by Calculated Risk on 12/23/2008 10:35:00 AM

Tuesday, December 23, 2008

Existing Home Sales Plunge in November

From the NAR: Existing-Home Sales Decline in Economic Uncertainty

Existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 8.6 percent to a seasonally adjusted annual rate of 4.49 million units in November from a downwardly revised level of 4.91 million in October, and are 10.6 percent below the 5.02 million-unit pace in November 2007.

Lawrence Yun, NAR chief economist, expected a decline. “The quickly deteriorating conditions in the job market, stock market, and consumer confidence in October and November have knocked down home sales to another level. We hope the home sales impact from the stock market crash turns out to be short-lived, as was the case in 1987 and 2001,” he said.

...

Total housing inventory at the end of November rose 0.1 percent to 4.20 million existing homes available for sale, which represents an 11.2-month supply at the current sales pace, up from a 10.3-month supply in October.

Click on graph for larger image in new window.

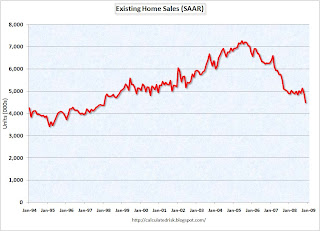

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2008 (4.49 million SAAR) were 8.6% lower than last month, and were 10.5% lower than November 2007 (5.02 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). NAR economist Yun suggested said a couple of months ago that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales. Although these are real transactions, this means activity (ex-foreclosures) is running around 3 million units SAAR.

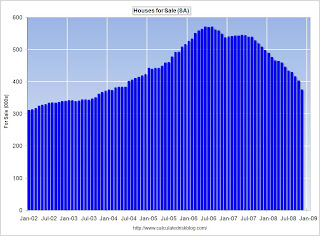

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased slightly to 4.20 million in November, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was the peak for inventory this year.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased slightly to 4.20 million in November, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was the peak for inventory this year. It is a little unusual for supply to increase in November (from October), and looking forward, usually supply falls sharply in December as homeowners take their properties off the market for the holidays. Something to watch for next month.

Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 11.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

I still expect sales to fall further over the next few months, although inventory has peaked for the year. I'll have more on existing home sales soon ...

New Home Sales in November

by Calculated Risk on 12/23/2008 10:01:00 AM

The Census Bureau reports, New Home Sales in November were at a seasonally adjusted annual rate of 407 thousand. This is the lowest sales rate since 1982.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for November since 1981. (NSA, 28 thousand new homes were sold in November 2008, 27 thousand were sold in November 1981).

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in November 2008 were at a seasonally adjusted annual rate of 407,000, according toAnd one more long term graph - this one for New Home Months of Supply.

estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

This is 2.9 percent below the revised October of 419,000 and is 35.3 percent below the November 2007 estimate of 629,000.

"Months of supply" is at 11.5 months.

"Months of supply" is at 11.5 months. The months of supply for October was revised up to 11.8 months - the ALL TIME RECORD!

For new homes, both sales and inventory are falling quickly.

And on inventory:

TheInventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but are still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

seasonally adjusted estimate of new houses for sale at the end of November was 374,000. This represents a supply of 11.5 months at the current sales rate.

This is a another very weak report. I'll have some charts on existing home sales and more on new home sales later today ...

Existing Home Sale Decline Sharply in November

by Calculated Risk on 12/23/2008 10:00:00 AM

The NAR reported this morning that existing home sales were at a 4.49 million rate in November, 8.6% below the 4.91 million rate in October.

The months of supply increased to 11.2 months. I'll have some charts shortly (New Home sales is being released today too).

Frozen Wages

by Calculated Risk on 12/23/2008 09:14:00 AM

IN addition to more part time workers, freezing wages is becoming a common theme (hat tip Brian):

From Reuters: U.S. manufacturers cut jobs and pay amid downturn

According to the employment consulting firm Watson Wyatt, 11 percent of all the companies it recently surveyed either already had cut wages or planned to do so over the next 12 months, and 10 percent either have reduced their employer 401(k) match or planned to do so.From Cincinnati.com: No pay raise for salaried Duke workers

"Companies are trying to do things that are much more thoughtful as opposed to just, let's take 10 percent of the work force off," Jeffrey Joerres, chief executive of Manpower Inc, the world's No. 2 staffing company, said in a phone interview.

Between 1,500 and 1,700 employees of Duke Energy in Cincinnati and Northern Kentucky are included in a salaried employee wage freeze announced by the utility last week to help cope with the recession.From the San Francisco Chronicle: Wage freeze proposed for S.F. unions

About half of the Charlotte, N.C.-based company's 18,000 employees are included.

Duke said it was freezing 2009 wages for managers, supervisors and salaried workers in finance, human resources, information technology and other technical areas.

