by Calculated Risk on 8/07/2014 08:37:00 AM

Thursday, August 07, 2014

Weekly Initial Unemployment Claims decline to 289,000, 4-Week Average Lowest since February 2006

The DOL reports:

In the week ending August 2, the advance figure for seasonally adjusted initial claims was 289,000, a decrease of 14,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 302,000 to 303,000. The 4-week moving average was 293,500, a decrease of 4,000 from the previous week's revised average. This is the lowest level for this average since February 25, 2006 when it was 290,750. The previous week's average was revised up by 250 from 297,250 to 297,500.The previous week was revised up to 303,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 293,500.

This was lower than the consensus forecast of 305,000.

Wednesday, August 06, 2014

Thursday: Unemployment Claims

by Calculated Risk on 8/06/2014 07:21:00 PM

From Tim Duy at Economist's View: Fed Watch: Fed Hawks Squawk

How much leeway does Fed Chair Janet Yellen have in her campaign to hold interest rates low for a considerable period after asset purchases end later this year? If you listen to Fed hawks, you would believe that she is quickly running out of room. ...CR Note: Duy says the "hawks will remain frustrated", but it is also important to note that they have also been wrong!

... At the moment, we are focused on wages as the missing part of the higher rate equation. But that is too narrow of an analysis. Also on Yellen's side is low actual inflation and anchored inflation expectations. To be sure, the Fed will be under increasing pressure to begin normalizing policy if unemployment drops below 6%. At that point the Fed will be sufficiently close to their objectives that they will believe the odds of falling behind the curve will rise in the absence of movement toward policy normalization. But without a more pressing threat to inflation expectations from a combination of actual inflation in excess of the Fed's target and wage growth to support that inflation, Yellen has room to normalize policy at a gradual pace. For now, the data is still on her side and the hawks will remain frustrated, much as they have for the past several years.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 302 thousand.

• Early, the Trulia Price Rent Monitors for July. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 3:00 PM, Consumer Credit for June from the Federal Reserve. The consensus is for credit to increase $18.3 billion.

Payroll Employment and Seasonal Factors

by Calculated Risk on 8/06/2014 05:31:00 PM

This might be a good time to review the seasonal pattern for employment.

Even in the best of years there are a significant number of jobs lost in the months of January and July. In 1994, when the economy added almost 3.9 million jobs, there were 2.25 million lost in January 1994, and almost 1 million payroll jobs lost in July of that year.

This year, in July 2014, 1.11 million total jobs were lost (not seasonally adjusted, NSA), however all of the decline in non-farm payrolls NSA was from the public sector (teacher layoffs). Usually those teachers return to the payrolls in September and early October. Since this happens every year, the BLS applies a seasonal adjustment before reporting the headline number.

For the private sector, there are always a number of jobs lost in January (retailers and others cutting jobs) and in September (summer hires let go).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the seasonal pattern for the last decade for both total nonfarm jobs and private sector only payroll jobs. Notice the large spike down every January.

In July, the private sector added 127 thousand jobs (NSA). This was the strongest July since 1999.

The key point is this is a series that NEEDS a seasonal adjustment!

U.S. Births increased in 2013 after Declining for Five Consecutive Years

by Calculated Risk on 8/06/2014 12:11:00 PM

This provisional data for 2013 was released in May and shows a possible impact of the great recession ...

From the National Center for Health Statistics: Births: Preliminary Data for 2013. The NCHS reports:

The 2013 preliminary number of U.S. births was 3,957,577, slightly more (4,736) than in 2012. ...The most amazing data is on teen births (see 2nd graph below).

The general fertility rate was 62.9 births per 1,000 women aged 15–44, down slightly from 2012 and a record low.

Here is a long term graph of annual U.S. births through 2013 ...

Click on graph for larger image.

Click on graph for larger image.Births had declined for five consecutive years, and are about 8.3% below the peak in 2007 (births in 2007 were at the all time high - even higher than during the "baby boom"). I suspect certain segments of the population were under stress before the recession started - like construction workers - and even more families were in distress in 2008 through 2012. And this led to fewer babies.

Notice that the number of births started declining a number of years before the Great Depression started. Many families in the 1920s were under severe stress long before the economy collapsed. By 1933 births were down by almost 23% from the early '20s levels.

Of course economic distress isn't the only reason births decline - look at the huge decline following the baby boom that was driven by demographics. But it is not surprising that the number of births slow or decline during tough economic times - but that appears to be over now.

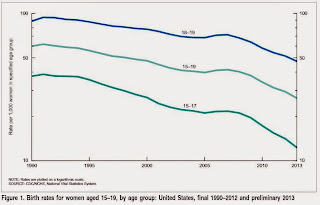

The second graph is from the NCHS report and shows births per 1,000 women by teen age group. From the NCHS:

The second graph is from the NCHS report and shows births per 1,000 women by teen age group. From the NCHS: The number of births to teenagers aged 15–19 in 2013 was 274,641, also down 10% from 2012 and the lowest number of teen births ever reported for the United States. The 2013 number of births was 38% less than in 2007 (444,899), the most recent high, and 57% less than in 1970, the all-time peak year for the number of teen births (644,708).Far fewer teens births is great news (and is probably related to the much higher enrollment rates).

Another key trends ... women are waiting longer to have babies:

The birth rate for women aged 20–24 was 81.2 births per 1,000 women in 2013, down 2% from the previous record low rate in 2012 (83.1). Since 2007, the rate for women in this age group has declined steadily at nearly 4% per year.Waiting longer to have children makes sense (see: Demographics and Behavior) and we should expect a baby boom in a few years as the largest cohorts move into the 25 to 34 years old age groups. (for largest cohorts, see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group).

The 2013 preliminary birth rate for women aged 30–34 was 98.7 births per 1,000 women, up 1% from the rate in 2012 (97.3). The number of births to women in their early 30s also increased in 2013, by 2%. The rate for women aged 35–39 was 49.6 births per 1,000 women, up 3% from 2012 (48.3), reaching the highest rate for this age group since 1963. The number of births to women in their late 30s increased 3% in 2013.

P.S. I expect that as families have babies, they will tend to buy homes (as opposed to rent)! The demographics are favorable for renting now (see: The Favorable Demographics for Apartments), but eventually the demographics will be more positive for home ownership.

Trade Deficit decreased in June to $41.5 Billion

by Calculated Risk on 8/06/2014 08:30:00 AM

The Department of Commerce reported:

[T]otal June exports of $195.9 billion and imports of $237.4 billion resulted in a goods and services deficit of $41.5 billion, down from $44.7 billion in May, revised. June exports were $0.3 billion more than May exports of $195.6 billion. June imports were $2.9 billion less than May imports of $240.3 billion.The trade deficit was smaller than the consensus forecast of $45.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through June 2014.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in June.

Exports are 18% above the pre-recession peak and up 3% compared to June 2013; imports are about 2% above the pre-recession peak, and up about 5% compared to June 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $96.41 in June, up from $96.12 in May, and down from $96.87 in June 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $30.1 billion in June, from $26.7 billion in June 2013.