by Calculated Risk on 5/28/2014 10:00:00 AM

Wednesday, May 28, 2014

Zillow: Case-Shiller House Price Index expected to slow slightly year-over-year in April

The Case-Shiller house price indexes for March were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

It looks like the year-over-year change for Case-Shiller will continue to slow. From Zillow: Case-Shiller: Another Month of Strong Home Value Appreciation

The Case-Shiller data for March 2014 came out [yesterday], and based on this information and the April 2014 Zillow Home Value Index (ZHVI, released May 20), we predict that next month’s Case-Shiller data (April 2014) will show that both the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 11.8 percent on a year-over-year basis, respectively. The seasonally adjusted (SA) month-over-month change from March to April will be 1.2 percent for the 20-City Composite Index and 1.1 percent for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for April will not be released until Tuesday, June 24.So the Case-Shiller index will probably show another strong year-over-year gain in April, but a little lower than in March (12.4% year-over-year).

Case-Shiller indices have shown very little slowing in monthly appreciation, as they continue to show a somewhat inflated picture of home prices. On a year-over-year basis the indices are slowing down ever so slightly, but we have not seen the same signs of a slowdown in the Case-Shiller data that we have seen in other data. The Case-Shiller indices are biased toward the large, coastal metros currently still seeing substantial home value gains, and they include foreclosure re-sales. The inclusion of foreclosure re-sales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed. However, as the prevalence of foreclosures and foreclosure re-sales is declining, so is the impact they have on the Case-Shiller indices. Moreover, the fact that Case-Shiller uses a three-month average is strongly diluting the impact of the most recent numbers and with that the showing of a slowdown. More on the difference between Case-Shiller and ZHVI can be found here.

We expect home value appreciation to continue to moderate in 2014 (even if we can’t yet see it in the Case-Shiller data), rising 2.2 percent between April 2014 and April 2015, nationally — a rate much more in line with historic appreciation rates. The main drivers of this moderation include rising mortgage rates and less investor participation – leading to decreased demand – and increasing for-sale inventory supply. Further details on our forecast of home values can be found here, and more on Zillow’s full April 2014 report can be found here.

| Zillow March 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Apr 2013 | 165.35 | 168.35 | 152.24 | 155.07 |

| Case-Shiller (last month) | Mar 2014 | 181.43 | 186.35 | 166.80 | 171.39 |

| Zillow Forecast | YoY | 11.8% | 11.8% | 11.8% | 11.8% |

| MoM | 1.9% | 1.1% | 2.0% | 1.2% | |

| Zillow Forecasts1 | 184.9 | 188.3 | 170.2 | 173.4 | |

| Current Post Bubble Low | 146.45 | 149.86 | 134.07 | 137.13 | |

| Date of Post Bubble Low | Mar-12 | Feb-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 26.2% | 25.7% | 26.9% | 26.5% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

MBA: "Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey"

by Calculated Risk on 5/28/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 23, 2014. ...

The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.31 percent, the lowest level since June 2013, from 4.33 percent, with points decreasing to 0.15 from 0.20 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013 (one year ago).

As expected, with the mortgage rate increases, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 15% from a year ago.

Tuesday, May 27, 2014

ATA Trucking Index increased in April

by Calculated Risk on 5/27/2014 07:43:00 PM

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Increased 1.5% in April

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 1.5% in April, after rising 0.6% the previous month. In April, the index equaled 129.1 (2000=100) versus 127.2 in March. The all-time high was in November 2013 (131.0).

Compared with April 2013, the SA index increased 4.8%, which is the largest year-over-year gain of 2014.

...

“April was the third straight gain in tonnage totaling 4%,” said ATA Chief Economist Bob Costello. Tonnage is off 1.4% from the all-time high in November.

“I’m pleased that tonnage has been making solid progress after falling a total of 5.2% in December and January,” he said. “And April’s nice gain was better than the contraction in industrial production and the lackluster retail sales during the same month.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index has rebounded following the sharp decline during the winter and is now up 4.8% year-over-year.

Weekly Update: Housing Tracker Existing Home Inventory up 8.3% year-over-year on May 26th

by Calculated Risk on 5/27/2014 04:14:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 8.3% above the same week in 2013.

Inventory is still very low - still below the level in 2012 (yellow) when prices started increasing - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Comment on House Prices: Real Prices, Price-to-Rent Ratio

by Calculated Risk on 5/27/2014 01:40:00 PM

I've been expecting a slowdown in year-over-year prices as "For Sale" inventory slowly increases, and the slowdown might be starting, but this was a still very strong month-to-month increase. The Case-Shiller Composite 20 index was up 1.2% in March 2014 seasonally adjusted (SA). Not much of a slowdown!

In March 2013, the Composite 20 index was up an even stronger 1.7% month-to-month SA, so the year-over-year change was slightly lower in March than in February. This is the fourth consecutive month with lower month-to-month changes than the same month last year. So the year-over-year change has declined from 13.7% in November 2013 to a still very strong 12.4% in March 2014.

It is likely the Case-Shiller Composite 20 index is overstating national price increases due to the inclusion of distressed sales, and the heavy weighting of coastal cities. Other indexes show less price appreciation than Case-Shiller (Black Knight, FNC), and Zillow indicated prices declined slightly in April. So I expect a further decline in the year-over-year change in the Case-Shiller April index (this index is a 3 month average and tends to lag some other indexes).

Also, I've heard talk of a new "bubble" for house prices. And it does appear, by the measures below, that house prices are somewhat above the historical norm. However since there is little evidence of speculative buying, I wouldn't call this a bubble - although these double digit price increases are clearly unsustainable.

Note: My definition of a "bubble", from a post I wrote in April 2005, Housing: Speculation is the Key:

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation ... Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the "bubble" bursts.There was a clear bubble in 2005 with prices much more out of line with fundamentals than now, and rampant speculation with excessive leverage. Currently I'm not concerned.

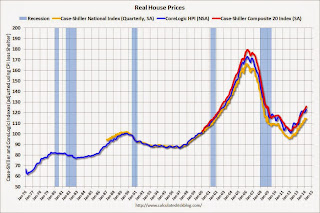

It is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $277,000 today adjusted for inflation (just over 38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to mid-2004 levels (and also back up to Q2 2008), and the Case-Shiller Composite 20 Index (SA) is back to Nov 2004 levels, and the CoreLogic index (NSA) is back to November 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q4 2001 levels, the Composite 20 index is back to August 2002, and the CoreLogic index back to June 2002.

In real terms, house prices are back to early '00s levels.

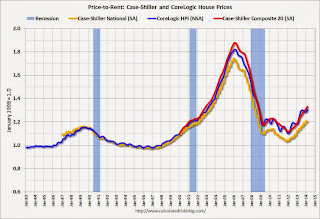

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q1 2002 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to February 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels.