by Calculated Risk on 6/27/2010 11:40:00 AM

Sunday, June 27, 2010

Weekly Summary and a Look Ahead

The key economic report this week will be the June Employment Report to be released on Friday. It will be a busy week ...

On Monday, the BEA will release the May Personal Income and Outlays report. The consensus is for a 0.5% increase in income, and a 0.2% increase in spending. Also on Monday, the May Chicago Fed National Activity Index will be released at 8:30 AM. This is a composite index of other data.

On Tuesday, the April Case-Shiller house price index will be released at 9:00 AM. The consensus is for a slight decline in the house price index. At 10:00 AM, the Conference Board will release Consumer Confidence for June (consensus is for about the same as in May or 63.3).

On Wednesday, the ADP employment report will be released (consensus is for an increase of 60K private sector jobs, up from 55K in May). Also on Wednesday, the Chicago Purchasing Managers Index for June will be released. Consensus is for the PMI to be about the same as May, or 59.7.

Also on Wednesday, Altanta Fed President will speak to the Rotary Club of Baton Rouge at 1 PM ET on the economic outlook.

On Thursday, the closely watched initial weekly unemployment claims will be released. Consensus is for a decline to 450K from 457K last week. The automakers will report vehicle sales for June. Expectations are for about a 11.4 million SAAR for light vehicles in June – down slightly from the 11.6 million rate in May. Some forecasts are even lower, from Edmunds:

Edmunds.com forecasts June's Seasonally Adjusted Annualized Rate (SAAR) will be 11.2 million, down from 11.6 million in May, which was a weak month.Also on Thursday, at 10 AM, the ISM Manufacturing index for June will be released (expectations are for a decrease to 59.0 from 59.7 in May) and Construction Spending for April (consensus is for a slight decline in spending).

Also on Thursday, the NAR will release May Pending Home sales at 10 AM. The consensus is for a decline of around 15%. Take the under! Economist Tom Lawler writes:

[M]y “best guess” estimate is that pending sales in May will be down about 35% from April.And on Friday, the BLS will release the June Employment report at 8:30 AM. The consensus is for a loss of 100K payroll jobs in June, and for the unemployment rate to increase slightly to 9.8% (from 9.7%). Of course the minus 100K includes a substantial decline in the number of temporary hires for Census 2010 (May was the peak month). It will be important to remove the Census hiring to try to determine the underlying trend. Consensus is around a gain of 150K payroll jobs ex-Census. (see Employment Report Preview for more).

Also on Friday, the American Bankruptcy Institute will probably report personal bankruptcy filings for June. This will probably show another "surge" in filings.

And Friday afternoon will be another BFF (Bank Failure Friday) ...

And a summary of last week:

The Census Bureau reported that New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 300 thousand.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows New Home Sales vs. recessions for the last 45 years.

Sales of new single-family houses in May 2010 were at a seasonally adjusted annual rate of 300,000 ... This is 32.7 percent (±9.9%) below the revised April rate of 446,000 and is 18.3 percent (±13.0%) below the May 2009 estimate of 367,000.The 300 thousand annual sales rate is a new all time record low. The previous record low annual sales rate was 338 thousand in September 1981.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in May 2010 (5.66 million SAAR) were 2.2% lower than last month, and were 19.2% higher than May 2009 (4.75 million SAAR).

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it is helpful to look at the YoY change.

Inventory increased 1.1% YoY in May. This is the second consecutive month of a year-over-year increases in inventory. Although the YoY increase is small, I expect it will be higher later this year.

Inventory increased 1.1% YoY in May. This is the second consecutive month of a year-over-year increases in inventory. Although the YoY increase is small, I expect it will be higher later this year.This increase in inventory is especially concerning because the reported inventory is already historically very high, and the 8.3 months of supply in May is well above normal. The months of supply will probably stay near this level in June, because of more tax credit related sales (reported at closing), but the months-of-supply could be close to double digits later this year.

And a double digit months-of-supply would be a really bad sign for house prices ...

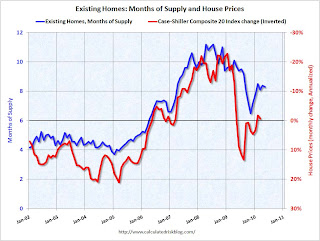

This graph show months of supply and the annualized change in the Case-Shiller Composite 20 house price index (inverted).

