by Calculated Risk on 7/16/2012 04:32:00 PM

Monday, July 16, 2012

Report: HARP Refis increase signficantly

From Alan Zibel at the WSJ: ‘Underwater’ Refis Grow; Critics Not Satisfied

The number of homeowners refinancing their mortgages under a revamped federal program grew in May, but critics are still pressing a federal regulator to do more.This is a significant increase in refinance activity, but still somewhat below expectations. However the automated system wasn't released until the end of March - and there were some issues with that system - so maybe there more HARP refinances over the rest of 2012.

For the first five months of 2012, more than 78,000 homeowners who owe more than 105% of their property’s value have refinanced using the government’s Home Affordable Refinance Program, or HARP. That was up from about 60,000 in all of 2011, the Federal Housing Finance Agency said in a report Monday.

This table shows the number of HARP refinances by LTV through May of this year compared to all of 2011. Clearly there has been an increase in activity.

| HARP Activity | |||

|---|---|---|---|

| 2012, Through May | All of 2011 | Since Inception | |

| Total HARP | 297,103 | 400,024 | 1,318,954 |

| LTV >80% -105% | 218,830 | 340,033 | 1,150,065 |

| LTV >105% -125% | 67,155 | 59,991 | 157,771 |

| LTV >125% | 11,118 | 0 | 11,118 |

Downward Revisions: Q2 GDP Tracking around 1.1%

by Calculated Risk on 7/16/2012 01:35:00 PM

From Merrill Lynch:

Today’s weak retail sales report leaves Q2 GDP tracking a meager 1.1%. We expect the economy to remain weak through the rest of the year with growth of only 1.3% in Q3 and 1.0% in Q4. This translates to GDP growth of only 1.3% Q4/Q4, significantly below the Fed’s forecast of 1.9-2.4%.Via Ezra Klein:

Macro advisers: Q2 GDP tracking 1%Nouriel Roubini:

US Q2 GDP growth looks like 1.2% at best ... Q3 growth could be well below 1% given June sales report and unintended inventory build up. US at stall speedGoldman has lowered their forecast to 1.1% for Q2.

Earlier: Empire State Survey shows modest expansion in July

by Calculated Risk on 7/16/2012 11:27:00 AM

This was released earlier ... from the NY Fed: Empire State Manufacturing Survey

The general business conditions index rose five points to 7.4. New orders, however, declined, as that index slipped into negative territory for the first time since November 2011, falling five points to -2.7.This was the first regional manufacturing surveys released for July. The general business conditions index was slightly better than expected although new orders were down. The employment index was the highest since March.

...

Employment levels climbed higher, with the employment index rising six points to 18.5, while the average workweek index fell three points to zero.

...

Indexes for the six-month outlook generally remained favorable, but held at levels below those seen earlier this year. The future general business conditions index fell three points to 20.2, with 37 percent of respondents expecting improved conditions in the months ahead and 17 percent anticipating a worsening.

The Philly Fed index was especially weak in June, and the July index will be released on Thursday.

Retail Sales decline 0.5% in June

by Calculated Risk on 7/16/2012 08:30:00 AM

On a monthly basis, retail sales were down 0.5% from May to June (seasonally adjusted), and sales were up 3.8% from June 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $401.5 billion, a decrease of 0.5 percent (±0.5%) from the previous month, but 3.8 percent (±0.7%) above June 2011.Ex-autos, retail sales declined 0.4% in June.

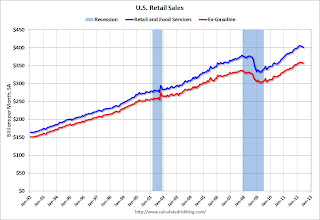

Click on graph for larger image.

Click on graph for larger image.Sales for May were unchanged at a 0.2% decrease.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 21.2% from the bottom, and now 6.0% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.1% from the bottom, and now 6.1% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data, but just since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.1% from the bottom, and now 6.1% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.2% on a YoY basis (3.8% for all retail sales). Retail sales ex-gasoline decreased 0.3% in June.

This was below the consensus forecast for retail sales of a 0.2% increase in June, and below the consensus for a 0.1% increase ex-auto.

This was below the consensus forecast for retail sales of a 0.2% increase in June, and below the consensus for a 0.1% increase ex-auto. Some of the decrease was related to the decline in gasoline prices, but this is another indicator of a weak June.

Sunday, July 15, 2012

Monday: Retail Sales, Empire State Manufacturing Survey

by Calculated Risk on 7/15/2012 10:12:00 PM

This will be a busy week for economic data.

• At 8:30 AM ET, Retail Sales for June will be released. The consensus is for retail sales to increase 0.2% in June, and for retail sales ex-autos to increase 0.l%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for July will be released. The consensus is for a reading of 4.5, up from 2.3 in June (above zero is expansion). This is the first regional survey for July.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales for May report will be released (Business inventories). The consensus is for 0.3% increase in inventories.

The Asian markets are mixed tonight, with little change.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down about 3, and the DOW futures down about 25.

Oil: WTI futures are down to $86.69 (this is down from $109.77 in February, but up last week) and Brent is at $102.35 per barrel.

Yesterday:

• Summary for Week Ending July 13th

• Schedule for Week of July 15th

Four more questions this week for the July contest: