by Calculated Risk on 6/21/2012 03:55:00 PM

Thursday, June 21, 2012

Mortgage Rates: Another Week, Another Record Low

Below is a graph comparing mortgage rates from the Freddie Mac Primary Mortgage Market Survey® (PMMS®) and the refinance index from the Mortgage Bankers Association (MBA).

The MBA reported yesterday that refinance activity increased again last week.

Earlier today from Freddie Mac: 30-Year Fixed-Rate Mortgage Averages 3.66 Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average mortgage rates easing amid worsening economic indicators. Both the 30-year fixed and the 5-year ARM registered new average record lows.

30-year fixed-rate mortgage (FRM) averaged 3.66 percent with an average 0.7 point for the week ending June 21, 2012, down from last week when it averaged 3.71 percent. Last year at this time, the 30-year FRM averaged 4.50 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently at the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates are there! The 30 year conforming mortgage rates were at 4.23% in October 2010, so a 50 bps drop would be 3.73% - and rates hit 3.66% last week.

There was an increase this week in FHA streamlined refinances (due to lower premiums). And there has also been an increase in refinance activity from borrowers with negative equity and loans owned or guaranteed by Fannie or Freddie.

Earlier on Existing Home Sales:

• Existing Home Sales in May: 4.55 million SAAR, 6.6 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph • Existing Home Sales graphs

Misc: Philly Fed, Leading Indicators, FHFA House Price index increases 0.8%

by Calculated Risk on 6/21/2012 01:56:00 PM

Catching up ...

• From the Philly Fed: June 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, fell from a reading of -5.8 in May to -16.6, its second consecutive negative reading ...

...

The current employment index increased 3 points this month [to 1.8]. Firms indicated fewer hours worked this month: the average workweek index decreased 14 points and posted its third consecutive negative reading.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.

The average of the Empire State and Philly Fed surveys declined in May, and is at the lowest level since last summer.

• Also this morning, the Markit Flash PMI came in below expectations at 52.9% (slower expansion).

• The Conference Board leading indicators increased 0.3% in May:

"Economic data in general reflect a U.S. economy that is growing modestly, neither losing nor gaining momentum," said Ken Goldstein, economist at the Conference Board, a private research group. However, he added that ongoing U.S. and international challenges are making economic strengthening "difficult."• The FHFA house price index showed further gains in April: FHFA House Price Index Up 0.8 Percent in April

U.S. house prices rose 0.8 percent on a seasonally adjusted basis from March to April, according to the Federal Housing Finance Agency’s monthly House Price Index. ... For the 12 months ending in April, U.S. prices rose 3.0 percent.

Existing Home Sales: Inventory and NSA Sales Graph

by Calculated Risk on 6/21/2012 12:00:00 PM

The NAR reported inventory decreased to 2.49 million units in May, down 0.4% from the downwardly revised 2.50 million in April (revised down from 2.54 million). This is down 20.4% from May 2011, and down 2.6% from the inventory level in May 2005 (mid-2005 was when inventory started increasing sharply).

It is very likely that inventory will be below the comparable month in 2005 for the rest of the year. It is even possible that inventory has peaked for 2012 (or is at least very close to the peak).

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.

This year (dark red for 2012) inventory is at the lowest level for the month of May since 2004, and inventory is below the level in May 2005 (not counting contingent sales). However inventory is still elevated using months-of-supply.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are above the sales for the 2008, 2009 and 2011 (2010 was slightly higher because of the tax credit). Sales are well below the bubble years of 2005 and 2006.

Sales NSA (red column) are above the sales for the 2008, 2009 and 2011 (2010 was slightly higher because of the tax credit). Sales are well below the bubble years of 2005 and 2006.

Also it appears distressed sales were down in May. From the NAR:

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 25 percent of May sales (15 percent were foreclosures and 10 percent were short sales), down from 28 percent in April and 31 percent in May 2011.This suggests non-distressed sales increased in May, and that is a positive sign for the housing market.

Earlier:

• Existing Home Sales in May: 4.55 million SAAR, 6.6 months of supply

• Existing Home Sales graphs

Existing Home Sales in May: 4.55 million SAAR, 6.6 months of supply

by Calculated Risk on 6/21/2012 10:00:00 AM

The NAR reports: Existing-Home Sales Constrained by Tight Supply in May, Prices Continue to Gain

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 1.5 percent to a seasonally adjusted annual rate of 4.55 million in May from 4.62 million in April, but are 9.6 percent above the 4.15 million-unit pace in May 2011.

...

Total housing inventory at the end of May slipped 0.4 percent to 2.49 million existing homes available for sale, which represents a 6.6-month supply2 at the current sales pace; there was a 6.5-month supply in April. Listed inventory is 20.4 percent below a year ago when there was a 9.1-month supply. Unsold inventory has trended down from a record 4.04 million in July 2007; supplies reached a cyclical peak of 12.1 months in July 2010.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May 2012 (4.55 million SAAR) were 1.5% lower than last month, and were 9.6% above the May 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 2.49 million in May from the downwardly revised 2.50 million in April (revised down from 2.54 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

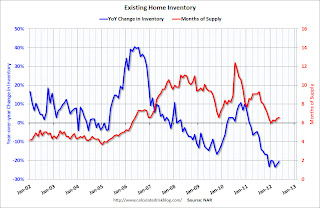

According to the NAR, inventory declined to 2.49 million in May from the downwardly revised 2.50 million in April (revised down from 2.54 million). Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.4% year-over-year in May from May 2011. This is the fifteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 20.4% year-over-year in May from May 2011. This is the fifteenth consecutive month with a YoY decrease in inventory.Months of supply increased slightly to 6.6 months in May.

This was at expectations of sales of 4.57 million. I'll have more soon ...

Weekly Initial Unemployment Claims mostly unchanged, Four week average highest this year

by Calculated Risk on 6/21/2012 08:38:00 AM

The DOL reports:

In the week ending June 16, the advance figure for seasonally adjusted initial claims was 387,000, a decrease of 2,000 from the previous week's revised figure of 389,000. The 4-week moving average was 386,250, an increase of 3,500 from the previous week's revised average of 382,750.The previous week was revised up from 386,000 to 389,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 386,250.

The average had been between 363,000 and 384,000 all year, so this is a new high for the year.

And here is a long term graph of weekly claims:

This was above the consensus forecast of 383,000 and suggests some renewed weakness in the labor market.

This was above the consensus forecast of 383,000 and suggests some renewed weakness in the labor market.