by Calculated Risk on 5/26/2011 09:00:00 AM

Thursday, May 26, 2011

Q1 real GDP growth unrevised at 1.8% annualized rate

From the BEA: Gross Domestic Product, First Quarter 2011 (second estimate)

This was below the consensus forecast of an upward revision to 2.1%, and the details were weaker. Overall GDP growth was unrevised in the second estimate, although Personal Consumption Expenditures (PCE) growth was revised down, mostly offset by an increase in the "Change in private inventories". (see table at bottom for changes in contribution to GDP).

The following graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The current quarter is in blue.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The dashed line is the current growth rate. Growth in Q1 at 1.8% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

The following table shows the changes from the advance release (this is the Contributions to Percent Change in Real Gross Domestic Product).

| Contributions to Percent Change in Q1 Real Gross Domestic Product | |||

|---|---|---|---|

| 2nd Estimate | Advance | Change | |

| Percent change at annual rate: | |||

| Gross domestic product | 1.8 | 1.8 | 0.0 |

| Percentage points at annual rates: | |||

| Personal consumption expenditures.. | 1.53 | 1.91 | -0.4 |

| Goods | 0.83 | 1.12 | -0.3 |

| Durable goods | 0.66 | 0.78 | -0.1 |

| Nondurable goods | 0.17 | 0.34 | -0.2 |

| Services | 0.69 | 0.80 | -0.1 |

| Gross private domestic investment | 1.45 | 1.01 | 0.4 |

| Fixed investment | 0.26 | 0.09 | 0.2 |

| Nonresidential | 0.33 | 0.18 | 0.2 |

| Structures | -0.48 | -0.63 | 0.2 |

| Equipment and software | 0.81 | 0.80 | 0.0 |

| Residential | -0.07 | -0.09 | 0.0 |

| Change in private inventories | 1.19 | 0.93 | 0.3 |

| Net exports of goods and services | -0.06 | -0.08 | 0.0 |

| Exports | 1.16 | 0.64 | 0.5 |

| Imports | -1.22 | -0.72 | -0.5 |

| Government consumption expenditures | -1.07 | -1.09 | 0.0 |

| Federal | -0.68 | -0.68 | 0.0 |

| National defense | -0.68 | -0.69 | 0.0 |

| Nondefense | 0.00 | 0.00 | 0.0 |

| State and local | -0.39 | -0.41 | 0.0 |

Weekly Initial Unemployment Claims increase to 424,000

by Calculated Risk on 5/26/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

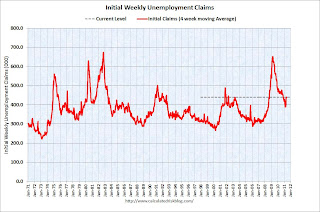

In the week ending May 21, the advance figure for seasonally adjusted initial claims was 424,000, an increase of 10,000 from the previous week's revised figure of 414,000. The 4-week moving average was 438,500, a decrease of 1,750 from the previous week's revised average of 440,250.The following graph shows the 4-week moving average of weekly claims for the last 40 years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 438,500.

The 4-week average is back to the level of last November when there were fewer payroll jobs being added each month - and that is very concerning.

Wednesday, May 25, 2011

Misc: State Revenues increases, Gas Prices fall, GDP and Weekly Claims tomorrow

by Calculated Risk on 5/25/2011 10:19:00 PM

• From the Rockefeller Institute of Government: States Report Strong Growth in Tax Revenues in the First Quarter of 2011

The Rockefeller Institute's compilation of data from 47 early reporting states shows collections from major tax sources increased by 9.1 percent in nominal terms in the first quarter of 2011 compared to the same quarter of 2010. That represented the third consecutive quarter of increasing strength in revenues. Tax collections now have been rising for five straight quarters, following five quarters of declines, but were still 3.1 percent lower in early 2011 than in the same period three years agoThe press release has a state by state breakdown. Revenue is still 3.1% lower than at the beginning of the recession.

...

