by Calculated Risk on 9/09/2012 01:41:00 PM

Sunday, September 09, 2012

Employment Report Graphs: Participation Rate, Duration of Unemployment and Diffusion Indexes

Below are three more graphs based on the August employment report.

For more employment graphs and analysis, see:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

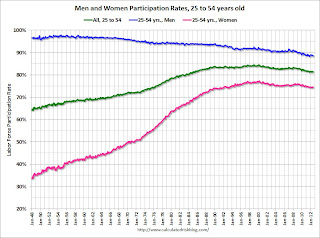

The following graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The participation rate for women increased significantly from the mid 30s to the mid 70s. This rate was at 75.5% prior to the recession, and declined to a post-recession low of 74.3%. There has been almost no recovery in the participation rate for prime working age women. This rate has mostly flattened out this year, and was still near the low in August at 74.5%.

The participation rate for men has decreased from the high 90s a few decades ago, to a low of 88.3% after the recession. This rate hasn't increased very much, and was at 88.5% in August.

There might be some "bounce back" for both men and women (some of the recent decline is probably cyclical), but the long term trend for men is down.

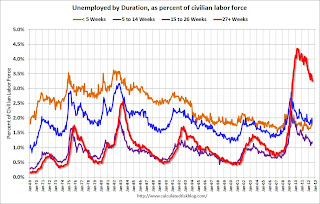

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 weeks, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 weeks, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.All categories are generally moving down, but there was an increase in the 'less than 5 weeks' and '15 to 26 weeks' categories in August.

Unfortunately the long term unemployed remains very high at 3.3% of the labor force in August, but this is the lowest percentage since 2009.

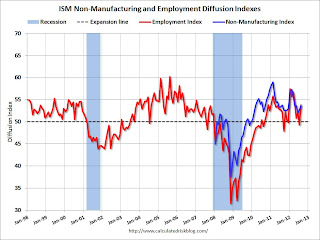

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS:

Diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. If there are employment gains, the more widespread, the better - even if job growth is slow. From the BLS: Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The BLS diffusion index for total private employment was at 50.2 in August, down from 54.3 in July. For manufacturing, the diffusion index declined to 36.4 from 50.6 in July. This is the lowest level for manufacturing since 2009.

Not only was job growth was weak in August, but job gains were not widespread across industries (another negative).

Yesterday:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th

• Analysis: I expect QE3 on Sept 13th

LA Times: Boom Time in Bakersfield

by Calculated Risk on 9/09/2012 09:33:00 AM

Coastal California is doing better. And some inland areas are improving (I've mentioned the turnaround in Temecula before - one of the hardest hit areas during the recession). Here is another area doing better ...

From the LA Times: Many signs point to a Bakersfield boom

The state's economic recovery has largely been concentrated on the coast, leaving behind much of the hard-hit San Joaquin Valley. But Bakersfield, perhaps best known for oil, agriculture and country music, has reclaimed an old title: boomtown.High energy prices have really helped Bakersfield, but it appears the entire economy is growing.

Bakersfield has been adding population and jobs at a brisk pace and is a few thousand jobs from matching its peak employment level of five years ago. ... Employment has grown across many sectors, including manufacturing. Even construction, which suffered mightily statewide during the housing bust, has strengthened. And unlike many struggling municipalities, in Kern County officials have recommended a budget increase that would allow hiring of more than 150 people.

Yesterday:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th

• Analysis: I expect QE3 on Sept 13th

Saturday, September 08, 2012

Analysis: I expect QE3 on Sept 13th

by Calculated Risk on 9/08/2012 06:46:00 PM

Since the Jackson Hole Symposium, I've been thinking it is very likely that so-called "QE3" would be announced at the next FOMC meeting (Sept 12th and 13th). And after thinking about Columbia University professor Michael Woodford's paper presented at Jackson Hole, I think this round of asset purchases might be more effective than most people expect.

Notes: QE3 is shorthand for another Large Scale Asset Purchases (LSAP) program. "QE" is monetary policy, not fiscal policy (not spending).

Yesterday, Goldman Sach economist Sven Jari Stehn beat me to the punch. He wrote:

[W]e expect the Federal Open Market Committee (FOMC) to announce a return to asset purchases as well as a lengthening of the FOMC’s forward guidance for the first hike in the funds rate to mid-2015 or beyond at the September 12-13 FOMC meeting. Our baseline forecast is an open-ended purchase program, focused on agency mortgage-backed securities.I'd like to add a few points:

[O]ur “double punch” Fed call relates to the much-discussed study presented by Columbia University professor Michael Woodford at Jackson Hole last Friday. Woodford argues that forward guidance is a powerful tool both in theory and practice. But in his view the effect of asset purchases is largely confined to their role in conveying guidance about future monetary policy actions. ...

We fully agree with Woodford’s view that such aggressive guidance measures could be a powerful tool. However, we also believe that Fed officials are unlikely to adopt them anytime soon.

