by Calculated Risk on 9/27/2012 11:00:00 AM

Thursday, September 27, 2012

Kansas City Fed: Regional Manufacturing Activity "slowed somewhat" in September

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Slowed Somewhat

The Federal Reserve Bank of Kansas City released the September Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity slowed somewhat, although producers’ expectations for future activity remained relatively positive.This was below expectations of a 5 reading for the composite index. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Factories reported only minimal overall growth in our region in September, and both production and new orders fell slightly” said Wilkerson. “But firms anticipate growth to pick up later this year and on into next year.”

...

The month-over-month composite index was 2 in September, down from 8 in August and 5 in July, and the lowest in nine months. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index dropped from 7 to -4, and the shipments, new orders, and order backlog indexes also moved into negative territory. The employment index eased from 2 to 1, while the new orders for export index inched higher but remained below zero. Both inventory indexes eased but were still in positive territory.

Despite the overall slowdown, most future factory indexes were little changed and remained at generally favorable levels. The future composite index was unchanged at 16, while the future shipments, new orders, and order backlog indexes increased slightly. The future employment index was stable at 16, while the future production index eased somewhat from 31 to 29. The future capital expenditures index fell for the second straight month, while the new orders for export index posted no change.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM index for September will be released Monday, Oct 1st, and these surveys suggest another weak reading close to 50.

NAR: Pending home sales index declined 2.6% in August

by Calculated Risk on 9/27/2012 10:03:00 AM

From the NAR: Pending Home Sales Decline in August

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 2.6 percent to 99.2 in August from an upwardly revised 101.9 in July but is 10.7 percent above August 2011 when it was 89.6. The data reflect contracts but not closings.This was below the consensus forecast of a slight increase.

The PHSI in the Northeast rose 0.9 percent to 78.2 in August and is 19.9 percent above August 2011. In the Midwest the index declined 2.6 percent to 95.0 in August but is also 19.9 percent higher than a year ago. Pending home sales in the South slipped 1.1 percent to an index of 110.4 in August but are 13.2 percent above August 2011. With broad inventory shortages in the West, the index fell 7.2 percent in August to 102.5 and is 4.2 percent below a year ago.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in September and October.

Weekly Initial Unemployment Claims decline to 359,000

by Calculated Risk on 9/27/2012 08:30:00 AM

Other releases: From the BEA, Q2 GDP was revised down to 1.3% from 1.7%.

From the Census Bureau:

New orders for manufactured durable goods in August decreased $30.1 billion or 13.2 percent to $198.5 billion, the U.S. Census Bureau announced today. This decrease, down following three consecutive monthly increases, was the largest decrease since January 2009 and followed a 3.3 percent July increase.The decline was due to the volatile transportation sector.

The DOL reports:

In the week ending September 22, the advance figure for seasonally adjusted initial claims was 359,000, a decrease of 26,000 from the previous week's revised figure of 385,000. The 4-week moving average was 374,000, a decrease of 4,500 from the previous week's revised average of 378,500.The previous week was revised up from 382,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,000.

This was below the consensus forecast of 376,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but moving up recently.

Wednesday, September 26, 2012

Thursday: Unemployment Claims, Durable Goods, GDP

by Calculated Risk on 9/26/2012 08:04:00 PM

On Europe ...

From the Financial Times: Rajoy fights Spanish turmoil

Mariano Rajoy will on Thursday attempt to stave off a backlash from financial markets by announcing budget plans for next year ... His government is also preparing to unveil a new reform programme and the results of a banking stress test.From the NY Times: European Markets Jolted Amid Protests in Greece and Spain

Excerpt with permission.

On Tuesday in Spain, tens of thousands of demonstrators besieged Parliament to protest austerity measures planned by Mr. Rajoy. ...On Thursday:

In Athens, trade unions called a nationwide strike Wednesday to contest billions of dollars in new salary and pension cuts being discussed by the government and its international creditors. ...

[Prime Minister Antonis] Samaras is negotiating a $15 billion austerity package that is needed to persuade Greece’s so-called troika of lenders — the International Monetary Fund, the European Central Bank and the European Commission — to release nearly $40.7 billion in financial aid that the country needs to stay solvent.

Mr. Rajoy has been trying for months to convince investors that Spain can handle its own problems and that it will not need a bailout that would force Madrid to cede some authority over its fiscal affairs to its lenders, and is set to introduce new cutbacks to meet budgetary goals. Those will include restrictions on early retirement and various measures to streamline regulations and fight unemployment ...

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 376 thousand from 382 thousand.

• Also at 8:30 AM, the Durable Goods Orders report for August will be released by the Census Bureau. The consensus is for a 5.0% decrease in durable goods orders.

• Also at 8:30 AM, the BEA will released the third estimate of Q2 Gross Domestic Product. The consensus is that real GDP increased 1.7% annualized in Q2, unchanged form the second estimate.

• At 10:00 AM, the NAR will release the Pending Home Sales Index for September. The consensus is for a 0.3% increase in the index.

• At 10:30 AM, the Kansas City Fed regional Manufacturing Survey for September will be released. This is the last of the regional surveys for September. The consensus is for a reading of 5, down from 8 in August (above zero is expansion).

A question for the September economic prediction contest:

Earlier on new home sales:

• New Home Sales at 373,000 SAAR in August

• New Home Sales and Distressing Gap

• New Home Sales graphs

New Home Prices: Average Highest since 2008

by Calculated Risk on 9/26/2012 03:20:00 PM

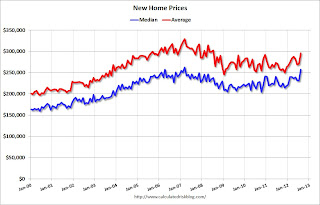

As part of the new home sales report, the Census Bureau reported that the average price for new homes increased to the highest level since August 2008.

From the Census Bureau: "The median sales price of new houses sold in August 2012 was $256,900; the average sales price was $295,300."

The following graph shows the median and average new home prices.

Click on graph for larger image.

Click on graph for larger image.

During the bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. With fewer foreclosures now, it appears the builders are moving to slightly higher price points.

The second graph shows the percent of new home sales by price. At the peak of the housing bubble, almost 40% of new homes were sold for more than $300K - and over 20% were sold for over $400K.

The percent of home over $300K declined to 20% in January 2009. Now it has rebounded to around 35%. And less than 10% were under $150K.

The percent of home over $300K declined to 20% in January 2009. Now it has rebounded to around 35%. And less than 10% were under $150K.

Earlier:

• New Home Sales at 373,000 SAAR in August

• New Home Sales and Distressing Gap

• New Home Sales graphs