by Calculated Risk on 5/05/2015 03:17:00 PM

Tuesday, May 05, 2015

Final Update: Recovery Measures

I posted these graphs regularly during the recession and recovery.

Here is a final update (until the next recession) to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

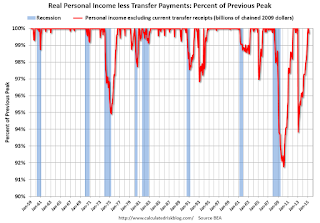

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

All four of the indicators are above pre-recession levels (GDP and Personal Income less Transfer Payments, Industrial Production, and employment).

The first graph is for real GDP through Q1 2015.

Real GDP returned to the pre-recession peak in Q3 2011, and is at a new post-recession high (although Q1 2015 GDP might be revised down).

At the worst point - in Q2 2009 - real GDP was off 4.2% from the 2007 peak.

This indicator was off 8.3% at the worst point.

Real personal income less transfer payments reached the pre-recession peak in January 2012. Then real personal income less transfer payments increased sharply in December 2012 due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013. This is why there is a second dip in this indicator in 2013.

Real personal income less transfer payments are now above the pre-recession peak - and above the December 2012 surge.

Industrial production was off 16.9% at the trough in June 2009.

There has been a little weakness recently (mostly related to oil and gas), and now industrial production is 4.4% above the pre-recession peak.

The final graph is for employment through March 2015.

Payroll employment is now 2.0% above the pre-recession peak.