by Calculated Risk on 9/08/2012 01:07:00 PM

Saturday, September 08, 2012

Schedule for Week of Sept 9th

Earlier:

• Summary for Week Ending Sept 7th

The key event this week is the two day FOMC meeting on Wednesday and Thursday. There is a very strong possibility that the Fed will provide additional accommodation.

The key reports for this week will be the July trade balance report on Tuesday, the August retail sales report on Friday, Industrial Production on Friday, and August CPI also on Friday.

In Europe, Germany's Constitutional Court is expected to rule if the European Stability Mechanism (ESM, the proposed permanent replacement for the EFSF or European Financial Stability Facility) is constitutional on Wednesday at 6 AM ET.

8:30 AM: Trade Balance report for July from the Census Bureau.

8:30 AM: Trade Balance report for July from the Census Bureau. This graph is through June. Exports increased in June and imports decreased. Some of the decline in June was due to falling oil prices. According to the EIA, Brent futures average $110.34 in May, but declined to $95.16 in June, before increasing to $102.62 in July. There is a lag between future prices and import prices, but this suggests the dollar value of oil imports (per barrel) probably increased a little in July.

The consensus is for the U.S. trade deficit to increase to $44.3 billion in July, up from from $42.9 billion in June. Export activity to Europe will be closely watched due to economic weakness.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in June to 3.762 million, up from 3.657 million in May. The number of job openings (yellow) has generally been trending up, and openings are up about 16% year-over-year compared to June 2011. This was the most job openings since mid-2008.

8:30 AM: Import and Export Prices for August. The consensus is a for a 1.5% increase in import prices

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.4% increase in inventories.

8:30 AM: Producer Price Index for August. The consensus is for a 1.4% increase in producer prices (0.2% increase in core).

12:30 PM: FOMC Meeting Announcement. Additional policy accommodation is very likely. The FOMC might lengthen their forward guidance for the first rate hike to mid-2015 or later, and / or also launch an open ended Large Scale Asset Purchases(LSAP) program (commonly called QE3).

2:00 PM: FOMC Forecasts The will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:15 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM ET: Retail Sales for August.

8:30 AM ET: Retail Sales for August. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 21.9% from the bottom, and now 6.6% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.8% in August, and for retail sales ex-autos to increase 0.7%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This shows industrial production since 1967.

The consensus is for Industrial Production a 0.1% decline in August, and for Capacity Utilization to decline to 79.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for sentiment to decrease to 74.0 from 73.5 in August.

10:00 AM: Manufacturing and Trade: Inventories and Sales for July (Business inventories). The consensus is for 0.5% increase in inventories.

Summary for Week Ending Sept 7th

by Calculated Risk on 9/08/2012 08:07:00 AM

The key event of the week was in Europe when ECB President Mario Draghi announced the Outright Monetary Transactions (OMT). It is hard to tell how effective these measures will be, although analysts at Nomura think the OMT bought policymakers three months at best: "This latest round of policy announcements could buy up to three months should countries call for help relatively quickly and conditions attached to the bail outs are light."

In the US, it was a busy week. The employment report was weak again with only 96,000 payroll jobs added in August, and the ISM manufacturing index suggested contraction in manufacturing for the fourth consecutive month.

Other data was a little better - vehicle sales in August were at 14.5 million SAAR, the ISM services index was above expectation, and initial weekly unemployment claims declined more than expected.

But the key report was employment, and payroll job growth remains sluggish.

Here is a summary of last week in graphs:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

There were 96,000 payroll jobs added in August, with 103,000 private sector jobs added, and 7,000 government jobs lost. The unemployment rate decreased to 8.1% (from the household survey), and the participation rate declined to 63.5%. The decline in the unemployment rate was mostly due to the lower participation rate.

There were 96,000 payroll jobs added in August, with 103,000 private sector jobs added, and 7,000 government jobs lost. The unemployment rate decreased to 8.1% (from the household survey), and the participation rate declined to 63.5%. The decline in the unemployment rate was mostly due to the lower participation rate.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.7%.

