by Calculated Risk on 7/29/2011 05:39:00 PM

Friday, July 29, 2011

Bank Failures #59 & 60 in 2011: Virginia and South Carolina

A Business Bank in retreat

Crumbled capital.

by Soylent Green is People

From the FDIC: Xenith Bank, Richmond, Virginia, Assumes All of the Deposits of Virginia Business Bank, Richmond, Virginia

As of March 31, 2011, Virginia Business Bank had approximately $95.8 million in total assets and $85.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.3 million. ... Virginia Business Bank is the 59th FDIC-insured institution to fail in the nation this year, and the first in Virginia.From the FDIC: SCBT, National Association, Orangeburg, South Carolina, Assumes All of the Deposits of BankMeridian, N.A., Columbia, South Carolina

As of March 31, 2011, BankMeridian, N.A. had approximately $239.8 million in total assets and $215.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $65.4 million. ... BankMeridian, N.A. is the 60th FDIC-insured institution to fail in the nation this year, and the third in South Carolina.

HVS: Q2 Homeownership and Vacancy Rates

by Calculated Risk on 7/29/2011 02:53:00 PM

The Census Bureau released the Housing Vacancies and Homeownership report for Q2 this morning.

As Tom Lawler has been discussing (see posts at bottom), this is from a fairly small sample, and the homeownership and vacancy rates are higher than estimated in other reports (like Census 2010). This report is commonly used by analysts to estimate the excess vacant supply for housing, but it doesn't appear to be useful for that purpose.

It does show the trend, but I wouldn't rely on the absolute numbers.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate declined to 65.9%, down from 66.4% in Q1 2010.

From Tom Lawler:

The HVS has consistently overstated overall US housing vacancy rates, and consistently understated the number of US households – mainly “missing” millions of renter households – for over a decade. Census 2010 “found” 116,716,292 US households for April 1, 2010, 75,986,074 of which were owner-occupied households, and 40,730,218 of which were renter-occupied households.CR note: we will get the Census 2010 age group homeownership rates soon.

While the HVS numbers don’t “correlate” all that well, a decent “best guess” for the US homeownership rate last quarter would probably be around 64.2%, or about the same as in 1990. Given the substantial aging of the population over the last two decades, that would imply that homeownership rates for most age groups last quarter were the lowest since the 1980’s.

The HVS homeowner vacancy rate declined to 2.5% from 2.6% in Q1.

The HVS homeowner vacancy rate declined to 2.5% from 2.6% in Q1.From Lawler:

The “homeowner vacancy rate” from the HVS last quarter was 2.5%, down from 2.6% in the previous quarter but unchanged from a year ago. The HVS homeowner vacancy rate in the first half of 2010 was 2.55%, compared to the decennial Census estimate as of April 1, 2010 of 2.4%.

Lawler:

Lawler: This survey also produced an estimated rental vacancy rate last quarter of 9.2%, down from 9.7% in the previous quarter and 10.6% in the second quarter of last year. The HVS estimate of the US rental vacancy rate for the first half of 2010 was 10.6%, compared to the decennial Census estimates as of Apri1 1, 2010 of 9.2%. Last quarter’s HVS rental vacancy rate was the lowest since the third quarter of 2002.This report does suggest that the homeownership rate and vacancy rates are falling.

Here are some previous posts about some of the HVS issues by economist Tom Lawler:

• Census Bureau on Homeownership Rate: We've got “Some 'Splainin' to Do”

• Be careful with the Housing Vacancies and Homeownership report

• Lawler: Census 2010 and the US Homeownership Rate

• Lawler: Census 2010 Demographic Profile: Highlights, Excess Housing Supply Estimate, and Comparison to HVS

• Lawler: The “Excess Supply of Housing” War

• Lawler: Census Releases Demographic Profile of 12 States and DC: Confirms Bias of HVS

• Lawler: Census 2010 and Excess Vacant Housing Units

• Lawler: On Census Housing Stock/Household Data

• Lawler: Housing Vacancy Survey appears to massively overstate number of vacant housing units

• Lawler: US Households: Why Researchers / Analysts are “Confused”

GDP: Investment Contributions

by Calculated Risk on 7/29/2011 11:35:00 AM

According to the Bureau of Economic Analysis (BEA), real GDP is still below the pre-recession peak. The estimate for real GDP in Q2 (2005 dollars) is $13,270.1 billion, still 0.4% below the $13,326 billion in Q4 2007.

