by Calculated Risk on 9/17/2011 10:35:00 PM

Saturday, September 17, 2011

Repeat: Sovereign Debt Series

CR Note: This series is from "Some investor guy". He wrote these posts just over a year ago. The series starts with some basics, and concludes in Part 5 with some speculation. The data is a year old - as an example the probability of default for Greece is now close to 100%! (as opposed to over 50% last year).

• Part 1: How Large is the Outstanding Value of Sovereign Bonds?

• Part 2. How Often Have Sovereign Countries Defaulted in the Past?

• Part 2B: More on Historic Sovereign Default Research

• Part 3. What are the Market Estimates of the Probabilities of Default?

• Part 4. What are Total Estimated Losses on Sovereign Bonds Due to Default?

• Part 5A. What Happens If Things Go Really Badly? $15 Trillion of Sovereign Debt in Default

• Part 5B. Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

• Part 5C. Some Policy Options, Good and Bad

• Part 5D. European Banks, What if Things Go Really Badly?

Earlier:

• Summary for Week ending September 16th

• Schedule for Week of Sept 18th

Europe Update: Little Progress

by Calculated Risk on 9/17/2011 06:55:00 PM

Nothing was resolved. It sounds like there will be another round of stress tests including exposure to sovereign debt. About time!

• From the WSJ: EU Ends Talks With Little Progress in Overcoming Divisions

At the end of two days of informal talks here, the finance ministers made little progress in overcoming divisions ... they continued to spar over a range of issues, including whether to impose a financial transactions tax, boost the euro zone's rescue fund and how to address Finland's demands for collateral in return for its contribution to Greece's bailout.• From Bloomberg: Greece’s Premier Cancels U.S. Trip Before ‘Critical’ Week (ht jb)

...

Michel Barnier, the EU's commissioner for financial regulation, said that while the 2011 tests were an improvement over last year's, "we must also acknowledge that the tests did not restore the credibility in banks strength in the way we would have hoped."

The tests should be strengthened, he said. "In particular, I think we need to reconsider how we treat sovereign exposure and liquidity, and further improve coordination between supervisors," Mr. Barnier said.

Greek Prime Minister George Papandreou canceled a U.S. visit that was to begin tomorrow, saying he needed to remain in the country for a “critical” seven days in its effort to avert a bond default.• From the Irish Times: €10bn interest-rate cuts on State bailout signed off

“The coming week is particularly critical for the implementation of the July 21 decisions in the euro area and the initiatives which the country must undertake,” said a statement e-mailed today from Papandreou’s office in Athens.

...

EU and International Monetary Fund inspectors will hold a conference call with Finance Minister Evangelos Venizelos to resume and accelerate their review on Sept. 19

EU FINANCE ministers have signed off on a package of interest rate cuts on Ireland’s bailout which will benefit the State by up to € 10 billion during the course of the rescue.Earlier:

• Summary for Week ending September 16th

• Schedule for Week of Sept 18th

Schedule for Week of Sept 18th

by Calculated Risk on 9/17/2011 02:15:00 PM

Earlier:

• Summary for Week ending September 16th

Three key housing reports will be released this week: September homebuilder confidence on Monday, August housing starts on Tuesday, and August existing home sales on Wednesday.

The September FOMC meeting was extended to two days, and the statement will be released on Wednesday. The Fed is expected to announce a program to increase the average maturity of their portfolio - and possibly lower the interest rate on excess reserves.

10 AM ET: The September NAHB homebuilder survey. The consensus is for a reading of 15, unchanged from August. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for four years.

8:30 AM: Housing Starts for August. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years.

8:30 AM: Housing Starts for August. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years. Total housing starts were at 604 thousand (SAAR) in July, down 1.5% from the revised June rate of 613 thousand. Single-family starts declined 4.9% to 425 thousand in July.

The consensus is for a decrease to 592,000 (SAAR) in August.

Early: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

Early: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).This graph shows the Architecture Billings Index since 1996. The index decreased in in July to 45.1 from 46.3 in June. Anything below 50 indicates a contraction in demand for architects' services.

This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last several months and the four average was at 1995 levels last week.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for sales of 4.75 million at a Seasonally Adjusted Annual Rate (SAAR) in August, up from 4.67 million SAAR in July. This is probably low - economist Tom Lawler estimates the NAR will report sales of 4.91 million.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for sales of 4.75 million at a Seasonally Adjusted Annual Rate (SAAR) in August, up from 4.67 million SAAR in July. This is probably low - economist Tom Lawler estimates the NAR will report sales of 4.91 million.Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). These revisions are expected this fall.