The change in payroll employment for July was revised down from +163,000 to +141,000, and June was revised down from +64,000 to +45,000, for a total revision of minus 41,000 over those two months.

This was below expectations of 125,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 8.1% (red line).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 8.1% (red line).

The Labor Force Participation Rate declined to 63.5% in August (blue line)- another new cycle low. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio declined to 58.3% in August (black line). This is a new low for the year, and just above the cycle low.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The economy has added 1.11 million jobs over the first eight months of the year (1.21 million private sector jobs). At this pace, the economy would add around 1.8 million private sector jobs in 2012; less than the 2.1 million added in 2011. Also, at this pace of payroll job growth, the unemployment rate will probably still be above 8% at the end of the year.

This was another weak employment report, especially with the downward revisions and slight decline in hourly earnings.

• ISM Manufacturing index decreases slightly in August to 49.6

This is the third consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.6% in August, down slightly from 49.8% in July. The employment index was at 51.6%, down from 52.0%, and the new orders index was at 47.1%, down from 48.0%.

This is the third consecutive month of contraction (below 50) in the ISM index since the recession ended in 2009. PMI was at 49.6% in August, down slightly from 49.8% in July. The employment index was at 51.6%, down from 52.0%, and the new orders index was at 47.1%, down from 48.0%.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.0%. This suggests manufacturing contracted in August for the third consecutive month.

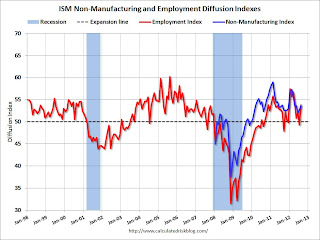

• ISM Non-Manufacturing Index increases in August

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction.

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.0% and indicates faster expansion in August than in July. The internals were mixed with the employment index up sharply, but new order down slightly.

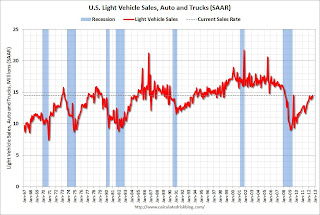

• U.S. Light Vehicle Sales at 14.5 million annual rate in August

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.52 million SAAR in August. That is up 17% from August 2011, and up 3% from the sales rate last month.

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.52 million SAAR in August. That is up 17% from August 2011, and up 3% from the sales rate last month.The year-over-year increase was fairly large because the auto industry was still recovering from the impact of the tsunami and related supply chain issues in 2011 (the issues were mostly over in September of 2011).

Sales have averaged a 14.17 million annual sales rate through the first seven months of 2012, up from 12.4 million rate for the same period of 2011.

This was above the consensus forecast of 14.3 million SAAR (seasonally adjusted annual rate).

It looks like auto sales will be up slightly in Q3 compared to Q2, and make another small positive contribution to GDP.

• Construction Spending decreased in July

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 61% below the peak in early 2006, and up 19% from the recent low. Non-residential spending is 29% below the peak in January 2008, and up about 30% from the recent low.

Public construction spending is now 15% below the peak in March 2009 and near the post-bubble low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 19%. Non-residential spending is also up year-over-year mostly due to energy spending (power and electric). Public spending is still down year-over-year, although it now appears public construction spending is moving sideways.

The slight decline in residential construction spending in July followed several months of solid gains. The solid year-over-year increase in private residential investment is a positive for the economy (the increase in 2010 was related to the tax credit).

• Weekly Initial Unemployment Claims decline to 365,000

The DOL reports:

The DOL reports:In the week ending September 1, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 12,000 from the previous week's revised figure of 377,000. The 4-week moving average was 371,250, an increase of 250 from the previous week's revised average of 371,000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 371,250.

This was below the consensus forecast of 370,000.

