by Calculated Risk on 1/25/2010 03:03:00 PM

Monday, January 25, 2010

CRE and Moral and Social Constraints to Strategic Defaults

On Tishman Speyer and Blackrock's strategic default on Peter Cooper Village and Stuyvesant Town ...

From the WSJ:

The Stuyvesant Town deal is one of several Tishman Speyer did at the top of the market that the company is trying to save. But the company itself isn't threatened. It took advantage of easy credit and investors' eagerness to buy into real estate during the good times. As a result, it didn't put much of its own cash into deals.Yes, it was a highly leveraged deal with little money at risk. And the debt was secured based on fantasy proforma statements (not unlike many stated income borrowers).

Tishman and Blackrock tried for a loan modification, but when they couldn't obtain one on acceptable terms, they choose to walk away because the property is worth far less than they owe even though they could afford to continue to make the payments.

In research paper last year on homeowners with negative equity walking away: Moral and Social Constraints to Strategic Default on Mortgages by Guiso, Sapienza and Zingales, the authors wrote:

"[P]eople who know someone who defaulted are 82% more likely to declare their intention to do so." And "as defaults become more common", there is a "contagion effect that reduces the social stigma associated with default".

Imagine a homeowner who bought at the top, "took advantage of easy credit", put little or money down, and now finds themselves owing far more than the property is worth. And now imagine they hear of large landlords (or Morgan Stanley last year) just walking away from CRE loans. Does that reduce the social stigma and contribute to residential strategic defaults?

Update: Diana Olick at CNBC asks a similar question: Strategic Defaults

More on Existing Home Sales

by Calculated Risk on 1/25/2010 12:14:00 PM

Earlier the NAR released the existing home sales data for December; here are a few more graphs ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

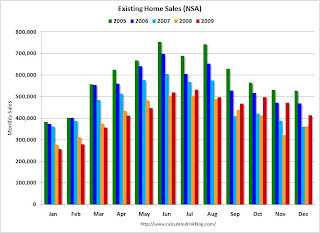

This graph shows NSA monthly existing home sales for 2005 through 2009 (see Red columns for 2009).

Sales (NSA) in December were much higher than in December 2007 and 2008.

The second graph shows existing home sales (left axis) through December, and new home sales (right axis) through November. The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent spike in existing home sales was due primarily to the first time homebuyer tax credit.

Eventually - when the housing market is more healthy - the ratio of existing to new home sales will probably return to the historical relationship. The third graph shows existing home sales and year end inventory as a percent of total owner occupied homes.

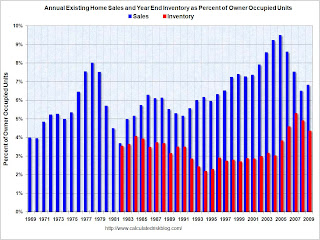

The third graph shows existing home sales and year end inventory as a percent of total owner occupied homes.

Both sales and inventory are above the normal range, although reported inventory has been declining for two years.

Both sales and inventory are being heavily impacted by government policies (boosting sales through tax credits and low mortgage rates, and limiting inventory through modification programs). There is probably a substantial "shadow inventory" that will come on the market, but the timing and size of the inventory are unknown.

The term "shadow inventory" is used in different ways. I consider all of the following to be "shadow inventory":

Probably the most important point to remember is that what matters for the economy and jobs is new home sales and residential investment. Until the excess housing inventory is reduced (both home and the rental units), new residential investment will be under pressure.REOs. There are bank owned properties that have not been put on the market yet. Foreclosures in process and seriously delinquent loans (although some of these may be in the modification process). New high rise condos. These properties are not included in the new home inventory report from the Census Bureau, and do not show up anywhere unless they are listed. Homeowners waiting for a better market. These are homeowners waiting for better market conditions to sell.

