by Calculated Risk on 9/23/2012 12:53:00 PM

Sunday, September 23, 2012

Update: House Prices will decline month-to-month Seasonally later in 2012

I've mentioned this before, but it is probably worth repeating ...The Not Seasonally Adjusted (NSA) house price indexes will show month-to-month declines later this year. This should come as no surprise and will not be a sign of impending doom.

• There is a seasonal pattern for house prices. Prices tend to be stronger in the spring and early summer, and then weaker in the fall and winter.

• Currently there is a stronger than normal seasonal pattern. This is because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have a larger negative impact on prices in the fall and winter.

• Two of the most followed house price indexes are three month averages. This means the indexes lag the month-to-month change. The Case-Shiller report for "July", to be released on Tuesday, is actually an average of May, June and July. The CoreLogic index is a three month average, but weighted to the most recent month. Prices have probably started declining month-to-month seasonally in August or September, but this will not show up in the indexes for several months. (Several real estate agents have told me the seasonal slowdown has started in their areas).

• The key is to watch the year-over-year change and to compare to the NSA lows earlier this year. I think house prices have already bottomed, and will be up slightly year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic (through July) and NSA Case-Shiller Composite 20 index (through June) over the last several years. There is a clear seasonal pattern.

Right now I'm guessing the CoreLogic index will report negative month-to-month price changes for August or September, and Case-Shiller for September or October. Just something to be aware of ...

Yesterday:

• Summary for Week Ending Sept 21st

• Schedule for Week of Sept 23rd

• Goldman Estimate: QE3 could be $1.2 to $2.0 Trillion

Unofficial Problem Bank list declines to 878 Institutions

by Calculated Risk on 9/23/2012 10:37:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 21, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, the OCC released its actions through mid-August 2012 that led to many changes in the Unofficial Problem Bank List. This week there 13 removals and five additions leaving the list with 878 institutions with assets of $327.4 billion. A year ago, the list held 986 institutions with assets of $400.4 billion.Yesterday:

Removals from action termination include NCB, FSB, Hillsboro, OH ($1.6 billion); Farmers Bank & Trust, National Association, Great Bend, KS ($655 million); Coconut Grove Bank, Miami, FL ($617 million); Alaska Pacific Bank, Juneau, AK ($177 million Ticker: ALPB); The First National Bank of Milaca, Milaca, MN ($169 million); Peoples National Bank of Mora, Mora, MN ($157 million); The Farmers National Bank of Cynthiana Cynthiana, KY ($104 million); The Mason National Bank, Mason, TX ($90 million).

Removals through unassisted merger were Gateway Business Bank, Cerritos, CA ($181 million); Bank of Naples, Naples, FL ($116 million); Northwest Bank, Lake Oswego, OR ($94 million); and Sonoran Bank, N.A., Phoenix, AZ ($28 million) Border Trust Company, Augusta, ME ($45 million) voluntarily liquidated on August 14, 2012.

The additions were Community Bank, Staunton, VA ($502 million Ticker: CFFC); Slavie Federal Savings Bank, Bel Air, MD ($177 million); Amory Federal Savings and Loan Association, Amory, MS ($99 million); First Capital Bank, Bennettsville SC ($60 million Ticker: FCPB); and United Trust Bank, Palos Heights, IL ($45 million).

Next week, we anticipate for the FDIC to release its actions through August 2012.

Recently, the Treasury Department issued its monthly Congressional TARP update report, which included bank holding companies or institutions that failed to make their August 15th TARP dividend or interest payment. There are 112 institutions on the Unofficial Problem Bank List that directly or are controlled by a parent company that did not make the August 15th payment. Within this group are 43 institutions, including 9 with assets over $1 billion, that have missed 10 or more quarterly payments. See the table for additional details. Theoretically, only healthy banks were eligible for an infusion of capital through the various TARP programs. At least 15 TARP recipients have failed and given the large number of TARP recipients on the Unofficial Problem Bank List, it appears that reality does not comport with theory.

• Summary for Week Ending Sept 21st

• Schedule for Week of Sept 23rd

• Goldman Estimate: QE3 could be $1.2 to $2.0 Trillion

Saturday, September 22, 2012

Goldman Estimate: QE3 could be $1.2 to $2.0 Trillion

by Calculated Risk on 9/22/2012 10:56:00 PM

A few excerpts from a research note by Goldman Sachs chief economist Jan Hatzius:

• ... We now view the Fed as following a looser version of the “threshold rule” championed by Chicago Fed President Charles Evans.The keys will be to watch the unemployment rate and several core measures of inflation. As of August, the unemployment rate was at 8.1% - and mostly moving sideways - and core PCE for July was up 1.6% year-over-year (plenty of room to the 2½%-2¾% range).