2:15 PM: FOMC Meeting Announcement. The FOMC meeting was extended to two days, and many people expect the FOMC to announce a program to change the composition of their balance sheet (extend maturities) - and to possibly lower the interest rate on excess reserves. There will no press briefing after this meeting - the next press conference is scheduled for Nov 2nd.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 420,000 from 428,000 last week.

10:00 AM: Conference Board Leading Indicators for August. The consensus is for no change for this index.

10:00 AM: FHFA House Price Index for July 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

Expected: The Moody's/REAL Commercial Property Price Indices (commercial real estate price index) for July.

1:30 PM: New York Fed President William Dudley speaks at the Bretton Woods meeting: "Financial Stability and Economic Growth" (part of the IMF/World Bank annual meetings).

Summary for Week ending Sept 16th

by Calculated Risk on 9/17/2011 08:17:00 AM

This was another weak week for U.S. economic data. Retail sales were flat in August, the Philly and NY Fed manufacturing surveys showed further contraction, and initial weekly unemployment claims increased again. Also core measures of inflation moved higher in August.

There was also some quarterly data released: CoreLogic released their negative equity report showing little improvement in Q2, and the Fed released the Flow of Funds report showing that household mortgage debt is decreasing, but still much higher than in previous decades as a percent of GDP.

And once again the European financial crisis was on the front pages. It seemed

s the story changed day-to-day - and on Wednesday German Chancellor Angela Merkel and French President Nicolas Sarkozy made some positive comments about Greece and the ECB, Fed and several other central banks announced a dollar liquidity program for European banks. Still, nothing has been resolved.

Here is a summary in graphs:

• Retail Sales flat in August

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

On a monthly basis, retail sales were flat from July to August (seasonally adjusted, after revisions), and sales were up 7.2% from August 2010. Retail sales excluding autos increased 0.1% in August. Sales for and June and July were revised down.

Retail sales are up 17.1% from the bottom, and now 2.9% above the pre-recession peak. The consensus was for retail sales to increase 0.2% in August, and for a 0.3% increase ex-auto.

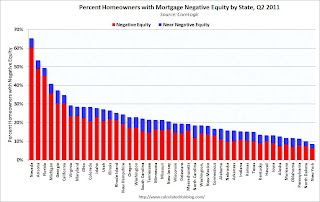

• CoreLogic: 10.9 Million U.S. Properties with Negative Equity in Q2

CoreLogic released the Q2 2011 negative equity report this week. "CoreLogic ... released Q2 negative equity data showing that 10.9 million, or 22.5 percent, of all residential properties with a mortgage were in negative equity at the end of the second quarter of 2011, down very slightly from 22.7 percent in the first quarter."

CoreLogic released the Q2 2011 negative equity report this week. "CoreLogic ... released Q2 negative equity data showing that 10.9 million, or 22.5 percent, of all residential properties with a mortgage were in negative equity at the end of the second quarter of 2011, down very slightly from 22.7 percent in the first quarter."

This graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

From CoreLogic: "Nevada had the highest negative equity percentage with 60 percent of all of its mortgaged properties underwater, followed by Arizona (49 percent), Florida (45 percent), Michigan (36 percent) and California (30 percent)."

• Industrial Production increased 0.2% in August, Capacity Utilization increases slightly

From the Fed: Industrial production and Capacity Utilization. "Industrial production increased 0.2 percent in August ... Capacity utilization for total industry edged up to 77.4 percent, a rate 1.9 percentage points above its level from a year earlier but 3.0 percentage points below its long-run (1972--2010) average."

From the Fed: Industrial production and Capacity Utilization. "Industrial production increased 0.2 percent in August ... Capacity utilization for total industry edged up to 77.4 percent, a rate 1.9 percentage points above its level from a year earlier but 3.0 percentage points below its long-run (1972--2010) average."

This graph shows Capacity Utilization. This series is up 10.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.4% is still 3.0 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Capacity utilization at 77.4% is still 3.0 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

This graph shows industrial production since 1967.

Industrial production increased in August to 94.0 (although earlier months were revised down).

After the fairly rapid increase last year, increases in industrial production and capacity utilization have slowed recently.

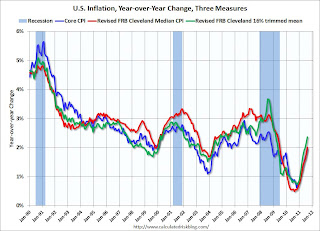

• Key Measures of Inflation increased in August

The Cleveland Fed released the median CPI and the trimmed-mean CPI this week: "According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.6% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.3% (4.0% annualized rate) during the month. ... the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.6% annualized rate) in August. The CPI less food and energy increased 0.2% (3.0% annualized rate) on a seasonally adjusted basis."

The Cleveland Fed released the median CPI and the trimmed-mean CPI this week: "According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.6% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.3% (4.0% annualized rate) during the month. ... the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.6% annualized rate) in August. The CPI less food and energy increased 0.2% (3.0% annualized rate) on a seasonally adjusted basis."

On a year-over-year basis, these measures of inflation are increasing, and are near the Fed's target.

• Fed Manufacturing Surveys indicate Contraction

From the NY Fed: Empire State Manufacturing Survey: "The general business conditions index inched down one point, to -8.8." This was lower than expectations of a reading of -3.6.

From the NY Fed: Empire State Manufacturing Survey: "The general business conditions index inched down one point, to -8.8." This was lower than expectations of a reading of -3.6.

From the Philly Fed: September 2011 Business Outlook Survey. "The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a very low reading of -30.7 in August to -17.5 in September." This indicates contraction in September and was slightly below the consensus forecast of -15.0.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys rebounded in September, but is still well below zero - possibly indicating a further decline in the ISM index.

• Weekly Initial Unemployment Claims increased to 428,000

The DOL reported: "In the week ending September 10, the advance figure for seasonally adjusted initial claims was 428,000, an increase of 11,000 from the previous week's revised figure of 417,000."

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 419,500.

The 4-week average has been increasing recently and this is the highest level since early July.

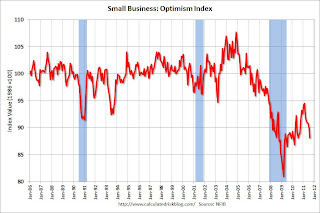

• NFIB: Small Business Optimism Index declines in August

From the National Federation of Independent Business (NFIB): Small Business Confidence Takes Huge Hit: Optimism Index Now in Decline for Six Months Running.

From the National Federation of Independent Business (NFIB): Small Business Confidence Takes Huge Hit: Optimism Index Now in Decline for Six Months Running.

"Confidence in the economy among small-business owners tumbled in August, as NFIB’s monthly Small-Business Optimism Index dropped a whopping 1.8 points, settling at a disturbingly low 88.1. The Index has now been in decline for a full six months."

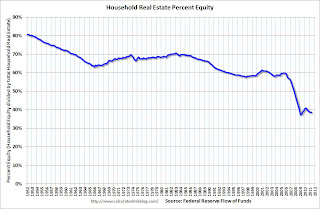

• Q2 Flow of Funds: Household Real Estate assets off $6.6 trillion from peak

The Federal Reserve released the Q2 2011 Flow of Funds report this week: Flow of Funds. The Fed estimated that the value of household real estate fell $65 billion to $16.18 trillion in Q2 2011, from $16.25 trillion in Q1 2011. The value of household real estate has fallen $6.6 trillion from the peak - and is still falling in 2011.

Household net worth peaked at $65.9 trillion in Q2 2007, and then net worth fell to $49.5 trillion in Q1 2009 (a loss of $16 trillion). Household net worth was at $58.5 trillion in Q2 2011 (up $8.9 trillion from the trough, but before the recent stock sell-off).

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2011, household percent equity (of household real estate) was at 38.6% - about the same as in Q1.

Note: about 30.3% of owner occupied households have no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 38.6% equity - and 10.9 million households have negative equity.

TThis graph shows household real estate assets and mortgage debt as a percent of GDP.

TThis graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $47 billion in Q2. Mortgage debt has now declined by $678 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

Household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• Other Economic Stories ...

• From the WSJ: Central Banks Boost Dollar Liquidity

• Ceridian-UCLA: Diesel Fuel index declined in August

• From Diana Olick at CNBC: Huge Surge in Bank of America Foreclosures

• Households Doubling Up and Housing

• State Unemployment Rates "little changed" in August

• Early Look: 2012 Social Security Cost-Of-Living Adjustment on track for 3.5% increase

Friday, September 16, 2011

Unofficial Problem Bank list declines to 984 Institutions

by Calculated Risk on 9/16/2011 09:50:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 16, 2011.

Changes and comments from surferdude808:

The OCC did not release its actions through mid-August as we anticipated they would last week. Perhaps there are operational issues or changes in release protocol after the merger with the OTS. Without the OCC release and the FDIC sitting on its hands this week as far as closures, there were only minor changes to the Unofficial Problem Bank List this week. In all, there were two removals, which leaves the list with 984 institutions and assets of $402.4 billion. A year ago, there were 854 institutions with assets of $416.0 billion.Best to all!

The removals were Premier Bank & Trust, National Association, North Canton, OH ($175 million Ticker: OLCB) and Northland National Bank, Gladstone, MO ($46 million ), which had their actions terminated by the OCC. Perhaps the OCC will make an appearance next week.