by Calculated Risk on 2/21/2011 12:00:00 PM

Monday, February 21, 2011

Libya Update

Note: U.S. Markets are closed today in observance of Presidents' Day. Here are the weekly schedule and summary:

• Summary for Week ending February 19th

• Schedule for Week of February 20th

By requests, some links on Libya ...

• From the NY Times: Qaddafi’s Grip on Power Seems to Ebb as Forces Retreat

The 40-year-rule of Libyan strongman Col. Muammar el-Qaddafi appeared to teeter Monday as his security forces retreated to a few buildings in the Libyan capital of Tripoli, where fires burned unchecked and senior government officials and diplomats announced defections.• The Telegraph has a site that is updated frequently: Libya protests: live

... several senior officials — including the justice minister and members of the Libyan mission to the United Nations — announced their resignations.

• From al Jazeera: Libya Live Blog

Europe: ECB Lending Spike due to Irish Banks and other topics

by Calculated Risk on 2/21/2011 08:56:00 AM

A few European notes and stories ...

• From the WSJ: Irish Banks Behind ECB Lending Surge

An unusual surge in overnight lending from the European Central Bank last week was connected to Ireland's effort to wind down nationalized lenders Anglo Irish Bank Corp. and Irish Nationwide Building Society ... The two banks moved collateral from the ECB's longer-term refinancing facilities to the more expensive overnight-lending program as part of a plan to auction off deposits and certain other assets on their balance sheets, the person saidThe fear late last week was that some large European bank was in trouble, and now it appears this is just related to winding down the Irish banks.

• From AP: Ireland's Leading Party Wants New Bailout Terms. What a surprise (Not). The Irish election is this Friday, February 25th.

• From the NY Times: Greece’s Efforts to Limit Tax Evasion Have Little Success

Various studies have estimated that Greece may be losing as much as $30 billion a year to tax evasion — an amount that would have gone a long way to solving its debt problems. ... But payments have only trickled in.Another surprise. Tax evasion is an art form in many countries.

• From Bloomberg: German Business Confidence Unexpectedly Rises to Record Unexpectedly?

• Note: There is a meeting of several EU leaders, apparently including Angela Merkel and Nicolas Sarkozy, in Helsinki on March 4th, and then a special eurozone debt crisis summit on March 11th.

• The Ten Year yields for certain European countries declined slightly today. Here are the Ten Year yields for Portugal, Spain, Ireland and Greece.

Sunday, February 20, 2011

Libya Update

by Calculated Risk on 2/20/2011 08:34:00 PM

By requests, some links on Libya ...

• From the NY Times: Qaddafi’s Son Warns of Civil War as Libyan Protests Widen

• From the WSJ: Gadhafi's Son Warns of Civil War in Libya

Sunday, Moammar Gadhafi's son went on state television to proclaim that his father remained in charge with the army's backing and would "fight until the last man, the last woman, the last bullet."• From al Jazeera: Libya Live Blog

Seif al-Islam Gadhafi ... warned the protesters that they risked igniting a civil war in which Libya's oil wealth "will be burned."

• From Reuters: Libya tribal chief threatens to block oil exports

The "Curse of Negative Equity"

by Calculated Risk on 2/20/2011 03:12:00 PM

We will be discussing the impact of negative equity for years. Toluse Olorunnipa at the Miami Herald has an anecdote: The curse of negative home equity

Wesley Ulloa bought her first condo for $230,000 in 2007, and watched helplessly as it lost two-thirds of its value [to about $80,000 today] ... She’s one of hundreds of thousands of South Floridians coping with the reality of being underwater on their mortgages—one of the most widespread side effects of the real estate market collapse.The choices are to tough it out, try for a modification or short sale, or just default. All bad choices - and this will limit her choices in the future too.

“I get a little angry. I think ‘Man I bought this for $230,000 and for what I’m paying, I could be in a house’,” she said. “But I can’t dwell on it. I mean, what are you going to do?”

