by Calculated Risk on 3/29/2010 07:52:00 PM

Monday, March 29, 2010

Ireland to Report Bank Writedowns Tuesday

Two different perspectives, first from The Times: Ireland on the brink of full-scale bank nationalisation

The Republic of Ireland faced the prospect last night of having most of its banking system nationalised amid growing speculation that the Dublin Government would raise its stakes in both remaining private sector operators — Allied Irish Bank and Bank of Ireland.But Karl Whelan at The Irish Economy blog writes: Super Tuesday Leaks

[A] report [yesterday] that the Government’s stake in AIB would rise from 25 per cent to 70 per cent and its holding in BoI would be lifted from 16 per cent to 40 per cent.

...

With the Irish Nationwide and EBS building societies being merged and nationalised, and Anglo Irish Bank, the other large banking company, also nationalised, most of the industry would be in the State’s hands.

Ireland is the first significant Western country to be faced with the humiliation of wholesale bank nationalisation in this crisis, although the Republic took its three main banks into state ownership 18 months ago.

There is nothing new about the idea of the state potentially owning 70 percent of AIB. Even based on previous expectations for NAMA discounts, this was always a possibility. ... [I]t is hard to reconcile the continuing circulation of the same ownership statistics as before with the new information (if such it is) on discounts and also on capital levels.The world has come full circle. The main stream media screams "nationalization" and the blog keeps the numbers in perspective.

Note: NAMA is National Asset Management Agency, a "bad bank" set up by the government to take many of the distressed assets in Ireland. This was a very different approach than in the U.S.

Market and Greece Update

by Calculated Risk on 3/29/2010 04:00:00 PM

First, from the NY Times: In Crucial Test, Greece Raises $6.7 Billion in Bond Sale

The bonds, worth $6.7 billion, were priced to yield 6 percent, according to banks that managed the sale, meaning that Greece was paying a princely 3.34 percentage points above what Germany, considered the European benchmark, pays to borrow at a similar maturity. It was also well above the rates paid by governments in Portugal, Spain, Ireland and Italy, other countries whose indebtedness has caused concern.Since it is almost the end of Q1 ... here is a market update:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today. The S&P 500 was first at this level in December 1998; over 11 years ago.

The S&P 500 is up 73.4% from the bottom in 2009 (497 points), and still off 25% from the peak (392 points below the max).

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Residential Investment Stalled

by Calculated Risk on 3/29/2010 01:37:00 PM

The BEA released an update to the underlying detail tables for Q4 today. The following graph uses the updated data for Residential Investment through Q4, and an estimate for Q1 based on housing data through February (a 10% annualized decline in residential investment).

Note: Residential Investment includes new single family structures, new multi-family structures, home improvement, brokers' commissions on sale of structures and a few minor categories. Click on graph for large image.

Click on graph for large image.

This graph shows total Residential Investment, and single-family structures, both as a percent of GDP.

Residential investment (RI) is one of the best leading indicators for the economy. Usually RI as percent of GDP is declining before a recession, and climbs sharply coming out of a recession.

Note: The 2001 recession was a business led recession. Some readers will notice the sharp decline in 1966 and wonder why the economy didn't slide into a recession - the answer is the rapid build-up for the Vietnam war kept the economy out of recession (not the best antidote).

But this time RI is moving sideways. This time is different.

The reason RI is moving sideways is because of the huge overhang of existing housing units (both single family and rental units). And this is one of the key reasons I think the current recovery will be sluggish and choppy - and that unemployment will stay elevated for some time.

Stated simply: One of the usual engines of recovery - residential investment - isn't contributing this time.

ATA Truck Tonnage Index declines in February

by Calculated Risk on 3/29/2010 10:56:00 AM

From the American Trucking Association: ATA Truck Tonnage Index Fell 0.5 Percent in February Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.5 percent in February, following a revised 1.9 percent increase in January [revised down from 3.1%]. The latest drop put the SA index at 108.5 (2000=100), down from 109.1 in January.Trucking is a coincident indicator for the economy, but the snow makes it difficult to tell about February.

...

Compared with February 2009, SA tonnage increased 2.6 percent, which was the third consecutive year-over-year gain. For the first two months of 2010, SA tonnage was up 3.5 percent compared with the same period last year. For all of 2009, the tonnage index contracted 8.7 percent, which was the largest annual decrease since 1982.

ATA Chief Economist Bob Costello said that the February tonnage reading is difficult to interpret because of the severe winter storms that impacted truck freight movements during the month, particularly on the East Coast.

