by Calculated Risk on 5/05/2015 03:17:00 PM

Tuesday, May 05, 2015

Final Update: Recovery Measures

I posted these graphs regularly during the recession and recovery.

Here is a final update (until the next recession) to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

All four of the indicators are above pre-recession levels (GDP and Personal Income less Transfer Payments, Industrial Production, and employment).

The first graph is for real GDP through Q1 2015.

Real GDP returned to the pre-recession peak in Q3 2011, and is at a new post-recession high (although Q1 2015 GDP might be revised down).

At the worst point - in Q2 2009 - real GDP was off 4.2% from the 2007 peak.

This indicator was off 8.3% at the worst point.

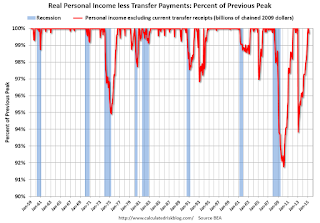

Real personal income less transfer payments reached the pre-recession peak in January 2012. Then real personal income less transfer payments increased sharply in December 2012 due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013. This is why there is a second dip in this indicator in 2013.

Real personal income less transfer payments are now above the pre-recession peak - and above the December 2012 surge.

Industrial production was off 16.9% at the trough in June 2009.

There has been a little weakness recently (mostly related to oil and gas), and now industrial production is 4.4% above the pre-recession peak.

The final graph is for employment through March 2015.

Payroll employment is now 2.0% above the pre-recession peak.

CoreLogic: House Prices up 5.9% Year-over-year in March

by Calculated Risk on 5/05/2015 11:59:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports National Homes Prices Rose by 5.6 Percent Year Over Year in February 2015

CoreLogic® ... today released its March 2015 CoreLogic Home Price Index (HPI®) which shows that home prices nationwide, including distressed sales, increased by 5.9 percent in March 2015 compared with March 2014. This change represents 37 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 2 percent in March 2015 compared with February 2015.

Including distressed sales in March, 27 states plus the District of Columbia were at or within 10 percent of their peak prices. Seven states, including Colorado, Nebraska, New York, Oklahoma, Tennessee, Texas and Wyoming, reached new home price highs since January 1976 when the CoreLogic HPI started.

Excluding distressed sales, home prices increased by 6.1 percent in March 2015 compared with March 2014 and increased by 2 percent month over month compared with February 2015. ...

“The homes for sale inventory continues to be limited while buyer demand has picked up with low mortgage rates and improving consumer confidence,” said Frank Nothaft, chief economist for CoreLogic. “As a result, there has been continued upward pressure on prices in most markets, with our national monthly index up 2 percent for March 2015 and up approximately 6 percent from a year ago.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.0% in March, and is up 5.9% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty seven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty seven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increase had mostly moved sideways over the last eight months, but might be increasing a little faster now.

ISM Non-Manufacturing Index increased to 57.8% in April

by Calculated Risk on 5/05/2015 10:05:00 AM

The April ISM Non-manufacturing index was at 57.8%, up from 56.5% in March. The employment index increased in April to 56.7%, up slightly from 56.6% in March. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: April 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in April for the 63rd consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 57.8 percent in April, 1.3 percentage points higher than the March reading of 56.5 percent. This represents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased substantially to 61.6 percent, which is 4.1 percentage points higher than the March reading of 57.5 percent, reflecting growth for the 69th consecutive month at a faster rate. The New Orders Index registered 59.2 percent, 1.4 percentage points higher than the reading of 57.8 percent registered in March. The Employment Index increased 0.1 percentage point to 56.7 percent from the March reading of 56.6 percent and indicates growth for the 14th consecutive month. The Prices Index decreased 2.3 percentage points from the March reading of 52.4 percent to 50.1 percent, indicating prices increased in April for the second consecutive month, but at a slower rate. According to the NMI®, 14 non-manufacturing industries reported growth in April. The majority of respondents indicate that there has been an uptick in business activity due to the improved economic climate and prevailing stability in business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 57.8% and suggests faster expansion in April than in March. Overall this was a solid report.

Trade Deficit increased in March to $51.4 Billion

by Calculated Risk on 5/05/2015 08:43:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $51.4 billion in March, up $15.5 billion from $35.9 billion in February, revised. March exports were $187.8 billion, $1.6 billion more than February exports. March imports were $239.2 billion, $17.1 billion more than February imports.The trade deficit much larger than the consensus forecast of $42.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through March 2015.

Click on graph for larger image.

Click on graph for larger image.Imports and exports increased in March ( due a bounce back following the resolution of the West Coast port slowdown).

Exports are 13% above the pre-recession peak and down 3% compared to March 2014; imports are 3% above the pre-recession peak, and up 1% compared to March 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $46.47 in March, down from $49.53 in February, and down from $93.91 in March 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $31.2 billion in March, from $20.4 billion in March 2014. Much of this increase was due to unloading all the ships backed up at West Coast ports. The deficit with China is a large portion of the overall deficit.

Note: The deficit was larger than the BEA assumed for the advance GDP estimate, and this suggests GDP be revised down for Q1.

Monday, May 04, 2015

Tuesday: Trade Deficit, ISM non-Manufacturing Index

by Calculated Risk on 5/04/2015 08:06:00 PM

Note: West Coast port traffic increased sharply in March following the resolution of the labor issue in February. The workers were catching up with all the ships anchored in the harbor (now gone).

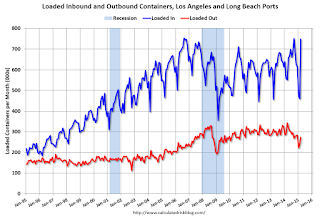

This graph is monthly for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Both imports and exports rebounded in March, but imports rebounded more - and were up 36% year-over-year - whereas exports were down 20% year-over-year.

This suggests more imports from Asia in March, and also suggests the trade deficit was significantly higher in March than in February.

Tuesday:

• At 8:30 AM ET, Trade Balance report for March from the Census Bureau. The consensus is for the U.S. trade deficit to be at $42.0 billion in March from $35.4 billion in February.

• At 10:00 AM, the ISM non-Manufacturing Index for April. The consensus is for index to decrease to 56.2 from 56.5 in March.