Fortunately, we are somewhat more optimistic than Woodford with regard to the impact of Fed asset purchases. ... we believe that a more moderate strengthening of the forward guidance coupled with renewed asset purchases could provide a decent amount of monetary easing next week.

• Nothing in recent data suggests a "substantial and sustainable strengthening" in economic activity. This was the key sentence from the last FOMC minutes:

"Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery"• Note that Goldman Sachs expects BOTH "a lengthening of the forward guidance to mid-2015" AND "an open-ended purchase program". Atlanta Fed President Dennis Lockhart alluded to this in his interview in the WSJ last week:

If the Fed were to act, Mr. Lockhart said half-measures would not get the job done. While he didn't state what the steps could be, he said stimulus, if chosen, should be "a package. When I say package that means two or three things done at the same time to create maximum possible gains."• As far as additional forward guidance, imagine if Fed Chairman Ben Bernanke made it very clear that the 2% inflation target is symmetrical - not a ceiling, and that the FOMC would not move quickly to slow inflation if the unemployment rate was still high.

This isn't as strong a forward guidance as nominal GDP targeting (NGDP), but it would still provide guidance that the Fed will show patience before raising rates.

In fact, back in April, Fed Chairman Ben Bernanke said:

“[The 2 percent target is] not a ceiling, it’s a symmetric objective, and we attempt to bring inflation close to 2 percent. And in particular, if inflation were to jump for whatever reason—and we don’t have, obviously don’t have perfect control of inflation—we’ll try to return inflation to 2 percent at a pace which takes into account the situation with respect to unemployment.”I expect Bernanke to reiterate this again in the press conference this week.

• And on effectiveness, one of the key transmission channels for monetary policy is through residential investment and mortgages. The previous rounds of QE (and "twist") have lowered mortgage rates and allowed homeowners with excellent credit and income to refinance. However this channel has been limited as Bernanke noted in his Jackson Hole speech:

It is likely that the crisis and the recession have attenuated some of the normal transmission channels of monetary policy relative to what is assumed in the models; for example, restrictive mortgage underwriting standards have reduced the effects of lower mortgage rates.As residential investment recovers, and house prices increase (or at least stabilize), this channel will probably become more effective.

Last month I summarized some of The economic impact of a slight increase in house prices. This includes mortgage lenders and appraisers becoming more confident in the mortgage and housing markets. I think that is starting to happen, and I think QE might have more traction now through the housing channel.

Conclusion: I expect both QE, and an extended forward guidance, to be announced this week at the FOMC meeting.

Earlier:

• Summary for Week Ending Sept 7th

• Schedule for Week of Sept 9th

Schedule for Week of Sept 9th

by Calculated Risk on 9/08/2012 01:07:00 PM

Earlier:

• Summary for Week Ending Sept 7th

The key event this week is the two day FOMC meeting on Wednesday and Thursday. There is a very strong possibility that the Fed will provide additional accommodation.

The key reports for this week will be the July trade balance report on Tuesday, the August retail sales report on Friday, Industrial Production on Friday, and August CPI also on Friday.

In Europe, Germany's Constitutional Court is expected to rule if the European Stability Mechanism (ESM, the proposed permanent replacement for the EFSF or European Financial Stability Facility) is constitutional on Wednesday at 6 AM ET.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph is through June. Exports increased in June and imports decreased. Some of the decline in June was due to falling oil prices. According to the EIA, Brent futures average $110.34 in May, but declined to $95.16 in June, before increasing to $102.62 in July. There is a lag between future prices and import prices, but this suggests the dollar value of oil imports (per barrel) probably increased a little in July.

The consensus is for the U.S. trade deficit to increase to $44.3 billion in July, up from from $42.9 billion in June. Export activity to Europe will be closely watched due to economic weakness.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in June to 3.762 million, up from 3.657 million in May. The number of job openings (yellow) has generally been trending up, and openings are up about 16% year-over-year compared to June 2011. This was the most job openings since mid-2008.

8:30 AM: Import and Export Prices for August. The consensus is a for a 1.5% increase in import prices

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.4% increase in inventories.

8:30 AM: Producer Price Index for August. The consensus is for a 1.4% increase in producer prices (0.2% increase in core).

12:30 PM: FOMC Meeting Announcement. Additional policy accommodation is very likely. The FOMC might lengthen their forward guidance for the first rate hike to mid-2015 or later, and / or also launch an open ended Large Scale Asset Purchases(LSAP) program (commonly called QE3).

2:00 PM: FOMC Forecasts The will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM ET: Retail Sales for August.

8:30 AM ET: Retail Sales for August. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 21.9% from the bottom, and now 6.6% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.8% in August, and for retail sales ex-autos to increase 0.7%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This shows industrial production since 1967.

The consensus is for Industrial Production a 0.1% decline in August, and for Capacity Utilization to decline to 79.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for sentiment to decrease to 74.0 from 73.5 in August.

10:00 AM: Manufacturing and Trade: Inventories and Sales for July (Business inventories). The consensus is for 0.5% increase in inventories.