The following graph is constructed as a percent of the previous peak. This shows when GDP has bottomed - and when GDP has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

At the worst point, real GDP was off 5.1% from the 2007 peak. Since the most common definition of a depression is a 10%+ decline in real GDP, the 2007 recession was not a depression. Note: There is no formal definition of a depression. Some people use other definitions such as the duration below the previous peak. By that definition, using both GDP and employment, this seems like the "Lesser depression", but not by the common definition.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph is for real GDP through Q2 2011 and shows real GDP is still 0.4% below the previous pre-recession peak.

Note: There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). The BEA will release GDI with the 2nd GDP estimate.

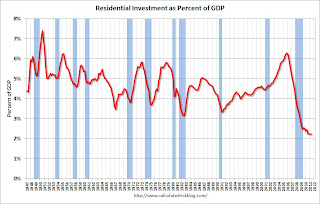

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Residential Investment (RI) made a positive contribution to GDP in Q2 2011, however the four quarter rolling average is still negative. The rolling four quarter average for RI will probably turn positive in Q3.

Residential Investment (RI) made a positive contribution to GDP in Q2 2011, however the four quarter rolling average is still negative. The rolling four quarter average for RI will probably turn positive in Q3.

Equipment and software investment has made a significant positive contribution to GDP for eight straight quarters (it is coincident).

The contribution from nonresidential investment in structures was positive in Q2. Nonresidential investment in structures typically lags the recovery, however investment in energy and power is masking weakness in office, mall and hotel investment (the underlying details will be released next week).

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

Residential Investment (RI) increased slightly in Q2, and as a percent of GDP, RI is just above the record low set last quarter.

Residential Investment (RI) increased slightly in Q2, and as a percent of GDP, RI is just above the record low set last quarter.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

I expect RI to increase in 2011 and add to both GDP and employment growth - for the first time since 2005 (even with the weak first half, this appears correct).

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

Equipment and software investment has been increasing sharply, however investment growth only increased in Q2 at a 5.7% annualized rate - the slowest rate since investment declined in Q2 2009.

Non-residential investment in structures increased in Q2, and is just above the record low. I'll add details for investment in offices, malls and hotels next week.

Earlier ...

• Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

• Real GDP still below Pre-Recession Peak, Chicago PMI declines, Consumer Sentiment Weak

Real GDP still below Pre-Recession Peak, Chicago PMI declines, Consumer Sentiment Weak

by Calculated Risk on 7/29/2011 09:55:00 AM

• From the Chicago Business Barometer™: The overall index decreased to 58.8 in July from 61.1 in June. This was below consensus expectations of 60.2. Note: any number above 50 shows expansion.

The employment index decreased to 51.5 from 58.7.

• GDP: Not only has growth slowed, but the recession was significantly worse than earlier estimates suggested. Real GDP is still not back to the pre-recession peak.

The following graph shows the current estimate of real GDP and the pre-revision estimate (blue). I'll have more later on GDP.

• The final July Reuters / University of Michigan consumer sentiment index declined slightly to 63.7 from the preliminary reading of 63.8 - and down sharply from 71.5 in June.

• The final July Reuters / University of Michigan consumer sentiment index declined slightly to 63.7 from the preliminary reading of 63.8 - and down sharply from 71.5 in June.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with lower gasoline prices, consumer sentiment declined sharply - possible because of the heavy coverage of the debt ceiling charade.

Earlier ...

• Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

by Calculated Risk on 7/29/2011 08:30:00 AM

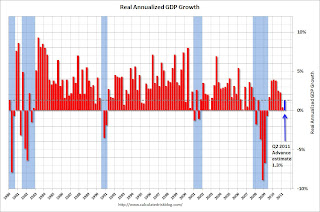

Note: This release contains a number of revisions. The recession was significantly worse than in earlier estimates. Last quarter (Q1) was revised down to just 0.4% real GDP growth.

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.3 percent in the second quarter of 2011, (that is, from the first quarter to the second quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.4 percent.The following graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q2 at 1.3% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.A few key numbers:

• Real personal consumption expenditures increased 0.1 percent in the second quarter, compared with an increase of 2.1 percent in the first.

• Investment: "Real nonresidential fixed investment increased 6.3 percent in the second quarter, compared with an increase of 2.1 percent in the first. Nonresidential structures increased 8.1 percent, in contrast to a decrease of 14.3 percent. Equipment and software increased 5.7 percent, compared with an increase of 8.7 percent. Real residential fixed investment increased 3.8 percent, in contrast to a decrease of 2.4 percent."

• Real federal government consumption expenditures and gross investment increased 2.2 percent in the second quarter, in contrast to a decrease of 9.4 percent in the first.

I'll have much more ...