by Calculated Risk on 10/15/2011 03:41:00 PM

Saturday, October 15, 2011

Schedule for Week of Oct 16th

Earlier:

• Summary for Week Ending Oct 14th

Three key housing reports will be released this week: October homebuilder confidence on Tuesday, September housing starts on Wednesday, and September existing home sales on Thursday.

For manufacturing, the October NY Fed (Empire state) survey will be released on Monday, the October Philly Fed survey on Thursday, and the September Industrial Production and Capacity Utilization report on Monday. The high frequency surveys (Empire state, Philly Fed, and weekly initial unemployment claims) are all expected to show some improvement.

On prices, the September Producer Price index (PPI) will be released Tuesday, and CPI will be released Wednesday.

Fed Chairman Ben Bernanke speaks on Tuesday, and several regional Fed presidents speak throughout the week. On Sunday, Oct 23rd, the European leaders will hold a summit meeting.

8:30 AM ET: NY Fed Empire Manufacturing Survey for October. The consensus is for a reading of -3.25, up slightly from -8.82 in September (below zero is contraction).

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for September. This graph shows industrial production since 1967. Industrial production increased in August to 94.0 (although earlier months were revised down).

The consensus is for a 0.2% increase in Industrial Production in September, and an increase to 77.5% (from 77.4%) for Capacity Utilization. The Ceridian index suggests Industrial Production declined in September.

8:30 AM: Producer Price Index for September. The consensus is for a 0.3% increase in producer prices (0.1% increase in core).

10 AM ET: The October NAHB homebuilder survey. The consensus is for a reading of 15, up slightly from 14 in September. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for four years.

1:15 PM: Speech, Fed Chairman Ben Bernanke, "The Effects of the Great Recession on Central Bank Doctrine and Practice", At the Federal Reserve Bank of Boston 56th Economic Conference, Boston, Massachusetts

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

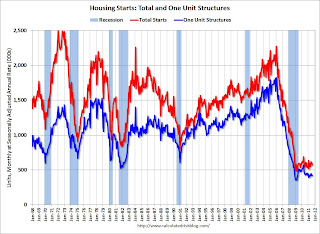

8:30 AM: Housing Starts for September. After collapsing following the housing bubble, housing starts have mostly been moving sideways for almost three years.

8:30 AM: Housing Starts for September. After collapsing following the housing bubble, housing starts have mostly been moving sideways for almost three years. Total housing starts were at 571 thousand (SAAR) in August, down 5.0% from the revised July rate of 601 thousand (revised from 604). Single-family starts declined 1.4% to 417 thousand in August.

The consensus is for an increase to 590,000 (SAAR) in September. More sideways ...

8:30 AM: Consumer Price Index for September. The consensus is for a 0.3% increase in prices. The consensus for core CPI is an increase of 0.2%. CPI-W for September will be released too. This index is used for Social Security Cost-of-living and other adjustments, and COLA is currently on track to increase by about 3.5% for next year.

2:00 PM: Federal Reserve Beige Book for early October, Informal review by the Federal Reserve Banks of current economic conditions in their Districts

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 400,000 from 404,000 last week. If the consensus is correct, the 4-week average would fall to the lowest level since early April.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 4.93 million at a Seasonally Adjusted Annual Rate (SAAR) in September, down from 5.03 million SAAR in August. This is probably a little high - economist Tom Lawler estimates the NAR will report sales of 4.80 million.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 4.93 million at a Seasonally Adjusted Annual Rate (SAAR) in September, down from 5.03 million SAAR in August. This is probably a little high - economist Tom Lawler estimates the NAR will report sales of 4.80 million.Update 10/18/2011: Lawler has upped his forecast to 4.83 million.

Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). There is no firm date for the release of these revisions.

10:00 AM: Philly Fed Survey for Septmeber. The consensus is for a reading of -9.0 (below zero indicates contraction), up from -17.5 last month.

10:00 AM: Conference Board Leading Indicators for September. The consensus is for a 0.3% increase in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for September 2011

European Union leaders will hold a summit meeting.