• What are the thresholds? We read the committee as signaling that the federal funds rate will not rise until the unemployment rate has fallen to the 6½%-7% range. The corresponding threshold for the end of QE3 may be in the 7%-7½% range.

•These implicit commitments are undoubtedly subject to an inflation ceiling ... may be a year-on-year core PCE reading of 2½%-2¾%.

• All this is subject to change ... The flexibility to respond to such changes is a key advantage of keeping the thresholds implicit rather than explicit.

• ... Under the committee’s economic forecasts, we estimate that the funds rate would stay near zero until mid-2015, while QE3 would run through mid-2014 and total $1.2trn.

• Under our own economic forecasts, we estimate that the funds rate would stay near zero until mid-2016, while QE3 would run through mid-2015 and total just under $2trn.

• If the recovery continues to disappoint, additional steps are possible.

Earlier:

• Summary for Week Ending Sept 21st

• Schedule for Week of Sept 23rd

Summary for Week Ending Sept 21st

by Calculated Risk on 9/22/2012 01:05:00 PM

Once again, the housing news was mostly positive last week and manufacturing was mostly disappointing.

Housing starts were a little below expectations - mostly because of the volatile multi-family sector - but starts are still up sharply from a year ago. Two-thirds of the way through 2012, single family starts are on pace for 515 thousand this year, and total starts are on pace for about 740 thousand.

In 2011, there were 609 total starts, and a record low 430 thousand single family starts. So housing starts are on pace for about a 20% increase from 2011. No wonder builder confidence was at the highest level since June 2006. That is a significant increase and will give the economy a boost.

Existing home sales increased too. The key numbers in the existing home sales report are inventory and months-of-supply. Inventory was down 18.2% year-over-year in August, and months-of-supply declined to 6.1 months - the lowest for the month of August since 2005.

The decline in inventory has been stunning, even for those of us expecting a significant decline - and I expect the year-over-year declines will start to decrease in the coming months.

Unfortunately both regional manufacturing surveys released this week (Empire State and Philly Fed) both showed contraction in September (although the Philly Fed index was close to unchanged).

A final note: The Fed's Flow of Funds survey showed household mortgage debt has decreased by over $1 trillion from the peak. Some of this decline is from homeowners paying down their mortgage (perhaps to refinance), but most of the decline was due to foreclosures or short sales (defaults). This reminded me of some of my posts from years ago ... new readers might not realize I was once one of the biggest bears around, see: The Trillion Dollar Bear

Here is a summary of last week in graphs:

• Housing Starts increased to 750 thousand in August

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 750 thousand (SAAR) in August, up 2.3% from the revised July rate of 733 thousand (SAAR). Note that July was revised from 746 thousand.

Single-family starts increased 5.5% to 535 thousand in August.

Total starts are up 57% from the bottom start rate, and single family starts are up 51% from the low.

This was below expectations of 768 thousand starts in August, but the key is starts are up solidly from last year. Right now starts are on pace to be up about 25% from 2011. Also total permits are up sharply from last year.

• Existing Home Sales in August: 4.82 million SAAR, 6.1 months of supply

The NAR reports: August Existing-Home Sales and Prices Rise

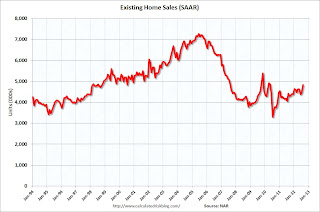

The NAR reports: August Existing-Home Sales and Prices RiseThis graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2012 (4.82 million SAAR) were 7.8% higher than last month, and were 9.3% above the August 2011 rate.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory decreased 18.2% year-over-year in August from August 2011. This is the eighteenth consecutive month with a YoY decrease in inventory.

Months of supply declined to 6.1 months in August.

This was above expectations of sales of 4.55 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• AIA: Architecture Billings Index shows slight expansion in August

From AIA: Architecture Billings Index Inches Back into Positive Territory

From AIA: Architecture Billings Index Inches Back into Positive TerritoryThis graph shows the Architecture Billings Index since 1996. The index was at 50.2 in August, up from 48.7 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further weakness in CRE investment later this year and into next year (it will be some time before investment in offices and malls increases).

