by Calculated Risk on 10/16/2011 01:11:00 PM

Sunday, October 16, 2011

Unofficial Problem Bank list declines to 979 Institutions

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 14, 2011.

Changes and comments from surferdude808:

After several changes, the Unofficial Problem Bank List finished the week with 979 institutions and assets of $403.8 billion. A year ago, there were 875 institutions with assets of $401.6 billion on the list. This week, there were five removals and one addition.Yesterday:

The addition this week is The Savannah Bank, National Association, Savannah, GA ($737 million Ticker: SAVB). Also, the Federal Reserve issued a Prompt Corrective Action order against Anchor Commercial Bank, North Palm Beach, FL ($143 million), which has been operating under a Written Agreement since March 2010.

Among the removals are The Elgin State Bank, Elgin, IL ($277 million), which merged on an unassisted basis with St. Charles Bank & Trust Company, Saint Charles, IL. The other removals were the four failed banks -- First State Bank, Cranford, NJ ($204 million); Piedmont Community Bank, Gray, GA ($202 million); Country Bank, Aledo, IL ($191 million); and Blue Ridge Savings Bank, Inc., Asheville, NC ($161 million). All of these failures were costly relative to the failed bank assets at more than 22 percent. Moreover, Piedmont Community Bank and Country Bank resolution costs were around 35 percent of their respective assets. While the Unofficial Problem Bank List has trended down over the past three months, failure continues as the primary removal method.

• Summary for Week Ending Oct 14th

• Lawler: Early Read on Existing Home Sales in September

• Schedule for Week of Oct 16th

Lawler: For Seriously-Troubled Loans: A Call to ARMs

by Calculated Risk on 10/16/2011 08:02:00 AM

From economist Tom Lawler:

Many folks have for some strange reason argued that safe and effective loan modifications for troubled borrowers should get these borrowers into 30-year fixed-rate mortgages – even though short-term interest rates are close to zero, and expected to stay close to zero “until at least 2013.” One reason, of course, is that the typical ARM offered by US lenders has been one where the margin over the short-term index rate used has been really high – 275 bp for prime borrowers and often 600 bp for “subprime” borrowers. Such margins have been well in excess of the effective margin of fixed-rate mortgages over the full Treasury curve, after adjusting for the option cost of the prepayment option.

If, however, an adjustable rate mortgage with a “reasonable” margin were offered to struggling borrowers, it might just be worth the “risk” of having these borrowers take some interest-rate risk in exchange for lowering their risk of losing their home, by having a larger share of their reduced payment going to principal pay down.

Many struggling borrowers, of course, are in danger of losing their homes in the short- or intermediate-term, and it’s not clear if putting such borrowers into a long-term fixed-rate mortgage which includes prepayment risk in the rate is the “best” for such borrowers.

As an example, consider a borrower who has a mortgage with a $200,000 balance, a 6.5% current interest rate, and 25 years (300 months) left to maturity. Suppose further that (1) the home’s current value is, say, $160,000; (2) the borrower’s current monthly income is, say, $52,000 a year; and (3) the borrower pays about $250/month in taxes and insurance.

Currently that borrower’s total mortgage payment is around 37% of her income, and she is $40,000 (20%) under water. In addition, a comparable home today would rent for less than her mortgage payment.

Now suppose one were to offer her two options: (1) modify her rate to a 4.5% fixed-rate loan that amortizes over 25 years; or (2) modify her rate where her payment was the same as a 4.5% 25-year fixed-rate loan, but her actual interest rate (or accrual rate) was set for the first 12 months at 1.50% -- which is about 140 bp over the one-year constant maturity Treasury rate – and would then adjust each yearly anniversary to a rate equal to the one-year constant maturity Treasury rate plus 140 bp.

If interest rates were to follow current forward one-year interest rates, then her interest rate would increase by less than 50 bp a year from now, and then about 50 bp the year after that. But for simplicity’s sake, let’s just assume that in each of the next four years, the one-year Treasury rate increases by 50 bp. Let’s take a look at what the borrower would face over the next several years.

First, of course, the borrower’s mortgage payment would decline by the same amount for both loans – about 15% (her P&I payment would drop by about 18%) – to about 31% of her income.

