by Calculated Risk on 1/23/2010 04:46:00 PM

Saturday, January 23, 2010

Update on Residential Investment

This is an update of some graphs in a post last month: Residential Investment: Moving Sideways.

Housing Starts Click on graph for larger image in new window.

Click on graph for larger image in new window.

Housing starts are still moving sideways ...

Total housing starts were at 557 thousand (SAAR) in December, down 4.0% from the revised November rate, and up 16% from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for seven months.

Single-family starts were at 456 thousand (SAAR) in December, down 6.9% from the revised November rate, and 28 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at around this level for seven months.

Builder Confidence This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 15 in January. This is a decrease from 16 in December and 17 in November.

More moving sideways ... (or down!)

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

MBA Purchase Index This graph shows the MBA Purchase Index and four week moving average since 1990.

This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is slightly above the 12 year low set last week.

Although there are more cash buyers now (all the investor buying), this suggests further weakness in home purchases.

House Prices

LoanPerformance reported yesterday that house prices fell again in November.

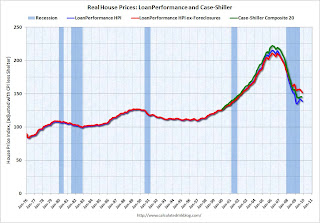

Most people follow the Case-Shiller index (to be released next Tuesday), but the Fed uses the First American CoreLogic LoanPerformance House Price Index (HPI). This graph shows the three indices with January 2000 = 100.

This graph shows the three indices with January 2000 = 100.

The index is off 5.7% over the last year, and off 30.0% from the peak.

The index has declined for three consecutive months.

The Case-Shiller might show a decline in November too, but it is a 3 month average, so the decline might not show up until December.

For more graphs, here are real prices and the price-to-rent ratio using the LoanPerformance HPI.

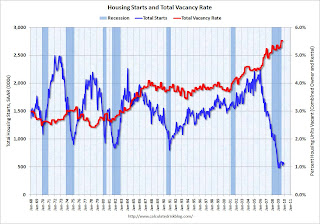

Vacant Housing Units The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing through Q3 2009 (Q4 will be released in early February).

The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing through Q3 2009 (Q4 will be released in early February).

As I've noted several times, it is difficult to see a robust recovery without a recovery in residential investment. And it is hard to imagine a strong recovery in residential investment until the huge overhang of excess housing units are absorbed.

I don't expect another plunge in housing starts or new home sales, but as long as these indicators are moving sideways - or just recovering modestly - I think the economic recovery will be sluggish.

More on Bernanke

by Calculated Risk on 1/23/2010 12:52:00 PM

From Jim Hamilton at Econbrowser: Why Bernanke should be reconfirmed

I asked a senior Fed staff economist in 2008 how Bernanke was holding up personally under all the pressure. He used an expression I hadn't heard before, but seems very apt. He said he was extremely impressed by Bernanke's "intellectual stamina," by which he meant a tireless energy to continually re-evaluate, receive new input, assess the consequences of what has happened so far, and decide what to do next. That is an extremely rare quality. Most of us can be very defensive about the decisions we've made, and our emotional tie to those can prevent us from objectively processing new information. On the recent occasions I've seen Bernanke personally, that's certainly what I observed as well. Even with all he's been through, the man retains a remarkable openness to hear what others may have to say.From Brad DeLong: Don't Block Ben!

Please permit me to suggest that intellectual stamina is the most important quality we need in the Federal Reserve Chair right now.

I think Bernanke is one of the best in the world for this job--I cannot think of anyone clearly better.From Paul Krugman: The Bernanke Conundrum

As I see it, the two things that worry me about Bernanke stem from the same cause: to a greater degree than I had hoped, he has been assimilated by the banking Borg. In 2005, respectable central bankers dismissed worries about a housing bubble, ignoring the evidence; in the winter of 2009-2010, respectable central bankers are worried about nonexistent inflation rather than actually existing unemployment. And Bernanke, alas, has become too much of a respectable central banker.Krugman suggests we need someone with the "intellectual chops for the job", but who hasn't been assimilated by the "banking Borg" - and someone who would also be effective in leading the FOMC. I agree that Bernanke meets the first and last qualifications. And I think he is a far better Fed Chairman than Greenspan.

That said, however, what is the alternative? Calculated Risk says we can do better. But can we, really?

It’s not that hard to think of people who have the intellectual chops for the job of Fed chair but aren’t fully part of the Borg. But it’s very hard to think of people with those qualities who have any chance of actually being confirmed, or of carrying the FOMC with them even if named as chairman (which is one reason why this suggestion is crazy). Does it make sense to deny Bernanke reappointment simply in order to appoint someone who would follow the same policies?

And yet, the Fed really needs to be shaken out of its complacency.

As I said, I’m agonizing.

However I'd also prefer someone who expressed concerns about the asset bubbles fairly early on. Perhaps it is premature to name a specific person, but I think San Francisco Fed President Janet Yellen comes close to meeting all of the criteria.

