by Calculated Risk on 6/20/2012 07:00:00 AM

Wednesday, June 20, 2012

MBA: FHA Mortgage Refinance Applications increase sharply

From the MBA: Government Refinance Applications More Than Double in Latest MBA Survey

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index fell 9 percent from one week earlier.

“Refinance volume increased again last week, but the composition of activity changed markedly. Despite rates remaining near all-time lows, conventional refinance application volume declined, and the HARP share of refinance activity dropped to 20 percent,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “On the other hand, FHA refinance volume exploded to an all-time high, more than doubling over the week. New, lower FHA premiums on streamlined refinance loans came fully into effect, and borrowers seized the opportunity to lower their mortgage rates without increasing their FHA premiums. Purchase activity fell off last week, but this is likely only a recalibration following the Memorial Day holiday, as the level of activity remains within the narrow band seen for the past 3 years.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.87 percent, matching the lowest rate in the history of the survey, from 3.88 percent, with points increasing to 0.49 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The purchase index is still very weak, and is mostly moving sideways.

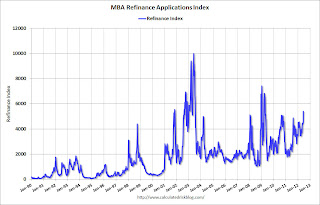

Refinance activity continues to increase, especially with the surge in FHA streamline refinancing - and because mortgage rates are near the record low set the previous week.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates have fallen about that far - and refinance activity is now at the highest level since 2009.