Existing Home Sales decline Sharply in December

by Calculated Risk on 1/25/2010 10:00:00 AM

The NAR reports: December Existing-Home Sales Down but Prices Rise; 2009 Sales Up

Existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 16.7 percent to a seasonally adjusted annual rate of 5.45 million units in December from 6.54 million in November, but remain 15.0 percent above the 4.74 million-unit level in December 2008.

For all of 2009 there were 5,156,000 existing-home sales, which was 4.9 percent higher than the 4,913,000 transactions recorded in 2008; it was the first annual sales gain since 2005.

...

Total housing inventory at the end of December fell 6.6 percent to 3.29 million existing homes available for sale, which represents a 7.2-month supply at the current sales pace, up from a 6.5-month supply in November.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Dec 2009 (5.45 million SAAR) were 16.7% lower than last month, and were 15% higher than Dec 2008 (4.74 million SAAR).

Of course many of the transactions in November were due to first-time homebuyers rushing to beat the initial expiration of the tax credit (that has now been extended). That pushed sales far above the historical normal level; based on normal turnover, existing home sales would be in the 4.5 to 5.0 million SAAR range.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.29 million in December from 3.52 million in November. The all time record high was 4.57 million homes for sale in July 2008.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.29 million in December from 3.52 million in November. The all time record high was 4.57 million homes for sale in July 2008. This is not seasonally adjusted and December is usually the lowest month of the year - so this decline is mostly seasonal.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 7.2 months in December.

A normal market has under 6 months of supply, so this is still high.

This decline was expected. I'll have more later ... but remember to ignore the median prices (that is distorted by the mix), and to focus more on new home sales than existing home sales.

Stuyvesant Town turned over to Creditors

by Calculated Risk on 1/25/2010 08:45:00 AM

A story we have been following since the property was purchased ...

From the NY Times: Huge N.Y. Housing Complex Is Returned to Creditors

The owners of Stuyvesant Town and Peter Cooper Village ... have decided to turn over the properties to creditors, officials said Monday morning.More from the WSJ: Tishman Venture Gives Up Stuyvesant Project

The decision by Tishman Speyer Properties and BlackRock Realty comes four years after the $5.4 billion purchase of the complexes’ 110 buildings and 11,227 apartments in what was the most expensive real estate deal of its kind in American history.

The venture acquired the 56-building, 11,000-unit property for $5.4 billion in 2006 ... By some accounts, Stuyvesant Town is only valued at $1.8 billion now ... all the equity investors—including the California Public Employees' Retirement System, a Florida pension fund and the Church of England—and many of the debtholders, including Government of Singapore Investment Corp., or GIC, and Hartford Financial Services Group, are in danger of seeing most, if not all, of their investments wiped out.

Sunday, January 24, 2010

Financial Times: 'Bankers to lobby for softer reforms'

by Calculated Risk on 1/24/2010 09:45:00 PM

From the Financial Times: Bankers to lobby for softer reforms (ht MrM)

Senior Wall Street bankers heading to the World Economic Forum will use the meeting in Davos to lobby regulators against a rigorous implementation of Barack Obama’s plan to cap the size and trading activity of banks.That is no surprise.

excerpted with permission

The article quotes UK chancellor Alistair Darling as opposing Obama's proposal, from The Times: Alistair Darling warns Barack Obama over banking reforms

In an interview with The Sunday Times, the chancellor made clear that he saw serious shortcomings in the American approach.The Financial Times points out that "chimes" with previous comments of Secretary Geithner.

“It is always difficult to say ex ante that you would never intervene to save a particular sort of bank,” he said. “In Lehman, for example, there wasn’t a single retail deposit, but the then American administration allowed it to go down and that brought the rest of the system down on the back of it.

“You could end up dividing institutions and making them separate legal entities but that isn’t the point. The point is the connectivity between them in relation to their financial transactions."

More on Q4 GDP Forecasts

by Calculated Risk on 1/24/2010 05:13:00 PM

As I mentioned in the previous summary post, the consensus is for a pretty strong Q4 GDP headline number. But this was driven by changes in inventory and probably will not last. A couple of stories ...

From Bloomberg: Growth Probably Accelerated as 2009 Ended: U.S. Economy Preview

Gross domestic product expanded at a 4.6 percent pace from October through December ... according to the median estimate of 74 economists surveyed by Bloomberg News. ... “Inventories are going to be responsible for at least half of the growth, if not more,” said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. in New York.And from Rex Nutting at MarketWatch: Eye-popping GDP number not sustainable

Economists surveyed by MarketWatch are forecasting a 5.5% annualized increase ... "Although we anticipate a large rise in GDP, underlying growth is expected to be rather tepid, held down by declines in structures, government spending, and motor vehicle sales," wrote Peter D'Antonio, an economist for Citigroup Global Markets.For more, see beware the blip and also from Krugman: Blip.

...

Most of the boost in the economy in the fourth quarter came not from sales of goods and services but from the adjustment in the inventories of unsold goods.

Weekly Summary and a Look Ahead

by Calculated Risk on 1/24/2010 12:52:00 PM

This will be a busy week for housing data, and the Q4 GDP report will be released on Friday.

On Monday, the National Association of Realtors (NAR) will report existing home sales for December. The consensus is for a significant decline to 5.9 million units (SAAR). From James Hagerty at the WSJ: Why You Can Yawn Over Monday’s Home Sales ‘Shock’

The National Association of Realtors is due to release its monthly report on existing home sales at 10 a.m. Monday, and it’s likely to look lousy. ... Analysts are predicting a sharp drop from November’s level. ...I'd take it one step further and remind everyone that what matters for the economy and jobs is new home sales and housing starts, not existing home sales.

Tom Lawler, a housing economist in rural Virginia ... expects Monday’s report from the Realtors to show that resales in December were down 17% from November to a seasonally adjusted annual rate of 5.42 million. Dan Oppenheim of Credit Suisse expects a 12% drop to 5.76 million. ...

So get over it. In advance.

On Tuesday the Case-Shiller house price index for November will be released. This might show a decline since the LoanPerformance index (see below) has declined for three straight months.

On Wednesday New Home sales for December will be released by the Census Bureau. The consensus is for a slight increase. Also on Wednesday the FOMC meeting announcement will be released (no change to rates or wording is expected).

On Thursday, durable goods will be released and on Friday the Q4 GDP report. The consensus is for 4.5% real GDP growth (annualized), and Goldman Sachs is forecasting 5.8%. Remember, beware the blip and also from Krugman: Blip.

And a summary of last week ...

Click on graph for larger image in new window.

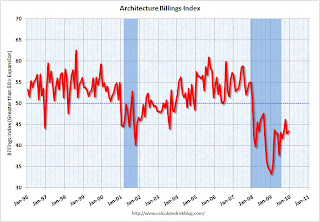

Click on graph for larger image in new window.This index is primarily a leading indicator for non-residential construction.

The American Institute of Architects’ Architecture Billings Index increased slightly to 43.4 in December from 42.8 in November. It was at 46.1 in October. Any reading below 50 indicates contraction.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through 2010, and probably longer.

Moody's reported: "After 13 consecutive months of declining property values, the Moody’s/REAL Commercial Property Price Index (CPPI) measured a 1.0% increase in prices in November. Prices began falling over two years ago and significant declines were seen throughout 2009, with several months experiencing 5%+ value drops. The 1.0% growth in prices seen in November is a small bright spot for the commercial real estate sector, which has seen values fall over 43% from the peak."

Moody's reported: "After 13 consecutive months of declining property values, the Moody’s/REAL Commercial Property Price Index (CPPI) measured a 1.0% increase in prices in November. Prices began falling over two years ago and significant declines were seen throughout 2009, with several months experiencing 5%+ value drops. The 1.0% growth in prices seen in November is a small bright spot for the commercial real estate sector, which has seen values fall over 43% from the peak."The graph is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Note that Moody's added: "We expect commercial real estate prices to decline further in the months ahead."