Summary for Week Ending Sept 7th

by Calculated Risk on 9/08/2012 08:07:00 AM

The key event of the week was in Europe when ECB President Mario Draghi announced the Outright Monetary Transactions (OMT). It is hard to tell how effective these measures will be, although analysts at Nomura think the OMT bought policymakers three months at best: "This latest round of policy announcements could buy up to three months should countries call for help relatively quickly and conditions attached to the bail outs are light."

In the US, it was a busy week. The employment report was weak again with only 96,000 payroll jobs added in August, and the ISM manufacturing index suggested contraction in manufacturing for the fourth consecutive month.

Other data was a little better - vehicle sales in August were at 14.5 million SAAR, the ISM services index was above expectation, and initial weekly unemployment claims declined more than expected.

But the key report was employment, and payroll job growth remains sluggish.

Here is a summary of last week in graphs:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

There were 96,000 payroll jobs added in August, with 103,000 private sector jobs added, and 7,000 government jobs lost. The unemployment rate decreased to 8.1% (from the household survey), and the participation rate declined to 63.5%. The decline in the unemployment rate was mostly due to the lower participation rate.

There were 96,000 payroll jobs added in August, with 103,000 private sector jobs added, and 7,000 government jobs lost. The unemployment rate decreased to 8.1% (from the household survey), and the participation rate declined to 63.5%. The decline in the unemployment rate was mostly due to the lower participation rate.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.7%.

The change in payroll employment for July was revised down from +163,000 to +141,000, and June was revised down from +64,000 to +45,000, for a total revision of minus 41,000 over those two months.

This was below expectations of 125,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 8.1% (red line).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 8.1% (red line).

The Labor Force Participation Rate declined to 63.5% in August (blue line)- another new cycle low. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio declined to 58.3% in August (black line). This is a new low for the year, and just above the cycle low.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The economy has added 1.11 million jobs over the first eight months of the year (1.21 million private sector jobs). At this pace, the economy would add around 1.8 million private sector jobs in 2012; less than the 2.1 million added in 2011. Also, at this pace of payroll job growth, the unemployment rate will probably still be above 8% at the end of the year.

This was another weak employment report, especially with the downward revisions and slight decline in hourly earnings.

• ISM Manufacturing index decreases slightly in August to 49.6

This is the third consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.6% in August, down slightly from 49.8% in July. The employment index was at 51.6%, down from 52.0%, and the new orders index was at 47.1%, down from 48.0%.

This is the third consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.6% in August, down slightly from 49.8% in July. The employment index was at 51.6%, down from 52.0%, and the new orders index was at 47.1%, down from 48.0%.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.0%. This suggests manufacturing contracted in August for the third consecutive month.

• ISM Non-Manufacturing Index increases in August

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction.

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.0% and indicates faster expansion in August than in July. The internals were mixed with the employment index up sharply, but new order down slightly.

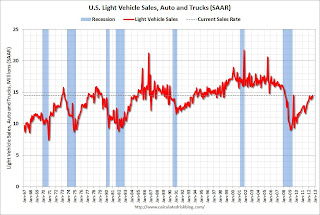

• U.S. Light Vehicle Sales at 14.5 million annual rate in August

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.52 million SAAR in August. That is up 17% from August 2011, and up 3% from the sales rate last month.

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.52 million SAAR in August. That is up 17% from August 2011, and up 3% from the sales rate last month.The year-over-year increase was fairly large because the auto industry was still recovering from the impact of the tsunami and related supply chain issues in 2011 (the issues were mostly over in September of 2011).

Sales have averaged a 14.17 million annual sales rate through the first seven months of 2012, up from 12.4 million rate for the same period of 2011.

This was above the consensus forecast of 14.3 million SAAR (seasonally adjusted annual rate).

It looks like auto sales will be up slightly in Q3 compared to Q2, and make another small positive contribution to GDP.

• Construction Spending decreased in July

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 61% below the peak in early 2006, and up 19% from the recent low. Non-residential spending is 29% below the peak in January 2008, and up about 30% from the recent low.

Public construction spending is now 15% below the peak in March 2009 and near the post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 19%. Non-residential spending is also up year-over-year mostly due to energy spending (power and electric). Public spending is still down year-over-year, although it now appears public construction spending is moving sideways.

The slight decline in residential construction spending in July followed several months of solid gains. The solid year-over-year increase in private residential investment is a positive for the economy (the increase in 2010 was related to the tax credit).

• Weekly Initial Unemployment Claims decline to 365,000

The DOL reports:

The DOL reports:In the week ending September 1, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 12,000 from the previous week's revised figure of 377,000. The 4-week moving average was 371,250, an increase of 250 from the previous week's revised average of 371,000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 371,250.

This was below the consensus forecast of 370,000.

• ADP: Private Employment increased 201,000 in August

• AAR: Rail Traffic "mixed" in August, Building related commodities were up

• Trulia: Asking House Prices increased in August, Rent increases slow

• Housing: Inventory down 23% year-over-year in early September