by Calculated Risk on 12/19/2008 07:26:00 PM

Friday, December 19, 2008

Schwarzenegger may force unpaid time off for state employees

From Bloomberg: Schwarzenegger May Order Unpaid Leave for Employees

California Governor Arnold Schwarzenegger may force all state workers to take two days of unpaid leave each month to conserve money ... The practice would begin in February and would last through June 2010 ...

The executive order also would seek to cut the state’s workforce by 10 percent through firings if necessary and would freeze new hiring ...

The leave would amount to a 10 percent pay cut ...

Crude Oil below $33 per Barrel

by Calculated Risk on 12/19/2008 04:39:00 PM

From Bloomberg: New York Oil Falls as Stockpiles at Cushing, Oklahoma, Climb

Crude oil dropped below $33 a barrel in New York as rising stockpiles at Cushing, Oklahoma, leave little room to store supplies for delivery next year.UPDATE: For those that missed it, the article also mentions:

The more-active February contract rose 69 cents, or 1.7 percent, to $42.36.But my key points concerning the economic impact are the same.

For the U.S. economy, I think there are two points worth repeating: 1) this decline in oil prices will significantly reduce PCE for gasoline, oil and other energy goods - and provide a stimulus for U.S. household to either save more, or spend more on other items, and 2) the oil price decline will also impact investment in domestic oil production (also foreign oil production, but that doesn't direclty impact the U.S. economy).

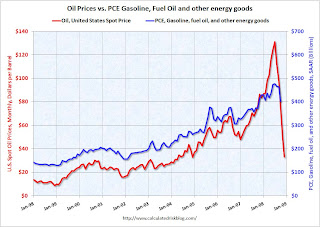

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly).

Click on graph for larger image in new window.

Click on graph for larger image in new window. At current oil prices, it appears oil related PCE could fall to $250 billion or so SAAR, from close to $500 billion SAAR in July. This is a savings of almost $20 billion per month compared to July. And that would be helpful and definitely provide some cushion for consumers. This might show up as more savings, as opposed to other consumption, but rebuilding savings is probably a necessary step towards rebuilding household balance sheets.

Data sources: PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117. Oil prices from EIA U.S. Spot Prices.

The second graph (repeated from earlier in the week) compares real oil prices (data from the St. Louis Fed, adjusted with CPI) and real investment in petroleum exploration and wells in the U.S. (data from the BEA).

This doesn't include investment in alternative energy sources.

Not surprisingly there is a strong correlation between oil prices and investment. With oil prices now in the $33 per barrel range, this suggests that domestic investment could fall under $20 billion per year or so. This is another area of non-residential investment that will probably see a significant decline in 2009.

Not surprisingly there is a strong correlation between oil prices and investment. With oil prices now in the $33 per barrel range, this suggests that domestic investment could fall under $20 billion per year or so. This is another area of non-residential investment that will probably see a significant decline in 2009.

T2 Partners: "Why There Is More Pain to Come"

by Calculated Risk on 12/19/2008 01:25:00 PM

There is a lot of great data in this report, but be careful how you use it.

From T2 Partners: An Overview of the Housing/Credit Crisis And Why There Is More Pain to Come (hat tip Chad) Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is an example of great data, but it could be very misleading. The total for household mortgages (including 2nds and HELOCs) is $10.57 trillion according the the Fed's Q3 Flow of Funds report.

If you start adding up the household mortgages on this chart ($0.7 trillion for subprime, $1.0 trillion for Alt-A, $2.1 trillion for HELOCs, $2.4 trillion for Jumbos, $4.6 trillion for Agency MBS, and $4.7 trillion for Prime) you discover that there is some significant double counting (most Agency MBS is Prime - so that is a huge source of the double counting).

There are similar problems elsewhere in the report, but overall the information is great.

Q3 2008: Mortgage Equity Extraction Strongly Negative

by Calculated Risk on 12/19/2008 10:55:00 AM

Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q3 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q3 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $64.1 billion, or negative 2.4% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.  Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

This measure is also slightly negative.

The Fed's Flow of Funds report shows the amount of mortgages outstanding is declining, and this is partially because of debt cancellation per foreclosure sales, and partially due to homeowners paying down their mortgages (as opposed to borrowing more). Note: most homeowners pay down their principal a little each month (unless they have an IO or Neg AM loan), so with no new borrowing, equity extraction would always be negative.

But this suggests that the Home ATM is closed, and MEW is no longer supporting consumption.

The Auto Bailout

by Calculated Risk on 12/19/2008 10:43:00 AM

From the WSJ: Auto Makers to Get $17.4 Billion

The White House announced a $17.4 billion rescue package for the troubled Detroit auto makers that allows them to avoid bankruptcy and leaves many of the big decisions for the incoming Obama administration.

...

The deal would extend $13.4 billion in loans to General Motors Corp. and Chrysler LLC in December and January, with another $4 billion likely available in February.

...

The agreement designates a person to oversee the government's effort, although officials stopped short of referring to that as a "car czar." For the outgoing Bush administration, that person will be Treasury Secretary Henry Paulson.

Thursday, December 18, 2008

GM and Chrylser Bailout Plan might be announced Friday

by Calculated Risk on 12/18/2008 09:08:00 PM

From Bloomberg: GM, Chrysler Said to Be Poised for U.S. Loans to Get Into March

General Motors Corp. and Chrysler LLC would get U.S. loans to stay afloat until March under a Bush administration rescue plan that may be unveiled as soon as today ...We are all banks now!

The Treasury Department may lend to the automakers through their credit arms, GMAC LLC and Chrysler Financial, to avoid having other industrial companies line up for access to the $700 billion Troubled Asset Relief Program ...

Federal Reserve Assets

by Calculated Risk on 12/18/2008 08:07:00 PM

Here is another look at the Fed's balance sheet (released today). As a reminder, Dallas Fed President Richard Fisher commented in early November that he expected the Fed assets to grow to $3 trillion by the end of this year.

"I would not be surprised to see them aggregate to $3 trillion—roughly 20 percent of GDP—by the time we ring in the New Year."

Click on graph for larger image in new window.

The Federal Reserve assets increased to $2.312 trillion this week.

Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

Although the assets are still increasing, it looks like Fisher was overly pessimistic - $3 trillion by year end seems less likely now.

The Doris "Tanta" Dungey Endowed Scholarship Fund

by Calculated Risk on 12/18/2008 06:23:00 PM

From our very own bacon_dreamz:

I've established The Doris Dungey Endowed Scholarship Fund at Illinois State University . Donations to the fund will be used for two things: first, to purchase a bench on the ISU campus (we're hoping to have it placed in or near Milner Library, since Tanta liked to read so much) and second, to endow a journalism scholarship in Tanta 's name.

Once endowed, the scholarship will be awarded annually to a student with financial need that has demonstrated academic achievement and a passion for journalism. Tanta ’s work was obviously hugely influential, and I think a lot of people benefited both personally and professionally from her generosity, so for those who would like to give something back in her memory, I think this is a nice way to do it. I know I certainly gained a great deal from her work, but more than that she was also my friend, so I really hope she would be proud to have her name attached to this.

Donations can be made at the link below by entering "Doris Dungey Endowed Scholarship" in the Gift Designation box. Checks made out to the ISU Foundation with “Doris Dungey” in the memo can also be mailed to:ISU Foundation

attention: Mary Rundus

Illinois State University, Campus Box 8000

Normal, IL 61790.

http://www.development.ilstu.edu/credit/credit.phtml?id=8000

I've copied the paragraph I had to write about Tanta below, along with the scholarship selection criteria. ... I'm going to be involved in the annual selection process, as will [Tanta's niece] Kate, who will soon graduate from ISU with a double major in journalism and Spanish.

The Doris Dungey Endowed Scholarship Fund

Illinois State University Foundation

Normal, IllinoisAdministrative Agreement

The scholarship is given in loving memory of Doris Dungey—known as “Tanta” to her family, friends, and readers—who received her Bacherlor’s degree in English and Philosophy from Illinois State University in 1982 and her Master’s degree in English Literature from the University of Wisconsin-Madison . Tanta spent most of her career working as a mortgage banker, until 2006, when she was diagnosed with late-stage ovarian cancer and began devoting much of her time and energy to writing for Calculated Risk, a finance and economics blog, which she continued doing until she passed away late in 2008. In this short time, she elevated the public discourse surrounding the collapse of the mortgage and housing markets by writing what became a widely read and referenced series of prescient articles explaining the “grim details” of how the mortgage industry functions, and by frequently challenging the rest of the media—often by skewering what she viewed as inept reporting--to dig deeper, ask the right questions, avoid prejudices and cheap moralizing, and above all get the story right. She always did so with humor, a passion for delving into the details, an understanding of people, a strong sense of human decency, and an instantly recognizable style filled with spirit, insight, and literary allusions, which continues to attract, inform, and entertain readers from a wide variety of backgrounds. She enjoyed interacting with her readers and was a generous teacher, touching many lives through her work.

