by Calculated Risk on 9/03/2010 04:12:00 PM

Friday, September 03, 2010

Rail Traffic increases 5.7% in August compared to August 2009

From the Association of American Railroads: Rail Time Indicators. The AAR reports traffic in August 2010 was up 5.7% compared to August 2009 - and traffic was 11.6% lower than in August 2008.

However traffic declined 1.6% from July on a Seasonally Adjusted (SA) basis.

This graph shows U.S. average weekly rail carloads (NSA). Traffic increased in 16 of 19 major commodity categories year-over-year.

From AAR:

• U.S. freight railroads originated 1,179,447 carloads in August 2010, an average of 294,862 carloads per week. That’s up 5.7% from August 2009 though down 11.6% from August 2008 on a non-seasonally adjusted basis. It’s also the highest weekly average for any month since November 2008 and reverses a string of three straight months in which average unadjusted carloads fell in absolute terms.As the graph above shows, rail traffic collapsed in November 2008, and now, a year into the recovery, traffic has only recovered part way.

• However, on a seasonally adjusted basis, U.S. rail carloads fell 1.6% in August 2010 from July 2010. As the chart below ... shows, on an unadjusted basis rail traffic almost always increases from July to August. In that chart, note the upward slope of the line segment from July 2010 to August 2010. That slope is not as steep as the line segments for the same period in most other years on the graph, or for most prior years not shown on the chart. In a nutshell, that explains why seasonally adjusted rail traffic in August 2010 is down a bit when unadjusted traffic is up.

excerpts with permission

Employment Diffusion Indices

by Calculated Risk on 9/03/2010 02:03:00 PM

A few more comments:

Click on graph for larger image.

Click on graph for larger image.The BLS diffusion index for total private employment declined to 53.0 from 56.7 in July. For manufacturing, the diffusion index declined to 47.0 from 53.0 in July, and down sharply from 67.1 in April.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The increases in the diffusion indices in 2009 and earlier this year, was a clear positive in the monthly employment reports. However the decrease in the diffusion indices over the last few months (falling below 50% for manufacturing in August), is disappointing.

Earlier employment posts today (with many graphs):

ISM Non-Manufacturing Index declines in August

by Calculated Risk on 9/03/2010 11:23:00 AM

Earlier employment posts:

The August ISM Non-manufacturing index was at 51.5%, down from 54.3% in July - and below expectations of 53.0%. The employment index showed contraction in August at 48.2%. Note: Above 50 indicates expansion, below 50 contraction.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

The overall ISM index, and the employment index, are both at the lowest level since January.

From the Institute for Supply Management: August 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the eighth consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 51.5 percent in August, 2.8 percentage points lower than the 54.3 percent registered in July, indicating continued growth in the non-manufacturing sector but at a slower rate. The Non-Manufacturing Business Activity Index decreased 3 percentage points to 54.4 percent, reflecting growth for the ninth consecutive month, but at a slower rate than in July. The New Orders Index decreased 4.3 percentage points to 52.4 percent, and the Employment Index decreased 2.7 percentage points to 48.2 percent, reflecting contraction after one month of growth.

emphasis added

Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 9/03/2010 09:50:00 AM

Here are a few more graphs based on the employment report ...

Percent Job Losses During Recessions, aligned at Bottom Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the bottom of the recession (Both the 1991 and 2001 recessions were flat at the bottom, so the choice was a little arbitrary).

The dotted line shows the impact of Census hiring. In August, there were only 82,000 temporary 2010 Census workers still on the payroll. The number of Census workers will continue to decline - and the remaining gap between the solid and dashed red lines will be gone soon.

Employment-Population Ratio

The Employment-Population ratio increased to 58.5% in August from 58.4% in July.  This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate increased to 64.7% from 64.6% in July. This is the percentage of the working age population in the labor force. This increase was mostly because of the an increase in the teen participation rate (related to the very weak teen participation rate during the summer). The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.

As the employment picture improves, people will return to the labor force, and that will put upward pressure on the unemployment rate.

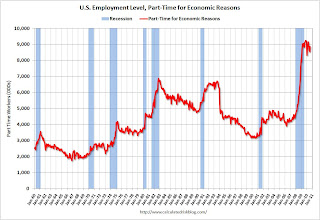

Part Time for Economic Reasons  From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) increased by 331,000 over the month to 8.9 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) was at 8.9 million in August. This increase was bad news.

The all time record of 9.24 million was set in October 2009.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.7% in August from 16.5% in July.

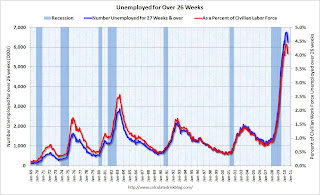

Unemployed over 26 Weeks

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are 6.249 million workers who have been unemployed for more than 26 weeks and still want a job. This is 4.1% of the civilian workforce. It appears the number of long term unemployed has peaked ... hopefully not because people are giving up.

Summary

The underlying details of the employment report were mixed. The positives: the upward revisions to the June and July reports, a slight increase in hours worked for manufacturing employees (flat for all employees), an increase in hourly wages, and the decrease in the long term unemployed. Other positives include the slight increase in the employment-population ratio and the participation rate.

The negatives include the hiring of only 60,000 ex-Census, the increase in the unemployment rate (including U-6), and the increase in part time workers for economic reasons.

Overall this was a weak report and is consistent with a sluggish recovery.

Earlier employment post today:

August Employment Report: 60K Jobs ex-Census, 9.6% Unemployment Rate

by Calculated Risk on 9/03/2010 08:30:00 AM

From the BLS:

Nonfarm payroll employment changed little (-54,000) in August, and the unemployment rate was about unchanged at 9.6 percent, the U.S. Bureau of Labor Statistics reported today. Government employment fell, as 114,000 temporary workers hired for the decennial census completed their work. Private-sector payroll employment continued to trend up modestly (+67,000).Census 2010 hiring decreased 114,000 in August. Non-farm payroll employment increased 60,000 in July ex-Census.

Both June and July payroll employment were revised up. "June was revised from -221,000 to -175,000, and the change for July was revised from -131,000 to -54,000."

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate vs. recessions.

Nonfarm payrolls decreased by 54 thousand in August. The economy has gained 229 thousand jobs over the last year, and lost 7.6 million jobs since the recession started in December 2007.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).The dotted line is ex-Census hiring. The two lines have almost joined since the decennial Census hiring is almost over.

For the current employment recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

This is another weak report, however the upwards revisions to June and July were a positive. The participation rate increased slightly - and that is good news - but the unemployment rate also increased. I'll have much more soon ...

Update: For more, see: Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

Thursday, September 02, 2010

Krugman: On Inflation and Interest Rates

by Calculated Risk on 9/02/2010 11:46:00 PM

From Paul Krugman in the NY Times: The Real Story

... When Mr. Obama first proposed $800 billion in fiscal stimulus, there were two groups of critics. Both argued that unemployment would stay high — but for very different reasons.The second half slowdown arrived right on schedule (maybe a month early). And there is no question who was correct on inflation and interest rates.

One group — the group that got almost all the attention — declared that the stimulus was much too large, and would lead ... to skyrocketing interest rates and soaring inflation.

The other group, which included yours truly, warned that the plan was much too small given the economic forecasts then available. ... Critics in the second camp were particularly worried about what would happen this year, since the stimulus would have its maximum effect on growth in late 2009 then gradually fade out. Last year, many of us were already warning that the economy might stall in the second half of 2010.

But now what? Unemployment is still too high ...

Employment Report Preview

by Calculated Risk on 9/02/2010 08:30:00 PM

1) The consensus is for a headline payroll number of minus 90,000 and for the unemployment rate to increase to 9.6% in August from 9.5% in July.

Goldman Sachs is forecasting a minus 125,000 headline payroll number, with no change in private employment and minus 115,000 decline in decennial Census employment. That gives a negative 10,000 ex-Census.

2) My estimate is the decennial Census workforce was reduced by 116,000 in August. This suggests a consensus headline payroll number of +26,000 ex-Census (see point 4). I'll take the under on payroll employment ex-Census.

3) The unemployment rate is dependent on both job creation and the participation rate (both numbers from the household survey - payroll employment is from the establishment survey).

Usually the participation rate - the percent of the civilian population in the labor force - falls when the job market is weak. And a decline in the participation rate puts downward pressure on the unemployment rate (and the opposite is true when the participation rate increases). For technical reasons, there is a possibility that the participation rate increased in August - even with weak job creation - putting upward pressure on the unemployment rate.

4) And here is an easy prediction: there will be some confusion about which payroll number to report!

Here is an excerpt from a employment report preview story from CNBC:

Investors are likely to focus on the private payrolls number, analysts said, given that overall payrolls data is expected to have been influenced by the loss of government census hiring, among other factors.What "other factors"? The reason everyone has switched to the private payroll number is because of the hiring and layoffs associated with the decennial Census. But this misses any local and state government layoffs (kind of a big story right now).

Reporting that is consistent with non-decennial Census employment reports is to lead with the headline payroll number ex-Census. What has confused some people (I think) is that the Census hiring and layoffs is Not Seasonally Adjusted (NSA), and the headline number is SA. Usually it is not appropriate to mix NSA and SA numbers, but this is a rare exception.

I checked with the BLS, and I even submitted it as a question when the BLS had their first live chat back in March:

9:34 Michele Walker (BLS-CES) -Oh well ... this will be the last big change in decennial Census employment.

Submitted via email from Bill: Hi. The headline payroll number is seasonally adjusted, and the hiring for the 2010 Census is NSA. How would you suggest adjusting for the 2010 Census hiring to determine the underlying trend (not counting the snow storms!)?

Thanks for your question Bill.

There is an adjustment made for the 2010 Census. Before seasonally adjusting the estimates, BLS makes a special modification so that the Census workers do not influence the calculation of the seasonal factors. Specifically, BLS subtracts the Census workers from the not-seasonally adjusted estimates before running seasonal adjustment using X-12. After the estimates have been seasonally adjusted, BLS adds the Census workers to the seasonally adjusted totals. Therefore, to determine the underlying trend of the total nonfarm (TNF) employment estimates (minus the Census workers), simply subtract the Census employment from the seasonally adjusted TNF estimate.

Realtors, Builders oppose another Housing Tax Credit

by Calculated Risk on 9/02/2010 05:09:00 PM

A couple of quotes from Kathleen Pender at the San Francisco Chronicle: Little support for new home-buyer tax credit

"We are not advocating another one. We think it's important for the market to have time to recover on its own," says Walter Molony, spokesman for the National Association of Realtors.And HUD Secretary Shaun Donovan said yesterday, via Reuters: No talk of new homebuyer tax credit

...

"From a political standpoint, with Congress not wanting to increase the debt, it would be too expensive," [Bernard Markstein, senior economist with the National Association of Home Builders] says. "In terms of advisable, we are bordering on where tax credits become ineffective."

"It is not high on anyone's list that we have heard. We have not heard Congress talking about renewing it," Housing and Urban Development Secretary Shaun Donovan said in response to a reporter's question about a possible tax credit renewal.

Hotel Occupancy Rate: Just below 2008 Levels

by Calculated Risk on 9/02/2010 02:30:00 PM

Hotel occupancy is one of several industry specific indicators I follow ...

From HotelNewsNow.com: STR: Chain scales report weekly increases

Overall, the industry’s occupancy increased 10.6% to 60.1%, ADR rose 2.4% to US$96.50, and revenue per available room increased 13.2% to US$57.98.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 7.9% compared to last year (the worst year since the Great Depression) and 3.9% below the median for 2000 through 2007.

The occupancy rate is just below the levels of 2008 - but 2008 was a tough year for the hotel industry!

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Greece: Default Probabilities before and after policy response

by Calculated Risk on 9/02/2010 12:18:00 PM

Here is a graph from the Council of Foreign Relations blog: Greek Debt Crisis – Apocalypse Later Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph from Paul Swartz at the CFR shows the default probabilities on three different dates:

On April 30th, no European plan was yet in place to address the ballooning Greek debt, and default was considered a real possibility in the short term. On May 11th, just after the European Stabilization Mechanism (ESM) was announced, markets sharply cut their view on the odds of default across all time horizons. ... On September 1st, the market’s view of the probability of default within two years was lower than before the ESM was announced, but higher over longer time frames.So initially the policy response lowered the default probabilities across all time frames (from red to light blue), but now - after further analysis - the default probabilities have increased for longer time frames (green).

Pending Home Sales increase in July

by Calculated Risk on 9/02/2010 10:00:00 AM

From the NAR: Pending Home Sales Rise

The Pending Home Sales Index ... rose 5.2 percent to 79.4 based on contracts signed in July from a downwardly revised 75.5 in June, but remains 19.1 percent below July 2009 when it was 98.1. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This suggests a small increase in existing home sales in September (reported when transactions close), but this also suggests double digit months of supply for some time.

Lawrence Yun, NAR chief economist, cautioned that there would be a long recovery process. “Home sales will remain soft in the months ahead ..."

Weekly initial unemployment claims decline slightly

by Calculated Risk on 9/02/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Aug. 28, the advance figure for seasonally adjusted initial claims was 472,000, a decrease of 6,000 from the previous week's revised figure of 478,000. The 4-week moving average was 485,500, a decrease of 2,500 from the previous week's revised average of 488,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 2,500 to 485,500.

Claims for last week were revised up from 473,000 to 478,000. So the level this week is about the same as initially reported last week.

The current level of the 4-week average suggests a weak job market.

Wednesday, September 01, 2010

Personal Bankruptcy Filings: Down from July, Up from August 2009

by Calculated Risk on 9/01/2010 06:54:00 PM

Note: The number of filings is volatile month to month - and August is frequently a bit lower than July.

From the American Bankruptcy Institute: August Consumer Bankruptcy Filings fall 8 Percent this Month

The 127,028 consumer bankruptcies filed in August represented a 8 percent decrease nationwide over the 137,698 filings recorded in July 2010, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). Though a decrease from the previous month, NBKRC’s data also showed that the August 2010 consumer filings represented a 6 percent increase from the 119,874 consumer filings recorded in August 2009. ...

“While monthly filings are volatile, consumer bankruptcies are still the highest they have been since Congress overhauled the bankruptcy law in 2005,” said ABI Executive Director Samuel J. Gerdano. “Consumer filings remain on track to top 1.6 million filings in 2010.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

In 2005 the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted. Since then the number of bankruptcy filings has increased steadily.

U.S. Light Vehicle Sales 11.5 Million SAAR in August

by Calculated Risk on 9/01/2010 04:00:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.47 million SAAR in August. That is down 18.9% from August 2009 (cash-for-clunkers), and down 0.5% from the July sales rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for August (red, light vehicle sales of 11.47 million SAAR from Autodata Corp).

The high for the year was in March, and sales have moved mostly sideways since then. The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current month sales rate. The current sales rate is still below the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

This was below most forecasts of around 11.6 million SAAR.

Some comments on August ISM Manufacturing Index

by Calculated Risk on 9/01/2010 12:15:00 PM

The Institute for Supply Management reported this morning that the PMI increased to 56.3 from 55.5 in July. Expectations were for a decrease to 53.0. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is an update to the graph showing the regional Fed manufacturing surveys and the ISM index through August.

The Fed surveys suggested that the ISM index would probably decline, but the relationship is noisy. Based on this graph I'd expect either the Fed surveys to bounce back in September - or the ISM to decline. Here is a long term graph that hopefully puts the uptick in August in perspective.

Here is a long term graph that hopefully puts the uptick in August in perspective.

In addition to the increase in the PMI, the production index increased to 59.9 from 57.0, and the employment index increased from 58.6 in July to 60.4. That suggests increased manufacturing employment in August.

However the new orders index declined in August to 53.1 from 53.5 in July (still expanding, but at a slower pace). And the inventory index was up for the 2nd month in a row to 51.4.

This report was somewhat better than expected, but I still expect the index to decline over the next couple of months.

General Motors: Sales off sharply from August 2009

by Calculated Risk on 9/01/2010 11:18:00 AM

Note: Sales in August 2009 were boosted by "Cash-for-clunkers".

From MarketWatch: GM August U.S. sales down 24.9% to 185,176 units

General Motors Co. said Wednesday that U.S. sales in August slumped 24.9% to 185,176 vehicles from 246,479 in August 2009.Note: in August 2009 U.S. light vehicle sales were 14.1 million (SAAR). This was related to "Cash-for-clunkers" - also General Motors emerged from bankruptcy on July 10, 2009.

I'll add reports from the other major auto companies as updates to this post.

Update1: From MarketWatch: Ford U.S. August sales slide 10.7% to 157,503

From MarketWatch: Chrysler U.S. August sales rise 7% to 99,611 units

NOTE: Once all the reports are released, I'll post a graph of the estimated total August light vehicle sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET. Most estimates are for an increase to 11.6 million SAAR in August from the 11.5 million SAAR in July.

