by Calculated Risk on 5/14/2011 10:16:00 PM

Saturday, May 14, 2011

Another Mortgage Refinance Wave?

Freddie Mac reported this week: 30-Year Fixed-Rate Mortgage Drops to 4.63 Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), which shows mortgage rates at their lowest level for 2011 after declining for the fourth consecutive week. The 30-year fixed-rate averaged 4.63 percent, and the 15-year fixed averaged 3.82 percent.Will this lead to another wave of mortgage refinancing?

Here is a graph of refinance activity and mortgage rates:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

Although mortgage rates are at the lowest level this year, it takes lower and lower rates to get people to refi (at least lower than recent purchase rates).

With 30 year mortgage rates still about 0.4 percentage points above the lows of last October, mortgage refinance activity will probably only pickup a little.

Earlier:

• Summary for Week Ending May 13th

Final Portugal bailout terms expected Monday, maybe Greece update too

by Calculated Risk on 5/14/2011 08:36:00 PM

From the Telegraph: EU to unveil Greece and Portugal bail-outs

Brussels is expected this week to unveil the details of its €78bn (£69bn) rescue for Portugal as it attempts to hammer out a second emergency package for Greece.This might impact the timing, from the NY Times: I.M.F. Head Is Arrested and Accused of Sexual Attack

...

Final terms of the Portuguese deal will be unveiled after the meeting of eurogroup finance ministers on Monday. Portugal is expected to be charged an average loan rate of about 5.5pc – cheaper than Ireland's 5.8pc but more expensive than the Greek level of just over 4pc.

Earlier:

• Summary for Week Ending May 13th

More on Debt Ceiling Charade

by Calculated Risk on 5/14/2011 03:43:00 PM

From the WSJ: Geithner Issues Warning on Debt Ceiling

Treasury Secretary Timothy Geithner warned in a letter to Congress that failure to raise the $14.294 trillion debt ceiling would drive up interest rates, push down household wealth, put more pressure on federal entitlement programs and cause a double-dip recession.First, even though the U.S. will hit the debt ceiling on Monday, there are games that Treasury can play - so Congress has until August 2nd. And there might even be some more tricks that can delay the date further - like promising to pay defense contractors sometime in the future. But some day in the not too distant future Congress will have to raise the debt ceiling - or suffer the consequences that Geithner describes.

...

The U.S. government debt is projected to hit the ceiling Monday. Treasury officials say they have until Aug. 2 before the country could begin defaulting on its debt.

...

"This would be an unprecedented event in American history," he wrote. "A default would inflict catastrophic, far-reaching damage on our Nation's economy, significantly reducing growth, and increasing unemployment."

Second, Congress will probably push this to the brink, but they will raise the debt ceiling before the country defaults. The first rule for most politicians is to get re-elected, and the easiest way to guarantee losing in 2012 is to throw the country back into recession. If that happened, I believe the voters would correctly blame the leaders of Congress, and I think Congress knows that too. Therefore it won't happen. I'm not worried and neither are investors.

Earlier:

• Summary for Week Ending May 13th

Summary for Week Ending May 13th

by Calculated Risk on 5/14/2011 08:36:00 AM

This was a light week for economic data. As expected, house prices continued to decline in March, the trade deficit increased in March due to higher oil prices, and inflation picked up a little, mostly due to - what else? - higher oil prices in April.

The good news is oil prices have fallen in May, and (WTI futures) are now under $100 per barrel (WTI futures were close to $114 per barrel at the end of April). Meanwhile the ten year Treasury yield has fallen to 3.19%, and mortgage rates are at the low for the year (the 30 year conforming is at 4.63%).

Below is a summary of economic data last week mostly in graphs:

• CoreLogic: House Prices declined 1.5% in March, Prices now 4.6% below 2009 Lows

Notes: Case-Shiller is the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts.

From CoreLogic: CoreLogic® Home Price Index Shows Year-Over-Year Decline for 8th Straight Month

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

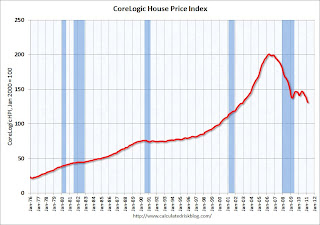

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 7.5% over the last year, and off 34.8% from the peak.

This was the eight straight month of year-over-year declines, and the ninth straight month of month-to-month declines. The index is now 4.6% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

The second graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through February release) and CoreLogic House Price Indexes (through March release) in real terms (adjusted for inflation using CPI less Shelter).

The second graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through February release) and CoreLogic House Price Indexes (through March release) in real terms (adjusted for inflation using CPI less Shelter).

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to December 2000, and the CoreLogic index back to December 1999.

The third graph is a price-to-rent ratio using the Case-Shiller Composite 20 (through February) and CoreLogic House Price Index (through March) (January 1998 = 1.0).

The third graph is a price-to-rent ratio using the Case-Shiller Composite 20 (through February) and CoreLogic House Price Index (through March) (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is just above the May 2009 levels (and about at November 2000 levels), and the CoreLogic index is back to December 1999.

• Trade Deficit increased to $48.2 billion in March

The first graph shows the monthly U.S. exports and imports in dollars through March 2011.

The first graph shows the monthly U.S. exports and imports in dollars through March 2011.

Both imports and exports increased in March (seasonally adjusted). Exports are well above the pre-recession peak, but imports are now increasing at a faster rate - mostly because of oil prices.