...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.2 billion tons of freight in 2008. Motor carriers collected $660.3 billion, or 83.1 percent of total revenue earned by all transport modes.

February Personal Income Flat, Spending Increases

by Calculated Risk on 3/29/2010 08:30:00 AM

From the BEA: Personal Income and Outlays, January 2010

Personal income increased $1.2 billion, or less than 0.1 percent ... Personal consumption expenditures (PCE) increased $34.7 billion, or 0.3 percent.Stagnant income and increased spending means the saving rate declined again ...

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in February, compared with an increase of 0.2 percent in January.

...

Personal saving -- DPI less personal outlays -- was $340.0 billion in February, compared with $374.9 billion in January. Personal saving as a percentage of disposable personal income was 3.1 percent in February, compared with 3.4 percent in January.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the February Personal Income report. The saving rate fell to 3.1% in February.

I still expect the saving rate to rise over the next couple of years - possibly to 8% or more - slowing the growth in PCE.

The following graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The increase in PCE in February was fairly strong (a 3.0% annual rate over the last three months). Using the Two Month average method, this suggests PCE growth in Q1 2010 will be around 3.0%. That will be the highest growth rate since Q1 2007, however this is being driven by less saving and transfer payments - not growth in income.

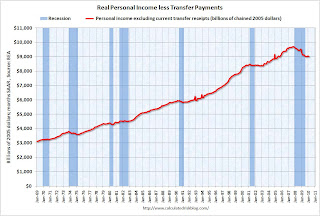

The National Bureau of Economic Research (NBER) uses several measures to determine if the economy is in recession. One of the measures is real personal income less transfer payments (see NBER memo). This declined in February to $9,006.4 billion (SAAR) from $9,020.2 billion in January, and is barely above the low of September 2009 ($9,000 billion).

This graph shows real personal income less transfer payments since 1969.

This graph shows real personal income less transfer payments since 1969.This measure of economic activity is moving sideways - similar to what happened following the 2001 recession.

To sum it up:

This is a decent report for PCE, but PCE growth is not sustainable without income growth.

Sunday, March 28, 2010

Edmunds.com: Vehicle Sales driven by Incentives in March

by Calculated Risk on 3/28/2010 08:24:00 PM

In the earlier Weekly Summary and a Look Ahead post, I forgot to mention that U.S. vehicle sales will be released on Thursday.

From Edmunds.com:

Edmunds.com analysts predict that March's Seasonally Adjusted Annualized Rate (SAAR) will be 12.4 million, up from 10.3 million in February 2010.

“Although this SAAR sounds promising, it’s too early to wave the flag and say that the economy has turned the corner,” Edmunds.com CEO Jeremy Anwyl told AutoObserver.com. “Incentives drove sales this month, but those were defensive moves in response to Toyota stepping up incentives and are unlikely to last because inventories are simply not high enough to justify them in the long term.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and a forecast for March from Edmunds.com.

Excluding the cash-for-clunkers month of August 2009, Edmunds is forecasting the highest sales rate since Sept 2008.

As Edmunds notes, the expected jump in March sales was driven by Toyota's incentive program to regain market share - and the response of the other manufacturers. As always I'll be posting the sales reports and an estimate of the SAAR around 4 PM ET on Thursday.

Weekly Summary and a Look Ahead

by Calculated Risk on 3/28/2010 12:30:00 PM

The employment report for March will be the focus this week, but there are several other key releases too.

On Monday, the Personal Income and Outlays report for February will be released by the BEA at 8:30 AM. The consensus is for a 0.1% increase in income and 0.3% increase in spending. This will provide a reasonable estimate of Q1 Personal Consumption Expenditure (PCE) growth.

On Tuesday, the January Case-Shiller house Price Index will be released at 9:00 AM. The consensus is for a small decline in prices (not seasonally adjusted). Consumer confidence will be released at 10 AM and former Fed Chairman Paul Volcker will be speaking on financial reform at noon.

On Wednesday, the ADP March employment report will be released (consensus is for 40,000 net private sector payroll jobs in March). This report excludes all government jobs and is not distorted by the temporary Census hiring. At 9:45 AM the Chicago PMI index for March will be released (consensus is for expansion, but at a slower rate than in February). At 10 AM, the Census Bureau will release the February Factory Orders report.

Also on Wednesday, Atlanta Fed President Dennis Lockhart will speak about employment.

On Thursday, the closely watched initial weekly unemployment claims will be released. Also the ISM Manufacturing Index for March at 10 AM (Consensus is for slightly less expansion in March), and Census Bureau will release February Construction Spending at 10 AM (consensus is for a decline of about 1.1%).

Also on Thursday, personal bankrutpcy filings for March will be released. Update: Also on Thursday, the auto manufacturers will releases March sales. The expectation is for a sharp rise to over 12 million units (SAAR) because of incentives.

And on Friday, the BLS will release the March employment report. The consensus is for 190,000 net payroll jobs, however this is distorted by both the February snow storms and temporary Census hiring (see Employment: March Madness). The consensus is for no change in the unemployment rate (9.7%), but historically the Census hiring has pushed down the unemployment rate in the March to May period – so we might see a slight decline. Goldman Sachs is estimate net payrolls increased 275,000 in March.

Also on Friday the FDIC will probably close several more banks. Once again I’ll be watching Puerto Rico!

And a summary of last week ...

A few stories:HAMP Principal Write-downs More on HAMP "Improvements" From David Streitfeld at the NY Times: A Bold U.S. Plan to Help Struggling Homeowners From Renae Merle at the WaPo: Second mortgages complicate efforts to help homeowners

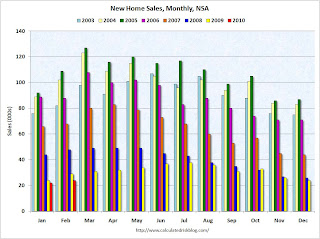

The Census Bureau reported New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 308 thousand. This is a new record low and a decrease from the revised rate of 315 thousand in January (revised from 309 thousand).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2010. In February 2010, 24 thousand new homes were sold (NSA).

This is below the previous record low of 29 thousand hit three times; in February 2009, 1982 and 1970.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009. Sales of new single-family houses in February 2010 were at a seasonally adjusted annual rate of 308,000, according to estimates released jointly today ... This is 2.2 percent (±15.3%)* below the revised January rate of 315,000 and is 13.0 percent (±12.2%) below the February 2009 estimate of 354,000.Obviously this was another extremely weak report.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2010 (5.02 million SAAR) were 0.6% lower than last month, and were 7.0% higher than February 2009 (4.69 million SAAR).

Note: existing home sales are counted at closing, so even though contracts must be signed in April to qualify for the tax credit, buyers have until June 30th to close.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.59 million in February from 3.27 million in January. The all time record high was 4.57 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern - inventory should increase further in the spring.

Note: This index is a leading indicator for Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.Historically, according to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through all of 2010, and probably longer.

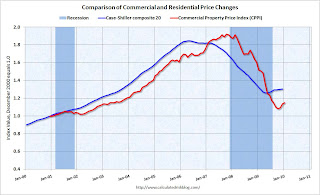

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices peaked in late 2007 and are now 40% below the peak in October 2007. Prices are at about the same level as early 2003.

Last week the Department of Transportation (DOT) reported that vehicle miles driven in January were down from January 2009:

Travel on all roads and streets changed by -1.6% (-3.7 billion vehicle miles) for January 2010 as compared with January 2009. Travel for the month is estimated to be 222.8 billion vehicle miles.

This graph shows the percent change from the same month of the previous year as reported by the DOT.

This graph shows the percent change from the same month of the previous year as reported by the DOT. As the DOT noted, miles driven in January 2010 were down -1.6% compared to January 2009, and miles driven have declined 2.9% compared to January 2008, and are down 4.7% compared to January 2007. This is a multi-year decline, and miles driven appear to be falling again.

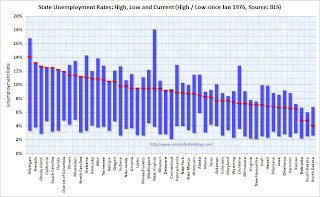

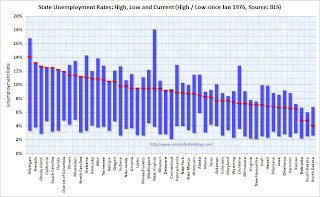

From the BLS: Regional and State Employment and Unemployment Summary

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).Fifteen states and D.C. now have double digit unemployment rates. New Jersey and Indiana are close.

Four states and set new series record highs: Florida, Nevada, Georgia and North Carolina. Three other states tied series record highs: California, Rhode Island and South Carolina.

Best wishes to all.

Aargh! Beware of reporting on the March Employment Report

by Calculated Risk on 3/28/2010 09:20:00 AM

I read this from Bloomberg this morning: Payrolls Probably Increased in March

Employers in the U.S. probably added jobs in March for the second time in more than two years, setting the stage for a broadening of the expansion, economists said before a report this week.Aargh.

Payrolls probably rose by 190,000, the most in three years, after declining 36,000 in February, according to the median forecast of 62 economists surveyed by Bloomberg News before the Labor Department’s April 2 report.

As I noted earlier this month in Employment: March Madness, a headline number of 200,000 net payroll jobs might be considered weak!

The March report will be distorted by two factors: 1) any bounce back from the snow storms in February, and 2) the decennial Census hiring that picked up sharply in March.

These are real payroll jobs, but the Census hiring is temporary - and the Census jobs that are added in March, April and May will all be lost over the following 6+ months.

What we are interested in is the underlying trend of payroll job growth. To find that number we need to adjust for the Census jobs (although they are reported NSA), and we also need to adjust for the February snow storms. Later this year we will need to add the Census jobs back to find the trend.

The important point is 190,000 is probably a weak number for March - and probably not "setting the stage for a broadening of the expansion" - although we need to see the details.

Saturday, March 27, 2010

Growth of Problem Banks (Unofficial)

by Calculated Risk on 3/27/2010 09:49:00 PM

By request here is a graph of the number of banks on the unofficial problem bank list over time.

We started posting the Unofficial Problem Bank list in early August 2009 (credit: surferdude808). The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest. Some of this data is released with a lag, for example the FDIC announced the February enforcement actions yesterday. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of banks on the unofficial list. The number has grown by almost 76% since early August 2009 - even with all the bank failures (failures are removed from the list).

The three red dots are the number of banks on the official problem bank list as announced in the FDIC quarterly banking profile for Q2, Q3, and Q4. The dots are lagged one month because of the delay in announcing formal actions.

The unofficial count is close, but is slightly lower than the official count - probably mostly due to timing issues.

Based on the current trend, there is a reasonable chance that the unofficial problem bank list will be over 1,000 banks later this year ...

Leonhardt: "Heading Off the Next Financial Crisis"

by Calculated Risk on 3/27/2010 05:36:00 PM

Here is a long piece from David Leonhardt in the New York Times Sunday magazine: Heading Off the Next Financial Crisis (ht Ann). A few excerpts:

To reduce the odds of a future crisis, the Obama plan would take three basic steps. First, regulators would receive more authority to monitor everything from mortgages to complex securities. This is meant to keep future financial time bombs, like the no-documentation loans and collateralized debt obligations of the past decade, from becoming rife. Second — and most important — financial firms would be forced to reduce the debt they take on and to hold more capital in reserve. This is the equivalent of requiring home buyers to make larger down payments: more capital will give firms a bigger cushion when investments start to go bad. Finally, if that cushion proves insufficient, the government would be allowed to seize a collapsing financial firm, much as it can already do with a traditional bank. Regulators would then keep the firm operating long enough to prevent a panic and slowly sell off its pieces.And on the stress tests ...

Will this work? It is difficult to know. No one can be sure where the next bubble or crisis will come from or, as a result, how to prevent it.

The crisis has made Wall Street much more conservative. But this will not last. It never does. Left to their own devices, financial firms will again take on big debts and big risks. They have a lot of incentive to do so. A Wall Street Journal analysis found that if one set of stricter leverage standards had been in place during the five years before the crisis, it would have reduced the biggest firms’ profitability by almost 25 percent.The banks hate the stress tests because they will expose their risk taking (and therefore reduce short term profits) - and they will fight hard to not have the tests part of the regular regulatory practice. That is a strong argument for making the stress tests a regular practice. Publish the test scenarios - and the results for each bank.

The model for setting future capital rules is the stress tests that the Fed conducted last year to gauge the strength of individual banks. Geithner convinced Obama to make those tests a core part of the financial-rescue strategy, and they ended up being something of a turning point in the crisis.

...

The stress tests, remember, were conducted when banks were financially and politically weak. When times were good over the previous decade, Fed officials — and not just Alan Greenspan — neglected to use the powers they did have. They came to believe the bubble rationales that Wall Street offered. It is not hard to see how that could happen again. The most telling case study may be Geithner himself.

Leonhardt covers a lot of ground ... a nice weekend read.

Fed's Tarullo Argues for Regular Stress Tests with Public Release of Results

by Calculated Risk on 3/27/2010 12:59:00 PM

From Fed Governor Daniel Tarullo: Lessons from the Crisis Stress Tests

The Supervisory Capital Assessment Program (SCAP) was fashioned in early 2009 as a key element of a crucial plan to stabilize the U.S. financial system. The stress tests, as they have been popularly called, required development on the fly, and under enormous pressure, of ideas that academics and supervisors had been considering for some time. After describing the concept, design, and implementation of last year's tests, I will explain how our experience has helped prompt major changes in Federal Reserve supervision of the nation's largest financial institutions. Then I will discuss how this experience has stimulated debate over the merits of publicly releasing supervisory information.Tarullo reviews the stress tests, and then argues that the public release of data was helpful (I agree):

As you know, unlike other countries that conducted stress exercises, we took the highly unusual step of publicly reporting the findings of the SCAP, including the capital needs and loss estimates for each of the 19 banks. This departure from the standard practice of keeping examination information confidential was based on the belief that greater transparency of the process and findings would help restore confidence in U.S. banks at a time of great uncertainty. Supervisors released the methodology and assumptions underlying the stress test first and then, two weeks later, the results for individual institutions. ...And then Tarullo argues for regular stress tests (I agree again):

The merits of publicly releasing firm-specific SCAP results were much debated within the Federal Reserve. In particular, some feared that weaker banks might be significantly harmed by the disclosures. In the end, though, market participants vindicated our decision.

To this end, the Federal Reserve is now implementing a more closely coordinated supervisory system in which a cross-firm, horizontal perspective is an organizing supervisory principle. We will concentrate on all activities within the holding companies that can create risk to the firm and the financial system, not just those that increase risk for insured depository institutions.And Turallo argues the macro assumptions and the individual stress test results should be made public:

An essential component of this new system will be a quantitative surveillance mechanism for large, complex financial organizations that will combine a more macroprudential, multidisciplinary approach with the horizontal perspective. Quantitative surveillance will use supervisory information, firm-specific data analysis, and market-based indicators to identify developing strains and imbalances that may affect multiple institutions, as well as emerging risks to specific firms. Periodic forward-looking scenario analyses will enhance our understanding of the potential effects of adverse changes in the operating environment on individual firms and on the system as a whole.

In fact, I believe that the most useful steps toward creating a practical, macroprudential supervisory perspective will be those that connect the firm-specific information and insight gained from traditional microprudential supervision to analysis of systemwide developments and emerging stresses. Here, precisely, is where our SCAP experience has helped lead the way.

[T]he release of details about assumptions, methods, and conclusions would expose the supervisory approach to greater outside scrutiny and discussion. Sometimes those discussions will help us improve our assumptions or methodology. At other times disclosure might reassure investors about the quality of the tests. Either way, the public's reaction to our assumptions and methods would be useful.I supported the stress tests of the largest financial institutions and I think this would be a helpful regular exercise (probably on an annual basis). I think another set of macro assumptions should be released (base case and severe), and the same level of detailed company specific information be released as for the SCAP.

...

[To increase transparency, the supervisors could] follow the SCAP precedent, with periodic release of detailed information about the assumptions, methods, and results of a cross-firm, horizontal, forward-looking exercise, including firm-specific outcomes. This approach would probably maximize both the potential benefits and potential risks. Note, however, that the possibility of a destabilizing market reaction may be lower if such information is released frequently, as major unpleasant surprises would be less likely with frequent, detailed disclosures.

The FSA is already doing regular stress tests in the U.K.:

We have now embedded our new approach to stress testing into our normal supervisory process. This includes supplementing firms’ own stress testing with supervisory stress testing of major firms. This involves regularly updating the stress test scenarios.The initial stress tests were very helpful, I think it is time for the Treasury and Fed to release another set of macro assumptions and stress test the banks again - and also release the company specific results.

Morning HAMP

by Calculated Risk on 3/27/2010 08:45:00 AM

Two articles and a favorable reaction from Laurie Goodman at Amherst ...

The Obama administration is about to ramp up its efforts to tackle second mortgages as part of an aggressive program announced by the White House on Friday to address foreclosures. ... Government officials have estimated that about 50 percent of troubled borrowers have a second mortgage. But a year after federal officials launched an initial program to lower payments on these second loans, not a single homeowner has been helped.Note: Merle is referring to the HAMP Second Lien Modification Program (2MP) to modify 2nd liens - and that program was updated yesterday too.

...

Just a few banks hold most of the second liens, according to data from Inside Mortgage Finance. Of the more than $840 billion in home-equity lines and piggyback loans outstanding, Bank of America has about $147 billion of them, while Wells Fargo and J.P. Morgan Chase have $124 billion and $118 billion of the market, respectively. Citigroup has about $53 billion of these loans on its books.

They have all signed up for the administration program announced last year, but none has taken action yet.

The new measures ... are aimed not only at the seven million households that are behind on their mortgages but, in a significant expansion of aid that proved immediately controversial, the 11 million that simply owe more on their homes than they are worth.

...

The latest programs, together with foreclosure assistance efforts already in place, are aimed at helping as many as four million embattled owners keep their houses. But the measures, which will take as long as six months to put into practice, might easily fall victim to some of the conflicting interests that have bedeviled efforts to date. None of these programs have the force of law, and lenders have often seen no good reason to participate.

To lubricate its efforts, the government plans to spread taxpayers’ money around liberally. ... All told, the new measures are expected to cost about $50 billion.

Today’s Treasury announcement represents a huge step forward in efforts to address the housing crisis. We have argued repeatedly that the housing market has two deep underlying problems: (1) “housing overhang” (i.e. the number of loans that are already in delinquent status or in foreclosure, most of which have substantial negative equity) and (2) the large number of borrowers with negative equity who are still paying but who are destined to go delinquent. We have estimated the housing overhang at >7 million units. Add to that the borrowers with considerable negative equity who have not yet defaulted and we arrive at approximately 12 million borrowersAlthough I'm not as optimistic as Goodman on the principal reduction program (as far as the number of homeowners who will be helped), these new program are a significant change. I've calling 2010 the "year of the short sale" and I think the HAFA short sale changes (like doubling the amount 2nd lien holders receive) will have an impact.

conceivably facing foreclosure over the next few years.

...

While there is no silver bullet to solving the housing crisis, we believe Treasury’s new program attacks the real problem: negative equity.

...

The changes in the HAMP modification program, with principal reduction moved front and center, is a very important development. While the actual impact depends on the implementation details, we believe this will dramatically improve the success rate on mortgage modifications. This will, in turn, help cushion future home price depreciation, and limit further housing market deterioration.

Friday, March 26, 2010

Unofficial Problem Bank List increases to 684

by Calculated Risk on 3/26/2010 11:54:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

As anticipated last week, the FDIC released its enforcement actions for February, which contributed to major changes in the Unofficial Problem Bank List. The list includes 684 institutions with aggregate assets of $351.2 billion, up from 653 institutions with assets of $332 billion last week.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Additions are 35 institutions with assets of $20.3 billion while 4 institutions with assets of $1 billion were removed. Removals include the three failures this week -- Desert Hills Bank ($497 million), Unity National Bank ($301 million), and Key West Bank ($88 million), and one action termination against Citizens Bank, New Tazewell, TN ($150 million).

Most notable among the 35 additions are Citizens Bank, Flint, MI ($11.3 billion Ticker: CRBC); Mile High Banks, Longmont, CO ($1.3 billion); United Security Bank, Fresno, CA ($694 million Ticker: UBFO); First Central Savings Bank, Glen Cove, NY ($683 million); and Finance Factors, Ltd., Honolulu, HI ($654 million).

In addition, Bank of Florida Corporation (Ticker: BOFL), with consolidated assets of $1.5 billion, announced that its three banking subsidiaries -- Bank of Florida - Southeast, Bank of Florida - Southwest, and Bank of Florida - Tampa Bay, received a Prompt Corrective Action order from the FDIC. The other new addition via a Prompt Corrective Action is AmericanFirst Bank, Clermont, FL ($90 million).

A few institutions already on the list also received a Prompt Corrective Action order including AmericanWest Bank, Spokane, WA ($1.6 billion Ticker: AWBC.PK); Ventura County Business Bank, Oxnard, CA ($93 million Ticker: VCBB.OB); and High Desert State Bank, Albuquerque, NM ($82 million).

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #41: Desert Hills Bank, Phoenix, Arizona

by Calculated Risk on 3/26/2010 07:03:00 PM

Not with the sound of money

But with banks failing

by Soylent Green is People

From the FDIC:New York Community Bank, Westbury, New York, Assumes All of the Deposits of Desert Hills Bank, Phoenix, Arizona

Desert Hills Bank, Phoenix, Arizona, was closed today by the Arizona Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....Hey - the FDIC used #40 twice! This is really 41 ...

As of December 31, 2009, Desert Hills Bank had approximately $496.6 million in total assets and $426.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $106.7 million. .... Desert Hills Bank is the 40th FDIC-insured institution to fail in the nation this year, and the first in Arizona. The last FDIC-insured institution closed in the state was Valley Capital Bank, N.A., Mesa, on December 11, 2009.

Bank Failures #38, #39 and #40: Florida and Georgia

by Calculated Risk on 3/26/2010 06:07:00 PM

Banks versus Bair's big sluggers

First inning triple.

by Soylent Green is People

From the FDIC: CharterBank, West Point, Georgia, Assumes All of the Deposits of McIntosh Commercial Bank, Carrollton, Georgia

McIntosh Commercial Bank, Carrollton, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Centennial Bank, Conway, Arkansas, Assumes All of the Deposits of Key West Bank, Key West, Florida

As of December 31, 2009, McIntosh Commercial Bank had approximately $362.9 million in total assets and $343.3 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $123.3 million. ... McIntosh Commercial Bank is the 38th FDIC-insured institution to fail in the nation this year, and the sixth in Georgia. The last FDIC-insured institution closed in the state was Bank of Hiawassee, Hiawassee, on March 19, 2010.

Key West Bank, Key West, Florida, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Bank of the Ozarks, Little Rock, Arkansas, Assumes All of the Deposits of Unity National Bank, Cartersville, Georgia

As of December 31, 2009, Key West Bank had approximately $88.0 million in total assets and $67.7 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $23.1 million. ... Key West Bank is the 39th FDIC-insured institution to fail in the nation this year, and the sixth in Florida. The last FDIC-insured institution closed in the state was Old Southern Bank, Orlando, on March 12, 2010.

Unity National Bank, Cartersville, Georgia, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....It is Friday!

As of December 31, 2009, Unity National Bank had approximately $292.2 million in total assets and $264.3 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $67.2 million. ... Unity National Bank is the 40th FDIC-insured institution to fail in the nation this year, and the seventh in Georgia. The last FDIC-insured institution closed in the state was McIntosh Commercial Bank, Carrollton, earlier today.

More on HAMP "Improvements"

by Calculated Risk on 3/26/2010 02:49:00 PM

There are four elements to the Making Home Affordable Program Enhancements:

1. Temporary Assistance for Unemployed Homeowners While They Search for Re-EmploymentThe focus is on principal writedowns, but possibly the bigger impact will be from the fourth point - the HAFA program (short sales and deed-in-lieu).

2. Requirement to Consider Alternative Principal Write-down Approach and Increased Principal Write-down Incentives

3. Improvements to Reach More Borrowers with HAMP Modifications

4. Helping Homeowners Move to More Affordable Housing

The temporary assistance is just that - temporary. Hopefully the homeowner will find a job otherwise most borrowers will be moved on to #4.

4. Helping Homeowners Move to More Affordable HousingI think this change will impact the most borrowers (I think principal reduction will be a limited tool). Treasury is doubling the incentive for 2nd lien holders (may still not be enough), and increasing the incentive for servicers and borrowers.Increase incentives to provide more homeowners with foreclosure alternatives Increase payoffs to subordinate lien holders who agree to release borrowers from debt to facilitate greater use of foreclosure alternatives including short sales or deeds-in-lieu. The new payoff schedule allows servicers to increase the maximum payoff to subordinate lien holders to 6 percent of the outstanding loan balance and doubles from $1,000 to $2,000 the incentive reimbursement that is available to investors for subordinate lien payoffs, subject to an overall cap of $6,000. Increase servicer incentive payments from $1,000 to $1,500 to increase use of foreclosure alternatives and encourage additional outreach to homeowners unable to complete a modification. Double relocation assistance payment for borrowers successfully completing foreclosure alternative to $3,000 Help homeowners who use a short sale or deed-in-lieu to transition more quickly to housing they can afford.

This is the HAFA program that is scheduled to start in early April. This will probably only apply to around 3 million of the 8 million homeowners who are delinquent on their mortgage (initial guess). And probably only about half of those 3 million will receive a modification or use a short sale.

HAMP Principal Write-downs

by Calculated Risk on 3/26/2010 11:41:00 AM

There are a number of changes to HAMP announced today. This includes help for unemployed homeowners and more outreach. David Streitfeld at the NY Times gives an overview: U.S. Plans Big Expansion in Effort to Aid Homeowners.

