by Calculated Risk on 6/26/2013 09:59:00 PM

Wednesday, June 26, 2013

Thursday: Personal Income and Outlays for May, Weekly Unemployment Claims

From Cardiff Garcia at the FT Alphaville: Rates and the US housing market

We don’t mean to be entirely dismissive of the prevailing higher rates. The economy didn’t need any shade thrown at one of its few bright spots, especially with the continued fiscal drag and steady-but-unimpressive employment gains. Low rates not only spur along housing but also make credit more affordable for buying durable goods and automobiles, purchases of which often accompany newly formed households.Thursday:

And there isn’t much evidence (yet) to show that the fundamental supply-side problems we previously discussed have been mitigated, as such improvements would partly depend on the housing market’s continued rebound and wider improvements in the economy.

But at least the higher rates have arrived at a time when the housing market had favourable momentum.

• At 8:30 AM ET, the Personal Income and Outlays report for May. The consensus is for a 0.2% increase in personal income in April, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for an decrease to 345 thousand from 354 thousand last week.

• At 10:00 AM, the Pending Home Sales Index for May from the NAR. The consensus is for a 1.0% increase in the index.

• At 11:00 AM, the Kansas City Fed Survey of Manufacturing Activity for June. This is the last of the regional manufacturing surveys for June. The consensus is for a reading of 4 for this survey, up from 2 in May (Above zero is expansion).

House Prices and Mortgage Rates

by Calculated Risk on 6/26/2013 05:20:00 PM

Several people have asked me about a comment from Fannie Mae chief economist Doug Duncan as quoted in a NY Times article a couple of weeks ago: In a Shift, Interest Rates Are Rising

“There’s no strong correlation between interest rates and home prices,” said Douglas Duncan, chief economist at Fannie Mae.Duncan is correct.

However, a key difference now compared to earlier periods, is that there is more investor buying. And investors will compare their returns on different investments - and rising rates will probably slow investor demand for real estate, even if they are all cash buyers. But, in general, I think rising rates might slow price increases but not lead to a decline in prices (we might see some seasonal declines).

I'll post some more thoughts on the relationship between house prices and interest rates (long term readers might remember I wrote about this in 2005), but first I'd like to post a couple of graphs.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the Corelogic House Price Index (started in 1976) and 30 year fixed mortgage rates as reported by Freddie Mac in their weekly Primary Mortgage Market Survey® .

Even with mortgage rates rising sharply in the late '70s, house prices continued to increase. And there were a few spikes in interest rates (like in 2000) that didn't slow price increases.

The second graph shows the same data, but with house prices in real terms (adjusted for inflation).

The second graph shows the same data, but with house prices in real terms (adjusted for inflation).Real prices were fairly flat in the late '70s and early '80s ... so maybe the spike in interest rates slowed price increases ... and then the economic weakness in the early '80s kept prices from rising even as mortgage rates declined.

In the early '90s, economic weakness (and the unwinding of a small housing bubble in certain states), lead to falling real prices even as mortgage rates declined.

The bottom line is other factors (like a stronger economy) have a bigger impact on house prices than changes in mortgage rates.

Philly Fed: State Coincident Indexes increased in 33 States in May

by Calculated Risk on 6/26/2013 01:59:00 PM

From the Philly Fed:

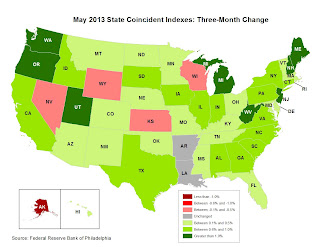

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for May 2013. In the past month, the indexes increased in 33 states, decreased in eight states, and remained stable in nine, for a one-month diffusion index of 50. Over the past three months, the indexes increased in 43 states, decreased in five, and remained stable in two, for a three-month diffusion index of 76.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In May, 37 states had increasing activity, down from 44 in April (including minor increases). This measure has been and up down over the last few years since the recovery has been sluggish.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. The map is mostly green again and suggests that the recovery is geographically widespread.

Vehicle Sales in June forecast to be at highest level since 2007

by Calculated Risk on 6/26/2013 11:46:00 AM

Note: The automakers will report June vehicle sales on Tuesday, July 2nd (next Tuesday). Here are a couple of forecasts:

From Reuters: June auto sales on pace for best showing since December '07: study

June auto sales are on track for their best month since before the 2008-2009 sales plunge ... J.D. Power and LMC Automotive said June sales will show a seasonally adjusted annualized rate of 15.7 million vehicles sold, up 7.6 percent from a year ago and the best showing since December 2007.From TrueCar: June 2013 New Car Sales Expected to Be Up Nearly Eight Percent According to TrueCar; June 2013 SAAR at 15.7M, Highest June SAAR Since 2007

For June 2013, new light vehicle sales in the U.S. (including fleet) is expected to be 1,380,543 units, up 7.8 percent from June 2012 ... The June 2013 forecast translates into a Seasonally Adjusted Annualized Rate ("SAAR") of 15.7 million new car sales, up from 15.3 million in May 2013 and up from 14.4 million in June 2012.Two key points: 1) sales growth will slow in 2013, and 2) it appears auto sales were solid in June.

Based on the first five months of 2013, it appears auto sales will increase again this year, but not double digit growth like the last few years. This suggests auto sales will contribute less to GDP growth this year than in the previous three years.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.2 | 5.3% |

| 1Sales rate for first five months of 2013. | ||

Q1 GDP Revised down to 1.8% Annualized Real Growth Rate

by Calculated Risk on 6/26/2013 08:45:00 AM

GDP was revised down from a 2.4% annualized real growth rate to 1.8% in Q1. From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.8 percent in the first quarter of 2013 (that is, from the fourth quarter to the first quarter), according to the "third" estimate released by the Bureau of Economic Analysis.Personal consumption expenditure growth was revised down from a 3.4% annualized rate in the 2nd estimate to 2.6% in the 3rd estimate of GDP.

...

The downward revision to the percent change in real GDP primarily reflected downward revisions to personal consumption expenditures, to exports, and to nonresidential fixed investment that were partly offset by a downward revision to imports.

Click on graph for larger image.

Click on graph for larger image.Last week I posted Four Charts to Track Timing for QE3 Tapering . Here is an update to the GDP chart.

The current FOMC forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

The first quarter was below the FOMC projections (red), and it appears the second quarter will also be below the FOMC forecast - if so, then GDP will have to pickup in the 2nd half of 2013 for the Fed to start tapering QE3 purchases in December.