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The petroleum deficit increased sharply in March as both the quantity and price increased - prices averaged $93.76 per barrel in March, up from $87.17 in February. Prices will be even higher in April.

The trade deficit was larger than the expected $47 billion.

• BLS: CPI increased 0.4% in April

This graph shows three measure of underlying inflation on a year-over-year basis. Over the last 12 months, core CPI has increased 1.3%, median CPI has increased 1.4%, and trimmed-mean CPI increased 1.7%.

This graph shows three measure of underlying inflation on a year-over-year basis. Over the last 12 months, core CPI has increased 1.3%, median CPI has increased 1.4%, and trimmed-mean CPI increased 1.7%.

Although the year-over-year increases are below the Fed's inflation target, the annualized rates were above the target in April. Core CPI increased at an annualized rate of 2.2%, median CPI 2.8% annualized, and trimmed-mean CPI increased 3.3% annualized.

However, with the slack in the system, I expect the year-over-year core measures to stay below 2% this year.

• BLS: Job Openings increased in March, Highest since 2008

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and are up 16% from March 2010. However the overall turnover remains low.

• NFIB: Small Business Optimism Index decreases in April

This graph shows the small business optimism index since 1986. The index decreased to 91.2 in April from 91.9 in March.

This graph shows the small business optimism index since 1986. The index decreased to 91.2 in April from 91.9 in March.

This has been trending up, although optimism has declined for two consecutive months now.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

The recovery continues to be sluggish for this index, probably partially because of the high concentration of real estate related companies.

• Consumer Sentiment increases in May

The preliminary May Reuters / University of Michigan consumer sentiment index increased to 72.4 from 69.8 in April.

The preliminary May Reuters / University of Michigan consumer sentiment index increased to 72.4 from 69.8 in April.

This was slightly above the consensus forecast of 70.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

This is still a low reading, but sentiment will probably improve later this month if gasoline prices fall.

• Other Economic Stories ...

• NY Fed Q1 Report on Household Debt and Credit

• Zillow on Negative Equity: 28.4% of all single-family homes with mortgages are "underwater"

• AAR: Rail Traffic "mixed" in April

• Ceridian-UCLA: Diesel Fuel index declines in April

• Unofficial Problem Bank list at 983 Institutions

Best wishes to all!

Friday, May 13, 2011

Unofficial Problem Bank list at 983 Institutions

by Calculated Risk on 5/13/2011 11:41:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 13, 2011.

Changes and comments from surferdude808:

Only two changes were made to the Unofficial Problem Bank List as the FDIC kept its liquidation squad home this weekend and the OCC did not release its actions through mid-April 2011. Moreover, the OTS has not updated its enforcement website page since May 5th and it may be a casualty given their on-going integration into the OCC. That is too bad as the OTS has been more prompt than its merger partner in publishing enforcement actions.

This week there is one addition -- Johnson Bank, Racine, WI ($4.9 billion), and one removal -- TIB Bank, Naples, FL ($1.8 billion), which merged on an unassisted basis with NAFH National Bank, Miami, FL. Thus, the Unofficial Problem Bank List count remains unchanged at 983, but aggregate assets increased to $425.4 billion from $422.1 billion.

April Update: 2012 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 5/13/2011 07:15:00 PM

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.6 percent over the last 12 months to an index level of 221.743 (1982-84=100). For the month, the index rose 0.8 percent prior to seasonal adjustment ..."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W1 for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

• In 2008, the Q3 average of CPI-W was 215.495. In the previous year, 2007, the average in Q3 of CPI-W was 203.596. That gave an increase of 5.8% for COLA for 2009.

• In 2009, the Q3 average of CPI-W was 211.013. That was a decline of 2.1% from 2008, however, by law, the adjustment is never negative so the benefits remained the same in 2010.

• In 2010, the Q3 average of CPI-W was 214.136. That was an increase of 1.5% from 2009, however the average was still below the Q3 average in 2008, so the adjustment was zero.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

The COLA adjustment is based on the increase from Q3 of one year from the highest previous Q3 average. So a 2.3% increase was announced in 2007 for 2008, and a 5.8% increase was announced in 2008 for 2009.

In Q3 2009, CPI-W was lower than in Q3 2008, so there was no change in benefits for 2010. And CPI-W in Q3 2010 was also lower than in Q3 2008, so once again there was no change in benefits.

Currently CPI-W is above the Q3 2008 average. The recent increase is mostly because of the surge in oil prices. CPI-W could be very volatile this year - and will depend on energy prices - but if the current level holds, COLA would be around 2.9% for next year (the current 221.743 divided by the Q3 2008 level of 215.495).

This is very early - if oil prices fall sharply, COLA could still be zero again.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.This is based on a one year lag. The National Average Wage Index is not available for 2010 yet, but wages probably didn't change much from 2009. If wages increased back to the 2008 level in 2010, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $109,000 from the current $106,800.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is CPI-W during Q3 (July, August and September).

(1) CPI-W usually tracks CPI-U (headline number) pretty well. From the BLS:

The Bureau of Labor Statistics publishes CPIs for two population groups: (1)the CPI for Urban Wage Earners and Clerical Workers (CPI-W), which covers households of wage earners and clerical workers that comprise approximately 32 percent of the total population and (2) the CPI for All Urban Consumers (CPI-U) ... which cover approximately 87 percent of the total population and include in addition to wage earners and clerical worker households, groups such as professional, managerial, and technical workers, the self- employed, short-term workers, the unemployed, and retirees and others not in the labor force.