Total housing starts were at 557 thousand (SAAR) in December, down 4.0% from the revised November rate, and up 16% from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for seven months.

Total housing starts were at 557 thousand (SAAR) in December, down 4.0% from the revised November rate, and up 16% from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for seven months.Single-family starts were at 456 thousand (SAAR) in December, down 6.9% from the revised November rate, and 28 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at around this level for seven months.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 15 in January. This is a decrease from 16 in December and 17 in November

The record low was 8 set in January. This is still very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May.

First American CoreLogic reported: "On a month-over-month basis ... national home prices declined by 0.2 percent in November 2009 compared to October 2009."

This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

This graph shows the national LoanPerformance data since 1976. January 2000 = 100.The index is off 5.7% over the last year, and off 30.0% from the peak.

The index has declined for three consecutive months.

Note: this is the house price indicator used by the Fed.

Best wishes to all.

CRE in SoCal: Vacancy Rates Up, Rents Fall

by Calculated Risk on 1/24/2010 09:24:00 AM

The headline is on the hopeful side, but the story has some details ...

From Roger Vincent at the LA Times: Bottom is near for building owners; recovery is another matter (ht Bill)

Overall office vacancy in the fourth quarter in Los Angeles, Orange, San Bernardino and Riverside counties was 18.5%, a substantial jump from 14.4% a year earlier, according to commercial real estate brokerage Cushman & Wakefield.And a different kind of "shadow inventory":

"Vacancies are up, and I believe they will continue to go up this year as we have continued job losses," said Joe Vargas, leader of the company's Southern California offices.

Right now, many firms have shrunk but are still renting the same amount of space they had in fatter days. Before they can grow enough to expand into bigger offices, they need to do enough hiring to fill up what they already have.Even if job losses stop, the vacancy rate will probably continue to rise as leases expire and companies downsize. And the current level of vacancies will continue to push down rents as landlords fight for tenants. And of course there will be little investment in new office buildings for some time.

"All the vacant space out there still doesn't reflect all the jobs that were lost," said Whitley Collins, regional managing director of real estate brokerage Jones Lang LaSalle.

Shadow space, as leased but unused space is often called, is impossible to measure accurately, but there is surely enough of it to slow the commercial real estate comeback. Office leasing growth usually lags behind economic recovery by six to nine months, Collins said. A local office market recovery might be as much as 18 months behind the economy now because of shadow space.

Saturday, January 23, 2010

Jon Stewart on Cramer's Tuesday Market Prediction

by Calculated Risk on 1/23/2010 10:40:00 PM

The Cramer bit starts at 7:50 ... another great Cramer prediction last Tuesday afternoon.

Here is the link to the video.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Indecision 2010 - The Re-Changening | ||||

| www.thedailyshow.com | ||||

| ||||

Senators "confident" Bernanke will be confirmed

by Calculated Risk on 1/23/2010 07:03:00 PM

From the Jackie Calmes and Sewell Chan at the NY Times: 2 Senators Predict Bernanke to Be Confirmed

And from David Wessel at the WSJ: Dodd, Gregg Predict Bernanke Will Win Confirmation Vote

Here is the statement:

Today, Senate Banking Committee Chairman Chris Dodd (D-CT) and Banking Committee Member Judd Gregg (R-NH) issued a joint statement on their confidence that Federal Reserve Chairman Ben Bernanke will be confirmed by the Senate for a second term.

“In the last few days there have been a flurry of media reports on Chairman Bernanke’s confirmation prospects, highlighting a very vocal opposition. Chairman Bernanke has done an excellent job responding to one of the most significant financial crises our country has ever encountered. We support his nomination because he is the right leader to guide the Federal Reserve in this recovering economy. Based on our discussions with our colleagues, we are very confident that Chairman Bernanke will win confirmation by the Senate for a second term."