by Calculated Risk on 5/14/2011 08:36:00 AM

Saturday, May 14, 2011

Summary for Week Ending May 13th

This was a light week for economic data. As expected, house prices continued to decline in March, the trade deficit increased in March due to higher oil prices, and inflation picked up a little, mostly due to - what else? - higher oil prices in April.

The good news is oil prices have fallen in May, and (WTI futures) are now under $100 per barrel (WTI futures were close to $114 per barrel at the end of April). Meanwhile the ten year Treasury yield has fallen to 3.19%, and mortgage rates are at the low for the year (the 30 year conforming is at 4.63%).

Below is a summary of economic data last week mostly in graphs:

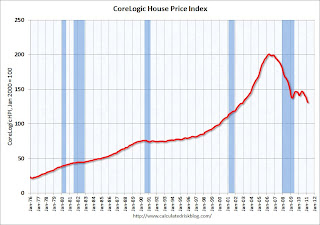

• CoreLogic: House Prices declined 1.5% in March, Prices now 4.6% below 2009 Lows

Notes: Case-Shiller is the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts.

From CoreLogic: CoreLogic® Home Price Index Shows Year-Over-Year Decline for 8th Straight Month

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 7.5% over the last year, and off 34.8% from the peak.

This was the eight straight month of year-over-year declines, and the ninth straight month of month-to-month declines. The index is now 4.6% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

The second graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through February release) and CoreLogic House Price Indexes (through March release) in real terms (adjusted for inflation using CPI less Shelter).

The second graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through February release) and CoreLogic House Price Indexes (through March release) in real terms (adjusted for inflation using CPI less Shelter).

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to December 2000, and the CoreLogic index back to December 1999.

The third graph is a price-to-rent ratio using the Case-Shiller Composite 20 (through February) and CoreLogic House Price Index (through March) (January 1998 = 1.0).

The third graph is a price-to-rent ratio using the Case-Shiller Composite 20 (through February) and CoreLogic House Price Index (through March) (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is just above the May 2009 levels (and about at November 2000 levels), and the CoreLogic index is back to December 1999.

• Trade Deficit increased to $48.2 billion in March

The first graph shows the monthly U.S. exports and imports in dollars through March 2011.

The first graph shows the monthly U.S. exports and imports in dollars through March 2011.

Both imports and exports increased in March (seasonally adjusted). Exports are well above the pre-recession peak, but imports are now increasing at a faster rate - mostly because of oil prices.

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The petroleum deficit increased sharply in March as both the quantity and price increased - prices averaged $93.76 per barrel in March, up from $87.17 in February. Prices will be even higher in April.

The trade deficit was larger than the expected $47 billion.

• BLS: CPI increased 0.4% in April

This graph shows three measure of underlying inflation on a year-over-year basis. Over the last 12 months, core CPI has increased 1.3%, median CPI has increased 1.4%, and trimmed-mean CPI increased 1.7%.

This graph shows three measure of underlying inflation on a year-over-year basis. Over the last 12 months, core CPI has increased 1.3%, median CPI has increased 1.4%, and trimmed-mean CPI increased 1.7%.

Although the year-over-year increases are below the Fed's inflation target, the annualized rates were above the target in April. Core CPI increased at an annualized rate of 2.2%, median CPI 2.8% annualized, and trimmed-mean CPI increased 3.3% annualized.

However, with the slack in the system, I expect the year-over-year core measures to stay below 2% this year.

• BLS: Job Openings increased in March, Highest since 2008

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and are up 16% from March 2010. However the overall turnover remains low.

• NFIB: Small Business Optimism Index decreases in April

This graph shows the small business optimism index since 1986. The index decreased to 91.2 in April from 91.9 in March.

This graph shows the small business optimism index since 1986. The index decreased to 91.2 in April from 91.9 in March.

This has been trending up, although optimism has declined for two consecutive months now.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

The recovery continues to be sluggish for this index, probably partially because of the high concentration of real estate related companies.

• Consumer Sentiment increases in May

The preliminary May Reuters / University of Michigan consumer sentiment index increased to 72.4 from 69.8 in April.

The preliminary May Reuters / University of Michigan consumer sentiment index increased to 72.4 from 69.8 in April.

This was slightly above the consensus forecast of 70.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

This is still a low reading, but sentiment will probably improve later this month if gasoline prices fall.

• Other Economic Stories ...

• NY Fed Q1 Report on Household Debt and Credit

• Zillow on Negative Equity: 28.4% of all single-family homes with mortgages are "underwater"

• AAR: Rail Traffic "mixed" in April

• Ceridian-UCLA: Diesel Fuel index declines in April

• Unofficial Problem Bank list at 983 Institutions

Best wishes to all!