In terms of dollars, California reported the largest increase in overall tax collections in the first quarter of 2011, where revenue collections rose by $1.4 billion or 5.6 percent. Illinois and New York also reported large increases in overall tax collections in terms of dollars.

• According to gasbuddy.com, gasoline prices are down about 15 cents per gallon nationally from the peak. Oil prices moved up today to almost $102 per barrel (WTI futures), but we should still further gasoline price declines after the Memorial Day weekend.

• At 8:30 AM tomorrow, the Department of Labor will release the initial weekly unemployment claims report. This is being watched closely now because of the sharp increase in initial claims at the end of April. The consensus is for a decrease to 404,000 from 409,000 last week.

Also at 8:30 AM, the BEA will release the second estimate of Q1 GDP. The consensus is for an upward revision to 2.1% annualized real GDP growth (from 1.8%). Goldman Sachs put out a note this afternoon:

[W]e now expect an upward revision to 2.1% (one tenth higher than before). [However the] soft April results ... imply about two tenths of additional downside risk to our Q2 GDP growth forecast, on top of our downward revision to 3.0% yesterday.Best to all

DOT: Vehicle Miles Driven decreased 1.4% in March compared to March 2010

by Calculated Risk on 5/25/2011 05:52:00 PM

The Department of Transportation (DOT) reported that vehicle miles driven in March were down 1.4% compared to March 2010:

Travel on all roads and streets changed by -1.4% (-3.5 billion vehicle miles) for March 2011 as compared with March 2010. Travel for the month is estimated to be 250.4 billion vehicle miles.

Cumulative Travel for 2011 changed by -0.1% (-0.8 billion vehicle miles).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 40 months - so this is a new record for longest period below the previous peak - and still counting!

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.U.S. oil prices in March averaged $103 per barrel, and although prices have declined in May from the April highs, prices have only fallen to just below the prices in March. Also other sources have reported demand for gasoline is down in April and May, so I expect the data for April to show a sharp year-over-year decline in miles driven.

ATA Trucking index decreased 0.7% in April

by Calculated Risk on 5/25/2011 02:54:00 PM

From ATA Trucking: ATA Truck Tonnage Index Fell 0.7 Percent in April

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.7 percent in April after gaining a revised 1.9 percent in March 2011. March’s increase was slightly better than the 1.7 percent ATA reported on April 26, 2011. The latest drop put the SA index at 114.9 (2000=100) in April, down from the March level of 115.6.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's Fore-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Compared with April 2010, SA tonnage climbed 4.8 percent. In March, the tonnage index was 6.5 percent above a year earlier.

“The drop in April is not a concern. Since freight volumes are so volatile truck tonnage is unlikely to grow every month, even on a seasonally adjusted basis,” ATA Chief Economist Bob Costello said. “I expect economic activity, and with it truck freight levels to grow at a moderate pace in the coming months and quarters.”

“The industry, and the economy at large, should benefit from the recent declines in oil and diesel prices,” Costello added.

...

Trucking serves as a barometer of the U.S. economy, representing 67.2 percent of tonnage carried by all modes of domestic freight transportation ... Motor carriers collected $563.4 billion, or 81.2 percent of total revenue earned by all transport modes.

Debt Ceiling Charade: Vote to Fail Next Week

by Calculated Risk on 5/25/2011 11:49:00 AM

Stan Collender writes: Not A Surprise: GOP Plans Vote On Debt Ceiling Bill Next Week

House Republicans announced yesterday that they would bring a "clean" debt ceiling to the House floor next week. ... by allowing members to vote against it now, the leadership will also be making it easier for some of them to vote for a debt ceiling increase later this summer.The theater of the absurd. Otherwise known as politics.

And from the WSJ: Geithner Dismisses Debt-Ceiling Debate as Political Theater

U.S. Treasury Secretary Timothy Geithner Wednesday dismissed as political theater a House vote on the debt ceiling that is expected to fail, and said Congress would ultimately raise the limit this summer.The key point is the vote next week is meaningless and the debt ceiling will be increased this summer.

“Right now this is all theater. Beneath the theater you are starting to see people work together,” Geithner said