Olorunnipa also notes: "More than 300,000 South Florida mortgages—or 43 percent of them—are currently underwater ..."

That percentage comes from CoreLogic's Q3 2010 negative equity report (Q4 will be released in a few weeks).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the break down of equity by state (for home with a mortgage). Florida is bad, but Nevada and Arizona are in worse shape. And with house prices falling again, the number of homeowners with negative increase some more (depending on the number of modifications and foreclosures).

Earlier posts:

• Summary for Week ending February 19th

• Schedule for Week of February 20th

Summary for Week ending February 19th

by Calculated Risk on 2/20/2011 09:27:00 AM

Here is the economic schedule for the coming week.

Retail sales were weaker than expected in January, and the reports for November and December were revised down. This suggests consumption in Q4 will be revised down slightly, and that the first quarter started a little slower than expected.

Industrial production and capacity utilization decreased slightly in January; however the manufacturing surveys from the New York and Philly Fed both showed improvement in February, suggesting any slowdown in January was probably due to the weather.

Housing is still flat on the floor. Housing starts increased in January because of an increase in multi-family starts (as expected). Single-family starts decreased 1.0% to 413 thousand in January - the lowest level since early 2009.

Both the producer price index (PPI 0.8%, core PPI 0.5%) and consumer price index (CPI 0.4%, core CPI 0.2%) increased in January. Core measures are still low, but have also been increasing.

Below is a summary of the previous week, mostly in graphs.

• Retail Sales increased 0.3% in January

On a monthly basis, retail sales increased 0.3% from December to January(seasonally adjusted, after revisions), and sales were up 7.8% from January 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 13.7% from the bottom, and now 0.4% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 7.1% on a YoY basis (7.8% for all retail sales). This was below expectations for a 0.5% increase. Retail sales ex-autos were up 0.3%; also below expectations of a 0.5% increase. Although lower than expected, retail sales are now above the pre-recession peak in November 2007.

• Housing Starts increased in January

Total housing starts were at 596 thousand (SAAR) in January, up 14.6% from the revised December rate of 520 thousand, and up 25% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 596 thousand (SAAR) in January, up 14.6% from the revised December rate of 520 thousand, and up 25% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

The increase in starts in January was entirely because of multi-family starts. Single-family starts decreased 1.0% to 413 thousand in January - the lowest level since early 2009.

This was above expectations of 540 thousand starts, but still very low. The low level of starts is good news for housing, and I expect starts to stay low until more of the excess inventory of existing homes is absorbed. Multi-family starts will rebound in 2011, but completions will probably be at or near record lows since it takes over a year to complete most multi-family projects.

• Industrial Production, Capacity Utilization decrease slightly in January

This graph shows Capacity Utilization. This series is up 7.9 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 7.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.1% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.

Industrial production decreased in January due to a decline in utilities. Production is still 5.6% below the pre-recession levels at the end of 2007.

The decline was a combination of an upward revision to December and less demand for heating in January.

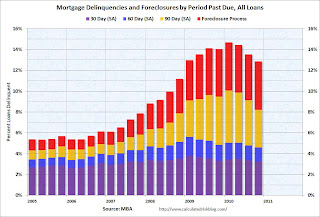

• MBA: Loans in Foreclosure Tie All-Time Record, fewer Short-term Delinquencies

The MBA reports that 12.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2010 (seasonally adjusted). This is down from 13.52 percent in Q3 2010.

The following graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 3.25% from 3.36% in Q3. This is below the average levels of the last 2 years, but still high.

Loans 30 days delinquent decreased to 3.25% from 3.36% in Q3. This is below the average levels of the last 2 years, but still high.

Delinquent loans in the 60 day bucket decreased to 1.34% from 1.44% in Q3; this is the lowest since Q2 2008.

The biggest decline was in the 90+ day delinquent bucket. This declined from 4.34% in Q3 3.63% in Q4. This is mostly due to modifications or putting the loans in the foreclosure process.

