by Calculated Risk on 1/24/2010 09:45:00 PM

Sunday, January 24, 2010

Financial Times: 'Bankers to lobby for softer reforms'

From the Financial Times: Bankers to lobby for softer reforms (ht MrM)

Senior Wall Street bankers heading to the World Economic Forum will use the meeting in Davos to lobby regulators against a rigorous implementation of Barack Obama’s plan to cap the size and trading activity of banks.That is no surprise.

excerpted with permission

The article quotes UK chancellor Alistair Darling as opposing Obama's proposal, from The Times: Alistair Darling warns Barack Obama over banking reforms

In an interview with The Sunday Times, the chancellor made clear that he saw serious shortcomings in the American approach.The Financial Times points out that "chimes" with previous comments of Secretary Geithner.

“It is always difficult to say ex ante that you would never intervene to save a particular sort of bank,” he said. “In Lehman, for example, there wasn’t a single retail deposit, but the then American administration allowed it to go down and that brought the rest of the system down on the back of it.

“You could end up dividing institutions and making them separate legal entities but that isn’t the point. The point is the connectivity between them in relation to their financial transactions."

More on Q4 GDP Forecasts

by Calculated Risk on 1/24/2010 05:13:00 PM

As I mentioned in the previous summary post, the consensus is for a pretty strong Q4 GDP headline number. But this was driven by changes in inventory and probably will not last. A couple of stories ...

From Bloomberg: Growth Probably Accelerated as 2009 Ended: U.S. Economy Preview

Gross domestic product expanded at a 4.6 percent pace from October through December ... according to the median estimate of 74 economists surveyed by Bloomberg News. ... “Inventories are going to be responsible for at least half of the growth, if not more,” said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. in New York.And from Rex Nutting at MarketWatch: Eye-popping GDP number not sustainable

Economists surveyed by MarketWatch are forecasting a 5.5% annualized increase ... "Although we anticipate a large rise in GDP, underlying growth is expected to be rather tepid, held down by declines in structures, government spending, and motor vehicle sales," wrote Peter D'Antonio, an economist for Citigroup Global Markets.For more, see beware the blip and also from Krugman: Blip.

...

Most of the boost in the economy in the fourth quarter came not from sales of goods and services but from the adjustment in the inventories of unsold goods.

Weekly Summary and a Look Ahead

by Calculated Risk on 1/24/2010 12:52:00 PM

This will be a busy week for housing data, and the Q4 GDP report will be released on Friday.

On Monday, the National Association of Realtors (NAR) will report existing home sales for December. The consensus is for a significant decline to 5.9 million units (SAAR). From James Hagerty at the WSJ: Why You Can Yawn Over Monday’s Home Sales ‘Shock’

The National Association of Realtors is due to release its monthly report on existing home sales at 10 a.m. Monday, and it’s likely to look lousy. ... Analysts are predicting a sharp drop from November’s level. ...I'd take it one step further and remind everyone that what matters for the economy and jobs is new home sales and housing starts, not existing home sales.

Tom Lawler, a housing economist in rural Virginia ... expects Monday’s report from the Realtors to show that resales in December were down 17% from November to a seasonally adjusted annual rate of 5.42 million. Dan Oppenheim of Credit Suisse expects a 12% drop to 5.76 million. ...

So get over it. In advance.

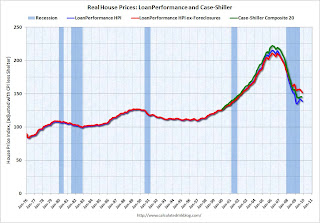

On Tuesday the Case-Shiller house price index for November will be released. This might show a decline since the LoanPerformance index (see below) has declined for three straight months.

On Wednesday New Home sales for December will be released by the Census Bureau. The consensus is for a slight increase. Also on Wednesday the FOMC meeting announcement will be released (no change to rates or wording is expected).

On Thursday, durable goods will be released and on Friday the Q4 GDP report. The consensus is for 4.5% real GDP growth (annualized), and Goldman Sachs is forecasting 5.8%. Remember, beware the blip and also from Krugman: Blip.