• Weekly Initial Unemployment Claims at 382,000

The DOL reports: "In the week ending September 15, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 3,000 from the previous week's revised figure of 385,000." The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.

The DOL reports: "In the week ending September 15, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 3,000 from the previous week's revised figure of 385,000." The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.This was above the consensus forecast of 373,000.

• Empire State and Philly Fed Manufacturing Surveys show contraction in September

From the Philly Fed: September Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 5 points, to a reading of -1.9."

From the Philly Fed: September Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 5 points, to a reading of -1.9."From MarketWatch: Empire State index hits nearly two-year low

This graph compares the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys increased slightly in September, and has remained negative for four consecutive months. This suggests another weak reading for the ISM manufacturing index.

• Fed's Q2 Flow of Funds: Household Mortgage Debt down $1 Trillion from Peak

The Federal Reserve released the Q2 2012 Flow of Funds report this week: Flow of Funds.

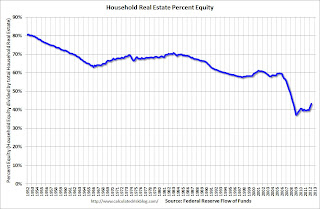

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2012, household percent equity (of household real estate) was at 43.1% - up from Q1, and the highest since Q2 2008. This was because of a small increase in house prices in Q2 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 43.1% equity - and over 10 million have negative equity.

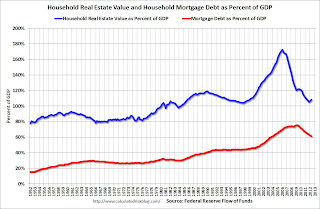

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt declined by $51 billion in Q2. Mortgage debt has now declined by $1.05 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up slightly in Q2 (as house prices increased), but is still near the lows of the last 30 years. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging (defaulting) ahead for households.

• Other Economic Stories ...

• LA area Port Traffic: Imports and Exports down YoY in August

• NAHB Builder Confidence increases in September, Highest since June 2006

• The Trillion Dollar Bear

Schedule for Week of Sept 23rd

by Calculated Risk on 9/22/2012 08:01:00 AM

Note: I'll post the weekly summary soon ... There are two key housing reports to be released this week: Case-Shiller house price index for July on Tuesday, and August New Home sales on Wednesday.

Other key reports include the third estimate of Q2 GDP on Thursday, and August Personal Income and Spending on Friday.

9:00 AM: LPS "First Look" Mortgage Delinquency Survey for August.

10:30 AM: Dallas Fed Manufacturing Survey for September. The consensus is for 0.5 for the general business activity index, up from -1.6 in August.

3:00 PM: San Francisco Fed President John Williams (voting member) speaks at The City Club of San Francisco, Jamison Roundtable Luncheon.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July.

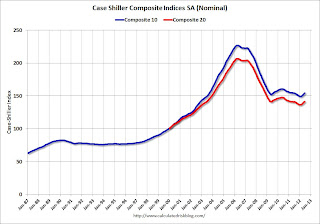

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average of May, June and July. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through June 2012 (the Composite 20 was started in January 2000).

The consensus is for a 1.2% year-over-year increase in the Composite 20 index (NSA) for July. The Zillow forecast is for the Composite 20 to increase 1.6% year-over-year, and for prices to increase 1.0% month-to-month seasonally adjusted.

10:00 AM: FHFA House Price Index for July 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.8% increase in house prices.

10:00 AM: Conference Board's consumer confidence index for September. The consensus is for an increase to 64.8 from 60.6 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September. The consensus is for an increase to -4 for this survey from -9 in August (above zero is expansion).

10:00 AM ET: New Home Sales for August from the Census Bureau.

10:00 AM ET: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for an increase in sales to 380 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 372 thousand in July. Watch for possible upgrades to the sales rates for previous months.

8:30 AM: Gross Domestic Product, 2nd quarter 2012 (third estimate); Corporate Profits, 2nd quarter 2012 (revised estimate) . This is the third estimate from the BEA. The consensus is that real GDP increased 1.7% annualized in Q2, unchanged form the second estimate.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 5.0% decrease in durable goods orders.

10:00 AM ET: Pending Home Sales Index for September. The consensus is for a 0.3% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for September. This is the last of the regional surveys for September. The consensus is for an a reading of 5, down from 8 in August (above zero is expansion).

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for an increase to 53.1, up from 53.0 in August.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 79.0, down from the preliminary September reading of 79.2, and up from the August reading of 74.3.