by Calculated Risk on 9/16/2012 10:00:00 AM

Sunday, September 16, 2012

Housing: Year over Year change in Asking Prices

According to housingtracker, median asking prices are up 2.1% year-over-year in early September. We can't read too much into this increase because these are just asking prices, and median prices can be distorted by the mix. As an example, the median asking price might have increased just because there are fewer low priced foreclosures listed for sale.

Note: The Trulia asking price index is adjusted for both mix and seasonality, but the housingtracker data is just the median, the 25th percentile and 75th percentile - and is impacted by both changes in the mix and seasonality.

But with those caveats, here is a graph of asking prices compared to the year-over-year change in the Case-Shiller composite 20 index.

Click on graph for larger image.

Click on graph for larger image.

The Case-Shiller index is in red. The brief period in 2010 with a year-over-year increase in the repeat sales index was related to the housing tax credit.

Also note that the 25th percentile took the biggest hit (that was probably the flood of low end foreclosures on the market).

Now the year-over-year change in median asking prices has been positive for ten consecutive months. We have to be careful about the mix (fewer foreclosures on the market), but this suggests year-over-year selling prices will stay positive.

On seasonality, asking prices peaked in June and are down slightly over the last three months. That is a reminder that the Not Seasonally Adjusted repeat sales indexes will show month-to-month declines later this year - and the focus will be on the year-over-year change.

Yesterday:

• Summary for Week Ending Sept 14th

• Schedule for Week of Sept 16th

Saturday, September 15, 2012

Unofficial Problem Bank list declines to 886 Institutions

by Calculated Risk on 9/15/2012 07:07:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 14, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

There were two removals and one addition to the Unofficial Problem Bank List, which leaves it standing at 886 institutions with assets of $330.5 billion. A year ago, the list held 984 institutions with assets of $402.4 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

The failed Truman Bank, St. Louis, MO ($282 million) and Alliant Bank, Sedgwick, KS, which merged out of existence on an unassisted basis. Added this week was The State Bank of Geneva, Geneva, IL ($84 million). Next week, we anticipate the OCC will release its actions through mid-August 2012.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Sept 14th

• Schedule for Week of Sept 16th

Schedule for Week of Sept 16th

by Calculated Risk on 9/15/2012 01:10:00 PM

Earlier:

• Summary for Week Ending Sept 14th

There are three key housing reports to be released this week: September homebuilder confidence on Tuesday, and August housing starts and August Existing Home sales, both on Wednesday.

For manufacturing, the September NY Fed (Empire state) and Philly Fed surveys will be released this week.

Also, for data nerds, the Fed's Q2 Flow of Funds report, and the Census Bureau's 2011 American Community Survey will be released.

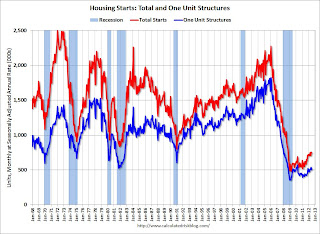

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. Total housing starts were at 746,000 (SAAR) in July, down 1.1% from the revised June rate of 754,000 (SAAR).

The consensus is for total housing starts to increase to 768,000 (SAAR) in August, up from 746,000 in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for sales of 4.55 million on seasonally adjusted annual rate (SAAR) basis. Sales in July 2012 were 4.47 million SAAR.

A key will be inventory and months-of-supply.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for September. The consensus is for a reading of 51.5, down from 51.9 in August.

10:00 AM: Philly Fed Survey for September. The consensus is for a reading of minus 4.0, up from minus 7.1 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for September. The consensus is no change in this index.

12:00 PM: Q2 Flow of Funds Accounts from the Federal Reserve.

Note: On Thursday, the Census Bureau will release the 2011 American Community Survey estimates.

Summary for Week Ending Sept 14th

by Calculated Risk on 9/15/2012 08:07:00 AM

The key event of the week was the FOMC announcement. Here were my posts:

• FOMC Statement: QE3 $40 Billion per Month, Extend Guidance to mid-2015

• FOMC Projections and Bernanke Press Conference

• Analysis: Bernanke Delivered

In other news, retail sales were strong due to higher gasoline prices. From Merrill Lynch:

Gasoline prices surged in the month, forcing consumers to spend more at the pump. Gasoline station sales climbed 5.5%, contributing to the majority of the gain in total sales. Netting out gasoline station sales, spending was only up 0.3%. ...Some of the other data was impacted by hurricane Isaac: Industrial production declined although this was partially due to the impact of Hurricane Isaac and weekly unemployment claims increased - also partially blamed on the hurricane.

Outside of gasoline, autos and building materials, core control sales fell 0.1%. This was a decidedly weak report, showing a pullback in consumer spending. ...

The combination of weak August core retail sales and a downward revision to July and June (0.1pp in each month), slices 0.4pp from our Q3 GDP tracking model. We are now looking for GDP growth of only 1.1% in Q3.

In a little good news, consumer sentiment increased some in September.

Overall this suggests more sluggish growth.

Here is a summary of last week in graphs:

• Retail Sales increased 0.9% in August

Click on graph for larger image.

Click on graph for larger image.On a monthly basis, retail sales were up 0.9% from July to August (seasonally adjusted), and sales were up 4.7% from August 2011. This increase was largely due to higher gasoline prices.

Sales for July were revised down to a 0.6% increase (from 0.8% increase).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.7% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted)

This was above the consensus forecast for retail sales of a 0.8% increase in August, and above (edit) the consensus for a 0.7% increase ex-auto.

• Trade Deficit at $42.0 Billion in July

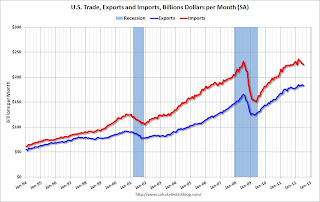

The Department of Commerce reported: "[T]otal July exports of $183.3 billion and imports of $225.3 billion resulted in a goods and services deficit of $42.0 billion, up from $41.9 billion in June, revised. July exports were $1.9 billion less than June exports of $185.2 billion. July imports were $1.8 billion less than June imports of $227.1 billion."

The Department of Commerce reported: "[T]otal July exports of $183.3 billion and imports of $225.3 billion resulted in a goods and services deficit of $42.0 billion, up from $41.9 billion in June, revised. July exports were $1.9 billion less than June exports of $185.2 billion. July imports were $1.8 billion less than June imports of $227.1 billion."The trade deficit was below the consensus forecast of $44.3 billion.

This graph shows the monthly U.S. exports and imports in dollars through July 2012.

Exports are 10% above the pre-recession peak and up 3% compared to July 2011; imports are just below the pre-recession peak, and up about 1% compared to July 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

• Industrial Production declined 1.2% in August, Capacity Utilization decreased

This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 78.2% is still 2.1 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.Industrial production decreased in August to 96.8. This is 16% above the recession low, but still 3.9% below the pre-recession peak.

The consensus was for Industrial Production to decrease 0.1% in August, and for Capacity Utilization to decline to 79.2%. Both IP and Capacity Utilization were below expectations.

• Consumer Sentiment increases in September to 79.2

The preliminary Reuters / University of Michigan consumer sentiment index for September increased to 79.2, up from the August reading of 74.3.

The preliminary Reuters / University of Michigan consumer sentiment index for September increased to 79.2, up from the August reading of 74.3.This was above the consensus forecast of 73.5 but still fairly low. Sentiment remains weak due to the high unemployment rate, sluggish economy and higher gasoline prices.

• Weekly Initial Unemployment Claims increase to 382,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.This was above the consensus forecast of 370,000.

Via MarketWatch: "The government said about 9,000 claims stemmed from the storm that passed through the Gulf Coast in late August."

The 4-week average of unemployment claims has mostly moved sideways this year.

• BLS: Job Openings "little changed" in July

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Jobs openings decreased in July to 3.664 million, down from 3.722 million in June. The number of job openings (yellow) has generally been trending up, and openings are up about 9% year-over-year compared to July 2011.

Quits increased slightly in July, and quits are up about 8% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• Other Economic Stories ...

• Key Measures show slowing inflation in August

• Lawler: Where has the increase in the number of renters of Single Family homes come from?

• CoreLogic: Negative Equity Decreases in Q2 2012

• Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in August

Friday, September 14, 2012

Fiscal Cliff: Goldman note and Merle Hazard

by Calculated Risk on 9/14/2012 08:52:00 PM

An excerpt from a Goldman Sachs research note by Alec Phillips today: The Fiscal Cliff Moves to Center Stage

While we are hopeful that lawmakers will manage to reach an agreement before year-end, we expect that the road to such an agreement will be a bumpy one.I've just been ignoring the "fiscal cliff" until after the election. I suspect some sort of deal will be reached - but you never know.

Ahead of the election, lawmakers seem unlikely to reach any sort of compromise on major tax or spending policies, particularly now that the window for a legislative agreement is essentially closed. Once the election results are known, lawmakers will work toward compromise, but members of both parties have an incentive to make the threat of “falling off the cliff” appear as credible as possible, so a resolution in November, or even early December, seems unlikely. Indeed, under a status quo election outcome, for example, a decision on even a short-term extension of expiring policies seems unlikely until late December, since political compromise would presumably come only after all other options have been exhausted.

... we think there is at least a one in three likelihood that lawmakers fail to agree by December 31. ... if a deal is reached by the end of the year it may not provide much certainty in 2013. After all, the debt limit may still need to be raised, and the since the most likely scenario seems to be a short-term extension of fiscal cliff-related policies, the risks from fiscal policy seem likely to continue into 2013, regardless of how the fiscal cliff is dealt with at year end.

Meanwhile, here is an animated version of Merle Hazard's "Fiscal Cliff"