Here is what her mortgage principal balance would look like at the end of each of the next 5 years (1) for the original loan; (2) for the 4.5% FRM loan; and (3) for the ARM.

| Remaining Mortgage Principal Balance, $200,000 Loan | |||

|---|---|---|---|

| End of Year: | 6.5% 25yr FRM | 4.5% 25yr FRM | 1-Yr ARM 25yr Am |

| 1 | $196,698 | $195,569 | $189,589 |

| 2 | $193,174 | $190,935 | $179,872 |

| 3 | $189,415 | $186,088 | $170,850 |

| 4 | $185,404 | $181,018 | $162,449 |

| 5 | $181,124 | $175,716 | $154,600 |

Because the 1-year ARM is based on a 4.5%, 25-year amortization schedule but the accrual rate is based on the very low short-term interest rate, a much larger % of the borrower’s payment goes to paying down principal – which is shown graphically in the above table. If interest rates were to increase by just 50 bp each year, the borrower’s mortgage balance would fall below TODAY”S value of her home in four years and four months. For the 4.5% fixed-rate loan, the borrower’s mortgage balance would not fall below $160,000 for seven years an nine months.

Of course, the borrower in the ARM case would be exposed to the risk that interest rates would increase. However, this borrower is already at significant risk of defaulting. Moreover, the borrower might be more WILLING to accept the ARM offer once she saw that her mortgage balance was falling so fast.

CR Note: This was a proposal from Tom Lawler for Seriously-Troubled Loans.

Yesterday:

• Summary for Week Ending Oct 14th

• Lawler: Early Read on Existing Home Sales in September

• Schedule for Week of Oct 16th

Saturday, October 15, 2011

Europe Update: Eight Days to Save Europe

by Calculated Risk on 10/15/2011 08:20:00 PM

The next key dates are Sunday, October 23rd, and the Germany / France deadline of November 4th.

The post title comes from this Financial Times article: G20 tells eurozone to tackle debt crisis

Despite a continued lack of agreement on key elements, the eurozone committed to finalise the details of ‘a comprehensive plan’ to recapitalise its banks, resolve the Greek debt crisis and add firepower to its funds to minimise contagion in time for a European summit in just eight days.From Bloomberg: Rehn Says EU Close to Reaching Agreement on Recapitalization

European Union Economic and Monetary Affairs Commissioner Olli Rehn said member states are set to agree on a “very serious plan” to recapitalize the region’s lenders ...From Bloomberg: G-20 Said to Consider List of 50 Systemically Important Banks

“I expect that in the coming days, we’ll have more clarity on this,” Rehn told Bloomberg Television after a meeting of finance ministers and central bank governors from the Group of 20 nations in Paris yesterday. “Member states and banks need to have very clear plans to put recapitalization in place as swiftly as possible.”

...

There’s now a “strong sense of urgency” among leaders, Rehn said. “The EU is acting very hard in order to put together a comprehensive strategy to overcome the sovereign debt crisis and banking-sector fragilities, which are severely intertwined.”

Group of 20 governments are considering naming as many as 50 banks as systemically important to the global economy and in need of extra capital, two officials from G-20 nations said.Sunday will be the new Monday again on Oct 23rd.

The list, drawn up by Financial Stability Board Chairman Mario Draghi, will be published in time for a G-20 leaders meeting in Cannes, France, on Nov. 3-4, said the officials ... Regulators have said the banks named will be forced to take on more capital.

Earlier:

• Summary for Week Ending Oct 14th

• Lawler: Early Read on Existing Home Sales in September

• Schedule for Week of Oct 16th

Schedule for Week of Oct 16th

by Calculated Risk on 10/15/2011 03:41:00 PM

Earlier:

• Summary for Week Ending Oct 14th

Three key housing reports will be released this week: October homebuilder confidence on Tuesday, September housing starts on Wednesday, and September existing home sales on Thursday.

For manufacturing, the October NY Fed (Empire state) survey will be released on Monday, the October Philly Fed survey on Thursday, and the September Industrial Production and Capacity Utilization report on Monday. The high frequency surveys (Empire state, Philly Fed, and weekly initial unemployment claims) are all expected to show some improvement.

On prices, the September Producer Price index (PPI) will be released Tuesday, and CPI will be released Wednesday.

Fed Chairman Ben Bernanke speaks on Tuesday, and several regional Fed presidents speak throughout the week. On Sunday, Oct 23rd, the European leaders will hold a summit meeting.

8:30 AM ET: NY Fed Empire Manufacturing Survey for October. The consensus is for a reading of -3.25, up slightly from -8.82 in September (below zero is contraction).

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for September. This graph shows industrial production since 1967. Industrial production increased in August to 94.0 (although earlier months were revised down).

The consensus is for a 0.2% increase in Industrial Production in September, and an increase to 77.5% (from 77.4%) for Capacity Utilization. The Ceridian index suggests Industrial Production declined in September.

8:30 AM: Producer Price Index for September. The consensus is for a 0.3% increase in producer prices (0.1% increase in core).

10 AM ET: The October NAHB homebuilder survey. The consensus is for a reading of 15, up slightly from 14 in September. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for four years.

1:15 PM: Speech, Fed Chairman Ben Bernanke, "The Effects of the Great Recession on Central Bank Doctrine and Practice", At the Federal Reserve Bank of Boston 56th Economic Conference, Boston, Massachusetts

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

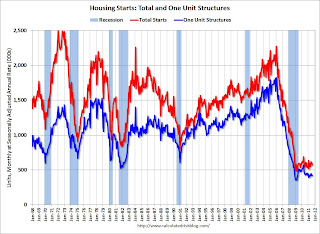

8:30 AM: Housing Starts for September. After collapsing following the housing bubble, housing starts have mostly been moving sideways for almost three years.

8:30 AM: Housing Starts for September. After collapsing following the housing bubble, housing starts have mostly been moving sideways for almost three years. Total housing starts were at 571 thousand (SAAR) in August, down 5.0% from the revised July rate of 601 thousand (revised from 604). Single-family starts declined 1.4% to 417 thousand in August.

The consensus is for an increase to 590,000 (SAAR) in September. More sideways ...

8:30 AM: Consumer Price Index for September. The consensus is for a 0.3% increase in prices. The consensus for core CPI is an increase of 0.2%. CPI-W for September will be released too. This index is used for Social Security Cost-of-living and other adjustments, and COLA is currently on track to increase by about 3.5% for next year.

2:00 PM: Federal Reserve Beige Book for early October, Informal review by the Federal Reserve Banks of current economic conditions in their Districts

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 400,000 from 404,000 last week. If the consensus is correct, the 4-week average would fall to the lowest level since early April.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 4.93 million at a Seasonally Adjusted Annual Rate (SAAR) in September, down from 5.03 million SAAR in August. This is probably a little high - economist Tom Lawler estimates the NAR will report sales of 4.80 million.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 4.93 million at a Seasonally Adjusted Annual Rate (SAAR) in September, down from 5.03 million SAAR in August. This is probably a little high - economist Tom Lawler estimates the NAR will report sales of 4.80 million.Update 10/18/2011: Lawler has upped his forecast to 4.83 million.

Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). There is no firm date for the release of these revisions.

10:00 AM: Philly Fed Survey for Septmeber. The consensus is for a reading of -9.0 (below zero indicates contraction), up from -17.5 last month.

10:00 AM: Conference Board Leading Indicators for September. The consensus is for a 0.3% increase in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for September 2011

European Union leaders will hold a summit meeting.

Lawler: Early Read on Existing Home Sales in September

by Calculated Risk on 10/15/2011 01:37:00 PM

From economist Tom Lawler:

Based on the information I have so far from local realtor associations/MLS/boards, I estimate that existing home sales as calculated by the National Association of Realtors ran at a seasonally adjusted annual rate [SAAR] of around 4.80 million, down 4.6% from August’s pace, but pretty darned close to the average monthly sales pace for the past four months. Existing home inventories clearly declined significantly from August to September, and while available listings data and the NAR inventory numbers often don’t “track” well month to month, my best guess is that the NAR inventory number for September will be down by about 3.8%, which would put the YOY inventory drop as measured by the NAR to about 14%.CR Note: The NAR will release September Existing-Home Sales on Thursday, Oct 20th at 10:00 AM ET. The consensus forecast is for 4.93 million sales in September (SAAR).

Based on Tom's estimate, inventory would fall to 3.44 million in September, down from 3.58 million in August, and months-of-supply would increase to 8.6 months from 8.5 months in August. This would be the lowest level inventory for September since 2005 (2.77 million in Sept 2005). The peak inventory for September was in 2007 at 4.37 million.

Earlier:

• Summary for Week Ending Oct 14th