by Calculated Risk on 9/15/2012 08:07:00 AM

Saturday, September 15, 2012

Summary for Week Ending Sept 14th

The key event of the week was the FOMC announcement. Here were my posts:

• FOMC Statement: QE3 $40 Billion per Month, Extend Guidance to mid-2015

• FOMC Projections and Bernanke Press Conference

• Analysis: Bernanke Delivered

In other news, retail sales were strong due to higher gasoline prices. From Merrill Lynch:

Gasoline prices surged in the month, forcing consumers to spend more at the pump. Gasoline station sales climbed 5.5%, contributing to the majority of the gain in total sales. Netting out gasoline station sales, spending was only up 0.3%. ...Some of the other data was impacted by hurricane Isaac: Industrial production declined although this was partially due to the impact of Hurricane Isaac and weekly unemployment claims increased - also partially blamed on the hurricane.

Outside of gasoline, autos and building materials, core control sales fell 0.1%. This was a decidedly weak report, showing a pullback in consumer spending. ...

The combination of weak August core retail sales and a downward revision to July and June (0.1pp in each month), slices 0.4pp from our Q3 GDP tracking model. We are now looking for GDP growth of only 1.1% in Q3.

In a little good news, consumer sentiment increased some in September.

Overall this suggests more sluggish growth.

Here is a summary of last week in graphs:

• Retail Sales increased 0.9% in August

Click on graph for larger image.

Click on graph for larger image.On a monthly basis, retail sales were up 0.9% from July to August (seasonally adjusted), and sales were up 4.7% from August 2011. This increase was largely due to higher gasoline prices.

Sales for July were revised down to a 0.6% increase (from 0.8% increase).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.7% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted)

This was above the consensus forecast for retail sales of a 0.8% increase in August, and above (edit) the consensus for a 0.7% increase ex-auto.

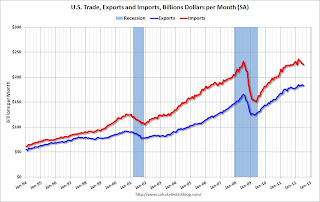

• Trade Deficit at $42.0 Billion in July

The Department of Commerce reported: "[T]otal July exports of $183.3 billion and imports of $225.3 billion resulted in a goods and services deficit of $42.0 billion, up from $41.9 billion in June, revised. July exports were $1.9 billion less than June exports of $185.2 billion. July imports were $1.8 billion less than June imports of $227.1 billion."

The Department of Commerce reported: "[T]otal July exports of $183.3 billion and imports of $225.3 billion resulted in a goods and services deficit of $42.0 billion, up from $41.9 billion in June, revised. July exports were $1.9 billion less than June exports of $185.2 billion. July imports were $1.8 billion less than June imports of $227.1 billion."The trade deficit was below the consensus forecast of $44.3 billion.

This graph shows the monthly U.S. exports and imports in dollars through July 2012.

Exports are 10% above the pre-recession peak and up 3% compared to July 2011; imports are just below the pre-recession peak, and up about 1% compared to July 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

• Industrial Production declined 1.2% in August, Capacity Utilization decreased

This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 78.2% is still 2.1 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.Industrial production decreased in August to 96.8. This is 16% above the recession low, but still 3.9% below the pre-recession peak.

The consensus was for Industrial Production to decrease 0.1% in August, and for Capacity Utilization to decline to 79.2%. Both IP and Capacity Utilization were below expectations.

• Consumer Sentiment increases in September to 79.2

The preliminary Reuters / University of Michigan consumer sentiment index for September increased to 79.2, up from the August reading of 74.3.

The preliminary Reuters / University of Michigan consumer sentiment index for September increased to 79.2, up from the August reading of 74.3.This was above the consensus forecast of 73.5 but still fairly low. Sentiment remains weak due to the high unemployment rate, sluggish economy and higher gasoline prices.

• Weekly Initial Unemployment Claims increase to 382,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 375,000.This was above the consensus forecast of 370,000.

Via MarketWatch: "The government said about 9,000 claims stemmed from the storm that passed through the Gulf Coast in late August."

The 4-week average of unemployment claims has mostly moved sideways this year.

• BLS: Job Openings "little changed" in July

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Jobs openings decreased in July to 3.664 million, down from 3.722 million in June. The number of job openings (yellow) has generally been trending up, and openings are up about 9% year-over-year compared to July 2011.

Quits increased slightly in July, and quits are up about 8% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

• Other Economic Stories ...

• Key Measures show slowing inflation in August

• Lawler: Where has the increase in the number of renters of Single Family homes come from?

• CoreLogic: Negative Equity Decreases in Q2 2012

• Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in August

Friday, September 14, 2012

Fiscal Cliff: Goldman note and Merle Hazard

by Calculated Risk on 9/14/2012 08:52:00 PM

An excerpt from a Goldman Sachs research note by Alec Phillips today: The Fiscal Cliff Moves to Center Stage

While we are hopeful that lawmakers will manage to reach an agreement before year-end, we expect that the road to such an agreement will be a bumpy one.I've just been ignoring the "fiscal cliff" until after the election. I suspect some sort of deal will be reached - but you never know.

Ahead of the election, lawmakers seem unlikely to reach any sort of compromise on major tax or spending policies, particularly now that the window for a legislative agreement is essentially closed. Once the election results are known, lawmakers will work toward compromise, but members of both parties have an incentive to make the threat of “falling off the cliff” appear as credible as possible, so a resolution in November, or even early December, seems unlikely. Indeed, under a status quo election outcome, for example, a decision on even a short-term extension of expiring policies seems unlikely until late December, since political compromise would presumably come only after all other options have been exhausted.

... we think there is at least a one in three likelihood that lawmakers fail to agree by December 31. ... if a deal is reached by the end of the year it may not provide much certainty in 2013. After all, the debt limit may still need to be raised, and the since the most likely scenario seems to be a short-term extension of fiscal cliff-related policies, the risks from fiscal policy seem likely to continue into 2013, regardless of how the fiscal cliff is dealt with at year end.

Meanwhile, here is an animated version of Merle Hazard's "Fiscal Cliff"

Bank Failure #42 in 2012: Truman Bank, Saint Louis, Missouri

by Calculated Risk on 9/14/2012 06:13:00 PM

Presidential paraphrase

“The buck won’t stop here”.

by Soylent Green is People

From the FDIC: Simmons First National Bank, Pine Bluff, Arkansas, Assumes All of the Deposits of Truman Bank, Saint Louis, Missouri

As of June 30, 2012, Truman Bank had approximately $282.3 million in total assets and $245.7 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $34.0 million. ... Truman Bank is the 42nd FDIC-insured institution to fail in the nation this year, and the second in Missouri.Friday is here!

August Update: Early Look at 2013 Cost-Of-Living Adjustments indicates 1.4% increase

by Calculated Risk on 9/14/2012 02:50:00 PM

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.7 percent over the last 12 months to an index level of 227.056 (1982-84=100). For the month, the index increased 0.7 percent prior to seasonal adjustment."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W1 for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

SPECIAL NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could happen next year and impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained

Since the highest Q3 average was last year (2011), at 223.233, we only have to compare to last year. Note: The last few years we needed to compare to Q3 2008 since that was the previous highest Q3 average.

Click on graph for larger image.

Click on graph for larger image.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Currently CPI-W is above the Q3 2011 average. If the current level holds, COLA would be around 1.4% for next year (the current 226.312 average divided by the Q3 2011 level of 223.233). With the recent increases in oil and gasoline prices, CPI COLA might be closer to 1.6% once the September data is released.

This is early - we need the data for September - but COLA will be slightly positive next year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.This is based on a one year lag. The National Average Wage Index is not available for 2011 yet, but wages probably didn't increase much from 2010. If wages increased the same as last year, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $112,500 from the current $110,100.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

(1) CPI-W usually tracks CPI-U (headline number) pretty well. From the BLS:

The Bureau of Labor Statistics publishes CPIs for two population groups: (1)the CPI for Urban Wage Earners and Clerical Workers (CPI-W), which covers households of wage earners and clerical workers that comprise approximately 32 percent of the total population and (2) the CPI for All Urban Consumers (CPI-U) ... which cover approximately 87 percent of the total population and include in addition to wage earners and clerical worker households, groups such as professional, managerial, and technical workers, the self- employed, short-term workers, the unemployed, and retirees and others not in the labor force.

Key Measures show slowing inflation in August

by Calculated Risk on 9/14/2012 01:03:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.8% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.0% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for August here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.6% (7.5% annualized rate) in August. The CPI less food and energy increased 0.1% (0.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.9%, and core CPI rose 1.9%. Core PCE is for July and increased 1.6% year-over-year.

On a monthly basis (annualized), two of these measure were at or below the Fed's target; trimmed-mean CPI was at 2.0%, Core CPI at 0.6% - although median CPI was at 2.8%. Core PCE for July was at 0.3%. These measures suggest inflation is now mostly below the Fed's target of 2% on a year-over-year basis and it appears the inflation rate is slowing.