On Bernanke's Reconfirmation

by Calculated Risk on 1/23/2010 08:49:00 AM

A few articles ...

From the WSJ: Populist Surge on Hill Eases the Support for Bernanke

Alarmed that there might not be the 60 votes in the Senate needed to extend Mr. Bernanke's term beyond its Jan. 31 expiration, the White House entered the fray publicly for the first time, with officials trying to win support among Democratic senators. President Barack Obama "has a great deal of confidence in what Chairman Bernanke did to bring our economy back from the brink," deputy White House press secretary Bill Burton told reporters aboard Air Force One. "And he continues to think that he's the best person for the job, and will be confirmed by the United States Senate."From the NY Times: Bernanke’s Bid for a Second Term at the Fed Hits Resistance

Two Democratic senators who are up for re-election this year announced that they would oppose Mr. Bernanke, whose four-year term as head of the central bank expires at the end of this month. Their decisions reflected a surge of opposition among some Democrats and Republicans to Mr. Bernanke, a primary architect of the bailout of the financial system and a contributor to policies that critics contend put the economy at risk in the first place.From the Financial Times: Bernanke under pressure

From CNBC: Bernanke Vote: 'Unthinkable Has Become a Possibility'

Bernanke definitely supported policies that contributed to the crisis, and he failed to see the problems coming. However once Bernanke started to understand the problem, he was very effective at providing liquidity for the markets.

But since his renomination, he hasn't done himself any favors. He has admitted the Fed failed as a regulator, but he hasn't explained why - or outlined a clear path forward. And Bernanke keeps saying really dumb things, like claiming incorrectly to have an exploding adjustable rate mortgage. That was an ignorant remark considering his position as Fed Chairman and the plight of so many Americans. And quoting a bank robber in testimony to Congress when addressing the long term deficit (suggesting Congress steal from middle class Americans?), and this right after he claimed he wouldn't comment on areas outside of the Fed's authority. Dumb.

I definitely think we could do better.

Friday, January 22, 2010

Unofficial Problem Bank Lists Increases to 584

by Calculated Risk on 1/22/2010 10:42:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. CR NOTE: This was compiled before the 5 bank failures today. There was a "timely" Prompt Corrective Action issued against Charter Bank, Santa Fe, NM and the bank was seized today!

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by a net two institutions to 584.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Aggregate assets total $305.3 billion, up from $304.8 billion last week. Additions include Pamrapo Savings Bank, Bayonne, NJ ($573 million); Capitol City Bank & Trust Company, Atlanta, GA ($322 million); Bank of Virginia, Midlothian, VA ($226 million); and Independence National Bank, Greenville, GA ($138 million).

Deletions are the two failures last week – Barnes Banking Company ($828 million), and St. Stephens State Bank ($25 million). The other change is a Prompt Corrective Action order issued by the OTS against Charter Bank, Santa Fe, NM ($1.3 billion) on January 20, 2010, which was already operating under a Cease & Desist order.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failures #8 & #9: Evergreen Bank, Seattle, Washington and Columbia River Bank, The Dalles, Oregon

by Calculated Risk on 1/22/2010 09:06:00 PM

Columbia River Bank,

Both washed away.

by Soylent Green is People

From the FDIC: Umpqua Bank, Roseburg, Oregon, Assumes All of the Deposits of Evergreen Bank, Seattle, Washington

Evergreen Bank Seattle, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....From the FDIC: Columbia State Bank, Tacoma, Washington, Assumes All of the Deposits of Columbia River Bank, The Dalles, Oregon

As of September 30, 2009, Evergreen Bank had approximately $488.5 million in total assets and $439.4 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $64.2 million. ... Evergreen Bank is the eighth FDIC-insured institution to fail in the nation this year, and the second in Washington. The last FDIC-insured institution closed in the state was Horizon Bank, Bellingham, on January 8, 2010.

Columbia River Bank, The Dalles, Oregon, was closed today by the Oregon Division of Finance and Corporate Securities, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes five bank failures today, and two with over $1 billion in assets each.

As of September 30, 2009, Columbia River Bank had approximately $1.1 billion in total assets and $1.0 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $172.5 million. ... Columbia River Bank is the ninth FDIC-insured institution to fail in the nation this year, and the first in Oregon. The last FDIC-insured institution closed in the state was Community First Bank, Prineville, on August 7, 2009.

Bank Failure #7: Charter Bank, Santa Fe, New Mexico

by Calculated Risk on 1/22/2010 08:31:00 PM

Hot tamales, fajitas

Zero cold hard cash.

by Soylent Green is People

From the FDIC: Charter Bank, Albuquerque, New Mexico, Assumes All of the Deposits of Charter Bank, Santa Fe, New Mexico

Charter Bank, Santa Fe, New Mexico, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Charter Bank, Albuquerque, New Mexico, a newly-chartered federal savings bank and a subsidiary of Beal Financial Corporation, Plano, Texas, to assume all of the deposits of Charter Bank.A theme today: Charter eats Charter. Premier eats Premier.