• ADP: Private Employment increased 201,000 in August

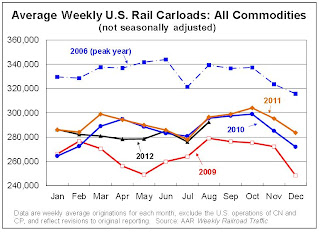

• AAR: Rail Traffic "mixed" in August, Building related commodities were up

• Trulia: Asking House Prices increased in August, Rent increases slow

• Housing: Inventory down 23% year-over-year in early September

Friday, September 07, 2012

Bank Failure #41 in 2012: First Commercial Bank, Bloomington, Minnesota

by Calculated Risk on 9/07/2012 08:03:00 PM

Autumn leaves yellow and fall

As do Mid-West Banks

by Soylent Green is People

From the FDIC: Republic Bank & Trust Company, Louisville, Kentucky, Assumes All of the Deposits of First Commercial Bank, Bloomington, Minnesota

As of June 30, 2012, First Commercial Bank had approximately $215.9 million in total assets and $206.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $63.9 million. ... First Commercial Bank is the 41st FDIC-insured institution to fail in the nation this year, and the fourth in Minnesota.It is Friday!

Earlier on employment:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

AAR: Rail Traffic "mixed" in August, Building related commodities were up

by Calculated Risk on 9/07/2012 05:32:00 PM

Once again rail traffic was "mixed". However building related commodities were up such as lumber and crushed stone, gravel, sand. Lumber was up 21% from August 2011.

From the Association of American Railroads (AAR): AAR Reports Mixed Weekly Rail Traffic for August

The Association of American Railroads (AAR) today reported U.S. rail carloads originated in August 2012 totaled 1,461,680, down 1.4 percent compared with August 2011. Intermodal traffic in August 2012 totaled 1,230,992 containers and trailers, up 51,145 units or 4.3 percent compared with August 2011. The August 2012 average weekly intermodal volume of 246,198 units is the second highest average for any August on record.

...

“U.S rail traffic in August was pretty much same song, different verse,” said AAR Senior Vice President John T. Gray. “Weakness in coal carloadings was largely but not entirely offset by increases in carloads of petroleum and petroleum products, autos, lumber, and several other commodities, with intermodal showing continued strength.”

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

On a non-seasonally adjusted basis, U.S. rail carload traffic fell 1.4% (21,050 carloads) in August 2012 from August 2011. Carloads totaled 1,461,680 for the month, an average of 292,336 per week, which is the highest weekly average since November 2011. It was the seventh straight year-over-year monthly decline.The second graph is for intermodal traffic (using intermodal or shipping containers):

Commodities with carload gains on U.S. railroads in August 2012 included petroleum and petroleum products (up 18,007 carloads, or 49.0%); motor vehicle and parts (up 8,966 carloads, or 13.0%); and crushed stone, sand, and gravel (up 6,905 carloads, or 7.3%). Carloads of lumber and wood products were up 21.3% (2,877 carloads) in August 2012; carloads of grain were up 1.7%.

Coal continues to suffer, with U.S. carloadings down 7.3% (48,493 carloads) in August 2012 from August 2011

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is now near peak levels.

U.S. intermodal traffic rose 4.3% (51,145 containers and trailers) in August 2012 over August 2011 on a non-seasonally adjusted basis, totaling 1,230,992 units for the month. The weekly average in August 2012 was 246,198, the second highest for an August in history.The top months for intermodal are usually in the fall, and it looks like intermodal traffic will be at or near record levels this year.

This is more evidence of sluggish growth - and of residential investment making a positive contribution.

Earlier on employment:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

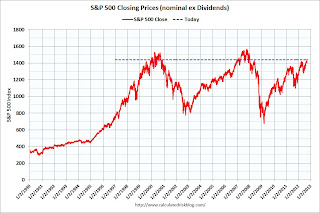

Market Update

by Calculated Risk on 9/07/2012 04:05:00 PM

Click on graph for larger image.

I haven't posted these graphs in a couple of months. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in December 1999; almost 13 years ago.

The second graph (click on graph for larger image) is from Doug Short shows the S&P 500 since the 2007 high ...

Earlier:

• August Employment Report: 96,000 Jobs, 8.1% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs