by Calculated Risk on 4/28/2009 01:21:00 PM

Tuesday, April 28, 2009

More Details on Making Home Affordable Second Lien Program

Press Release from the U.S. Treasury: Obama Administration Announces New Details on Making Home Affordable Program

Under the Second Lien Program, when a Home Affordable Modification is initiated on a first lien, servicers participating in the Second Lien Program will automatically reduce payments on the associated second lien according to a pre-set protocol. Alternatively, servicers will have the option to extinguish the second lien in return for a lump sum payment under a pre-set formula determined by Treasury, allowing servicers to target principal extinguishment to the borrowers where extinguishment is most appropriate.Here is the program update.

And a couple of examples of how the 2nd lien program would work.

Here are the basics (the interest rate reduction is for 5 years):

For amortizing loans (loans with monthly payments of interest and principal), we will share the cost of reducing the interest rate on the second mortgage to 1 percent. Participating servicers will be required to follow these steps to modify amortizing second liens:The interest only second lien structure is similar with the interest rate being reduced to 2%.Reduce the interest rate to 1 percent; Extend the term of the modified second mortgage to match the term of the modified first mortgage, by amortizing the unpaid principal balance of the second lien over a term that matches the term of the modified first mortgage; Forbear principal in the same proportion as any principal forbearance on the first lien, with the option of extinguishing principal under the Extinguishment Schedule; After five years, the interest rate on the second lien will step up to the then current interest rate on the modified first mortgage, subject to the Interest Rate Cap on the first lien, set equal to the Freddie Mac Survey Rate; The second mortgage will re-amortize over the remaining term at the higher interest rate(s); and Investors will receive an incentive payment from Treasury equal to half of the difference between (i) the interest rate on the first lien as modified and (ii) 1 percent, subject to a floor.

Although this is a serious reduction in the interest rate, this will probably attractive to 2nd lien investors - since the loss severity on second liens is so high. What happens in five years when the rates change for all these borrowers with negative equity?

Chrysler: Deal Reached with Creditors

by Calculated Risk on 4/28/2009 12:23:00 PM

From the NY Times: Deal Is Set on Chrysler Debt That May Avert Bankruptcy

The Treasury Department has worked out a preliminary agreement with Chrysler’s largest secured creditors ...The initial Treasury offer was $1.0 billion, and the banks countered at $4.5 billion and 40% equity in the new Chrysler. These is no mention of equity in the story.

Chrysler has about $6.9 billion in secured debt owned by big banks such as Citigroup and JPMorgan Chase and a group of hedge funds. Under the proposal, all of the debt would be canceled in exchange for $2 billion in cash...

Case-Shiller: City Data

by Calculated Risk on 4/28/2009 11:22:00 AM

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix, house prices have declined more than 50% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

In Phoenix, house prices have declined more than 50% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

Prices fell by 1% or more in most Case-Shiller cities in February, with Phoenix off 5.0% for the month alone.

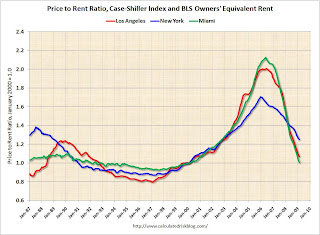

And here is the price-to-rent ratio for a few cities ... The second graph shows the price-to-rent ratio for Miami, Los Angeles and New York. This is similar to the national price-to-rent ratio, but uses local prices and local Owners' equivalent rent.

The second graph shows the price-to-rent ratio for Miami, Los Angeles and New York. This is similar to the national price-to-rent ratio, but uses local prices and local Owners' equivalent rent.

This ratio is getting close to normal for LA and Miami (Miami is back to the Jan 2000 ratio), but still has further to fall in NY.

Note: The Owners' Equivalent Rent (OER) is still increasing according to the BLS, however there are many reports of falling rents that isn't showing up yet in the OER.

House Prices: Compared to Stress Test Scenarios, and Seasonal Pattern

by Calculated Risk on 4/28/2009 10:14:00 AM

For more on house prices, please see: Case-Shiller: Prices Fall Sharply in February Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph compares the Case-Shiller Composite 10 index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index, February: 154.70

Stress Test Baseline Scenario, February: 157.26

Stress Test More Adverse Scenario, February: 154.01

It has only been two months, but prices are tracking the More Adverse scenario so far.

But we have to remember the headline Case-Shiller is not seasonally adjusted, and there is a strong seasonal pattern. Update: there is a seasonally adjusted data set here. This graph shows the month to month change (annualized) for the Case-Shiller Composite 10 index.

This graph shows the month to month change (annualized) for the Case-Shiller Composite 10 index.

Prices usually decline at the fastest rate in the winter months (or increase the least with rising prices), and prices decline the slowest during the summer. Just something to remember when the month-to-month price declines slow this summer.

This is why we use the year-over-year (YoY) price change too (in previous post). The YoY change for the Composite 10 is -18.8%, the worst YoY change was last month (January 2009 at -19.4%). About the same.

I'll have some Case-Shiller city data soon.

Case-Shiller: House Prices Fall Sharply in February

by Calculated Risk on 4/28/2009 09:05:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for February this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.6% from the peak, and off 2.1% in February.

The Composite 20 index is off 30.7% from the peak, and off 2.2% in February.

Prices are still falling and will probably decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 18.8% over the last year.

The Composite 20 is off 18.6% over the last year.

This is near the worst year-over-year price declines for the Composite indices since the housing bubble burst started.

I'll have more on house prices including a comparison to the stress test scenarios soon.

Report: BofA, Citi Told May Need to Raise Capital

by Calculated Risk on 4/28/2009 12:48:00 AM

From the WSJ: Fed Pushes Citi, BofA to Increase Capital

Regulators have told Bank of America Corp. and Citigroup Inc. that the banks may need to raise more capital ...The article also notes that the results of the stress test could be released the week of May 4th - and not on May 4th as originally announced.

