by Calculated Risk on 4/28/2010 04:55:00 PM

Wednesday, April 28, 2010

How long is an "Extended Period"?

Catherine Rampell at the NY Times Economix asks: How Long Is an ‘Extended Period’?

Short answer: Longer than many analysts expect.

First we can compare to the "considerable period" language in 2003:

So "extended period" is probably 6+ months after the language changes - the next meeting is June 23rd and 24th, so the earliest rate hike would probably be in December (barring a significant pickup in inflation or rapid decline in unemployment).June 25, 2003: Lowered Rate to 1%, Unemployment Rate peaked at 6.3% August 12, 2003: “the Committee believes that policy accommodation can be maintained for a considerable period.” Unemployment rate at 6.1% December 9, 2003: Last statement using the phrase "considerable period". Unemployment rate at 5.7% January 28, 2004: the Committee believes that it can be patient in removing its policy accommodation. Unemployment Rate 5.7% May 4, 2004: “the Committee believes that policy accommodation can be removed at a pace that is likely to be measured.” Unemployment Rate 5.6% June 30, 2004: FOMC raised the Fed Funds rate 25 bps. Unemployment Rate 5.6%

Last September I wrote: Fed Funds and Unemployment Rate. Here is an excerpt with an updated graph:

Click on graph for larger image in new window.

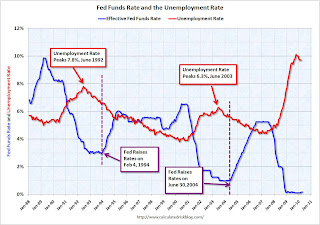

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, if we assume the unemployment rate peaked in October 2009 - and add 18 months - then the Fed would probably wait until early 2011 to raise rates (at the earliest). My guess is the Fed will probably wait until the unemployment rate is closer to 9% before removing the "extended period" language, and it is unlikely they will raise rates until the unemployment rate is below 8%.