by Calculated Risk on 3/25/2013 03:57:00 PM

Monday, March 25, 2013

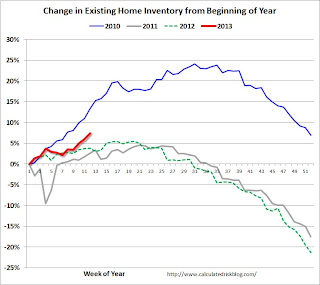

Existing Home Inventory is up 7.5% year-to-date on March 25th

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through March 25th - inventory is increasing faster than in 2011 and 2012. Housing Tracker reports inventory is down -21.2% compared to the same week in 2012 - still a rapid year-over-year decline.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 7.5% (above the peak percentage increase for 2011 and 2012) Right now I think inventory will not bottom until 2014, but it is still possible that inventory will bottom this year.

Bernanke: Central Banker policies are not "beggar-thy-neighbor"

by Calculated Risk on 3/25/2013 01:23:00 PM

This is a response to some analysts who think central bankers are currently following a "beggar-thy-neighbor" policy. Fed Chaiman Bernanke disagrees (so do I).

From Fed Chairman Ben Bernanke: Monetary Policy and the Global Economy. A few excerpts:

The uncoordinated abandonment of the gold standard in the early 1930s gave rise to the idea of "beggar-thy-neighbor" policies. According to this analysis, as put forth by important contemporary economists like Joan Robinson, exchange rate depreciations helped the economy whose currency had weakened by making the country more competitive internationally.5 Indeed, the decline in the value of the pound after 1931 was associated with a relatively early recovery from the Depression by the United Kingdom, in part because of some rebound in exports. However, according to this view, the gains to the depreciating country were equaled or exceeded by the losses to its trading partners, which became less internationally competitive--hence, "beggar thy neighbor." Over time, so-called competitive depreciations became associated in the minds of historians with the tariff wars that followed the passage of the Smoot-Hawley tariff in the United States. Both types of policies were decried--and in some textbooks, still are--as having prolonged the Depression by disrupting trade patterns while leading to an ultimately fruitless and destructive battle over shrinking international markets.

Economists still agree that Smoot-Hawley and the ensuing tariff wars were highly counterproductive and contributed to the depth and length of the global Depression. However, modern research on the Depression, beginning with the seminal 1985 paper by Barry Eichengreen and Jeffrey Sachs, has changed our view of the effects of the abandonment of the gold standard.6 Although it is true that leaving the gold standard and the resulting currency depreciation conferred a temporary competitive advantage in some cases, modern research shows that the primary benefit of leaving gold was that it freed countries to use appropriately expansionary monetary policies. By 1935 or 1936, when essentially all major countries had left the gold standard and exchange rates were market-determined, the net trade effects of the changes in currency values were certainly small. Yet the global economy as a whole was much stronger than it had been in 1931. The reason was that, in shedding the strait jacket of the gold standard, each country became free to use monetary policy in a way that was more commensurate with achieving full employment at home. Moreover, and critically, countries also benefited from stronger growth in trading partners that purchased their exports. In sharp contrast to the tariff wars, monetary reflation in the 1930s was a positive-sum exercise, whose benefits came mainly from higher domestic demand in all countries, not from trade diversion arising from changes in exchange rates.

The lessons for the present are clear. Today most advanced industrial economies remain, to varying extents, in the grip of slow recoveries from the Great Recession. With inflation generally contained, central banks in these countries are providing accommodative monetary policies to support growth. Do these policies constitute competitive devaluations? To the contrary, because monetary policy is accommodative in the great majority of advanced industrial economies, one would not expect large and persistent changes in the configuration of exchange rates among these countries. The benefits of monetary accommodation in the advanced economies are not created in any significant way by changes in exchange rates; they come instead from the support for domestic aggregate demand in each country or region. Moreover, because stronger growth in each economy confers beneficial spillovers to trading partners, these policies are not "beggar-thy-neighbor" but rather are positive-sum, "enrich-thy-neighbor" actions.

Dallas Fed: Regional Manufacturing Activity increased in March

by Calculated Risk on 3/25/2013 10:45:00 AM

From the Dallas Fed: Texas Manufacturing Activity Picks Up

Texas factory activity increased in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 6.2 to 9.9, indicating a slightly faster pace of output growth. The share of manufacturers noting a decrease in production fell to its lowest level in two years.All of the regional manufacturing surveys released so far have indicated expansion in March, and this suggests a pickup in overall manufacturing following a weak period over the last 6 to 8 months.

Other survey measures also suggested a pickup in manufacturing activity, with the new orders and shipments indexes moving up strongly in March after dipping in February. The new orders index came in at 8.7, up from 2.8, and the shipments index rose 8 points to 10.6.

Perceptions of broader business conditions improved in March. The general business activity index rose from 2.2 to 7.4, reaching its highest level in a year. The company outlook index moved up from 6.3 to 9.6.

Labor market indicators remained mixed. The employment index has been in positive territory so far in 2013 and edged up to 2.6 in March. ... The hours worked index remained slightly negative but ticked up to from –3 to –2.4.

emphasis added

Chicago Fed: "Economic Activity Improved in February"

by Calculated Risk on 3/25/2013 08:43:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Improved in February

Led by gains in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.44 in February from –0.49 in January. All four broad categories of indicators that make up the index increased from January, and three of the four categories made positive contributions to the index in February.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to +0.09 in February from +0.28 in January, marking its fourth consecutive reading above zero. February’s CFNAI-MA3 suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity improved in February, and growth was somewhat above its historical trend (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, March 24, 2013

Sunday Night Futures

by Calculated Risk on 3/24/2013 09:16:00 PM

Cyprus and the "troika" have reached a deal tonight. Reports are the euro zone finance ministers have also approved the plan. Preliminary reports are that there will be no tax on depositors, and apparently this means approval from the Cypriot Parliament is not required.

Update: Eurogroup statement: Eurogroup Statement on Cyprus

A few details from CyprusMail: Bailout deal reached

Deposits below 100,000 euros in Laiki will be transferred to Bank of Cyprus. Deposits above 100,000 euros, which under EU law are not insured, will be frozen and will be used to resolve debt. It remains unclear how large the writedown on those funds will be. Some reports suggested it might be as high as 40 per cent. Sources told Reuters that the proposal involved shifting deposits below 100,000 euros from the Popular Bank of Cyprus (also known as Laiki) to the Bank of Cyprus to create a "good bank".Monday economic releases:

• At 8:30 AM ET, Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Manufacturing Survey for March. The consensus is an increase to 3.4 from 2.2 in February (above zero is expansion).

• At 1:15 PM, Speech by Fed Chairman Ben Bernanke, Monetary Policy and the Global Economy, At the London School of Economics and Political Science, London, United Kingdom

Weekend:

• Summary for Week Ending March 22nd

• Schedule for Week of March 24th

The Asian markets opened green tonight with the Nikkei up 1.4%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 8 and Dow futures are up 70 (fair value).

Oil prices are up with WTI futures at $94.02 per barrel and Brent at $107.95 per barrel.

Reports: Cyprus Draft Deal Reached, No Details Yet

by Calculated Risk on 3/24/2013 08:10:00 PM

From CNBC: Cyprus, European Union Reach Draft Bailout Deal

Cyprus and its international lenders have reached a draft deal to rescue Cyprus, sources told CNBC.From the Peter Spiegel of the Financial Times:

No levy will be imposed on any deposits in Cypriot banks, but there will be a 'bail in' of Laiki depositors.

All Laiki deposits over €100k will be whacked. Total of haircut at BoC has not been decided.The Eurogroup still needs to meet, and then the Cyprus Parliament.

Update: CyprusMail: Bailout deal reached

Acting president Yiannakis Omirou has confirmed that a deal has been struck between Cyprus and international lenders.

Government sources suggest that the deal provides for a 30 per cent haircut on deposits of over €100,000 at Bank of Cyprus while reports said Popular Bank would be resolved.

Laiki deposits under 100,000 will be transferred to a ‘good bank,’ reports said.

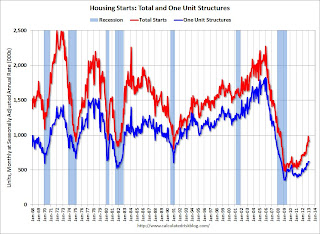

Housing Starts and the Unemployment Rate

by Calculated Risk on 3/24/2013 02:05:00 PM

By request, here is an update to a graph that I've been posting for several years. This shows single family housing starts (through February 2013) and the unemployment rate (inverted) also through February. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts moved sideways for two and a half years and only started increasing steadily near the end of 2011. This was one of the reasons the unemployment rate remained elevated.

Click on graph for larger image.

Click on graph for larger image.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover. However this time, with the huge overhang of existing housing units, this key sector didn't participate for an extended period.