This graph show months of supply and the annualized change in the Case-Shiller Composite 20 house price index (inverted).Below 6 months of supply (blue line) house prices are typically rising (red line, inverted).

Above 6 months of supply house prices are usually falling (although there were many programs to support house prices over the last year).

Later this year the months of supply will probably increase, and I expect house prices to fall further as measured by the Case-Shiller and CoreLogic repeat sales house price indexes.

The American Institute of Architects’ Architecture Billings Index declined to 45.8 in May from 48.5 in April. Any reading below 50 indicates contraction.

The American Institute of Architects’ Architecture Billings Index declined to 45.8 in May from 48.5 in April. Any reading below 50 indicates contraction.According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So there will probably be further declines in CRE investment through all of 2010, and probably well into 2011.

Best wishes to all.

G-20 poised to issue Statement

by Calculated Risk on 6/27/2010 09:08:00 AM

From Alan Beattie at the Financial Times in 2008 (via Bruce Bartlett):

An ineffectual international organisation yesterday issued a stark warning about a situation it has absolutely no power to change, the latest in a series of self-serving interventions by toothless intergovernmental bodies.And on a more serious note, from Bloomberg: G-20 May Stress Need to Cut Deficits as Leaders Split on Urgency of Target

“We are seriously concerned about this most serious outbreak of seriousness,” said the head of the institution ...

Group of 20 leaders are poised to endorse targets to tackle deficits while giving nations flexibility on when to start balancing their books, according to officials with knowledge of drafts of the final statement.From the NY Times: Leaders at Summit Talks Turn Attention to Deficit Cuts

...

The draft of the statement includes targets championed by Canadian Prime Minister Stephen Harper for countries to halve deficits by 2013 and start to stabilize their debt-to-output ratios by 2016, the officials said.

Despite President Obama’s pitch at the summit meeting for developed nations here for continued stimulus measures to prevent another global economic downturn, the United States will go along with other leaders who are more concerned about rising debt and join in a commitment to cut their governments’ deficits in half by 2013, administration officials said on Saturday.

Saturday, June 26, 2010

Freddie Mac: 90+ Day Delinquency Rate steady in May

by Calculated Risk on 6/26/2010 09:51:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Freddie Mac reported yesterday that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business was steady at 4.06% in May, the same rate as April, and up sharply from 2.73% in May 2009.

"Single-family delinquencies are based on the number of mortgages 90 days or more delinquent or in foreclosure as of period end ..."

The "good" news is the delinquency rate has stopped rising rapidly. However some of the earlier increase was because of foreclosure mortatoriums, and distortions from modification programs - loans in trial mods were considered delinquent until the modifications were made permanent.

Even though Freddie Mac has started foreclosing, modifying loans, and accepting short sales, the number of new 90+ day delinquencies has kept pace.

The data from Fannie Mae will be released next week ...

Employment Report Preview

by Calculated Risk on 6/26/2010 06:26:00 PM

Just a few notes on the June employment report to be released on Friday, July 2nd:

Andrew Tilton of Goldman Sachs noted this in a research note yesterday:

"We are cautiously optimistic that June’s payroll report will show a pickup in private-sector payroll growth to around 150,000. In part, this is because there seems to be some “crowding out” of private sector payroll growth by short-term Census hiring—indeed, this may explain a good part of the payroll disappointment last month. Total payrolls should be down about 100,000 in June as a large portion of Census employment rolls off."There will be some preliminary reports on employment released during the coming week: the ADP employment report, the Chicago PMI, and the ISM surveys.

However it is concerning that the regional Fed manufacturing surveys were mixed on employment (manufacturing has been one of the stronger sectors):

In addition weekly initial unemployment claims have remained elevated. Initial weekly claims have averaged 464,000 thousand in June, almost the same level as each of the previous 5 months.

Here is a repeat of the graph showing percent job losses during recessions, aligned at the bottom:

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms.

The dotted line shows the impact of Census hiring. In May, there were 564,000 temporary 2010 Census workers on the payroll. Just under half of those Census jobs will go away in June, and the two red lines will meet sometime later this year.

Second Liens and Personal Bankruptcy

by Calculated Risk on 6/26/2010 12:31:00 PM

From Mary Ellen Podmolik at the Chicago Tribune: Moral bankruptcy?