San Francisco's unionized city workers, including police officers, firefighters and nurses, should decide whether to forgo $35 million in cost-of-living raises in the coming months or face massive layoffs that would save the same amount, under a proposal announced Friday by Board of Supervisors President Aaron Peskin.From the Beaufort Ggazette: Education committee proposes wage freeze for state's teachers

A state-appointed education committee recommended last week that teacher pay in South Carolina be frozen for the next fiscal year because of declining sales-tax revenue.From FreshPlaza.com: US: Weyerhaeuser cuts dividend by 58%

With revenues expected to be significantly lower in the near future, the company is doing all it can to keep margins intact. Executives implemented a white-collar wage freeze ...From the WSJ: Trucking Firm YRC, Union Set Tentative 10% Wage Cut

YRC Worldwide Inc., one of the nation's largest trucking companies, will cut wages for 40,000 union workers by 10% if the workers approve a deal recommended by representatives of the International Brotherhood of Teamsters.From the WSJ: Unisys to Cut 1,300 Jobs, Suspend Raises

Unisys Corp. said it would cut 1,300 jobs, or 4.3% of its worldwide work force; consolidate plants; suspend its 401(k) matching program; and not offer raises to most employees next year.From the Huffington Post: FedEx Pay Cuts, 401k Freeze Coming

FedEx Corp. on Thursday announced more broad cost cuts _ including salary reductions _ as deteriorating economic conditions continue to drag down demand, warning the outlook for 2009 remains murky.Update: To be clear, here is how FedEx described the pay / benefit freeze:

...

The package delivery company said it will cut pay for senior executives and freeze 401(k) contributions for a year. On Jan. 1, CEO Smith will take a 20 percent pay cut, and the pay of other top brass will fall by 7.5 percent to 10 percent.

FedEx will also implement a 5 percent pay cut for all remaining U.S. "salaried exempt" personnel, which excludes hourly workers such as couriers and package handlers.

Base salary decreases, effective January 1, 2009:20% reduction for FedEx Corp. CEO Frederick W. Smith 7.5%-10.0% reduction for other senior FedEx executives 5.0% reduction for remaining U.S. salaried exempt personnel Elimination of calendar 2009 merit-based salary increases for U.S. salaried exempt personnel Suspension of 401(k) company matching contributions for a minimum of one year, effective February 1, 2009

White House: Hoocoodanode?

by Calculated Risk on 12/23/2008 12:19:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

Monday, December 22, 2008

OTS Official Accused of Backdating IndyMac Capital Infusion

by Calculated Risk on 12/22/2008 08:14:00 PM

From the WSJ: OTS Let IndyMac Backdate Infusion

The Treasury Department's inspector general is probing the Office of Thrift Supervision for permitting a backdated capital infusion into IndyMac Bancorp a few months before its collapse in July.This was the culture at the OTS - anything to help the "customers". The OTS competed with other regulators for "customers" (aka banks), and the OTS offered more "flexible" supervision - perhaps even backdating capital infusions!

The infusion allowed the bank to be classified as "well capitalized," instead of "adequately capitalized," at the end of the first quarter. That let IndyMac avoid having to take certain steps with the Federal Deposit Insurance Corp.

A top OTS official, West Region Director Darrel Dochow, was removed from his current duties in connection with the inquiry, according to letters released Monday by the office of Sen. Charles Grassley (R., Iowa). An OTS spokesman said Mr. Dochow wasn't available for comment.

In a letter to Sen. Grassley, Treasury Inspector General Eric M. Thorson said the probe would examine why Mr. Dochow allowed IndyMac to record $18 million in capital as received from its holding company before March 31, 2008, even though the injection occurred after that date.

For a great article on the OTS, see the WaPo: Banking Regulator Played Advocate Over Enforcer

When Countrywide Financial felt pressured by federal agencies charged with overseeing it, executives at the giant mortgage lender simply switched regulators in the spring of 2007.What a weird regulatory structure. And finally, here is the head of OTS taking a chainsaw to regulations in 2003.

The benefits were clear: Countrywide's new regulator, the Office of Thrift Supervision, promised more flexible oversight of issues related to the bank's mortgage lending. For OTS, which depends on fees paid by banks it regulates and competes with other regulators to land the largest financial firms, Countrywide was a lucrative catch.

But OTS was not an effective regulator.

| This photo from 2003 shows two regulators: John Reich (then Vice Chairman of the FDIC and later at the OTS) and James Gilleran of the Office of Thrift Supervision (with the chainsaw) and representatives of three banker trade associations: James McLaughlin of the American Bankers Association, Harry Doherty of America's Community Bankers, and Ken Guenther of the Independent Community Bankers of America. |

Housing Bust Impacting Labor Mobility

by Calculated Risk on 12/22/2008 07:30:00 PM

From the WSJ: U.S. State-to-State Migration Slowed, Census Reports

The great migration south and west in the U.S. is slowing, thanks to a housing crisis that is making it hard for many to move.As I noted early this year, approximately 1 in 8 households (the same proportion as with negative equity) will probably not accept a job transfer now because of depressed home values - and that is about 200,000 fewer households per year that will probably not move for better job opportunities.

...

Most southern and western states are not growing nearly as fast as they were at the start of the decade, pausing a long-term trend fueled by the desire for open spaces and warmer climates, according to population estimates released Monday by the Census Bureau.

...

"People want to go to where it's warm and where there are a lot of amenities, that's a long- term trend in this country," said William Frey, a demographer at the Brookings Institution in Washington.

"But people have stopped moving," he said. "It's a big risk when you move to a new place. You need to know that moving and getting a new mortgage is going to pay off for you."

One of the strengths of the U.S. labor market has been the flexibility associated with labor mobility - households could easily move from one region to another for better employment. The housing bust is now limiting this flexibility.

White House: No one could have known

by Calculated Risk on 12/22/2008 04:24:00 PM

Never mind that many people saw this coming - obviously the White House wasn't listening.

From the White House: Statement by the Press Secretary on Irresponsible Reporting by New York Times

Most people can accept that a news story recounting recent events will be reliant on '20-20 hindsight'. Today's front-page New York Times story relies on hindsight with blinders on and one eye closed.The "most significant factor" was "cheap money flowing into the U.S."? Uh, no.

The Times' 'reporting' in this story amounted to finding selected quotes to support a story the reporters fully intended to write from the onset, while disregarding anything that didn't fit their point of view. To prove the point, when they filed their story, NYT reporters were completely unfamiliar with the President's prime time address to the nation where he laid out in detail all of the causes of the housing and financial crises. For example, the President highlighted a factor that economists agree on: that the most significant factor leading to the housing crisis was cheap money flowing into the U.S. from the rest of the world, so that there was no natural restraint on flush lenders to push loans on Americans in risky ways. This flow of funds into the U.S. was unprecedented. And because it was unprecedented, the conditions it created presented unprecedented questions for policymakers.

In his address the President also explained in detail the failure of financial institutions to perform normal and necessary due diligence in creating, buying and selling new financial products -- a problem that almost no one saw as it was happening.

The most significant causes of the credit crisis were innovation in mortgage securitization coupled with almost no regulatory oversight (because of ideologues who opposed oversight and regulation). This led to lax lending standards (liar loans, DAPs, widespread use of Option ARMs as affordability products, etc.) and excessive speculation.

Oh well ... I agree the White House missed the story, but the idea that "no one saw" the problem coming is nonsense.

Credit Crisis Indicators

by Calculated Risk on 12/22/2008 02:29:00 PM

The sharp decline in treasury yields had continued across the board. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The 10-year yield is at 2.11% today, slightly above the record low of 2.07% set last Thursday.

This graph shows the 10 year yield since 1962. The smaller graph shows the ten year yield for this year - talk about cliff diving!

The yield on 3 month treasuries is 0.00% (bad). Right at ZERO when I checked!

Here are a few other indicators of credit stress:

| The TED spread was stuck above 2.0 for some time. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5. |

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now quality 30 day nonfinancial paper is yielding close to zero. If the credit crisis eases, I'd expect a significant decline in this spread - and the graph makes it clear this indicator is still in crisis.

|

It appears the Fed is finally getting some rates down - but clearly the 3-month treasury yield at zero is not a sign of a healthy economy.

REIS: Commercial Real Estate Loan Defaults May Triple

by Calculated Risk on 12/22/2008 11:43:00 AM

From Bloomberg: Commercial Loan Defaults May Triple as Rental Income Declines

U.S. commercial properties at risk of default could triple if rental income from office, retail and apartment buildings drops by even 5 percent, a likely possibility given the recession, according to research by New York-based real estate analysts at Reis Inc.At the end of Q3, REIS reported office vacancy rates hit 13.6% (see WSJ: Office Space Is Emptying Out). Clearly REIS expects a significant increase in the vacancy rate in Q4 2008 (to 14.6%), and then a further increase in 2009 to 15.6%. Although that 2009 projection might be low ...

Lenders that used optimistic rent estimates to grant mortgages beginning in 2005 stand to lose as much as $23.1 billion, or 7.02 percent, of total unpaid balances if landlords lose 5 percent of net operating income, according to Reis. ...

[O]ffice vacancies are forecast to rise to 15.6 percent next year from an estimated 14.6 percent at the end of 2008. ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions (hat tip Will)

Changes in the unemployment rate and the office vacancy rate are highly correlated. As the unemployment rate continues to rise over the next year or more, I'd expect the office vacancy rate to rise sharply - possible to 17% or more by the end of 2009 (significantly higher than the REIS forecast).

REIS believes the rise in defaults will primarily because of the overly optimistic projections used when properties were purchased in recent years:

“A large decline in net operating income isn’t necessary to shift a lot of properties underlying CMBS loans into debt- service coverage ratios that would be worrisome,” [Victor Calanog, REIS director of research] said in an interview.As I've noted several times, many existing properties were recently purchased at prices that were based on overly optimistic pro forma income projections. These loans typically included reserves to pay interest until rents increased (like a negatively amortizing option ARM), and it is likely that many of these deals will blow up when the interest reserve is depleted - probably in the 2009-2010 period.

...

Over the last three years, lenders raised income projections for commercial properties by as much as 15 percent more than those properties’ historical performance, he said.

“That optimism might not be warranted,” Calanog said. “There’s a big pool of loans underwritten in 2005 and 2006 coming due in 2010 and 2011 that I believe will experience a rise in delinquencies and defaults.”

Loans from those years assumed strong growth in rents, a scenario that seems unlikely as the recession deepens, Calanog said.