And a summary of last week ...

Click on graph for larger image in new window.

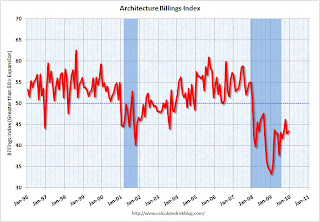

Click on graph for larger image in new window.This index is primarily a leading indicator for non-residential construction.

The American Institute of Architects’ Architecture Billings Index increased slightly to 43.4 in December from 42.8 in November. It was at 46.1 in October. Any reading below 50 indicates contraction.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through 2010, and probably longer.

Moody's reported: "After 13 consecutive months of declining property values, the Moody’s/REAL Commercial Property Price Index (CPPI) measured a 1.0% increase in prices in November. Prices began falling over two years ago and significant declines were seen throughout 2009, with several months experiencing 5%+ value drops. The 1.0% growth in prices seen in November is a small bright spot for the commercial real estate sector, which has seen values fall over 43% from the peak."

Moody's reported: "After 13 consecutive months of declining property values, the Moody’s/REAL Commercial Property Price Index (CPPI) measured a 1.0% increase in prices in November. Prices began falling over two years ago and significant declines were seen throughout 2009, with several months experiencing 5%+ value drops. The 1.0% growth in prices seen in November is a small bright spot for the commercial real estate sector, which has seen values fall over 43% from the peak."The graph is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Note that Moody's added: "We expect commercial real estate prices to decline further in the months ahead."

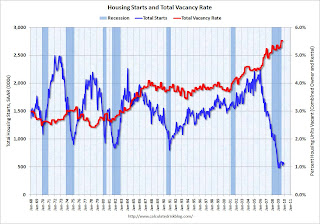

Total housing starts were at 557 thousand (SAAR) in December, down 4.0% from the revised November rate, and up 16% from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for seven months.

Total housing starts were at 557 thousand (SAAR) in December, down 4.0% from the revised November rate, and up 16% from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for seven months.Single-family starts were at 456 thousand (SAAR) in December, down 6.9% from the revised November rate, and 28 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at around this level for seven months.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 15 in January. This is a decrease from 16 in December and 17 in November

The record low was 8 set in January. This is still very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May.

First American CoreLogic reported: "On a month-over-month basis ... national home prices declined by 0.2 percent in November 2009 compared to October 2009."

This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

This graph shows the national LoanPerformance data since 1976. January 2000 = 100.The index is off 5.7% over the last year, and off 30.0% from the peak.

The index has declined for three consecutive months.

Note: this is the house price indicator used by the Fed.

Best wishes to all.

CRE in SoCal: Vacancy Rates Up, Rents Fall

by Calculated Risk on 1/24/2010 09:24:00 AM

The headline is on the hopeful side, but the story has some details ...

From Roger Vincent at the LA Times: Bottom is near for building owners; recovery is another matter (ht Bill)

Overall office vacancy in the fourth quarter in Los Angeles, Orange, San Bernardino and Riverside counties was 18.5%, a substantial jump from 14.4% a year earlier, according to commercial real estate brokerage Cushman & Wakefield.And a different kind of "shadow inventory":

"Vacancies are up, and I believe they will continue to go up this year as we have continued job losses," said Joe Vargas, leader of the company's Southern California offices.

Right now, many firms have shrunk but are still renting the same amount of space they had in fatter days. Before they can grow enough to expand into bigger offices, they need to do enough hiring to fill up what they already have.Even if job losses stop, the vacancy rate will probably continue to rise as leases expire and companies downsize. And the current level of vacancies will continue to push down rents as landlords fight for tenants. And of course there will be little investment in new office buildings for some time.

"All the vacant space out there still doesn't reflect all the jobs that were lost," said Whitley Collins, regional managing director of real estate brokerage Jones Lang LaSalle.

Shadow space, as leased but unused space is often called, is impossible to measure accurately, but there is surely enough of it to slow the commercial real estate comeback. Office leasing growth usually lags behind economic recovery by six to nine months, Collins said. A local office market recovery might be as much as 18 months behind the economy now because of shadow space.

Saturday, January 23, 2010

Jon Stewart on Cramer's Tuesday Market Prediction

by Calculated Risk on 1/23/2010 10:40:00 PM

The Cramer bit starts at 7:50 ... another great Cramer prediction last Tuesday afternoon.

Here is the link to the video.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Indecision 2010 - The Re-Changening | ||||

| www.thedailyshow.com | ||||

| ||||

Senators "confident" Bernanke will be confirmed

by Calculated Risk on 1/23/2010 07:03:00 PM

From the Jackie Calmes and Sewell Chan at the NY Times: 2 Senators Predict Bernanke to Be Confirmed

And from David Wessel at the WSJ: Dodd, Gregg Predict Bernanke Will Win Confirmation Vote

Here is the statement:

Today, Senate Banking Committee Chairman Chris Dodd (D-CT) and Banking Committee Member Judd Gregg (R-NH) issued a joint statement on their confidence that Federal Reserve Chairman Ben Bernanke will be confirmed by the Senate for a second term.

“In the last few days there have been a flurry of media reports on Chairman Bernanke’s confirmation prospects, highlighting a very vocal opposition. Chairman Bernanke has done an excellent job responding to one of the most significant financial crises our country has ever encountered. We support his nomination because he is the right leader to guide the Federal Reserve in this recovering economy. Based on our discussions with our colleagues, we are very confident that Chairman Bernanke will win confirmation by the Senate for a second term."

Update on Residential Investment

by Calculated Risk on 1/23/2010 04:46:00 PM

This is an update of some graphs in a post last month: Residential Investment: Moving Sideways.

Housing Starts Click on graph for larger image in new window.

Click on graph for larger image in new window.

Housing starts are still moving sideways ...

Total housing starts were at 557 thousand (SAAR) in December, down 4.0% from the revised November rate, and up 16% from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for seven months.

Single-family starts were at 456 thousand (SAAR) in December, down 6.9% from the revised November rate, and 28 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at around this level for seven months.

Builder Confidence This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 15 in January. This is a decrease from 16 in December and 17 in November.

More moving sideways ... (or down!)

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

MBA Purchase Index This graph shows the MBA Purchase Index and four week moving average since 1990.

This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is slightly above the 12 year low set last week.

Although there are more cash buyers now (all the investor buying), this suggests further weakness in home purchases.

House Prices

LoanPerformance reported yesterday that house prices fell again in November.

Most people follow the Case-Shiller index (to be released next Tuesday), but the Fed uses the First American CoreLogic LoanPerformance House Price Index (HPI). This graph shows the three indices with January 2000 = 100.

This graph shows the three indices with January 2000 = 100.

The index is off 5.7% over the last year, and off 30.0% from the peak.

The index has declined for three consecutive months.

The Case-Shiller might show a decline in November too, but it is a 3 month average, so the decline might not show up until December.

For more graphs, here are real prices and the price-to-rent ratio using the LoanPerformance HPI.

Vacant Housing Units The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing through Q3 2009 (Q4 will be released in early February).

The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing through Q3 2009 (Q4 will be released in early February).

As I've noted several times, it is difficult to see a robust recovery without a recovery in residential investment. And it is hard to imagine a strong recovery in residential investment until the huge overhang of excess housing units are absorbed.

I don't expect another plunge in housing starts or new home sales, but as long as these indicators are moving sideways - or just recovering modestly - I think the economic recovery will be sluggish.

More on Bernanke

by Calculated Risk on 1/23/2010 12:52:00 PM

From Jim Hamilton at Econbrowser: Why Bernanke should be reconfirmed

I asked a senior Fed staff economist in 2008 how Bernanke was holding up personally under all the pressure. He used an expression I hadn't heard before, but seems very apt. He said he was extremely impressed by Bernanke's "intellectual stamina," by which he meant a tireless energy to continually re-evaluate, receive new input, assess the consequences of what has happened so far, and decide what to do next. That is an extremely rare quality. Most of us can be very defensive about the decisions we've made, and our emotional tie to those can prevent us from objectively processing new information. On the recent occasions I've seen Bernanke personally, that's certainly what I observed as well. Even with all he's been through, the man retains a remarkable openness to hear what others may have to say.From Brad DeLong: Don't Block Ben!

Please permit me to suggest that intellectual stamina is the most important quality we need in the Federal Reserve Chair right now.

I think Bernanke is one of the best in the world for this job--I cannot think of anyone clearly better.From Paul Krugman: The Bernanke Conundrum

As I see it, the two things that worry me about Bernanke stem from the same cause: to a greater degree than I had hoped, he has been assimilated by the banking Borg. In 2005, respectable central bankers dismissed worries about a housing bubble, ignoring the evidence; in the winter of 2009-2010, respectable central bankers are worried about nonexistent inflation rather than actually existing unemployment. And Bernanke, alas, has become too much of a respectable central banker.Krugman suggests we need someone with the "intellectual chops for the job", but who hasn't been assimilated by the "banking Borg" - and someone who would also be effective in leading the FOMC. I agree that Bernanke meets the first and last qualifications. And I think he is a far better Fed Chairman than Greenspan.

That said, however, what is the alternative? Calculated Risk says we can do better. But can we, really?

It’s not that hard to think of people who have the intellectual chops for the job of Fed chair but aren’t fully part of the Borg. But it’s very hard to think of people with those qualities who have any chance of actually being confirmed, or of carrying the FOMC with them even if named as chairman (which is one reason why this suggestion is crazy). Does it make sense to deny Bernanke reappointment simply in order to appoint someone who would follow the same policies?

And yet, the Fed really needs to be shaken out of its complacency.

As I said, I’m agonizing.

However I'd also prefer someone who expressed concerns about the asset bubbles fairly early on. Perhaps it is premature to name a specific person, but I think San Francisco Fed President Janet Yellen comes close to meeting all of the criteria.

On Bernanke's Reconfirmation

by Calculated Risk on 1/23/2010 08:49:00 AM

A few articles ...

From the WSJ: Populist Surge on Hill Eases the Support for Bernanke

Alarmed that there might not be the 60 votes in the Senate needed to extend Mr. Bernanke's term beyond its Jan. 31 expiration, the White House entered the fray publicly for the first time, with officials trying to win support among Democratic senators. President Barack Obama "has a great deal of confidence in what Chairman Bernanke did to bring our economy back from the brink," deputy White House press secretary Bill Burton told reporters aboard Air Force One. "And he continues to think that he's the best person for the job, and will be confirmed by the United States Senate."From the NY Times: Bernanke’s Bid for a Second Term at the Fed Hits Resistance

Two Democratic senators who are up for re-election this year announced that they would oppose Mr. Bernanke, whose four-year term as head of the central bank expires at the end of this month. Their decisions reflected a surge of opposition among some Democrats and Republicans to Mr. Bernanke, a primary architect of the bailout of the financial system and a contributor to policies that critics contend put the economy at risk in the first place.From the Financial Times: Bernanke under pressure

From CNBC: Bernanke Vote: 'Unthinkable Has Become a Possibility'

Bernanke definitely supported policies that contributed to the crisis, and he failed to see the problems coming. However once Bernanke started to understand the problem, he was very effective at providing liquidity for the markets.

But since his renomination, he hasn't done himself any favors. He has admitted the Fed failed as a regulator, but he hasn't explained why - or outlined a clear path forward. And Bernanke keeps saying really dumb things, like claiming incorrectly to have an exploding adjustable rate mortgage. That was an ignorant remark considering his position as Fed Chairman and the plight of so many Americans. And quoting a bank robber in testimony to Congress when addressing the long term deficit (suggesting Congress steal from middle class Americans?), and this right after he claimed he wouldn't comment on areas outside of the Fed's authority. Dumb.

I definitely think we could do better.

Friday, January 22, 2010

Unofficial Problem Bank Lists Increases to 584

by Calculated Risk on 1/22/2010 10:42:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. CR NOTE: This was compiled before the 5 bank failures today. There was a "timely" Prompt Corrective Action issued against Charter Bank, Santa Fe, NM and the bank was seized today!