[Filing bankruptcy] may seem an extreme riff on the difficult decisions homeowners make to unburden themselves of debt owed on properties that have lost substantial value. Lawyers and housing counselors say, however, that personal bankruptcy filings are becoming more commonplace as debt-holders seek sums due them, particularly on second "piggyback" mortgages used to buy homes.I suspect eliminating debt from 2nd liens is one of the reasons there has been a surge in personal bankruptcy filings this year. The deep recession and high unemployment rate are probably the main reasons.

"It's a big trend," said Dan Lindsey, a supervisory attorney at the Legal Assistance Foundation of Metropolitan Chicago. "Banks are having a hard enough time dealing with the first mortgages. The second (mortgages), there's no equity there to collect so they're being charged off and sold to debt buyers and rearing their ugly heads later. It's a drastic last resort to file Chapter 7, but in some cases it's appropriate."

...

"My other option was to say I'll roll the dice with the bank," [former homeowner Del] Phillips said. "Will they really come after me? I wouldn't put it past the bank industry to do that. It's going to kill me to pay a bank for a house I no longer owned. I was, like, there's no way I'm going to pay the bank another dime."

Unofficial Problem Bank List increases to 797 Institutions

by Calculated Risk on 6/26/2010 09:16:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 25, 2010.

Changes and comments from surferdude808:

CR provided a tease earlier on some of changes to the Unofficial Problem Bank List that would be happening as the FDIC released its enforcement actions for May yesterday. As CR predicted, it was a busy week as 24 institutions were added while 8 were removed. Also, the agencies issued numerous Prompt Corrective Action Orders.

Overall, the Unofficial Problem Bank List stands at 797 institutions with aggregate assets of $409.6 billion, up from 781 institutions with assets of $404.5 billion last week. Removals include the failed Peninsula Bank ($644 million), First National Bank ($253 million), and High Desert State Bank ($83 million). The FDIC terminated actions against De Witt State Bank ($39 million), Citizens State Bank of Lankin ($37 million), BankHaven ($22 million), and The Farmers Bank ($18 million). The other removal was for VisionBank of Iowa ($87 million) which merged with its affiliate sister bank -- Ames Community Bank ($383 million) that also happens to be on the Unofficial Problem Bank List as it is operating under a Written Agreement.

There were 24 institutions with aggregate assets of $6.5 billion added to the list this week. Notable additions include Bank of Choice, Greeley, CO ($1.3 billion); Nova Bank, Berwyn, PA ($598 million); CornerstoneBank, Atlanta, GA ($536 million); and Sterling Federal Bank, F.S.B., Sterling, IL ($501 million). Geographically, five institutions from Georgia, three from Missouri, and two from California, Colorado, Illinois, and Pennsylvania were added.

In a sign that the agencies may be taking their regulatory authority seriously, they issued 11 Prompt Corrective Action Orders against institutions on the Unofficial Problem Bank List. Generally, a PCA Order is a narrow enforcement action proscribing for an institution to raise its regulatory capital ratios by a certain date. As way of background, in 1991 via the Federal Deposit Insurance Corporation Improvement Act (FDICIA) Congress mandated for the regulators to take certain actions including closing troubled institutions promptly. The intent was to prevent a recurrence of the "zombie thrifts" that regulators allowed to stay open for many years despite being insolvent, which contributed the large price tag of the last banking crisis. The PCA legislation requires regulators to take certain actions that are triggered by so-called capital trip wires. For example, regulators are supposed to stop an institution from issuing brokered deposits or giving managers golden parachutes when they are no longer "well capitalized." Another trip wire requires for regulators to close an institution when its tangible capital ratio breeches 2 percent. The thinking behind this provision is that closure before equity goes negative would lessen losses to the deposit insurance fund and the potential that taxpayer monies would be needed to support resolutions. Some industry observers believe the regulators have been remiss in enforcing PCA, particularly the timely closing of insolvent institutions. To support this conclusion, observers point to Corus Bank and Guaranty Bank that posted negative equity in their Call Reports several quarters before they were closed or the substantial loss rates on failed institutions that reported satisfactory capital ratios just before failure.

The 11 institutions receiving a PCA Order include LibertyBank ($768 million); Butte Community Bank ($523 million Ticker: CVLL); Metro Bank of Dade County ($442 million); Ravenswood Bank ($301 million); SouthwestUSA Bank ($214 million); Blue Ridge Savings Bank, Inc. ($209 million); Legacy Bank ($169 million); Olde Cypress Community Bank ($169 million); Shoreline Bank ($110 million); Badger State Bank ($93 million); and Thunder Bank ($33 million).