The percent of loans in the foreclosure process increased to 4.63% (tying the record set in Q1 2010). This is due to the foreclosure pause.

From the MBA: Short-term Delinquencies Fall to Pre-Recession Levels, Loans in Foreclosure Tie All-Time Record

• Core Measures show increase in Inflation

This graph shows these three measure of inflation on a year-over-year basis. Over the last 12 months, core CPI has increased 0.95%, median CPI has increased 0.83%, and trimmed-mean CPI increased 0.97% - all less than 1%.

This graph shows these three measure of inflation on a year-over-year basis. Over the last 12 months, core CPI has increased 0.95%, median CPI has increased 0.83%, and trimmed-mean CPI increased 0.97% - all less than 1%.

However, all three increased in January at a higher annualized rate: core CPI increased at an annualized rate of 2.1%, median CPI 2.0% annualized, and trimmed-mean CPI increased 2.7% annualized. This is just one month, but the annualized rate for these key measures is at or above the Fed's inflation target. With the slack in the system, I have been expecting these core measures to stay below 2% this year.

• NAHB Builder Confidence unchanged in February

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was unchanged at 16 in February. This was slightly below expectations of an increase to 17. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the December data for starts (January housing starts will be released tomorrow).

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the December data for starts (January housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for over two years.

• Other Economic Stories ...

• CoreLogic: NAR’s 2010 existing home sales are overstated by 15% to 20%

• From the NY Fed: The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to improve in February

• From David Leonhardt at the NY Times Economix: Seattle’s Foreseeable Housing Bust

• From David Streitfeld article: Housing Crash Is Hitting Cities Thought to Be Stable

• From Nick Timiraos, Victoria McGrane and Ruth Simon at the WSJ: Big Banks Face Fines on Role of Servicers

• From the NY Fed: Quarterly Report on Household Debt and Credit

• An economic letter from Justin Weidner and John Williams at the SF Fed: What Is the New Normal Unemployment Rate?

• From the Philly Fed: Philly Fed Survey highest since January 2004

• Unofficial Problem Bank list increases to 951 Institutions

Best wishes to all!

Saturday, February 19, 2011

Middle East Update

by Calculated Risk on 2/19/2011 11:00:00 PM

Earlier: Schedule for Week of February 20th

A few links ...

• From Bloomberg: Bahrain Vows to Ease Tension; Mideast Unrest Spreads

Bahrain’s authorities backed down from a standoff with protesters in a bid to ease tensions as government forces in Yemen, Libya and Djibouti shot at demonstrators ... In Yemen, gunfire broke out in the capital yesterday, leaving one man dead, shot in the neck by government supporters, as the unrest entered the ninth day.• From the LA Times: Bahrain protesters back at Pearl Square despite violence

The thousands who paraded in Pearl Square on Saturday night believed they had journeyed too far to stop their uprising now. Just as the Egyptians in Tahrir Square mourned their dead and vowed their passing would produce major social change, the Bahrainis now found resolve in their grief.• From the NY Times: Cycle of Suppression Rises in Libya and Elsewhere

Libyan security forces moved against protesters Saturday in Benghazi, the country’s second-largest city and the epicenter of the most serious challenge to four decades of Col. Muammar el-Qaddafi’s rule, opposition leaders and residents said. The death toll rose to at least 104 people, most of them in Benghazi ...• From the NY Times: Oil Flows, but High Prices Jangle Nerves

The turmoil in North Africa and the Middle East has helped drive oil prices up to more than $102 a barrel for an important benchmark crude, Brent, although so far there have been no significant disruptions in production or supply ... While Egypt and Tunisia have little oil, Libya is one of Africa’s largest holders of crude oil reserves, Algeria and Iran are major suppliers and Bahrain and Yemen both border Saudi Arabia on the peninsula that produces most of the world’s oil.