The good news is single family starts have been increasing steadily for over a year, and that should mean more construction employment this year, and that the unemployment rate should decline further in 2013.

Cyprus Sunday

by Calculated Risk on 3/24/2013 09:50:00 AM

Updates at 1:45 PM ET: Meeting now scheduled for 3 PM ET. Cyprus central bank is now limiting cash withdrawals to 100 euros per day.

Cypriot President Nicos Anastasiades is in Brussels to hold talks with the "troika" and the Eurogroup meeting is scheduled to start at 1700 GMT (1 PM ET). Of course these meetings always start and run late ...

From the NY Times: As Deadline Nears, Cyprus Scrambles to Devise a Bailout

The Cypriot president, Nicos Anastasiades, flew to Brussels on Sunday after mapping out a tentative outline of a deal late Saturday with representatives of the troika of negotiators involved in the bailout: the European Central Bank, the European Commission and the International Monetary Fund.From the CyprusMail: Cyprus seeks 11th-hour deal to avert financial collapse

His first order of business was a meeting with Mario Draghi, the president of the central bank; Christine Lagarde, the managing director of the monetary fund; and José Manuel Barroso, the president of the commission. Herman Van Rompuy, the president of the European Council, which represents European Union leaders, was expected to preside over the meeting.

Mr. Anastasiades had also briefed Cypriot political leaders on the outline...

The revised bailout terms now under discussion would assess a one-time tax of 20 percent on deposits above 100,000 euros at one of the nation’s biggest banks, the Bank of Cyprus, which has the largest number of savings accounts on the island. ...

A separate tax of 4 percent would be assessed on uninsured deposits at all other banks, including the 26 foreign banks that operate in Cyprus.

Under the plan, savings under 100,000 euros would not be touched ...

Without a deal on Monday, the ECB says it will cut off emergency funds to Cypriot banks, spelling certain collapse and potentially pushing the country out of the euro zone.

Finance Ministers of the 17-nation euro zone will meet at 1700 GMT Sunday. ...

A senior Cypriot official said Nicosia had agreed with its lenders on a 20 per cent levy over and above €100,000 at the island's largest lender, Bank of Cyprus, and four per cent on deposits above the same level at other banks.

Media reports suggested talks were stuck on a demand by the IMF that Bank of Cyprus absorb the good assets of competitor Popular Bank and take on its nine billion euro debt to the central bank as well.

Saturday, March 23, 2013

Unofficial Problem Bank list declines to 797 Institutions

by Calculated Risk on 3/23/2013 05:32:00 PM

Here is the unofficial problem bank list for Mar 22, 2013.

Changes and comments from surferdude808:

As expected, a quiet week as there were only four removals from the Unofficial Problem Bank List. The removals leave the list at 797 institutions with assets of $294.3 billion. The list has not been under 800 since Friday, July 23, 2010. A year ago, the list held 949 institutions with assets of $379.8 billion.Earlier:

Actions were terminated against Saehan Bank, Los Angeles, CA ($602 million Ticker: SAEB); CIBM Bank, Champaign, IL ($471 million Ticker: CIBH); Bank of Little Rock, Little Rock, AR ($193 million); and Bank VI, Salina, KS ($65 million). In a more rare event, the Federal Reserve terminated a Prompt Corrective Action order against Bank of Bartlett, Bartlett, TN ($370 million).

Next week, we anticipate the FDIC will release its enforcement action through February 2013.

• Summary for Week Ending March 22nd

• Schedule for Week of March 24th

Schedule for Week of March 24th

by Calculated Risk on 3/23/2013 01:09:00 PM

Earlier:

• Summary for Week Ending March 22nd

The key reports this week are the February New Home sales report on Tuesday, Case-Shiller house prices for January, also on Tuesday, the February Personal Income and Outlays report on Friday, and the third estimate of Q4 GDP on Thursday.

Fed Chairman Ben Bernanke will speak on Monday at the London School of Economics.

Also, for manufacturing, the Dallas, Richmond and Kansas City Fed surveys for March will be released this week.

Note: the ECB deadline for Cyprus is Monday evening.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for March. The consensus is an increase to 3.4 from 2.2 in February (above zero is expansion).

1:15 PM: Speech by Fed Chairman Ben Bernanke, Monetary Policy and the Global Economy, At the London School of Economics and Political Science, London, United Kingdom

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 3.5% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January.

9:00 AM: S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through December 2012 (the Composite 20 was started in January 2000).

The consensus is for a 8.2% year-over-year increase in the Composite 20 index (NSA) for January. The Zillow forecast is for the Composite 20 to increase 8.0% year-over-year, and for prices to increase 0.8% month-to-month seasonally adjusted.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the January sales rate.

The consensus is for a decrease in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 437 thousand in January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March. The consensus is for a reading of 5.5 for this survey, down from 6.0 in February (Above zero is expansion).

10:00 AM: Conference Board's consumer confidence index for March. The consensus is for the index to decrease to 69.0.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: Pending Home Sales Index for February. The consensus is for a 0.7% decrease in this index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 340 thousand from 336 thousand last week. The "sequester" budget cuts might start impacting weekly claims soon.

8:30 AM: Q4 GDP (third estimate). This is the third estimate of GDP from the BEA. The consensus is that real GDP increased 0.6% annualized in Q4, revised up from 0.1% in the second estimate.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a decrease to 56.1, down from 56.8 in February.

11:00 AM: Kansas City Fed regional Manufacturing Survey for March. The consensus is for a reading of minus 3, up from minus 10 in February (below zero is contraction).

SIFMA recommends 2:00 PM market close on Thursday in observance of the Good Friday Holiday.

Note: Markets Closed in observance of the Good Friday Holiday.

8:30 AM ET: Personal Income and Outlays for February. The consensus is for a 0.9% increase in personal income in February (following the sharp increase in December due to some people taking income early to avoid higher taxes, and then the sharp decline in January), and for 0.6% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for March). The consensus is for a reading of 72.5.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for February 2013

Summary for Week ending March 22nd

by Calculated Risk on 3/23/2013 08:11:00 AM

The major story this week was the ongoing crisis in Cyprus. There will be further developments this weekend with a Monday deadline (the ECB will not provide liquidity to Cyprus banks after Monday, without an "EU/IMF programme in place"). The resolution is unclear and anything could happen, although it seems likely that Cyprus will remain in eurozone and receive a bailout - and that large depositors (over €100,000) will take significant losses.

The events in Cyprus are a reminder that there are downside risks to the economy, with the two most obvious risks being Europe and overly restrictive US fiscal policy. Otherwise the economy appears to be improving.

This was another week of solid economic data. Housing starts were up again, and are now up 27.7% year-over-year. Even with the strong increase in starts, total housing starts are still historically very low suggesting more growth over the next few years.

The existing home sales report was solid too with a strong increase in conventional sales. Inventory is still falling sharply on a year-over-year basis, but it appears the year-over-year decline may be slowing (inventory is very low right now).

Other positive data included an increase in the Architecture Billings Index (leading indicator for commercial real estate) that was at the highest level since 2007, and a decrease in the 4-week average of initial weekly unemployment claims - at the lowest level since February 2008. It is a good sign when indicators are the highest in years (or lowest in years for negative indicators like unemployment claims). Even manufacturing showed signs of life in the New York and Philly Fed manufacturing surveys.

The sequestration budget cuts will probably start slowing the economy soon, but right now the economy is clearly improving.

Here is a summary of last week in graphs:

• Housing Starts increased to 917 thousand SAAR in February

Click on graph for larger image.

Click on graph for larger image.

From the Census Bureau: "Privately-owned housing starts in February were at a seasonally adjusted annual rate of 917,000. This is 0.8 percent above the revised January estimate of 910,000 and is 27.7 percent above the February 2012 rate of 718,000.

Single-family housing starts in February were at a rate of 618,000; this is 0.5 percent above the revised January figure of 615,000. The February rate for units in buildings with five units or more was 285,000."

This was at expectations of 919 thousand starts in February. Starts in February were up 27.7% from February 2012; single family starts were up 31.5% year-over-year. Starts in December and January were revised up, and permits were strong. This was another solid report.

• Existing Home Sales in February: 4.98 million SAAR, 4.7 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2013 (4.98 million SAAR) were 0.8% higher than last month, and were 10.2% above the February 2012 rate.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 19.2% year-over-year in February from February 2012. This is the 24th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).

Inventory decreased 19.2% year-over-year in February from February 2012. This is the 24th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).Months of supply increased to 4.7 months in February.

This was close to expectations of sales of 5.01 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• AIA: Architecture Billings Index increases, Strongest Growth since 2007

From AIA: Architecture Billings Index Continues to Improve at a Healthy Pace "The American Institute of Architects (AIA) reported the February ABI score was 54.9, up slightly from a mark of 54.2 in January. This score reflects a strong increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.8, higher than the reading of 63.2 the previous month – and its highest mark since January 2007."

From AIA: Architecture Billings Index Continues to Improve at a Healthy Pace "The American Institute of Architects (AIA) reported the February ABI score was 54.9, up slightly from a mark of 54.2 in January. This score reflects a strong increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.8, higher than the reading of 63.2 the previous month – and its highest mark since January 2007."This graph shows the Architecture Billings Index since 1996.

Every building sector is now expanding and new project inquiries are strongly positive (highest since January 2007). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for seven consecutive months and suggests some increase in CRE investment in the second half of 2013.

• Weekly Initial Unemployment Claims increase to 336,000

The DOL reports "In the week ending March 16, the advance figure for seasonally adjusted initial claims was 336,000, an increase of 2,000 from the previous week's revised figure of 334,000. The 4-week moving average was 339,750, a decrease of 7,500 from the previous week's revised average of 347,250."

The DOL reports "In the week ending March 16, the advance figure for seasonally adjusted initial claims was 336,000, an increase of 2,000 from the previous week's revised figure of 334,000. The 4-week moving average was 339,750, a decrease of 7,500 from the previous week's revised average of 347,250."

The previous week was revised up from 332,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 339,750 - this is the lowest level since early February 2008.

Weekly claims were below the 340,000 consensus forecast. Note: Claims might increase over the next few months due to the "sequestration" budget cuts, but right now initial unemployment claims suggest an improving labor market.

• Philly Fed Manufacturing Survey Shows Expansion in March

From the Philly Fed: March Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of -12.5 in February to 2.0 this month ... The new orders index increased from a reading of -7.8 in February to 0.5, its first positive reading in three months."

From the Philly Fed: March Manufacturing Survey "The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of -12.5 in February to 2.0 this month ... The new orders index increased from a reading of -7.8 in February to 0.5, its first positive reading in three months."

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

The average of the Empire State and Philly Fed surveys increased in March, and is back above zero. This suggests the ISM manufacturing index will show further expansion in March.

Friday, March 22, 2013

Cyprus: Bank Resolution Bills Passed, Vote Saturday on Tax on uninsured deposits

by Calculated Risk on 3/22/2013 09:05:00 PM

From the NY Times: Cyprus Passes Parts of Bailout Bill, but Delays Vote on Tax

Lawmakers took steps late Friday to revise a formula for obtaining a bailout of Cyprus’s banks but faced strong signals that the plan would not pass muster with international lenders.There will be additional votes tomorrow, and a meeting with the Eurogroup on Sunday.

The Parliament put off until later this weekend a vote on a crucial new proposal that would confiscate 22 to 25 percent of uninsured deposits above 100,000 euros through a new tax on account holders in one of the nation’s most troubled banks.

From the WSJ: Cyprus Adopts Bank Overhaul Plan

[T]he Parliament in Nicosia passed two key bills that would allow it to close down its second largest bank, Popular Bank of Cyprus, and aggressively curtail the free flow of money on the island. The bank restructuring law would see depositors in Popular Bank, also known as Laiki Bank, to lose as much as 40% of their savings above €100,000 ... As details of the latest plan emerged late Friday, there were signs that the country may be forced to also resolve Bank of Cyprus, its biggest lender. ...Additional resources:

[T]he government in Nicosia had proposed to levy a 20% tax on depositors with more than €100,000 in their accounts in Bank of Cyprus. The government hoped that would allow them to protect the lender ... But senior European finance-ministry officials in a call Friday evening expressed doubts that the plan would raise enough money to ring fence the lender ...

The Telegraph: Cyprus bail-out: live

The CyprusMail: Cyprus Crisis Update, Friday March 22nd

DOT: Vehicle Miles Driven increased 0.5% in January

by Calculated Risk on 3/22/2013 05:50:00 PM

The Department of Transportation (DOT) reported:

Based on preliminary reports from the State Highway Agencies, travel during January 2013 on all roads and streets in the nation changed by +0.5 percent (1.2 billion vehicle miles) resulting in estimated travel for the month at 226.9 billion vehicle-miles.The following graph shows the rolling 12 month total vehicle miles driven.

This total includes 71.6 billion vehicle-miles on rural roads and 155.3 billion vehicle-miles on urban roads and streets.

Traffic was up slightly in all regions. The rolling 12 month total is still moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 62 months - over 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were down in January compared to January 2012. In January 2013, gasoline averaged of $3.39 per gallon according to the EIA. In 2012, prices in January averaged $3.44 per gallon. However prices spiked in February, and that will probably impact miles driven in the next monthly report.

Gasoline prices were down in January compared to January 2012. In January 2013, gasoline averaged of $3.39 per gallon according to the EIA. In 2012, prices in January averaged $3.44 per gallon. However prices spiked in February, and that will probably impact miles driven in the next monthly report.However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

Lawler: The “Strange Case” of the NAR’s Regional Existing Condo/Co-op Sales

by Calculated Risk on 3/22/2013 02:57:00 PM

From economist Tom Lawler:

The National Association of Realtors estimated that existing home sales ran at a seasonally adjusted annual rate of 4.98 million in February, up 0.8% from January’s upwardly-revised (to 4.94 million from 4.92 million, though unadjusted sales were not revised) pace. While the NAR’s estimate was slightly below consensus, it was above my estimate based on regional tracking – mainly, it appears, because of a “most strange” surge in condo/co-op sales in the South not reflected in local realtor reports.

The NAR estimated that existing SF home sales ran at a SAAR of 4.36 million in February, down 0.3% from January’s pace – an estimate that seems broadly consistent with regional realtor/MLS reports. In sharp contrast, the NAR estimated that existing condo/co-op sales ran at a SAAR of 620,000, up 8.8% from January’s pace – with condo/co-op sales on the South purportedly up 20.8% on a seasonally adjusted basis on the month, and up 29.4% on an unadjusted basis from last February’s pace. This gain seems especially suspect given that Florida Realtors (formerly the Florida Association of Realtors) reported that existing condo and townhome sales by realtors in Florida (the “condo capital” of the South) in February were up only 7.0% from last February’s pace! Quite frankly, the NAR’s estimates for existing condo/co-op sales don’t “smell” right.

Below is a table showing historical estimates of regional existing condo/co-op sales from the NAR, expressed as a seasonally adjusted annual rate. Note all the periods where seasonally adjusted sales in a region were exactly the same for at least three consecutive months.

As the table indicates, seasonally-adjusted sales show periods of remarkable stability in all four regions – partly, of course, because the NAR rounds seasonally adjusted sales to the nearest 10,000 (and unadjusted sales to the nearest thousand), which seems like “excessive” rounding. E.g., if “unrounded” condo/co-op sales on a seasonally adjusted annual rate basis in the Midwest went from 45,100 to 54,500 -- a 20.8% jump – sales rounded to the nearest 10,000 would show sales as being flat!). Conversely, if unrounded

SAAR sales went from 54,500 to 55,100 – 1.1% increase – SAAR sales rounded to the nearest 10,000 would jump from 50,000 to 60,000, a 20% gain! According to the NAR, existing condo/co-op sales in the Midwest ran at a SAAR of 50,000 in ten of the 12 months of 2011.

When the NAR released its “rebenchmarking” of existing home last year, there were “astonishingly” big revisions in regional sales of existing condos and co-ops – suggesting either issues with the rebenchmarking, some serious issues with its previous methodology or both.

NAR estimates for existing condo/co-op sales only go back to 1999, and it first published monthly estimates in 2005.

| Year | Month | Northeast | Midwest | South | West |

|---|---|---|---|---|---|

| 2010 | Jan | 100,000 | 60,000 | 200,000 | 130,000 |

| Feb | 110,000 | 70,000 | 210,000 | 140,000 | |

| Mar | 110,000 | 50,000 | 200,000 | 140,000 | |

| Apr | 130,000 | 60,000 | 210,000 | 140,000 | |

| May | 100,000 | 60,000 | 230,000 | 150,000 | |

| Jun | 100,000 | 60,000 | 210,000 | 130,000 | |

| Jul | 80,000 | 40,000 | 170,000 | 100,000 | |

| Aug | 90,000 | 40,000 | 190,000 | 110,000 | |

| Sept | 80,000 | 40,000 | 190,000 | 110,000 | |

| Oct | 90,000 | 50,000 | 180,000 | 110,000 | |

| Nov | 90,000 | 50,000 | 210,000 | 110,000 | |

| Dec | 100,000 | 50,000 | 220,000 | 130,000 | |

| 2011 | Jan | 100,000 | 60,000 | 250,000 | 150,000 |

| Feb | 100,000 | 50,000 | 210,000 | 130,000 | |

| Mar | 90,000 | 50,000 | 240,000 | 130,000 | |

| Apr | 80,000 | 50,000 | 220,000 | 130,000 | |

| May | 110,000 | 50,000 | 200,000 | 120,000 | |

| Jun | 100,000 | 50,000 | 190,000 | 120,000 | |

| Jul | 70,000 | 50,000 | 210,000 | 110,000 | |

| Aug | 120,000 | 50,000 | 200,000 | 130,000 | |

| Sept | 100,000 | 50,000 | 210,000 | 130,000 | |

| Oct | 80,000 | 50,000 | 210,000 | 130,000 | |

| Nov | 70,000 | 60,000 | 210,000 | 120,000 | |

| Dec | 100,000 | 50,000 | 200,000 | 130,000 | |

| 2012 | Jan | 100,000 | 60,000 | 210,000 | 140,000 |

| Feb | 100,000 | 60,000 | 220,000 | 130,000 | |

| Mar | 100,000 | 60,000 | 210,000 | 130,000 | |

| Apr | 110,000 | 60,000 | 210,000 | 130,000 | |

| May | 100,000 | 60,000 | 220,000 | 130,000 | |

| Jun | 90,000 | 60,000 | 220,000 | 110,000 | |

| Jul | 100,000 | 60,000 | 220,000 | 130,000 | |

| Aug | 110,000 | 70,000 | 240,000 | 130,000 | |

| Sept | 110,000 | 70,000 | 250,000 | 130,000 | |

| Oct | 110,000 | 70,000 | 250,000 | 130,000 | |

| Nov | 110,000 | 80,000 | 280,000 | 130,000 | |

| Dec | 110,000 | 70,000 | 250,000 | 140,000 | |

| 2013 | Jan | 110,000 | 80,000 | 240,000 | 140,000 |

| Feb p | 110,000 | 80,000 | 290,000 | 140,000 |

Cyprus Update

by Calculated Risk on 3/22/2013 11:20:00 AM

It is after 5 PM in Cyprus and Parliament is expected to vote soon ... on something.

From the Telegraph: Cyprus bail-out: live

[H]ere's what we think that proposal might look like, based on reports and rumours from journalists on the ground.And from the CyprusMail: Cyprus Crisis Update, Friday March 22nd

Laiki Bank - the island's second largest lender - is wound down. Depositors' first €100,000 are hived into the Bank of Cyprus. Everything else is put into a bad bank, and sold off, likely at a 20pc to 40pc discount. ... According to information on the spread of deposits, a 9.46pc levy - lower than the 9.9pc proposed in the Eurogroup's original plan - on deposits over €100,000 would do the trick.

Under such an arrangement, the biggest losers would be those with deposits over €100,000 in Laiki Bank, who could be charged a 9.46pc levy and have any deposit over €100,000 swallowed into the 'bad bank' and sold off at a discount, losing as much as 40pc of its value. ...

Does this mean the Bank of Cyprus is safe? For now, yes. But as we have seen from the draft banking bill, the government wants to give the Cypriot central bank powers to restructure any bank as it sees necessary- the ominous "any other measure" clause that blogger Yiannis Mouzakis helpfully translated from the Greek.

Not to mention the draconian capital controls included in the draft bill, among which are compulsory renewal of all time savings deposits upon maturity, conversion of current accounts to time deposits, ban or restrictions on non cash transactions.

A solution to Cyprus’ bailout crisis within the framework set down by the European Union may be possible within "the next few hours", the ruling DISY deputy leader Averof Neophytou said.

"There is cautious optimism that in the next few hours we may be able to reach an agreed platform so parliament can approve these specific measures which will be consistent with the approach, the framework and the targets agreed at the last Eurogroup," Neophytou told reporters.

Hotels: Occupancy Rate near pre-recession levels

by Calculated Risk on 3/22/2013 09:28:00 AM

Another update on hotels from HotelNewsNow.com: STR: US results for week ending 16 March

In year-over-year comparisons, occupancy was up 1.4 percent to 66.6 percent, average daily rate rose 4.5 percent to US$112.05 and revenue per available room increased 5.9 percent to US$74.66.The 4-week average of the occupancy rate is close to normal levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2013, yellow is for 2012, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

The occupancy rate will increase seasonal over the next few weeks and then move sideways until summer vacation travel starts. This occupancy rate has improved from the same period last year - and is close to pre-recession levels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Thursday, March 21, 2013

Cyprus Parliament expected to vote on new plan Friday

by Calculated Risk on 3/21/2013 10:15:00 PM

Two more articles:

From the NY Times: Mood Darkens in Cyprus as Deadline Is Set for Bailout

President Nicos Anastasiades presented Parliament on Thursday with a plan that scrapped a controversial tax on bank deposits.From the WSJ: Clock Ticks on Cyprus

...

