by Calculated Risk on 6/26/2010 12:31:00 PM

Saturday, June 26, 2010

Second Liens and Personal Bankruptcy

From Mary Ellen Podmolik at the Chicago Tribune: Moral bankruptcy?

[Filing bankruptcy] may seem an extreme riff on the difficult decisions homeowners make to unburden themselves of debt owed on properties that have lost substantial value. Lawyers and housing counselors say, however, that personal bankruptcy filings are becoming more commonplace as debt-holders seek sums due them, particularly on second "piggyback" mortgages used to buy homes.I suspect eliminating debt from 2nd liens is one of the reasons there has been a surge in personal bankruptcy filings this year. The deep recession and high unemployment rate are probably the main reasons.

"It's a big trend," said Dan Lindsey, a supervisory attorney at the Legal Assistance Foundation of Metropolitan Chicago. "Banks are having a hard enough time dealing with the first mortgages. The second (mortgages), there's no equity there to collect so they're being charged off and sold to debt buyers and rearing their ugly heads later. It's a drastic last resort to file Chapter 7, but in some cases it's appropriate."

...

"My other option was to say I'll roll the dice with the bank," [former homeowner Del] Phillips said. "Will they really come after me? I wouldn't put it past the bank industry to do that. It's going to kill me to pay a bank for a house I no longer owned. I was, like, there's no way I'm going to pay the bank another dime."

Unofficial Problem Bank List increases to 797 Institutions

by Calculated Risk on 6/26/2010 09:16:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 25, 2010.

Changes and comments from surferdude808:

CR provided a tease earlier on some of changes to the Unofficial Problem Bank List that would be happening as the FDIC released its enforcement actions for May yesterday. As CR predicted, it was a busy week as 24 institutions were added while 8 were removed. Also, the agencies issued numerous Prompt Corrective Action Orders.

Overall, the Unofficial Problem Bank List stands at 797 institutions with aggregate assets of $409.6 billion, up from 781 institutions with assets of $404.5 billion last week. Removals include the failed Peninsula Bank ($644 million), First National Bank ($253 million), and High Desert State Bank ($83 million). The FDIC terminated actions against De Witt State Bank ($39 million), Citizens State Bank of Lankin ($37 million), BankHaven ($22 million), and The Farmers Bank ($18 million). The other removal was for VisionBank of Iowa ($87 million) which merged with its affiliate sister bank -- Ames Community Bank ($383 million) that also happens to be on the Unofficial Problem Bank List as it is operating under a Written Agreement.

There were 24 institutions with aggregate assets of $6.5 billion added to the list this week. Notable additions include Bank of Choice, Greeley, CO ($1.3 billion); Nova Bank, Berwyn, PA ($598 million); CornerstoneBank, Atlanta, GA ($536 million); and Sterling Federal Bank, F.S.B., Sterling, IL ($501 million). Geographically, five institutions from Georgia, three from Missouri, and two from California, Colorado, Illinois, and Pennsylvania were added.

In a sign that the agencies may be taking their regulatory authority seriously, they issued 11 Prompt Corrective Action Orders against institutions on the Unofficial Problem Bank List. Generally, a PCA Order is a narrow enforcement action proscribing for an institution to raise its regulatory capital ratios by a certain date. As way of background, in 1991 via the Federal Deposit Insurance Corporation Improvement Act (FDICIA) Congress mandated for the regulators to take certain actions including closing troubled institutions promptly. The intent was to prevent a recurrence of the "zombie thrifts" that regulators allowed to stay open for many years despite being insolvent, which contributed the large price tag of the last banking crisis. The PCA legislation requires regulators to take certain actions that are triggered by so-called capital trip wires. For example, regulators are supposed to stop an institution from issuing brokered deposits or giving managers golden parachutes when they are no longer "well capitalized." Another trip wire requires for regulators to close an institution when its tangible capital ratio breeches 2 percent. The thinking behind this provision is that closure before equity goes negative would lessen losses to the deposit insurance fund and the potential that taxpayer monies would be needed to support resolutions. Some industry observers believe the regulators have been remiss in enforcing PCA, particularly the timely closing of insolvent institutions. To support this conclusion, observers point to Corus Bank and Guaranty Bank that posted negative equity in their Call Reports several quarters before they were closed or the substantial loss rates on failed institutions that reported satisfactory capital ratios just before failure.

The 11 institutions receiving a PCA Order include LibertyBank ($768 million); Butte Community Bank ($523 million Ticker: CVLL); Metro Bank of Dade County ($442 million); Ravenswood Bank ($301 million); SouthwestUSA Bank ($214 million); Blue Ridge Savings Bank, Inc. ($209 million); Legacy Bank ($169 million); Olde Cypress Community Bank ($169 million); Shoreline Bank ($110 million); Badger State Bank ($93 million); and Thunder Bank ($33 million).