Executives at both banks are objecting to the preliminary findings ...

Industry analysts and investors predict that some regional banks, especially those with big portfolios of commercial real-estate loans, likely fared poorly on the stress tests. Analysts consider Regions Financial Corp., Fifth Third Bancorp and Wells Fargo & Co. to be among the leading contenders for more capital....

No one will believe the test results if Citi isn't required to raise more capital.

Monday, April 27, 2009

Robert Shiller at Seattle Pacific University

by Calculated Risk on 4/27/2009 08:49:00 PM

Professor Shiller spoke at Seattle Pacific University today. After the Q&A, reader Erik asked Shiller:

Q: Why does the FHFA (OFHEO) index show house price gains for the last two months, whereas the Case-Shiller is showing prices are still falling.I'll revisit this question soon, but I prefer the Case-Shiller index.

A (Erik's notes): He thought about it for a bit, and said "I haven't studied it yet", I think it is because the "OFHEO index doesn't capture foreclosures as much our index." They tend to use conventional mortgages more and conventional mortgages seem to hold out longer and as a result "there may be an upward bias to their numbers." He then paused and said, the OFHEO numbers are a bit fishy (he looked perplexed) to me because they seem to have broken the smooth trend (he gestured with his hand the trend and finished with an upward movement) and I can't quite figure out where they came from, but I suspect it is from them capturing too few foreclosures or us capturing too many (laughs) even OFHEO has said they don't know why or can't explain their own numbers from the last two months.

Tim at the Seattle Bubble Blog has more: Robert Shiller at SPU—Psychology and the Housing Market

One amusing part of the afternoon session was a story Dr. Shiller related about a localized Los Angeles housing bubble in 1885. In describing the mentality in 1885 Los Angeles, he said that people thought “Los Angeles is special!” He also quoted from an article in the LA Times which was published during the aftermath of the collapse in 1886:Also, the Case-Shiller house price index for February will be released tomorrow morning (Tuesday).We Californians have learned something. And that is that home prices can’t just go up forever—they have to be supported by something. Never again will Californians make this mistake....

For anyone interested in hearing the entire afternoon lecture, you can listen to it right here:

GM Bondholders Respond to Exchange Offer

by Calculated Risk on 4/27/2009 06:20:00 PM

This morning GM offered to exchange equity in the restructured company for the outstanding $27 billion in debt. The bondholders responded negatively ...

Statement from ad hoc committee of GM bondholders via WSJ:

... The current offer is neither reasonable nor adequate. Both the union and the bondholders hold unsecured claims against GM. However, the union's VEBA would receive a 50 percent recovery in cash and a 39 percent stake in a new GM for its $20 billion in obligations; while bondholders, who own more than $27 billion in GM bonds and have the same legal rights as the unions, would only receive a mere 10 percent of the restructured company and essentially no cash.Apparently the bondholders are preparing a counteroffer.

The offer was made unilaterally, without any prior discussion or negotiation with bondholders and in spite of repeated calls for dialogue.

...

This offer demonstrates that the company and the auto task force, unfortunately, are pinning their hopes on an extremely risky and legally questionable turnaround in bankruptcy court, instead of engaging its lenders and workers in the very type of negotiations that could avoid such a fate.

Truck Tonnage: More Cliff Diving in March

by Calculated Risk on 4/27/2009 04:38:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Plunged 4.5 Percent in March Click on graph for larger image in new window.

Click on graph for larger image in new window.

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index fell 4.5 percent in March, marking the first month-to-month decrease of 2009. The gains during the previous two months, which totaled 4.5 percent, were erased with March’s drop. (February’s increase was revised down to 1.5 percent.) In March, the SA tonnage index equaled just 101.4 (2000 = 100), which is its lowest level since March 2002. The fleets did report higher volumes than in February, as the not seasonally adjusted (NSA) index increased 10.2 percent, but that is well below the 15 to 20 percent range that NSA tonnage usually rises from February to March. In March, the NSA index equaled 104.7.This suggests the economy was still very weak in March.

Compared with March 2008, tonnage contracted 12.2 percent, which was the second-worst year-over-year decrease of the current cycle. In December 2008, the largest year-over-year contraction, tonnage dropped 12.5 percent from a year earlier.

ATA Chief Economist Bob Costello said he wasn’t too surprised at March’s reading. “Many fleets were telling us during March that freight was getting a little better. The problem is that freight should be significantly better in March, which is why the seasonally adjusted index fell,” Costello said. “While the industry is desperate for some positive news, it is unfortunate that March’s data suggests the industry has not hit bottom just yet.”

U.S. Homeownership by Age Group

by Calculated Risk on 4/27/2009 02:57:00 PM

The previous post on the homeownership rate prompted several questions about what happens when the boomers retire? Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the homeownership by age group for three different time periods: 1985, 2000, and 2007. Back in 1985, the homeownership rate declined significantly after people turned 70. However, more recently, the homeownership rate has stayed above 80% for those in the 70 to 75 cohort, and close to 80% for people over 75.

I expect the homeownership rate to remain high for the boomer generation too. Although there will probably be a geographic shift as the boomer generation retires (towards the sun states) and some downsizing, I don't think the aging of the boomer generation will negatively impact the homeownership rate for 15 years or more.

And that reminds me of an animation I made several years ago showing the U.S. population distribution by age from 1920 to 2000 (plus 2005).

Animation updates every 2 seconds.

The graphs for 1900 and 1910 have a similar shape as 1920. With the medical advances of the 20th Century, we would expect the shape of the distribution to become flatter as fewer people die of illnesses in the prime of their lives.

There are a couple of things to watch for: