by Calculated Risk on 12/21/2014 09:59:00 AM

Sunday, December 21, 2014

Katie Couric and the Net Petroleum Exporter Myth

To understand what the general public is hearing about oil, I watched a Yahoo video yesterday with Katie Couric explaining the decline in oil prices.

In general the piece was very good. Couric started by explaining that the decline in oil prices could be explained in two words: Supply and Demand. She discussed reasons for more supply and softening demand.

Note: from Professor Hamilton "[In October] I discussed the three main factors in the recent fall in oil prices: (1) signs of a return of Libyan production to historical levels, (2) surging production from the U.S., and (3) growing indications of weakness in the world economy."

I'd add to the discussion that the short run supply and demand curves are both very steep for oil, so small changes in supply and / or demand can cause a large change in price (see A Comment on Oil Prices).

But then Couric mentioned a myth I've heard several times recently. She said:

In fact, [the U.S.] is now the world’s largest producer of petroleum, and for the last two years, it has been selling more to other countries than it’s been buying. Who knew?"Who knew?" No one, because it is not true. Yes, the U.S. is the largest producer this year (ahead of Saudi Arabia and Russia), but the U.S. is NOT "selling more to other countries than it's been buying".

The source of this error is that the U.S. is a net exporter of refined petroleum products, such as refined gasoline. Here is the EIA data on Weekly Imports & Exports of crude oil and petroleum products. The U.S. is importing around 9 million barrels per day of crude oil and products, and exporting around 4 million per day (mostly refined products). The U.S. is a large net importer!

Note: Here is some data on natural gas (the U.S. is net importer).

Another data source is the monthly trade balance report from the Department of Commerce that shows about a net petroleum trade deficit of about $15 to $20 billion per month this year. The good news is the petroleum contribution to the trade deficit has been declining, but it is still very large.

Couric was correct about supply and demand, but it is important to note the U.S. is still a large importer of oil.

Saturday, December 20, 2014

Existing Home Sales: A Likely "Miss"

by Calculated Risk on 12/20/2014 04:51:00 PM

The NAR will report November Existing Home Sales on Monday, December 22nd. The consensus is the NAR will report sales at 5.20 million seasonally adjusted annual rate (SAAR), however economist Tom Lawler estimates the NAR will report sales of 4.90 million on a SAAR basis.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 4 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Over the last four years, the consensus average miss was 150 thousand with a standard deviation of 160 thousand. Lawler's average miss was 70 thousand with a standard deviation of 45 thousand.

Note: Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has been doing a little better recently! Looking at the consensus for November, maybe some of the analysts took an early vacation this week.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | NA | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | --- |

| 1NAR initially reported before revisions. | |||

Schedule for Week of December 21st

by Calculated Risk on 12/20/2014 12:19:00 PM

The key reports this week are November Existing Home Sales on Monday, November Personal Income and Outlays on Tuesday, November New Home Sales on Tuesday, and the third estimate of Q3 GDP also on Tuesday.

Merry Christmas and Happy Holidays to All!

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for sales of 5.20 million on seasonally adjusted annual rate (SAAR) basis. Sales in October were at a 5.26 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.90 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.9% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 3rd quarter 2014 (third estimate). The consensus is that real GDP increased 4.3% annualized in Q3, revised up from the second estimate of 3.9%.

9:00 AM: FHFA House Price Index for October 2014. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.2% increase.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 93.0, down from the preliminary reading of 93.8, and up from the November reading of 88.8.

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for an increase in sales to 460 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 458 thousand in October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December.

10:00 AM: Personal Income and Outlays for November. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 289 thousand.

The NYSE and the NASDAQ will close at 1:00 PM ET.

All US markets will be closed in observance of the Christmas Holiday.

No economic releases scheduled.

Unofficial Problem Bank list declines to 401 Institutions

by Calculated Risk on 12/20/2014 08:07:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 19, 2014.

Changes and comments from surferdude808:

The OCC released an update on its latest enforcement action activity that contributed to many changes to the Unofficial Problem Bank List this week. Also, the FDIC closed a bank this Friday in what will likely will be the last closure of the year. In all, there were nine removals and four additions that leave the list with 401 institutions with assets of $125.1 billion. A year ago, the list held 633 institutions with assets of $216.7 billion. Assets on the list increased by $1.2 billion this week and one would have to go all the way back about two years to the week ending November 16, 2012 for a similar increase in assets.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 401.

Actions were terminated against The First National Bank of Layton, Layton, UT ($276 million); Stephens Federal Bank, Toccoa, GA ($147 million); First Federal Savings and Loan Association of Independence, Independence, KS ($137 million Ticker: FFSL); First Federal Bank, A FSB, Tuscaloosa, AL ($128 million); First National Community Bank, Chatsworth, GA ($124 million); Community Federal Savings Bank, Woodhaven, NY ($123 million); The Citizens National Bank of Meyersdale, Meyersdale, PA ($76 million); and Port Byron State Bank, Port Byron, IL ($75 million).

The FDIC shuttered Northern Star Bank, Mankato, MN ($19 million) today making it the 18th failure this year. A total of 23 institutions headquartered in Minnesota have failed since the on-set of the Great Recession, which ranks fifth after Georgia (88), Florida (71), Illinois (61), and California (40).

Additions this week were CertusBank, National Association, Easley, SC ($1.5 billion); Bank of Manhattan, N.A., El Segundo, CA ($496 million Ticker: MNHN); Solera National Bank, Lakewood, CO ($148 million Ticker: SLRK); and First Scottsdale Bank, National Association, Scottsdale, AZ ($95 million).

Next week we anticipate the FDIC will release an update on its enforcement action activity.

Friday, December 19, 2014

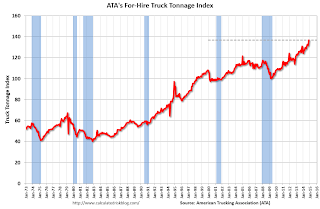

ATA Trucking Index increased 3.5% in November

by Calculated Risk on 12/19/2014 07:01:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Surged 3.5% in November

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index jumped 3.5% in November, following an increase of 0.5% during the previous month. In November, the index equaled 136.8 (2000=100), which was the highest level on record.

Compared with November 2013, the SA index increased 4.4%, down slightly from October’s 4.5% increase but still was the second highest year-over-year gain in 2014. Year-to-date, compared with the same period last year, tonnage is up 3.3%. ...

“With strong readings for both retail sales and factory output in November, I’m not surprised that tonnage increased as well,” said ATA Chief Economist Bob Costello. “However, the strength in tonnage did surprise to the upside.”

“The index has increased in four of the last five months for a total gain of 6.4%,” Costello said. “Clearly, the economy is doing well with tonnage on such a robust trend-line.”

Trucking serves as a barometer of the U.S. economy, representing 69.1% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.7 billion tons of freight in 2013. Motor carriers collected $681.7 billion, or 81.2% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 4.4% year-over-year.