Friday, June 25, 2010

Year of the Short Sale, and Deed in lieu

by Calculated Risk on 6/25/2010 09:45:00 PM

From Kenneth Harney in the WaPo: Foreclosure alternative gaining favor (ht ghostfaceinvestah)

There are two programs in Home Affordable Foreclosure Alternatives (HAFA), short sales and deed in lieu of foreclosure.

Harney writes:

Some of the largest mortgage servicers and lenders in the country are gearing up campaigns to reach out to carefully targeted borrowers with cash incentives that sometimes range into five figures, plus a simple message: Let's bypass the time-consuming hassles of short sales and foreclosures. Just deed us the title to your underwater home, and we'll call it a deal. ...The deal can be quick, and the first lender will agree not to pursue a deficiency judgment. However 2nds are a problem, and "deed in lieu" transactions still hit the borrower's credit history.

Borrowers with 2nds considering a "deed in lieu" transaction should contact the 2nd lien holders. HAFA offers a payout to 2nd lien holders in deed in lieu transactions who agree to release borrowers from debt (see point 4 here for payouts under deed in lieu).

Under the HAFA deed in lieu program, the borrower needs to be proactive with 2nd lien holders.

The deed in lieu program is gaining in popularity, from Harney:

Bank of America, has mailed 100,000 deed-in-lieu solicitations to customers in the past 60 days, and its volume of completed transactions is breaking company records, according to officials. ... To sweeten the pot, Bank of America is offering cash incentives that range from $3,000 to $15,000 ... [Matt Vernon, Bank of America's top short sale and deed-in-lieu executive] said.On the credit impact, from Carolyn Said at the San Francisco Chronicle:

[Craig Watts, a spokesman for FICO] said it is a "widespread myth" that short sales and deeds in lieu of foreclosure have less impact on credit scores than do foreclosures.And a video from HAMP / HAFA: "Your Graceful Exit"

"Generally speaking, when you can't pay your mortgage, in the eyes of the FICO score what matters is that you were not able to fill your obligation as you originally agreed and that failure is highly predictive of future risk," he said.

Bank Failure #86: High Desert State Bank, Albuquerque, New Mexico

by Calculated Risk on 6/25/2010 07:04:00 PM

Road running deposits flee

Wiley banker struck

by Soylent Green is People

From the FDIC: First American Bank, Artesia, New Mexico, Assumes All of the Deposits of High Desert State Bank, Albuquerque, New Mexico

As of March 31, 2010, High Desert State Bank had approximately $80.3 million in total assets and $81.0 million in total deposits. ...That makes three today ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.9 million. ... High Desert State Bank is the 86th FDIC-insured institution to fail in the nation this year, and the second in New Mexico. The last FDIC-insured institution closed in the state was Charter Bank, Santa Fe, on January 22, 2010.

Bank Failures #84 & #85: Florida and Georgia

by Calculated Risk on 6/25/2010 06:24:00 PM

Ringed on three sides by water

Way out blocked by Feds

Savannah shut down

Sheila's Summer season starts

Sad situation.

by Soylent Green is People

From the FDIC: Premier American Bank, Miami, Florida, Assumes All of the Deposits of Peninsula Bank, Englewood, Florida

As of March 31, 2010, Peninsula Bank had approximately $644.3 million in total assets and $580.1 million in total deposits. ...From the FDIC: The Savannah Bank, National Association, Savannah, Georgia, Assumes All of the Deposits of First National Bank Savannah, Georgia

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $194.8 million. Compared to other alternatives, ... Peninsula Bank is the 84th FDIC-insured institution to fail in the nation this year, and the fourteenth in Florida. The last FDIC-insured institution closed in the state was Bank of Florida – Southwest, Naples, on May 28, 2010.

As of March 31, 2010, First National Bank had approximately $252.5 million in total assets and $231.9 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $68.9 million. Compared to other alternatives, ... First National Bank is the 85th FDIC-insured institution to fail in the nation this year, and the ninth in Georgia. The last FDIC-insured institution closed in the state was Satilla Community Bank, Saint Marys, on May 14, 2010.

FDIC: May Enforcement Actions

by Calculated Risk on 6/25/2010 04:45:00 PM

Just a BFF (Bank Failure Friday) preview. It looks like surferdude808 will be busy updating the Unofficial Problem Bank list today ... the FDIC released their May Enforcement Actions.

There are eight Prompt Corrective Actions (PCA) for last month ... and that seems especially high.

ATA Truck Tonnage Index declines in May

by Calculated Risk on 6/25/2010 12:59:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Fell 0.6 Percent in May

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.6 percent in May, which was the first month-to-month drop since February of this year. This followed an upwardly revised 1 percent increase in April. The latest reduction put the SA index at 109.6 (2000=100).

...

Compared with May 2009, SA tonnage increased 7.2 percent, which was the sixth consecutive year-over-year gain. In April, the year-over-year increase was 9.5 percent. Year-to-date, tonnage is up 6.2 percent compared with the same period in 2009.

ATA Chief Economist Bob Costello said that truck freight tonnage is going to have ups and downs, but the trend continues in the right direction. “Despite the month-to-month drop in May, the trend line is still solid. There is no way that freight can increase every month, and we should expect periodic decreases. This doesn’t take away from the fact that freight volumes are quite good, especially considering the reduction in truck supply over the last couple of years.”

This graph from the ATA shows the Truck Tonnage Index since Jan 2006 (no larger image).

This graph from the ATA shows the Truck Tonnage Index since Jan 2006 (no larger image). This index has only shown a gradual increase since December.

Rail traffic was also soft in May.

KB Home: "Month of May was particularly challenging" for housing industry

by Calculated Risk on 6/25/2010 11:33:00 AM

On the conference call this morning, Jeffrey Mezger, president and chief executive officer of KB Home said the month of May was "particularly challenging" for the housing industry.

Paraphrasing ..

Q&A just started ...

On the current quarter (ended May 31st) from MarketWatch: KB Home shares fall on 'disappointing' results

Q1 GDP revised down to 2.7%

by Calculated Risk on 6/25/2010 08:32:00 AM

The Q1 real GDP rate was revised down again (third estimate) to 2.7% from the 2nd estimate of 3.0%.

Consumer spending was weaker in Q1 than originally estimated. PCE growth (personal consumption expenditures) was revised down to 3.0% in Q1 from the previous estimate of 3.5%.

Some more from Reuters: Economy Grew Slower in First Quarter than Expected, Up 2.7%

... business spending, which only rose at a 2.2 percent rate instead of 3.1 percent as reported last month. This was as a spending on structures was revised down to show a slightly bigger decline than reported last month. Growth in software and equipment investment was also lowered to a 11.4 percent rate from 12.7 percent.The "Change in private inventories" was revised up to a contribution of 1.88 percentage points from the previous estimate of 1.65. So inventory adjustment accounted for over two-thirds of the GDP growth in Q1 - and the inventory adjustment appears over. This is a weak third estimate.

...

Another drag on growth came from exports whose growth was eclipsed by a rise in imports, resulting in a trade deficit that subtracted from GDP.

... real final sales to domestic purchasers, considered a better measure of domestic demand, rose at a 1.6 percent rate instead of the 2.0 percent pace reported last month.

Thursday, June 24, 2010

Late Night Reading

by Calculated Risk on 6/24/2010 11:59:00 PM

Just a couple of depressing articles ...

From Paul Krugman in the NY Times: The Renminbi Runaround

As of Thursday, the currency was only about half a percent higher than its typical level before the announcement. And all indications are that watching the future movement of the renminbi will be like watching paint dry: Chinese officials are still making statements denying that a rise in their currency will do anything to reduce trade imbalances, and prices in the forward market, in which traders agree to exchange currencies at various points in the future, suggest a rise of only about 2 percent in the renminbi by the end of this year. This is basically a joke.From Michael Pettis: What might history tell us about the Greek crisis?

Update: Unemployment Benefits, Housing Tax Credit

by Calculated Risk on 6/24/2010 07:32:00 PM

From Lori Montgomery at the WaPo: Senate again rejects emergency spending package

The Senate on Thursday rejected a package of tax cuts, state aid and emergency jobless benefits ... [try again] after the July 4 recess. By then, more than 2 million people will have seen their unemployment benefits cut off, according to the U.S. Department of Labor.What this means is that anyone receiving extended unemployment benefits (there are several tiers) will not be eligible for the next tier when their unemployment benefits expire.

This bill also contains the extension of the closing date for the homebuyer tax credit. As of right now, homebuyers must close by June 30th to receive the tax credit.

But of course the housing industry wants even more. From Zach Fox at SNL Financial: Analysts: Record low new-home sales could lead to another tax credit

Even though he is not in favor of another tax credit, [Michael Widner, an analyst with Stifel Nicolaus & Co.] said May's exceptionally low number means plenty of industry insiders will push for one.Hopefully there will not be another housing tax credit. And hopefully the change in eligibility date for extended unemployment benefits will be approved.

"On the one hand, I know that the phones are ringing off the hook in D.C. right now for people clamoring for a new tax credit," Widner said. "So the shock value of an all-time low is going to be a lot of people saying: 'Oh my God, we gotta do more to stimulate housing.' ... And on the other hand, you're going to get people, who frankly I side with more, saying: 'You know, look, obviously the tax credit did nothing but pull demand forward, and in the wake of the tax credit you see the void left behind.'"

Misc: Quote of the Day, Greece Bond Spreads increase Sharply, and Market Update

by Calculated Risk on 6/24/2010 04:00:00 PM

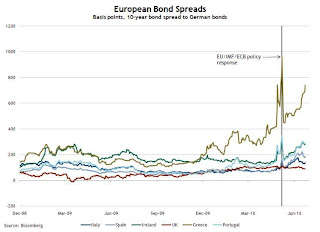

Here is a graph from the Atlanta Fed weekly Financial Highlights released today (graph as of June 23rd): Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

Greek bond spreads (over German bonds) have risen recently, near the highs seen before the European policy package was announced in early May.Note: The Atlanta Fed data is one day old. Nemo has links to the current data on the sidebar of his site.

Other euro zone countries’ bond spreads are also elevated during the same period.

Since tightening in early May, the 10-year Greece-to-German bond spread has risen to nearly 300 basis points (bps) (from 4.38% to 7.39%) through June 22. Other European peripherals’ spreads are elevated, with Portugal up 138 bps over the period, Ireland up 111 bps, and Spain 86 bps higher.

The spreads have widened further today: Greece is up sharply to 781 bps today.

Click on graph for interactive version in new window.

The graph has tabs to look at the different bear markets - "now" shows the current market - and there is also a tab for the "four bears".

And here is the quote of the day from BofA (via Bloomberg, ht Bill):

"Given the depth of the nation’s recessionary impacts on homeowners, a considerable number of customers will transition from homeownership over the next two years.""Transition from homeownership ..." Ouch.

Barbara Desoer, president of Bank of America’s home-loan and insurance unit, said in testimony prepared for a congressional hearing June 24, 2010

Lennar: June Home Sales off 20% to 25% from 2009

by Calculated Risk on 6/24/2010 02:43:00 PM

From Bloomberg: Lennar Home Sales Down as Much as 25% in June as Tax Credit Ends, CEO Says (ht Brian)

Lennar Corp.’s home sales are down 20 percent to 25 percent this month compared with a year earlier ... Chief Executive Officer Stuart Miller said.In June 2009, new home sales were at a 396K seasonally adjusted annual rate. This is just one home builder, but a 20% to 25% decline would put sales in June at about the record low level of May. This is almost certain to the worst June sales rate since the Census Bureau started keeping records in 1963.

“The entire market knew there’d be a slowdown as we came off the tax credit,” Miller said on a conference call with investors today. “It’s just that the reality of it doesn’t feel good.”

Hotel Occupancy Rate increases

by Calculated Risk on 6/24/2010 01:12:00 PM

From HotelNewsNow.com: STR: US results for week ending 19 June

In year-over-year measurements, the industry’s occupancy last week increased 5.8 percent to 66.7 percent. Average daily rate rose 1.1 percent to US$98.03—the third time in four weeks that the measurement has risen. Revenue per available room rose 7.0 percent to US$65.36.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change.

On a 4-week basis, occupancy is up 8.1% compared to last year (the worst year since the Great Depression) and still almost 7% below normal. About half way back!

Last year leisure travel (summer) held up better than business travel, now it appears business travel is recovering - and we will soon see if leisure travel will also pick up this year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

30 Year Mortgage Rates fall to Record Low

by Calculated Risk on 6/24/2010 10:54:00 AM

From Reuters: Mortgage Rates Drop to Lowest Level on Record

Interest rates on U.S. 30-year fixed-rate mortgages, the most widely used loan, averaged 4.69 percent for the week ended June 24, the lowest since Freddie Mac started the survey in April 1971.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 30 year fixed rate mortgage interest rate, and the Ten year Treasury yield since 2002. The 30 year mortgage rate is now at a series low (started in 1971), although the spread between the mortgage rate and the treasury yield has widened about 30 bps recently.

The decline in mortgage rates is related to the weak economy and falling treasury yields.

Weekly Initial Unemployment Claims Decline, Still High

by Calculated Risk on 6/24/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 19, the advance figure for seasonally adjusted initial claims was 457,000, a decrease of 19,000 from the previous week's revised figure of 476,000. The 4-week moving average was 462,750, a decrease of 1,500 from the previous week's revised average of 464,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending June 12 was 4,548,000, a decrease of 45,000 from the preceding week's revised level of 4,593,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The four-week average of weekly unemployment claims decreased this week by 1,500 to 462,750.