The central bank said the new package included “consolidation measures” to enable Cyprus Popular Bank, also known as Laiki Bank, to continue operating.

As the country’s most troubled lender, it would be reorganized by placing underperforming loans and questionable assets into a so-called bad bank and transferring healthy assets to the Bank of Cyprus, the nation’s largest financial institution. ...

But the central bank warned that if Parliament failed to pass the measure, “Laiki will default immediately, causing major consequences to its employees and its clients.”

Lawmakers will also vote on restrictions on taking cash out of banks and out of the country, known as capital controls, when the banks reopen. ...

The central bank said on Thursday that Cyprus had until Monday to reach an agreement ... the group of 17 finance ministers whose countries use the euro issued a statement declaring themselves “conditionally satisfied” with most of the new proposal, which the so-called troika of lenders ... is to assess on Friday after the Parliament vote.

emphasis added

Cyprus ... readied a plan that would restructure its second-largest lender and enforce unprecedented restrictions on financial transactions.

The proposals, if they take effect, would allow authorities to restrict noncash transactions, curtail check cashing, limit withdrawals and even convert checking accounts into fixed-term deposits when banks reopen. ...

Parliament is set to debate the measures on Friday. If Cyprus can't pass them, it could find itself with little choice but to leave the euro zone ...

Lumber Prices up Sharply, Suppliers Scramble to Keep Up

by Calculated Risk on 3/21/2013 06:13:00 PM

From the WSJ: Amid Housing Recovery, Humble Plywood Shines Anew

Growing demand and tight supplies have pushed up plywood prices by 45% in the past year, and U.S. producers are scrambling to get back up to speed after slashing output of the basic construction material during the housing bust.

Georgia-Pacific, the largest U.S. producer of plywood, will announce Friday it plans to invest about $400 million over the next three years to boost softwood plywood and lumber capacity by 20%.

...

With demand rising, the composite price for structural panels, which includes plywood and other wood products, jumped to $511 per thousand square feet on March 15 this year, up 45% from $351 in mid-March a year ago, according to Random Lengths, a Eugene, Ore., wood-products market reporting service.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows two measures of lumber prices (not plywood): 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Lumber prices are now at 2004 and 2005 levels. Demand is far below the levels during the housing bubble, but supply has fallen sharply too.

Cyprus Update

by Calculated Risk on 3/21/2013 04:06:00 PM

A few articles on Cyprus:

First, the deadline from the ECB: Governing Council decision on Emergency Liquidity Assistance requested by the Central Bank of Cyprus

The Governing Council of the European Central Bank decided to maintain the current level of Emergency Liquidity Assistance (ELA) until Monday, 25 March 2013.From the Financial Times: Cyprus targets big depositors in bank plan

Thereafter, Emergency Liquidity Assistance (ELA) could only be considered if an EU/IMF programme is in place that would ensure the solvency of the concerned banks.

Cyprus announced plans on Thursday to overhaul the island’s banking industry, including forcing big depositors to accept losses on their accounts ... “The banking system needs restructuring otherwise it will go bankrupt and it needs to be done immediately,” said Panicos Demetriades, governor of the Central Bank of Cyprus. Deposits up to €100,000 would be guaranteed and bank jobs would be safeguarded, he added.From Alphaville: Taxi for Laiki

Excerpt with permission

And live updates from the Telegraph: Cyprus bail-out: live

Philly Fed Manufacturing Survey Shows Expansion in March

by Calculated Risk on 3/21/2013 01:57:00 PM

Catching up ... earlier from the Philly Fed: March Manufacturing Survey

Manufacturers responding to the March Business Outlook Survey reported slight increases in business activity this month. Indicators for general activity and new orders increased notably, following negative readings over the previous two months. Indicators for shipments and employment remained positive and improved slightly this month. Changes in the surveyʹs broad indicators of future activity were mixed but continued to reflect general optimism about growth over the next six months.Last week, the Empire State manufacturing survey also indicated expansion in March.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of -12.5 in February to 2.0 this month ... The new orders index increased from a reading of -7.8 in February to 0.5, its first positive reading in three months.

The employment index increased from 0.9 in February to 2.7 this month, its second consecutive positive reading.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

The average of the Empire State and Philly Fed surveys increased in March, and is back above zero. This suggests the ISM manufacturing index will show further expansion in March.