by Calculated Risk on 9/16/2011 05:27:00 PM

Friday, September 16, 2011

Poll: Debt Ceiling impacted confidence similar to 9/11 and Katrina

Most of this article and poll is on politics, but this is a key point ...

From McClatchy Newspapers: Congress puts on smiley face in bid to curry public favor

Republican pollster Bill McInturff found that public disgust with the summer debt-ceiling debacle had eroded confidence in the economy and the federal government profoundly, on a scale similar to the 9/11 terrorist attacks and Hurricane Katrina.This is the argument I've been making - that the sharp decline in confidence might have been event driven and confidence could bounce back in a couple of months - to the already low levels before the debt ceiling nonsense. It usually takes 2 to 4 months to bounce back from an event driven decline in confidence, so maybe next month ...

Q2 Flow of Funds: Household Real Estate assets off $6.6 trillion from peak

by Calculated Risk on 9/16/2011 02:00:00 PM

The Federal Reserve released the Q2 2011 Flow of Funds report today: Flow of Funds. The Fed estimated that the value of household real estate fell $65 billion to $16.18 trillion in Q2 2011, from $16.25 trillion in Q1 2011. The value of household real estate has fallen $6.6 trillion from the peak - and is still falling in 2011.

Household net worth peaked at $65.9 trillion in Q2 2007, and then net worth fell to $49.5 trillion in Q1 2009 (a loss of $16 trillion). Household net worth was at $58.5 trillion in Q2 2011 (up $8.9 trillion from the trough, but before the recent stock sell-off).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

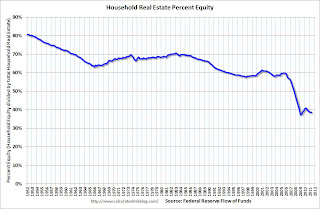

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2011, household percent equity (of household real estate) was at 38.6% - about the same as in Q1.

Note: about 30.3% of owner occupied households have no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 38.6% equity - and 10.9 million households have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $47 billion in Q2. Mortgage debt has now declined by $678 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

Assets prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

State Unemployment Rates "little changed" in August

by Calculated Risk on 9/16/2011 11:31:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in August. Twenty-six states and the District of Columbia reported unemployment rate increases, 12 states recorded rate decreases, and 12 states had no rate change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to report the highest unemployment rate among the states, 13.4 percent in August. California posted the next highest rate, 12.1 percent. North Dakota registered the lowest jobless rate, 3.5 percent, followed by Nebraska, 4.2 percent. ...

New Mexico registered the largest jobless rate decrease from August 2010 (-1.9 percentage points). Four additional states reported smaller but also statistically significant decreases over the year: Oklahoma (-1.4 percentage points), Indiana (-1.3 points), Oregon (-1.1 points), and Florida (-0.9 point). ... Forty-five states recorded unemployment rates that were not appreciably different from those of a year earlier.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

Three states and D.C. are at new 2007 recession highs: Arkansas (8.3%), D.C. (11.1%), Texas (8.5%) and Montana (7.8%).

The fact that 45 states and the District of Columbia have seen little or no improvement over the last year is a reminder that the unemployment crisis is ongoing.

Preliminary September Consumer Sentiment increases slightly to 57.8

by Calculated Risk on 9/16/2011 09:55:00 AM

The preliminary September Reuters / University of Michigan consumer sentiment index increased slightly to 57.8 from 55.7 in July.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. In August, sentiment was probably negatively impacted by the debt ceiling debate.

Note: It usually takes 2 to 4 months to bounce back from an event driven decline in sentiment (if the August decline was event driven) - and any bounce back from the debt ceiling debate would be to an already weak reading.

This was slightly above the consensus forecast of 56.0.

Update on EU Finance Ministers Meeting

by Calculated Risk on 9/16/2011 08:44:00 AM

Not much news yet ...

From Reuters: Geithner Presses EU to Act Decisively, Speak as One

U.S. Treasury Secretary Timothy Geithner told EU finance ministers on Friday they should end loose talk about a euro zone break-up and work more closely with the European Central Bank to tackle the debt crisis.And from the WSJ: Finance Chiefs Meet to Resolve Splits on Crisis

...

"What is very damaging (in Europe) from the outside is not the divisiveness about the broader debate, about strategy, but about the ongoing conflict between governments and the central bank, and you need both to work together to do what is essential to the resolution of any crisis," he said.

"Governments and central banks have to take out the catastrophic risks from markets ...(and avoid) loose talk about dismantling the institutions of the euro."

Euro-zone finance ministers gathering for two days of talks said they would strive to ease market tensions caused by the region's escalating sovereign-debt problems but didn't appear ready to overcome divisions that have marred efforts to resolve the crisis.