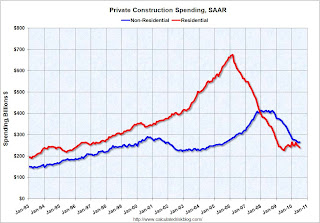

Construction Spending declines in July

by Calculated Risk on 9/01/2010 10:15:00 AM

Note: the ISM PMI increased to 56.3 from 55.5 in July (I'll have more later).

Overall construction spending decreased in July. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

From the Census Bureau: July 2010 Construction at $805.2 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during July 2010 was estimated at a seasonally adjusted annual rate of $805.2 billion, 1.0 percent (±1.4%)* below the revised June estimate of $813.1 billion. The July figure is 10.7 percent (±1.8%) below the July 2009 estimate of $901.2 billion.Private residential construction spending has turned down again - after the tax credit expired - and residential investment (RI) will be a drag on Q3 GDP. The "good" news is the overall drag from RI will be much smaller than during 2006, 2007 and 2008.

...

Spending on private construction was at a seasonally adjusted annual rate of $506.4 billion, 0.8 percent (±1.3%)* below the revised June estimate of $510.7 billion. Residential construction was at a seasonally adjusted annual rate of $240.3 billion in July, 2.6 percent (±1.3%) below the revised June estimate of $246.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $266.1 billion in July, 0.8 percent (±1.3%)* above the revised June estimate of $264.0billion.

ADP: Private Employment decreases 10,000 in August

by Calculated Risk on 9/01/2010 08:15:00 AM

ADP reports:

Private sector employment decreased by 10,000 from July to August on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from June to July was revised down slightly, from the previously reported increase of 42,000 to an increase of 37,000.Note: ADP is private nonfarm employment only (no government jobs).

The decline in private employment in August confirms a pause in the recovery already evident in other economic data.

...

Unlike the estimate of total establishment employment to be released on Friday by the Bureau of Labor Statistics (BLS), today’s figure does not include the effects of federal hiring — and now firing — for the 2010 Census.

The consensus was for ADP to show an increase of about 20,000 private sector jobs in August, so this was below consensus.

The BLS reports on Friday, and the consensus is for a decrease of 90,000 payroll jobs in August, on a seasonally adjusted (SA) basis, with the loss of around 116,000 temporary Census 2010 jobs (+26,000 ex-Census).

MBA: Purchase Application activity suggests low level of existing home sales in August and September

by Calculated Risk on 9/01/2010 07:33:00 AM

The MBA reports: Mortgage Applications Increase as Rates Hit New Low in MBA Weekly Survey

The Refinance Index increased 2.8 percent from the previous week and is at its highest level since May 1, 2009. The seasonally adjusted Purchase Index increased 1.8 percent from one week earlier.

...

"Refinancing activity picked up again last week, reaching new 15-month highs, as borrowers took advantage of even lower mortgage rates. The drop in mortgage rates was in line with Treasury rates as the latest data continue to show weak economic growth and an exceptionally weak housing market," said Michael Fratantoni, MBA's Vice President of Research and Economics. "The sharp decline in MBA's Purchase Application index in May had provided a clear leading indicator of the drops in new and existing home sales that were reported for June and July. Despite the slight increase in purchase activity in the past week, the continued low level of purchase applications indicates we are unlikely to see an increase in new home sales reported for August or existing home sales reported for September."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.43 percent from 4.55 percent, with points increasing to 1.34 from 0.89 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The contract rate is a new low for this survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Usually I start the graph in January 1990, but this shorter term graph shows that the purchase index has been moving sideways since May of this year.

As the MBA's Fratantoni noted, this suggests existing home sales in August and September will be around the same level as in July.

Tuesday, August 31, 2010

Existing Home Inventory declines slightly in August

by Calculated Risk on 8/31/2010 07:10:00 PM

Tom Lawler reports that at the end of August, listings on Realtor.com totaled 4,007,860, down 0.7% from 4,038,133 at the end of July. This is 2.5% above August 2009.

The NAR reported inventory at 3.98 million at the end of July, and at 3.924 million in August 2009. So they will probably report inventory at close to 4 million for August.

Since sales probably only increased slightly in August, the months-of-supply metric will be in double digits again in August and probably still over 12 months.

Note: there is a seasonal pattern for existing home inventory. Usually inventory peaks in July and declines slightly through October - and then declines sharply at the end of the year as sellers take their homes off the market for the holidays.