by Calculated Risk on 12/22/2008 10:43:00 AM

Monday, December 22, 2008

WSJ: Commercial Property Investors Seek Bailout

From the WSJ: Developers Ask U.S. for Bailout as Massive Debt Looms

With a record amount of commercial real-estate debt coming due, some of the country's biggest property developers have become the latest to go hat-in-hand to the government for assistance.Although the headline says "developers" this is really about property investors who bought commercial buildings at the price peak and are now underwater. But say the owners default and the properties are transferred to the bondholders - what is the risk to the economy? None.

They're warning policymakers that thousands of office complexes, hotels, shopping centers and other commercial buildings are headed into defaults, foreclosures and bankruptcies. The reason: according to research firm Foresight Analytics LCC, $530 billion of commercial mortgages will be coming due for refinancing in the next three years -- with about $160 billion maturing in the next year.

With the automakers there was a concern that a large number of jobs would be lost without a bailout. How many jobs will be lost if the ownership of an office building or mall changes? Very few.

The article suggests there is a concern that some owners will not be able to refinance because of the credit crisis, even though their properties have strong positive cash flow. But that seems like a liquidity issue for the Fed and the banks, and doesn't seem to require a bailout from the Treasury.

I don't see the argument for a bailout.

Sunday, December 21, 2008

NY Times: More Part Time Workers

by Calculated Risk on 12/21/2008 11:20:00 PM

From the NY Times: More Firms Cut Labor Costs Without Layoffs

A growing number of employers, hoping to avoid or limit layoffs, are introducing four-day workweeks, unpaid vacations and voluntary or enforced furloughs, along with wage freezes, pension cuts and flexible work schedules. These employers are still cutting labor costs, but hanging onto the labor.

...

Several employees at Hot Studio said they did not mind the policy, particularly as they have heard of layoffs elsewhere in the economy. “People feel they’d much rather have a job in six months than get a bonus right now,” said Jon Littell, a Web designer.

The magnanimous feeling will probably pass, said Truman Bewley, an economics professor at Yale University who has studied what happens to wages during a recession. If the sacrifices look as though they are going to continue for many months, he said, some workers will grow frustrated, want their full compensation back and may well prefer a layoff that creates a new permanence.

“These are feel-good, temporary measures,” he said.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the number of employees working part time for economic reasons for the last 50 years. IMPORTANT: The BLS made a change in Jan 1994, and prior to that change more workers fell into this category.

From the BLS:

Reasons for working part time. Persons who work part time do so either for noneconomic reasons (that is, because of personal constraints or preferences) or for economic reasons (that is, because of business-related constraints such as slack work or the lack of full-time opportunities). Because respondents typically are not familiar with this distinction, the question was reworded to provide examples of the two types of reasons. More importantly, the measurement of working part time involuntarily (or for economic reasons) was modified to better reflect the concept. Starting in 1994, workers who usually work part time and are working part time involuntarily must want and be available for full-time work.Although the chart is not population adjusted, this suggests that there is a larger move to part time employment in the current downturn than in previous downturns. I tend to focus on the unemployment rate, but employees working part time (for economic reasons) is an important part of the weak employment picture.

Japan Exports Decline 27%

by Calculated Risk on 12/21/2008 09:01:00 PM

From Bloomberg: Japan Exports Plunge Record 27% as Recession Deepens

Japan’s exports plunged the most on record in November as global demand for cars and electronics collapsed ... Exports fell 26.7 percent from a year earlier ...And this isn't just because of exports to the U.S. or Europe:

Exports to Asia fell 27 percent, the most since 1986, after the first decline in six years in October. Shipments to China, Japan’s largest trading partner, fell 25 percent, the steepest drop in 13 years.This looks like a worldwide recession including China (see: Forecaster: Negative Q4 GDP in China)

U.S. retail gasoline prices decline to $1.66 per gallon

by Calculated Risk on 12/21/2008 07:20:00 PM

From Bloomberg: U.S. Retail Gasoline Falls to $1.66 a Gallon, Lundberg Says

The average price of regular gasoline at U.S. filling stations fell to $1.66 a gallon as the nation’s recession sapped demand.

Gasoline slipped 9 cents, or 5.1 percent, in the two weeks ended Dec. 19, according to oil analyst Trilby Lundberg’s survey of 7,000 filling stations nationwide.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the nominal weekly U.S. gasoline prices since 1993 (source: EIA)

Gasoline prices are close to the 2000 through 2003 price range, when the median prices was just over $1.50 per gallon.

UK: Up to 15 national retail chains expected to go BK in January

by Calculated Risk on 12/21/2008 12:19:00 PM

From The Times: High street braced for Christmas sales carnage

UP to 15 national retail chains are predicted to go bust before the middle of January, forcing thousands more shopworkers onto the dole.The pattern will probably be similar in the U.S. with a number of retailers filing for bankruptcy in January (usually the worst month of the year for retail BKs), with more retail layoffs, and even more empty retail stores (see: Retail Space to be Vacated from some retail numbers from reader wc)

The prediction came from insolvency expert Begbies Traynor as well-known retail chains clamour to sell enough goods to meet their quarterly rent payments on Christmas Day. Nick Hood, partner at Begbies Traynor ... refused to name specific store groups, but this weekend it emerged that The Officers Club, a 150-strong national menswear chain, had been put up for distressed sale through KPMG, while the specialist tea retailer, Whittards, and music store Zavvi remained on the critical list.

...

Rupert Eastell, head of retail at BDO Stoy Hayward, said: “From tomorrow until mid-January, it’s going to be the worst three weeks for retailers in 20 years.”

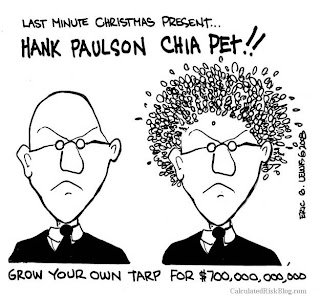

Last Minute Gift Idea

by Calculated Risk on 12/21/2008 05:56:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

This works for mini-me too.

Saturday, December 20, 2008

Real Estate and Tax Advantages

by Calculated Risk on 12/20/2008 11:24:00 PM

How come so many people write about real estate as a tax advantaged investment, and they never mention the tax disadvantage?

Take this article in the NY Times: Tax Break May Have Helped Cause Housing Bubble

Luckily the title contained the word "may" because it is pretty easy to demonstrate that the '97 tax change was a minor factor (at most) in the real estate bubble. But I have a question about this section:

Together with the other housing subsidies that had already been in the tax code — the mortgage-interest deduction chief among them — the law gave people a motive to buy more and more real estate.Yes, there is a mortgage interest deduction, and a capital gains exclusion for a primary residence - but there is also a property tax for real estate. This is a tax disadvantage compared to stocks and bonds.

...

Referring to the special treatment for capital gains on homes, Charles O. Rossotti, the Internal Revenue Service commissioner from 1997 to 2002, said: “Why insist in effect that they put it in housing to get that benefit? Why not let them invest in other things that might be more productive, like stocks and bonds?”

If you own a $500 thousand home, you probably pay $5 to $10 thousand per year in property taxes. If you own $500 thousand in stocks and bonds, how much do you pay per year in property taxes (just for owning them - not selling them)?

I'm not arguing for or against any particular tax treatment here, I just think when comparing the tax treatment of various assets, maybe we should consider all taxes.

NY Times: Ideologues Aided Mortgage Crisis

by Calculated Risk on 12/20/2008 06:23:00 PM

From the NY Times: White House Philosophy Stoked Mortgage Bonfire

The global financial system was teetering on the edge of collapse when President Bush and his economics team huddled in the Roosevelt Room of the White House for a briefing that, in the words of one participant, “scared the hell out of everybody.”This article makes some interesting points, but misses some of the key causes of the crisis. As an example then Fed Chairman Alan Greenspan isn't even mentioned in the article, and he was counseling Mr. Bush on reducing regulations.

...

Mr. Bush, according to several people in the room, paused for a single, stunned moment to take it all in.

“How,” he wondered aloud, “did we get here?”

The article incorrectly focuses on minority ownership and Fannie and Freddie (a small role in the crisis) and barely touches on Wall Street - and completely ignores the securitization process (a major enabler to the crisis). But there are some interesting quotes:

"There is no question we did not recognize the severity of the problems,” said Al Hubbard, Mr. Bush’s former chief economics adviser, who left the White House in December 2007. “Had we, we would have attacked them.”I'd like to see a mea culpa from Greg Mankiw and few others too.

Looking back, Keith B. Hennessey, Mr. Bush’s current chief economics adviser, says he and his colleagues did the best they could “with the information we had at the time.” But Mr. Hennessey did say he regretted that the administration did not pay more heed to the dangers of easy lending practices. And both Mr. Paulson and his predecessor, John W. Snow, say the housing push went too far.

“The Bush administration took a lot of pride that homeownership had reached historic highs,” Mr. Snow said in an interview. “But what we forgot in the process was that it has to be done in the context of people being able to afford their house. We now realize there was a high cost.”

Even this story is from early 2007 when the crisis should have been obvious to everyone:

Jason Thomas had a nagging feeling.Geesh - early 2007 - and one guy had a "nagging feeling"? Oh my ...

The New Century Financial Corporation, a huge subprime lender whose mortgages were bundled into securities sold around the world, was headed for bankruptcy in March 2007. Mr. Thomas, an economic analyst for President Bush, was responsible for determining whether it was a hint of things to come.

At 29, Mr. Thomas had followed a fast-track career path that took him from a Buffalo meatpacking plant, where he worked as a statistician, to the White House. He was seen as a whiz kid, “a brilliant guy,” his former boss, Mr. Hubbard, says.

As Mr. Thomas began digging into New Century’s failure that spring, he became fixated on a particular statistic, the rent-to-own ratio.

