by Calculated Risk on 12/19/2008 04:39:00 PM

Friday, December 19, 2008

Crude Oil below $33 per Barrel

From Bloomberg: New York Oil Falls as Stockpiles at Cushing, Oklahoma, Climb

Crude oil dropped below $33 a barrel in New York as rising stockpiles at Cushing, Oklahoma, leave little room to store supplies for delivery next year.UPDATE: For those that missed it, the article also mentions:

The more-active February contract rose 69 cents, or 1.7 percent, to $42.36.But my key points concerning the economic impact are the same.

For the U.S. economy, I think there are two points worth repeating: 1) this decline in oil prices will significantly reduce PCE for gasoline, oil and other energy goods - and provide a stimulus for U.S. household to either save more, or spend more on other items, and 2) the oil price decline will also impact investment in domestic oil production (also foreign oil production, but that doesn't direclty impact the U.S. economy).

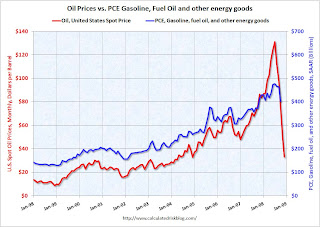

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly).

Click on graph for larger image in new window.

Click on graph for larger image in new window. At current oil prices, it appears oil related PCE could fall to $250 billion or so SAAR, from close to $500 billion SAAR in July. This is a savings of almost $20 billion per month compared to July. And that would be helpful and definitely provide some cushion for consumers. This might show up as more savings, as opposed to other consumption, but rebuilding savings is probably a necessary step towards rebuilding household balance sheets.

Data sources: PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117. Oil prices from EIA U.S. Spot Prices.

The second graph (repeated from earlier in the week) compares real oil prices (data from the St. Louis Fed, adjusted with CPI) and real investment in petroleum exploration and wells in the U.S. (data from the BEA).

This doesn't include investment in alternative energy sources.

Not surprisingly there is a strong correlation between oil prices and investment. With oil prices now in the $33 per barrel range, this suggests that domestic investment could fall under $20 billion per year or so. This is another area of non-residential investment that will probably see a significant decline in 2009.

Not surprisingly there is a strong correlation between oil prices and investment. With oil prices now in the $33 per barrel range, this suggests that domestic investment could fall under $20 billion per year or so. This is another area of non-residential investment that will probably see a significant decline in 2009.