The dashed line on the graph is the current 4-week average.

Initial weekly claims have been at about the same level since December 2009. The current level of 457,000 (and 4-week average of 462,750) is still high, and suggests ongoing weakness in the labor market.

Wednesday, June 23, 2010

DOT: Vehicle Miles Driven increase in April

by Calculated Risk on 6/23/2010 11:59:00 PM

Note: on New Home sales, please see: New Home Sales collapse to Record Low in May

The Department of Transportation (DOT) reported that vehicle miles driven in April were up 1.2% from April 2009:

Travel on all roads and streets changed by +1.2% (3.1 billion vehicle miles) for April 2010 as compared with April 2009. Travel for the month is estimated to be 255.9 billion vehicle miles.

Cumulative Travel for 2010 changed by -0.2% (-1.6 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the rolling 12 month total vehicle miles driven.

On a rolling 12 month basis, miles driven are still 2.0% below the peak - and only 0.6% above the recent low - suggesting a sluggish recovery.

Home Sales: Distressing Gap

by Calculated Risk on 6/23/2010 08:06:00 PM

This is something I've been tracking for years ... the first graph shows existing home sales (left axis) and new home sales (right axis) through May. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble, and the "distressing gap" (due partially to distressed sales). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Initially the gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The two spikes in existing home sales were due primarily to the first time homebuyer tax credit (the initial credit last year, followed by the extension to April 30th / close by June 30th). There were also two smaller bumps for new home sales related to the tax credit. Since new home sales are reported when contracts are signed, the 2nd spike for new home sales was in April and then sales collapsed in May.

The second graph shows the same information as a ratio - new home sales divided by existing home sales - through May 2010. The ratio decreased because the expiration of the tax credit impacts new home sales first. This is the all time low for the ratio (due to timing issues), and the ratio will increase somewhat as existing home sales collapse in July.

The ratio decreased because the expiration of the tax credit impacts new home sales first. This is the all time low for the ratio (due to timing issues), and the ratio will increase somewhat as existing home sales collapse in July.

I expect that eventually this ratio will return to the historical range of new home sales being around 15% to 20% of existing home sales. However that will only happen after the huge overhang of existing inventory (especially distressed inventory) is significantly reduced.

Fannie Mae cracks down on "Walk Aways"

by Calculated Risk on 6/23/2010 04:00:00 PM

Note: Earlier post on New Home sales: New Home Sales collapse to Record Low in May

From Fannie Mae: Fannie Mae Increases Penalties for Borrowers Who Walk Away

Fannie Mae (FNM/NYSE) announced today policy changes designed to encourage borrowers to work with their servicers and pursue alternatives to foreclosure. Defaulting borrowers who walk-away and had the capacity to pay or did not complete a workout alternative in good faith will be ineligible for a new Fannie Mae-backed mortgage loan for a period of seven years from the date of foreclosure.I'm not sure how they can tell if someone "walks away" (a borrower who could afford to make their mortgage payments, but instead strategically defaults), or if the borrower had no real choice.

...

Fannie Mae will also take legal action to recoup the outstanding mortgage debt from borrowers who strategically default on their loans in jurisdictions that allow for deficiency judgments. In an announcement next month, the company will be instructing its servicers to monitor delinquent loans facing foreclosure and put forth recommendations for cases that warrant the pursuit of deficiency judgments.

But this suggests that the number of strategic defaults is increasing.

And this reminds us of one of the tragedies of the bubble: many people bought before they were ready, or bought too much home. Whether they are "walking away" or losing their home because they can't afford it, they will be out of the market for some time.

FOMC Statement: Less Positive

by Calculated Risk on 6/23/2010 02:15:00 PM

The comments on the economy were slightly more negative than last meeting. The Fed noted the financial issues in Europe, and also commented that "underlying inflation has trended lower". Each statements was slightly less positive ...

From the Fed:

Information received since the Federal Open Market Committee met in April suggests that the economic recovery is proceeding and that the labor market is improving gradually. Household spending is increasing but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software has risen significantly; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad. Bank lending has continued to contract in recent months. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be moderate for a time.The key language about rates stayed the same: "The Committee ... continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period."

Prices of energy and other commodities have declined somewhat in recent months, and underlying inflation has trended lower. With substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh. Voting against the policy action was Thomas M. Hoenig, who believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to a build-up of future imbalances and increase risks to longer-run macroeconomic and financial stability, while limiting the Committee’s flexibility to begin raising rates modestly.