Typically, as home prices increase, rental costs rise proportionally. But Mr. Thomas sent charts to top White House and Treasury officials showing that the monthly cost of owning far outpaced the cost to rent. To Mr. Thomas, it was a sign that housing prices were wildly inflated and bound to plunge, a condition that could set off a foreclosure crisis as conventional and subprime borrowers with little equity found they owed more than their houses were worth.

It was not the Bush team’s first warning. The previous year, Mr. Lindsay, the former chief economics adviser, returned to the White House to tell his old colleagues that housing prices were headed for a crash. But housing values are hard to evaluate, and Mr. Lindsay had a reputation as a market pessimist, said Mr. Hubbard, adding, “I thought, ‘He’s always a bear.’ ”

In retrospect, Mr. Hubbard said, Mr. Lindsay was “absolutely right,” and Mr. Thomas’s charts “should have been a signal.”

Thread music ...

CRE Owner "Walking Away"

by Calculated Risk on 12/20/2008 10:16:00 AM

From the St. Petersburg Times: BayWalk owner proposes deal to surrender deed, walk away (hat tip Terry)

Hoping to avoid drawn-out foreclosure proceedings, BayWalk owner Fred Bullard said Friday he is negotiating a deal to simply surrender the deed to the downtown entertainment complex and walk away.And good luck pursuing him for any penalities:

Under the proposal, a bank would take control of the retail and restaurant portion of BayWalk and appoint a trustee to run the complex until a suitable buyer is found.

The technical owner of BayWalk, STP Redevelopment, has no other assets and was created solely to own BayWalk.As I've noted before, CRE owners are much more willing to just walk away than residential owners.

Friday, December 19, 2008

Retail Space to be Vacated

by Calculated Risk on 12/19/2008 09:27:00 PM

Back in October, the WSJ reported that mall vacancy rates increase sharply in Q3:

For strip centers and other open-air shopping venues, the vacancy rate climbed to 8.4% in the third quarter from 8.1% in the second quarter. That marks the highest rate since 1994, according to Reis. Meanwhile, retailers' closures outpaced new leases by 2.8 million square feet in U.S. strip centers in the third quarter, the third consecutive quarterly net decline. It is the first nine-month period of so-called negative net absorption since Reis started tracking the data in 1980.

...

The vacancy rate at malls in the top 76 U.S. markets rose to 6.6% in the third quarter, up from 6.3% in the previous quarter, to its highest level since late 2001, according to Reis.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the strip mall vacancy rate since Q2 2007. Note that the graph doesn't start at zero to better show the change.

But clearly it is about to get much worse.

Hat tip wc for the following!

Pre black Friday closing & liquidation announcements have come from Shoe Pavilion, Steve & Barry's, Gordman's, Radio Shack, JoAnn Fabric, Boscov's, Bennigan's, Winn Dixie, Office Max, Comp USA, Pier 1, and Sigrid Olsen. Of the 2 billion square feet of community/neighborhood retail space in the largest 76 metropolitan areas, vacancy has increased by 0.75% so far in 2008 (source: REIS).This list isn't exhaustive - we could add other retailers closing stores, filing bankruptcy or going out of business such as Sharper Image, Starbucks, The Disney Store, Wilson's Leather, Talbots, Ann Taylor, Bombay Co. and more.

In the last 2 months the number and severity of announcements from retailers has gotten worse. Based on press releases, and an estimate of average store size, I believe these 9 retailers [alone] will be leaving about 47 million square feet of space:

From the WSJ: Linens 'n Things to Be Liquidated 10/14/2008

From the WSJ: Linens 'n Things to Be Liquidated 10/14/2008From MarketWatch: Mervyns Closing all Stores After 60 Years in Business 10/30/2008

From the Consumerist: Santa's Not Coming: All KB Toys Stores To Be Liquidated And Closed KB Toys 12/11/2008

From the Tribune-Democrat: Value City closes 11/25/2008

From the WSJ: Circuit City Seeks Haven In Bankruptcy Protection 11/11/2008

From Costar: Bally Total Fitness Files Bankruptcy, Again 12/5/2008

From the Press Telegram: Shoe Pavilion shutting down all 64 stores 10/20/2008

From the WSJ: U.S. court OKs Tweeter Chapter 7 liquidation 12/5/2008

From the Times Dispatch: Judge allows RoomStore purchase of Mattress Discounters 12/4/2008

The percent of total retail space is estimate based on 2 billion square foot number; this is only the 76 markets covered by REIS (2007 Q3 = 1,965,651,000. 2010 forecast = 2,026,266,000).CR note: this is just a rough estimate - and many analysts are expecting a number of additional retail bankruptcies in January - but it is pretty clear the mall vacancy rate will rise sharply in 2009.

If 3/4 of the closing stores are in the top 76 metro areas defined by REIS, these 9 retailers alone will increase vacancy by 1.8% (compared with 0.75% during 2008).