Here is a fact sheet from Treasury on these changes.

The key changes are principal reductions and larger payments to 2nd liens (including for HAFA short sales). For short sales, the 2nd lien payment has been doubled from 3% of the outstanding balance to 6% - although this is probably still below the typical recovery rate for 2nd liens.

From Treasury on short sales (and deed-in-lieu):

Increase payoffs to subordinate lien holders who agree to release borrowers from debt to facilitate greater use of foreclosure alternatives including short sales or deeds-in-lieu.For 1st lien principal reduction, the incentive from the Federal Government (taxpayers) is to pay 15 cents on the dollar for reductions in the unpaid principal balance for LTVs (loan-to-values) between 115% and 140%. For LTVs above 140%, the payment is 10 cents on the dollar, and for reductions below 115%, the payment increases to 21 cents on the dollar.The new payoff schedule allows servicers to increase the maximum payoff to subordinate lien holders to 6 percent of the outstanding loan balance and doubles from $1,000 to $2,000 the incentive reimbursement that is available to investors for subordinate lien payoffs, subject to an overall cap of $6,000.

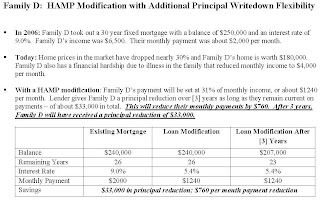

The Treasury has some examples here for the various changes.

An example of principal reduction (optional):

Click on example for larger image in new window.

Click on example for larger image in new window.So this is 133% LTV. So the taxpayers will pay 15 cents on the dollar to the lender to reduce the principal by $33,000. This is a payment of $4,950 (the lender takes a loss of $28,050). This still leave the borrower with a LTV of 115%.

Unemployment Rate Increases in 27 States in February

by Calculated Risk on 3/26/2010 10:00:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Twenty-seven states recorded over-the-month unemployment rate increases, 7 states and the District of Columbia registered rate decreases, and 16 states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in 46 states and the District of Columbia and declined in 4 states.

...

Michigan again recorded the highest unemployment rate among the states, 14.1 percent in February. The states with the next highest rates were Nevada, 13.2 percent; Rhode Island, 12.7 percent; California and South Carolina, 12.5 percent each; and Florida, 12.2 percent. North Dakota continued to register the lowest jobless rate, 4.1 percent in February, followed by Nebraska and South Dakota, 4.8 percent each. The rates in Florida and Nevada set new series highs, as did the rates in two other states: Georgia (10.5 percent) and North Carolina (11.2 percent).

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Fifteen states and D.C. now have double digit unemployment rates. New Jersey and Indiana are close.

Four states and set new series record highs: Florida, Nevada, Georgia and North Carolina. Three other states tied series record highs: California, Rhode Island and South Carolina.

Correction: Fed MBS Program: $6.075 Billion to go

by Calculated Risk on 3/26/2010 09:10:00 AM

For the MBS countdown I've been using the Atlanta Fed numbers and there was some rounding involved. Instead of $2 billion more to go, the Fed will buy $6.075 billion in MBS over the final week.

The program ends in a few days, and Adam Quinones at Mortgage News Daily was kind of enough to send me his spreadsheet (thanks!). Here is his story: Fed's MBS Purchase Program: One Week To Go

Since the inception of the program in January 2009, the Fed has spent $1.244 trillion in the agency MBS market, or 99.5 percent of the allocated $1.25 trillion, which is scheduled to run out next Wednesday. With one week left in the program, there is now only $6.1 billion in funding remaining.

Q4 GDP Revised down to 5.6%

by Calculated Risk on 3/26/2010 08:18:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 5.6 percent in the fourth quarter of 2009 ... Real personal consumption expenditures increased 1.6 percent in the fourth quarter.The headline GDP number was revised down to 5.6% annualized growth in Q4 (from 5.9%). The following table shows the changes from the "advance estimate" to the "second estimate" to the "third estimate" for several key categories:

| Advance | Second Estimate | Third Estimate | |

|---|---|---|---|

| GDP | 5.7% | 5.9% | 5.6% |

| PCE | 2.0% | 1.7% | 1.6% |

| Residential Investment | 5.7% | 5.0% | 3.8% |

| Structures | -15.4% | -13.9% | -18.0% |

| Equipment & Software | 13.3% | 18.2% | 19.0% |