...

As of September 30, 2009, Charter Bank had approximately $1.2 billion in total assets and $851.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $201.9 million. ... Charter Bank is the seventh FDIC-insured institution to fail in the nation this year, and the first in New Mexico. The last FDIC-insured institution closed in the state was Zia New Mexico Bank, Tucumcari, on April 23, 1999.

Bank Failure #6: Bank of Leeton, Leeton, Missouri

by Calculated Risk on 1/22/2010 07:05:00 PM

Flyover town with small bank

Not too big to fail

by Soylent Green is People

From the FDIC: Sunflower Bank, National Association, Salina, Kansas, Assumes All of the Deposits of Bank of Leeton, Leeton, Missouri

Bank of Leeton, Leeton, Missouri, was closed today by the Missouri Division of Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Small ones count too.

As of December 31, 2009, Bank of Leeton had approximately $20.1 million in total assets and $20.4 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.1 million. ... Bank of Leeton is the sixth FDIC-insured institution to fail in the nation this year, and the first in Missouri. The last FDIC-insured institution closed in the state was Gateway Bank of St. Louis, on November 6, 2009.

Bank Failure #5 in 2010: Premier American Bank, Miami, Florida

by Calculated Risk on 1/22/2010 06:07:00 PM

Premier American Bank

Like Icarus, scorched

by Soylent Green is People

From the FDIC: Premier American Bank, Miami, Florida, National Association, Assumes All of the Deposits of Premier American Bank, Miami, Florida

Premier American Bank, Miami Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Premier American Bank, National Association, Miami, Florida, a newly-chartered national institution, to assume all of the deposits of Premier American Bank. Premier American Bank, N.A. is a subsidiary of Bond Street Holdings, LLC, Naples, Florida.There were 140 bank failures in 2009, 25 in 2008 and 3 in 2007, so that makes 171 for this cycle.

...

As of September 30, 2009, Premier American Bank had approximately $350.9 million in total assets and $326.3 million in total deposits.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $85 million.... Premier American Bank is the fifth FDIC-insured institution to fail in the nation this year, and the first in Florida. The last FDIC-insured institution closed in the state was Peoples First Community Bank, Panama City, on December 18, 2009.

Real House Prices, Price-to-Rent Ratio

by Calculated Risk on 1/22/2010 04:00:00 PM

Earlier First American CoreLogic reported that house prices declined in November. This is the Fed's favorite house price index. This post looks at real prices and the price-to-rent ratio, but first a look at the market ...Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the First American CoreLogic LoanPerformance house price index through November (with and without foreclosures) and the Case-Shiller Composite 20 index through October in real terms (all adjusted with CPI less Shelter). It is interesting to look at the sharp decline in the index with foreclosures at the end of 2008 - this was what housing economist Tom Lawler described as "destickification" in the high foreclosure areas.

It is interesting to look at the sharp decline in the index with foreclosures at the end of 2008 - this was what housing economist Tom Lawler described as "destickification" in the high foreclosure areas.

Notice the LoanPerformance price index without foreclosures (in red) is now at the lowest level since July 2002 in real terms (inflation adjusted).

This isn't like 2005 when prices were way out of the normal range by most measures - and it is possible that total national prices bottomed in 2009 (although I think prices will fall further), but prices ex-foreclosures probably still have a ways to go, even with all the government programs aimed at supporting house prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through November 2009 using the First American CoreLogic LoanPerformance House Price Index: This graph shows the price to rent ratio (January 2000 = 1.0).

This graph shows the price to rent ratio (January 2000 = 1.0).

This suggests that house prices are still a little too high on a national basis. Also rents are still falling and the OER index tends to lag market rents by a few months. And that will push up the price-to-rent ratio, putting more pressure on house prices.

First American CoreLogic: House Prices Decline in November

by Calculated Risk on 1/22/2010 02:26:00 PM

The Fed's favorite house price indicator from First American CoreLogic’s LoanPerformance ...

From LoanPerformance: Home Prices Continue to Depreciate

On a month-over-month basis ... national home prices declined by 0.2 percent in November 2009 compared to October 2009.

...

Including distressed transactions, the HPI has fallen 30.0 percent nationally through November from its peak in April 2006. Excluding distressed properties, the national HPI has fallen 21.8 percent from the same peak.

...

"On average, we are expecting home prices to turn around next spring," said Mark Fleming, chief economist for First American CoreLogic. "While the share of REO sales are down, allowing price declines to moderate, there is concern moving forward with the levels of shadow inventory, negative equity, and the ability of modification programs to mitigate this risk."

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

The index is off 5.7% over the last year, and off 30.0% from the peak.

The index has declined for three consecutive months. I'll have some comparisons to Case-Shiller later, but according to First American CoreLogic, prices are now falling again. It might take another month for this to show up in the Case-Shiller index because it is an average over three months.