (approximately 19 months)

Thursday, January 20, 2011

Leonhardt: The Deficit We Want

by Calculated Risk on 1/20/2011 09:10:00 PM

David Leonhardt reviews some choices on reducing the deficit at Economix: The Deficit We Want

Here is the story on the polls Leonhardt discusses: Poll Finds Wariness About Cutting Entitlements

In some ways, this is a common story. When people are asked to choose between cutting spending or raising taxes, they want to cut spending.

Not surprisingly, when given a straight-up choice between broad spending cuts and tax increases, Americans say they would prefer to reduce the deficit mostly through less spending. It’s not even close: 62 percent for spending cuts, 29 percent for tax increases.But there is overwhelming support for individual programs:

A few questions later, though, our pollsters offered a different choice. Would people rather eliminate Medicare’s shortfall through reduced Medicare benefits or higher taxes?This is a huge disconnect.

The percentages then switch, becoming nearly a mirror image of what they had been. Some 64 percent of respondents preferred tax increases, while 24 percent chose Medicare cuts. The same is true of Social Security: 63 percent for higher taxes, 25 percent for reduced benefits.

Herein lies the political problem. We want to cut spending. We just don’t want to cut the benefits that the spending pays for.

Note: Medicare is a huge problem, as is the current General Fund structural deficit that requires either tax increases or probably cuts in defense spending. As Leonhardt notes, Social Security is a minor problem in comparison.

Market Update

by Calculated Risk on 1/20/2011 05:15:00 PM

I haven't posted this graph in some time ...

From Doug Short: Current Market Snapshot: S&P 500 Closes Down But Well off the Intraday Low

The S&P 500 closed the day down 0.13%. The index is 89.2% above the March 9 2009 closing low, which puts it 18.2% below the nominal all-time high of October 2007.

Earlier on Existing Home sales:

• December Existing Home Sales: 5.28 million SAAR, 8.1 months of supply

• Existing Home Inventory increases 8.4% Year-over-Year in December