by Calculated Risk on 2/04/2015 01:35:00 PM

Wednesday, February 04, 2015

Preview for January Employment Report: Taking the Under

Month after month I've taken the "over" for the employment report ("over" the consensus), and that has been correct most months. However, for January, I'll take the "under" ... however I think there is a good chance that employment will be up 3 million year-over-year (it would take 192 thousand jobs added including revisions).

Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus, according to Bloomberg, is for an increase of 230,000 non-farm payroll jobs in January (with a range of estimates between 215,000 and 268,000), and for the unemployment rate to be unchanged at 5.6%.

The BLS reported 252,000 jobs added in December.

Here is a summary of recent data:

• The ADP employment report showed an increase of 213,000 private sector payroll jobs in January. This was below expectations of 220,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing employment index decreased in January to 54.1%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs were unchanged in January. The ADP report indicated a 14,000 increase for manufacturing jobs in January.

The ISM non-manufacturing employment index decreased in January to 51.6%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 115,000 in January.

Combined, the ISM indexes suggests employment gains of 115,000. This suggests growth below expectations.

• Initial weekly unemployment claims averaged close to 298,000 in January, up from 291,000 in December. For the BLS reference week (includes the 12th of the month), initial claims were at 308,000; this was up from 289,000 during the reference week in December.

Generally this suggests a few more layoffs, seasonally adjusted, in January compared to the previous four months (employment gains averaged 284,000 per month for the previous four months).

• The final January University of Michigan consumer sentiment index increased to 98.1 from the December reading of 93.6. This was the highest level in over ten years. Sentiment is frequently coincident with changes in the labor market, but this increase is probably mostly due to sharply lower gasoline prices.

• On small business hiring: The small business index from Intuit showed a 20,000 increase in small business employment in January, down from 30,000 added in November and December.

• Trim Tabs reported that the U.S. economy added between 190,000 and 220,000 jobs in January. This was down from their 210,000 to 240,000 range last month (that was low but close). "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 141 million U.S. workers subject to withholding" December and January are challenging for TrimTabs due to year end bonuses - so they provided a range again this month.

• Conclusion: There is always some randomness to the employment report, but most indicators suggest fewer jobs added in January compared to the previous several months. The consensus forecast reflects some slowdown in employment growth, but I'll take the under this month (below 230,000).

Special Note: In addition to the normal revisions, the annual benchmark revision will be released with the January report. The preliminary estimate was an additional 7,000 jobs as of March 2014 (not a large revision).

Also, the new population controls will be used in the Current Population Survey (CPS) estimation process. The BLS notes that the "household survey data for January 2015 will not be directly comparable with data for December 2014 or earlier periods".

ISM Non-Manufacturing Index increased to 56.7% in January

by Calculated Risk on 2/04/2015 10:09:00 AM

The January ISM Non-manufacturing index was at 56.7%, up from 56.5% in December. The employment index decreased in January to 51.6%, down from 55.7% in December. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: January 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in January for the 60th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.7 percent in January, 0.2 percentage point higher than the December reading of 56.5 percent. This represents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased to 61.5 percent, which is 2.9 percentage points higher than the December reading of 58.6 percent, reflecting growth for the 66th consecutive month at a faster rate. The New Orders Index registered 59.5 percent, 0.3 percentage point higher than the reading of 59.2 percent registered in December. The Employment Index decreased 4.1 percentage points to 51.6 percent from the December reading of 55.7 percent and indicates growth for the eleventh consecutive month. The Prices Index decreased 4.3 percentage points from the December reading of 49.8 percent to 45.5 percent, indicating prices contracted in January when compared to December. According to the NMI®, eight non-manufacturing industries reported growth in January. Comments from respondents vary by industry and company; however, they are mostly positive and/or reflect stability about business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was close to the consensus forecast of 56.5% and suggests slightly faster expansion in January than in December. The sharp decline in the employment index is a little concerning.

ADP: Private Employment increased 213,000 in January

by Calculated Risk on 2/04/2015 08:20:00 AM

Private sector employment increased by 213,000 jobs from December to January according to the January ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 220,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 31,000 jobs in January, down from 47,000 jobs gained in December. The construction industry added 18,000 jobs, down from last month’s gain of 26,000. Meanwhile, manufacturing added 14,000 jobs in January, below December’s 23,000.

Service-providing employment rose by 183,000 jobs in January, down from 207,000 in December. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Employment posted another solid gain in January, although the pace of growth is slower than in recent months. Businesses in the energy and supplying industries are already scaling back payrolls in reaction to the collapse in oil prices, while industries benefiting from the lower prices have been slower to increase their hiring. All indications are that the job market will continue to improve in 2015.”

The BLS report for January will be released on Friday and the consensus is for 230,000 non-farm payroll jobs added in December.

MBA: Mortgage Applications increase, FHA Refinance Applications up 76%

by Calculated Risk on 2/04/2015 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 30, 2015. ...

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

“Following several weeks of already elevated refinance activity due to falling interest rates, FHA refinance applications increased 76.5 percent in response to a reduction in annual mortgage insurance premiums which took effect January 26,” said Lynn Fisher, MBA’s Vice President of Research and Economics. “Conventional refinance volume was up only 0.5 percent for the week while VA refinance volume was down 24.3 percent. FHA purchase applications were also up 12.4 percent over the week prior, despite a decrease in purchase applications in the rest of the market.” ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.79 percent, the lowest level since May 2013, from 3.83 percent, with points increasing to 0.29 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

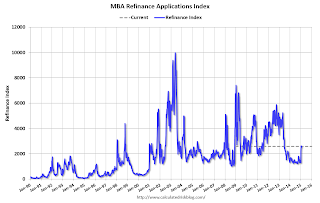

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It looks like 2015 will see more refinance activity than in 2014, especially from FHA loans!

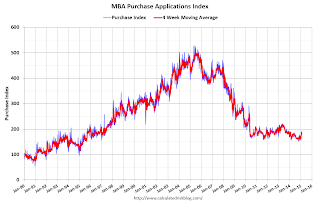

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the purchase index is up 3% from a year ago.

Tuesday, February 03, 2015

Wednesday: ADP Employment, ISM non-Manufacturing

by Calculated Risk on 2/03/2015 09:00:00 PM

From the WSJ: Oil Prices Surge 7% to One-Month High

U.S. oil futures notched a fourth consecutive gain, their longest winning streak since August. Prices have risen 19% in that time. The benchmark crude-oil contract on the New York Mercantile Exchange settled up $3.48, or 7%, at $53.05 a barrel, the highest settlement price since Dec. 31, 2014.Still down almost 50% from a year ago. A wild ride!

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 220,000 payroll jobs added in January, down from 241,000 in December.

• At 10:00 AM, the ISM non-Manufacturing Index for January. The consensus is for a reading of 56.5, up from 56.2 in December. Note: Above 50 indicates expansion.