by Calculated Risk on 9/02/2011 08:30:00 AM

Friday, September 02, 2011

August Employment Report: 0 Jobs (unchanged), 9.1% Unemployment Rate

From the BLS:

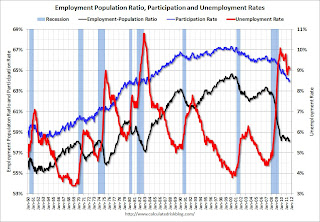

Nonfarm payroll employment was unchanged (0) in August, and the unemployment rate held at 9.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment in most major industries changed little over the month. Health care continued to add jobs, and a decline in information employment reflected a strike. Government employment continued to trend down, despite the return of workers from a partial government shutdown in Minnesota.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

...

The change in total nonfarm payroll employment for June was revised from

+46,000 to +20,000, and the change for July was revised from +117,000 to +85,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The unemployment rate was unchanged at 9.1% (red line).

The Labor Force Participation Rate increased to 64.0% in August (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio increased to 58.2% in August (black line).

Note: the household survey showed a strong gain in jobs, and that is why the unemployment rate could hold steady with no payroll jobs added - and the participation rate increase.

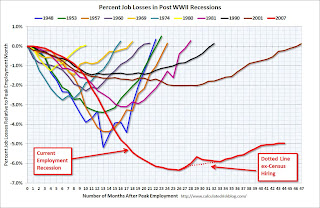

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring. The red line is moving sideways - and I'll need to expand the graph soon.

The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was very weak and well below expectations for payroll jobs. I'll have much more soon ...

Thursday, September 01, 2011

Misc: Jobs, Greek Bailout, REO and More

by Calculated Risk on 9/01/2011 08:20:00 PM

Let's start with jobs ...

• From the NY Times: White House Expects Persistently High Unemployment

The White House budget office forecast on Thursday that unemployment would remain at 9 percent through the 2012 presidential election year ... Unemployment will not return to the 5 percent range until 2017, the budget office said, reflecting the intensity of the hangover from the most severe recession since the Great Depression.• From CNBC: Friday's Jobs Report: Markets Bracing for More Bad News

Recent employment indicators suggest "zero growth in private payrolls," said Jack Ablin, chief investment officer at Harris Private Bank in Chicago. ... Economists at Goldman Sachs cut their forecast for August payrolls growth to 25,000 from 50,000, citing weakness in online job postings in recent months.• From Catherine Rampell at the NY Times: Jobs Report Preview

• My earlier post: Employment Situation Preview: Another Weak Report

Because of the reference period following so soon after an economic shock, and also because of the Verizon labor dispute, I'll take the "under" on the number of jobs added (less than 67,000). I'll also take the over on the unemployment rate (I expect higher than 9.1%).A few other stories:

• From the NY Times: European Banks Are Hard-Selling Greek Bailout Plan

[T]his first major bond restructuring in Europe’s long-festering debt crisis is shaping up as a much better deal for the banks than for the Greeks it is supposed to be helping.This seemed like a good deal for the banks when it was announced.

Holders of the Greek bonds would get much better value than they could in the open market, while Greece would still owe a lot of money.

• HUD reported that the FHA's inventory of REO declined sharply in July to 48,507 from 53,164 at the end of June (revised down). I graph REO inventory quarterly, and this suggests another sharp decline in REO inventory in Q3. This decline is a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. There are many more foreclosures coming - see my earlier post on Mortgage Delinquencies and REOs.

• Note: Tom Lawler corrected the percent of owner-occupied homes owned free and clear by state. He also supplied a list of all 50 states (see last table here).

Earlier today:

• Weekly Initial Unemployment Claims decline to 409,000

• ISM Manufacturing index declines slightly to 50.6.

• Construction Spending declined in July

• U.S. Light Vehicle Sales at 12.12 million SAAR in August

U.S. Light Vehicle Sales at 12.12 million SAAR in August

by Calculated Risk on 9/01/2011 04:20:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.12 million SAAR in August. That is up 5.3% from August 2010, and down less than 1% from the sales rate last month (12.2 million SAAR in July 2011).

This was right at the consensus forecast of 12.1 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for August (red, light vehicle sales of 12.12 million SAAR from Autodata Corp).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Sales declined slightly from the July rate.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession, and that the current level of sales are close to the 1990 recession bottom. This also shows the impact of the tsunami and supply chain issues on sales in May and June.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales should make a positive contribution to Q3 GDP as sales bounce back from the May and June lows. However, so far, sales in Q3 have average 12.16 million, only slightly above the Q2 rate - May and June were very weak, but April was above 13 million SAAR.

Employment Situation Preview: Another Weak Report

by Calculated Risk on 9/01/2011 01:54:00 PM

Tomorrow the BLS will release the August Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 67,000 payroll jobs in August, and for the unemployment rate to hold steady at 9.1%.

Once again estimates all over the place, including more whispers of a negative headline number. This isn't surprising since the economic data for August was very weak - especially during the first couple weeks of the month as the shock of a possible U.S. government default rattled consumer and business confidence.

The BLS survey reference week includes the 12th of the month, and the 12th fell on a Friday in August - at the end of the 2nd full week and just after the economic freeze due to the D.C. debate. So even with slightly less worrisome economic reports towards the end of the month, it is possible that the headline number could be below consensus or even negative.

An added wrinkle was the labor dispute at Verizon. I've seen several estimates, but the Verizon dispute (since settled) probably reduced employment by 45,000 in August (these will be added back in September).

So these two factors, 1) a reference period right after a significant shock, and 2) the Verizon labor dispute, suggest a weak employment report.

Here is a summary of recent data:

• The ADP employment report showed an increase of 91,000 private sector payroll jobs in August. Of course ADP hasn't been very useful in predicting the BLS report. Also note that government payrolls have been shrinking by about 30,000 each month. The ADP does use the same reference week as the BLS, and this would suggest around 60,000 nonfarm payroll jobs added.

• Initial weekly unemployment claims averaged about 410,000 per week in August, down slightly from the 412,000 average in July.

• The ISM manufacturing employment index decreased to 51.8%, down from 53.5% in July. Based on a historical correlation between the ISM index and the BLS employment report for manufacturing, this reading suggests a decline of about 10,000 private payroll jobs for manufacturing in August. Note: The ISM non-manufacturing index for August will be released next Tuesday.

• The final July Reuters / University of Michigan consumer sentiment index decreased to 55.7 from 63.7 in July. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This was probably impacted by the debt ceiling debate, but in general this would suggest a weak labor market.

• And on the unemployment rate from Gallup: Gallup Finds U.S. Unemployment Up in August

Unemployment, as measured by Gallup without seasonal adjustment, is at 9.1% at the end of August -- up from 8.8% at the end of July.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. Usually the NSA unemployment rate declines in August, so this would suggest an increase in the unemployment rate.

These data further confirm Gallup's mid-month prediction that the August unemployment rate that the government will report Friday will be higher than the 9.1% it reported in July -- barring another sizable decline in the U.S. workforce or an unusual seasonal adjustment.

Because of the reference period following so soon after an economic shock, and also because of the Verizon labor dispute, I'll take the "under" on the number of jobs added (less than 67,000). I'll also take the over on the unemployment rate (I expect higher than 9.1%).

Construction Spending declined in July

by Calculated Risk on 9/01/2011 12:20:00 PM

Note on Auto Sales: Once all the reports are released, I'll post a graph of the estimated total August light vehicle sales (SAAR) - usually around 4 PM ET. The consensus is for a decrease to 12.1 million SAAR in August from 12.2 million SAAR in July. Sales in August 2010 were at a 11.44 million SAAR.

Catching up ... this morning from the Census Bureau reported that overall construction spending declined in July:

during July 2011 was estimated at a seasonally adjusted annual rate of $789.5 billion, 1.3 percent (±1.9%)* below the revised June estimate of $799.8 billion.Private construction spending decline in July:

Spending on private construction was at a seasonally adjusted annual rate of $514.5 billion, 0.9 percent (±1.1%)* below the revised June estimate of $519.0 billion. Residential construction was at a seasonally adjusted annual rate of $248.1 billion in July, 1.4 percent (±1.3%) below the revised June estimate of $251.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $266.4 billion in July, 0.4 percent (±1.1%)* below the revised June estimate of $267.3 billion.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 63% below the peak in early 2006, and non-residential spending is 36% below the peak in January 2008.

Private construction spending is mostly moving sideways, and it is public construction spending that is now declining. Note: Residential construction spending for May and June were revised up significantly.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending has turned positive, but public spending is now falling sharply as the stimulus spending ends. The improvements in private non-residential are mostly due to energy spending.