I. Scholarship Candidate Qualifications Each candidate for a Doris Dungey Scholarship must be or have:A. Accepted for enrollment or enrolled in good standing at Illinois State University .

B. Demonstrated academic achievement, as evidenced by accumulative GPA of at least 3.0 on a 4.0 scale.

C. Have a declared major in Journalism

D. Demonstrated financial need

E. Work experience, extracurricular or volunteer activities (special emphasis for work on high school newspaper, year-book, or related experience)

F. Used for educational expenses.

G. Sample of published writing or graded essay along with a brief description of why it was chosen.

H. Essay explaining why the applicant is interested in pursuing a career in journalism

The Obama Stimulus Plan

by Calculated Risk on 12/18/2008 04:27:00 PM

From the WSJ: Obama Team Aims to Keep Stimulus Under $1 Trillion

President-elect Barack Obama's economic team is crafting a stimulus package to send to Congress worth between $675 billion and $775 billion over two years ... The transition team has conveyed the figures to Capitol Hill, where the package is likely to grow as it works its way through the House and Senate. An Obama adviser familiar with the planning said the package could top out around $850 billion.It sounds like this bill will be around $850 billion over two years, and will be signed before the end of January. Add this to the stimulus from lower gasoline and energy bills, lower adjustable rate mortgages, and lower rates for those that refinance. That is a lot of stimulus ...

...

Both sides in the talks want a package ready when Congress returns Jan. 6, so legislation can reach the House and Senate floors before Mr. Obama's Jan. 20 inauguration.

...

[The plan] will include a tax cut designed to pump $50 billion to $100 billion into the economy almost immediately; around $100 billion in aid to state governments, primarily to temporarily assume more of the cost of Medicaid, in hopes of staving off benefit cuts or tax increases; and funding in five main areas: traditional infrastructure, school construction, energy efficiency, broadband access and health-information technology.

DataQuick: Almost 50% of Home Sales are Foreclosure Resales in California Bay Area

by Calculated Risk on 12/18/2008 02:09:00 PM

NOTE from CR: be careful with median prices. This doesn't mean prices have fallen to an eight year low - this means that a combination of price declines and a significant change in mix (to lower priced homes) has happened. The Case-Shiller repeat sales index is a better measure of actual price declines.

From DataQuick: Bay Area median home price sinks to 8-year low; sales up over '07 again

Bay Area home sales decelerated in November but beat the year-ago mark for the third consecutive month. The allure of discounted foreclosures continued to drive sales in affordable inland markets, which helped push the median sale price down to its lowest point since former President Bill Clinton was in the White House.This fits with the earlier post today about interest rates. On loans up to $417K, 30 year fixed rates are below 5%, but on loans above $417K rates are still above 7%.

The median price paid for all new and resale houses and condos combined in the nine-county Bay Area fell to $350,000 last month. That was down 6.7 percent from $375,000 in October and down a record 44.4 percent from $629,000 in November 2007, according to MDA DataQuick, a San Diego-based real estate information service.

The November median sale price - the point where half of the homes sold for more and half for less - stood at its lowest since it was $350,000 in September 2000. It was 47.4 percent below the peak median of $665,000 reached last year in June, July and August.

...

A total of 5,756 new and resale houses and condos closed escrow in the region last month. That was down 24.4 percent from 7,613 sales in October but up 12.3 percent from 5,127 sales in November 2007.

Last month's tally was still the second-lowest for a November since at least 1988, when DataQuick's statistics begin.

...

Last month 47.6 percent of all homes that resold in the Bay Area had been foreclosed on at some point in the prior 12 months, up from 44.0 percent in October and 10.1 percent a year ago.

...

In November, use of FHA, government-insured mortgages allowing a down payment of as little as 3 percent rose to 20.6 percent of Bay Area home purchase loans. That's a record in DataQuick's statistics and up from less than 1.0 percent a year ago. At the same time, use of larger mortgages known as "jumbo loans," common in higher-cost coastal neighborhoods, continued to fall. Before the credit crunch hit in August 2007, 62 percent of Bay Area sales were financed with jumbos, then defined as over $417,000. Last month just 23.0 percent of purchase loans were over $417,000.