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by a net two institutions to 584.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Aggregate assets total $305.3 billion, up from $304.8 billion last week. Additions include Pamrapo Savings Bank, Bayonne, NJ ($573 million); Capitol City Bank & Trust Company, Atlanta, GA ($322 million); Bank of Virginia, Midlothian, VA ($226 million); and Independence National Bank, Greenville, GA ($138 million).

Deletions are the two failures last week – Barnes Banking Company ($828 million), and St. Stephens State Bank ($25 million). The other change is a Prompt Corrective Action order issued by the OTS against Charter Bank, Santa Fe, NM ($1.3 billion) on January 20, 2010, which was already operating under a Cease & Desist order.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failures #8 & #9: Evergreen Bank, Seattle, Washington and Columbia River Bank, The Dalles, Oregon

by Calculated Risk on 1/22/2010 09:06:00 PM

Columbia River Bank,

Both washed away.

by Soylent Green is People

From the FDIC: Umpqua Bank, Roseburg, Oregon, Assumes All of the Deposits of Evergreen Bank, Seattle, Washington

Evergreen Bank Seattle, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....From the FDIC: Columbia State Bank, Tacoma, Washington, Assumes All of the Deposits of Columbia River Bank, The Dalles, Oregon

As of September 30, 2009, Evergreen Bank had approximately $488.5 million in total assets and $439.4 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $64.2 million. ... Evergreen Bank is the eighth FDIC-insured institution to fail in the nation this year, and the second in Washington. The last FDIC-insured institution closed in the state was Horizon Bank, Bellingham, on January 8, 2010.

Columbia River Bank, The Dalles, Oregon, was closed today by the Oregon Division of Finance and Corporate Securities, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes five bank failures today, and two with over $1 billion in assets each.

As of September 30, 2009, Columbia River Bank had approximately $1.1 billion in total assets and $1.0 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $172.5 million. ... Columbia River Bank is the ninth FDIC-insured institution to fail in the nation this year, and the first in Oregon. The last FDIC-insured institution closed in the state was Community First Bank, Prineville, on August 7, 2009.

Bank Failure #7: Charter Bank, Santa Fe, New Mexico

by Calculated Risk on 1/22/2010 08:31:00 PM

Hot tamales, fajitas

Zero cold hard cash.

by Soylent Green is People

From the FDIC: Charter Bank, Albuquerque, New Mexico, Assumes All of the Deposits of Charter Bank, Santa Fe, New Mexico

Charter Bank, Santa Fe, New Mexico, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Charter Bank, Albuquerque, New Mexico, a newly-chartered federal savings bank and a subsidiary of Beal Financial Corporation, Plano, Texas, to assume all of the deposits of Charter Bank.A theme today: Charter eats Charter. Premier eats Premier.

...

As of September 30, 2009, Charter Bank had approximately $1.2 billion in total assets and $851.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $201.9 million. ... Charter Bank is the seventh FDIC-insured institution to fail in the nation this year, and the first in New Mexico. The last FDIC-insured institution closed in the state was Zia New Mexico Bank, Tucumcari, on April 23, 1999.

Bank Failure #6: Bank of Leeton, Leeton, Missouri

by Calculated Risk on 1/22/2010 07:05:00 PM

Flyover town with small bank

Not too big to fail

by Soylent Green is People

From the FDIC: Sunflower Bank, National Association, Salina, Kansas, Assumes All of the Deposits of Bank of Leeton, Leeton, Missouri

Bank of Leeton, Leeton, Missouri, was closed today by the Missouri Division of Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Small ones count too.

As of December 31, 2009, Bank of Leeton had approximately $20.1 million in total assets and $20.4 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.1 million. ... Bank of Leeton is the sixth FDIC-insured institution to fail in the nation this year, and the first in Missouri. The last FDIC-insured institution closed in the state was Gateway Bank of St. Louis, on November 6, 2009.