Friday, June 25, 2010

Year of the Short Sale, and Deed in lieu

by Calculated Risk on 6/25/2010 09:45:00 PM

From Kenneth Harney in the WaPo: Foreclosure alternative gaining favor (ht ghostfaceinvestah)

There are two programs in Home Affordable Foreclosure Alternatives (HAFA), short sales and deed in lieu of foreclosure.

Harney writes:

Some of the largest mortgage servicers and lenders in the country are gearing up campaigns to reach out to carefully targeted borrowers with cash incentives that sometimes range into five figures, plus a simple message: Let's bypass the time-consuming hassles of short sales and foreclosures. Just deed us the title to your underwater home, and we'll call it a deal. ...The deal can be quick, and the first lender will agree not to pursue a deficiency judgment. However 2nds are a problem, and "deed in lieu" transactions still hit the borrower's credit history.

Borrowers with 2nds considering a "deed in lieu" transaction should contact the 2nd lien holders. HAFA offers a payout to 2nd lien holders in deed in lieu transactions who agree to release borrowers from debt (see point 4 here for payouts under deed in lieu).

Under the HAFA deed in lieu program, the borrower needs to be proactive with 2nd lien holders.

The deed in lieu program is gaining in popularity, from Harney:

Bank of America, has mailed 100,000 deed-in-lieu solicitations to customers in the past 60 days, and its volume of completed transactions is breaking company records, according to officials. ... To sweeten the pot, Bank of America is offering cash incentives that range from $3,000 to $15,000 ... [Matt Vernon, Bank of America's top short sale and deed-in-lieu executive] said.On the credit impact, from Carolyn Said at the San Francisco Chronicle:

[Craig Watts, a spokesman for FICO] said it is a "widespread myth" that short sales and deeds in lieu of foreclosure have less impact on credit scores than do foreclosures.And a video from HAMP / HAFA: "Your Graceful Exit"

"Generally speaking, when you can't pay your mortgage, in the eyes of the FICO score what matters is that you were not able to fill your obligation as you originally agreed and that failure is highly predictive of future risk," he said.

Bank Failure #86: High Desert State Bank, Albuquerque, New Mexico

by Calculated Risk on 6/25/2010 07:04:00 PM

Road running deposits flee

Wiley banker struck

by Soylent Green is People

From the FDIC: First American Bank, Artesia, New Mexico, Assumes All of the Deposits of High Desert State Bank, Albuquerque, New Mexico

As of March 31, 2010, High Desert State Bank had approximately $80.3 million in total assets and $81.0 million in total deposits. ...That makes three today ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.9 million. ... High Desert State Bank is the 86th FDIC-insured institution to fail in the nation this year, and the second in New Mexico. The last FDIC-insured institution closed in the state was Charter Bank, Santa Fe, on January 22, 2010.

Bank Failures #84 & #85: Florida and Georgia

by Calculated Risk on 6/25/2010 06:24:00 PM

Ringed on three sides by water

Way out blocked by Feds

Savannah shut down

Sheila's Summer season starts

Sad situation.

by Soylent Green is People

From the FDIC: Premier American Bank, Miami, Florida, Assumes All of the Deposits of Peninsula Bank, Englewood, Florida

As of March 31, 2010, Peninsula Bank had approximately $644.3 million in total assets and $580.1 million in total deposits. ...From the FDIC: The Savannah Bank, National Association, Savannah, Georgia, Assumes All of the Deposits of First National Bank Savannah, Georgia

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $194.8 million. Compared to other alternatives, ... Peninsula Bank is the 84th FDIC-insured institution to fail in the nation this year, and the fourteenth in Florida. The last FDIC-insured institution closed in the state was Bank of Florida – Southwest, Naples, on May 28, 2010.

As of March 31, 2010, First National Bank had approximately $252.5 million in total assets and $231.9 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $68.9 million. Compared to other alternatives, ... First National Bank is the 85th FDIC-insured institution to fail in the nation this year, and the ninth in Georgia. The last FDIC-insured institution closed in the state was Satilla Community Bank, Saint Marys, on May 14, 2010.

FDIC: May Enforcement Actions

by Calculated Risk on 6/25/2010 04:45:00 PM

Just a BFF (Bank Failure Friday) preview. It looks like surferdude808 will be busy updating the Unofficial Problem Bank list today ... the FDIC released their May Enforcement Actions.

There are eight Prompt Corrective Actions (PCA) for last month ... and that seems especially high.