Bank Failure #5 in 2010: Premier American Bank, Miami, Florida

by Calculated Risk on 1/22/2010 06:07:00 PM

Premier American Bank

Like Icarus, scorched

by Soylent Green is People

From the FDIC: Premier American Bank, Miami, Florida, National Association, Assumes All of the Deposits of Premier American Bank, Miami, Florida

Premier American Bank, Miami Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Premier American Bank, National Association, Miami, Florida, a newly-chartered national institution, to assume all of the deposits of Premier American Bank. Premier American Bank, N.A. is a subsidiary of Bond Street Holdings, LLC, Naples, Florida.There were 140 bank failures in 2009, 25 in 2008 and 3 in 2007, so that makes 171 for this cycle.

...

As of September 30, 2009, Premier American Bank had approximately $350.9 million in total assets and $326.3 million in total deposits.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $85 million.... Premier American Bank is the fifth FDIC-insured institution to fail in the nation this year, and the first in Florida. The last FDIC-insured institution closed in the state was Peoples First Community Bank, Panama City, on December 18, 2009.

Real House Prices, Price-to-Rent Ratio

by Calculated Risk on 1/22/2010 04:00:00 PM

Earlier First American CoreLogic reported that house prices declined in November. This is the Fed's favorite house price index. This post looks at real prices and the price-to-rent ratio, but first a look at the market ...Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the First American CoreLogic LoanPerformance house price index through November (with and without foreclosures) and the Case-Shiller Composite 20 index through October in real terms (all adjusted with CPI less Shelter). It is interesting to look at the sharp decline in the index with foreclosures at the end of 2008 - this was what housing economist Tom Lawler described as "destickification" in the high foreclosure areas.

It is interesting to look at the sharp decline in the index with foreclosures at the end of 2008 - this was what housing economist Tom Lawler described as "destickification" in the high foreclosure areas.

Notice the LoanPerformance price index without foreclosures (in red) is now at the lowest level since July 2002 in real terms (inflation adjusted).

This isn't like 2005 when prices were way out of the normal range by most measures - and it is possible that total national prices bottomed in 2009 (although I think prices will fall further), but prices ex-foreclosures probably still have a ways to go, even with all the government programs aimed at supporting house prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through November 2009 using the First American CoreLogic LoanPerformance House Price Index: This graph shows the price to rent ratio (January 2000 = 1.0).

This graph shows the price to rent ratio (January 2000 = 1.0).

This suggests that house prices are still a little too high on a national basis. Also rents are still falling and the OER index tends to lag market rents by a few months. And that will push up the price-to-rent ratio, putting more pressure on house prices.

First American CoreLogic: House Prices Decline in November

by Calculated Risk on 1/22/2010 02:26:00 PM

The Fed's favorite house price indicator from First American CoreLogic’s LoanPerformance ...

From LoanPerformance: Home Prices Continue to Depreciate

On a month-over-month basis ... national home prices declined by 0.2 percent in November 2009 compared to October 2009.

...

Including distressed transactions, the HPI has fallen 30.0 percent nationally through November from its peak in April 2006. Excluding distressed properties, the national HPI has fallen 21.8 percent from the same peak.

...

"On average, we are expecting home prices to turn around next spring," said Mark Fleming, chief economist for First American CoreLogic. "While the share of REO sales are down, allowing price declines to moderate, there is concern moving forward with the levels of shadow inventory, negative equity, and the ability of modification programs to mitigate this risk."

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

The index is off 5.7% over the last year, and off 30.0% from the peak.

The index has declined for three consecutive months. I'll have some comparisons to Case-Shiller later, but according to First American CoreLogic, prices are now falling again. It might take another month for this to show up in the Case-Shiller index because it is an average over three months.

Hotel RevPAR off 16.7% in 2009

by Calculated Risk on 1/22/2010 12:18:00 PM

From HotelNewsNow.com: STR: US hotel industry ends '09 with double-digit RevPAR drop

Revenue per available room fell 16.7 percent to US$53.71 during 2009, according to year-end reports from Smith Travel Research.The occupancy rate in 2009 was the lowest since the Great Depression.

The industry’s occupancy fell 8.7 percent to 55.1 percent for the year and average daily rate dropped 8.8 percent to US$97.51.

“Good riddance to 2009, a year which we believe will go down as the worst in the modern hotel industry,” said Mark Lomanno, president at STR.

And on the weekly number, from HotelNewsNow.com: STR reports US performance for week ending 16 January 2010

In year-over-year measurements, the industry’s occupancy ended the week virtually flat with an 0.8-percent decrease to 47.8 percent. Average daily rate dropped 7.4 percent to finish the week at US$94.78. RevPAR for the week fell 8.2 percent to finish at US$45.33.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Notes: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays. It appears the occupancy rate might have stopped falling (Smith Travel Research reported the occupancy rate was off 0.8% compared to the same week in 2009), and business travel is the key over the next few months. However the low occupancy rate will continue to put pressure on the average daily room rate.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Unemployment Rate Increased in 43 States in December

by Calculated Risk on 1/22/2010 10:00:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally higher in December. Forty-three states and the District of Columbia recorded over-the-month unemployment rate increases, four states registered rate decreases, and three states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in all 50 states and the District of Columbia.

...

Michigan again recorded the highest unemployment rate among the states, 14.6 percent in December. The states with the next highest rates were Nevada, 13.0 percent; Rhode Island, 12.9 percent; and South Carolina, 12.6 percent. North Dakota continued to register the lowest jobless rate, 4.4 percent in December, followed by Nebraska and South Dakota, 4.7 percent each. The rate in South Carolina set a new series high, as did the rates in three other states: Delaware (9.0 percent), Florida (11.8 percent), and North Carolina (11.2 percent). The rate in the District of Columbia also set a new series high (12.1 percent).

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Sixteen states and D.C. now have double digit unemployment rates. Indiana, Missouri and Washington are all close.

Five states are at record unemployment rates: South Carolina, Florida, North Carolina, Georgia and Delaware, and several other states are close.

ABC News: Senate leadership uncertain if enough votes to re-confirm Bernanke

by Calculated Risk on 1/22/2010 08:47:00 AM

From ABC News: Senate Dems Not Sure They Can Get Enough Votes to Reconfirm Bernanke

... ABC News has learned that the Senate Democratic leadership isn't sure there are enough votes to re-confirm Ben Bernanke for another term as chairman of the Federal Reserve.From the WSJ: Fed's Bernanke Faces Tighter Vote in Senate

Bernanke's term expires on Jan. 31.

...

[Sen. Bernie Sanders, I-Vt.], Sen. Jim Bunning, R-Ky., Sen. Jim DeMint, R-S.C., and Sen. David Vitter, R-La., have all put holds on Bernanke's nomination, requiring 60 votes to proceed to a vote.

Ben Bernanke's confirmation for a second term as Federal Reserve chairman will go down to the wire and could be a closer vote than seemed likely just a few weeks ago.

...

Mr. Bernanke met with Senate Majority Leader Harry Reid Thursday as Democratic and Republican leaders surveyed senators to tally votes on the nomination. Mr. Bernanke needs 60 supporters to win approval for another four-year term.

HAMP Changes Coming

by Calculated Risk on 1/22/2010 12:27:00 AM

But what changes isn't exactly clear ...

From Peter Goodman at the NY Times: Treasury Weighs Fixes to a Program to Fend Off Foreclosures

The Treasury is likely to alter the program by making pay stubs an acceptable means of verifying income, rather than requiring tax documents ...Unless I'm missing something, the only change to be announced next week, mentioned in the article, is allowing borrowers to use pay stubs to verify income, as opposed to providing tax documents. That doesn't make much sense since it is pretty easy to provide tax documents, and underwriting in arrears is one of the keys to the program (the failure to document income was one of the problems with nontraditional mortgages). This sounds like another delaying tactic.

The changes by the Treasury Department are expected to include greater assistance for homeowners no longer able to make mortgage payments because their paychecks have shrunk ... The Treasury was still debating the method ... looking at either direct cash assistance or a grace period in which borrowers could postpone payments. That component may not be announced next week, but would follow soon after.

...

The changes to be introduced next week are unlikely to address what has emerged as a potent factor propelling a wave of foreclosures: the roughly 15 million borrowers who are said to be underwater ...