by Calculated Risk on 12/11/2009 11:30:00 AM

Friday, December 11, 2009

Q3 2009: Mortgage Equity Extraction Strongly Negative

Note: This is not MEW data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008. My thanks to Jim Kennedy and the other Fed contributors for the previous MEW updates. For those interested in the last Kennedy data, here is a post, and the spreadsheet from the Fed is available here.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q3 2009, the Net Equity Extraction was minus $91 billion, or negative 3.3% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined in Q3, and this was partially because of debt cancellation per foreclosure sales, and some from modifications, like Wells Fargo's principal reduction program, and partially due to homeowners paying down their mortgages as opposed to borrowing more. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be negative.

Equity extraction was very important in increasing consumer spending during the housing bubble (some disagree with this, but I think they are wrong). Atif Mian and Amir Sufi of the University of Chicago Booth School of Business wrote a piece earlier this year: Guest Contribution: Housing Bubble Fueled Consumer Spending

Findings in our research suggest ... the rise in house prices from 2002 to 2006 was a main driver of economic growth during this time period, and the subsequent collapse of house prices is likely a main contributor to the historic consumption decline over the past year.Don't expect the Home ATM to be reopened any time soon - so any significant increase in consumer spending will come from income growth, not borrowing.

University of Michigan Consumer Sentiment

by Calculated Risk on 12/11/2009 10:01:00 AM

From MarketWatch: Consumer sentiment soars in early Dec

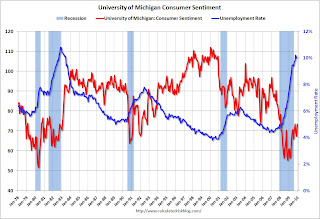

Consumer sentiment improved markedly in early December, according to media reports on Friday of the Reuters/University of Michigan index. The consumer sentiment index rose to 73.4 in early December from 67.4 in November. ... This is the highest level of consumer sentiment since September.Although this is being reported as "soars" and above expectations, sentiment is still low - at recesssion levels - and this is just a rebound to the September level.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Consumer sentiment is a coincident indicator - it tells you what you pretty much already know.

This graph shows consumer sentiment and the unemployment rate. There are other factors impacting sentiment too - like gasoline prices - but it is no surprise that consumer sentiment is still very low.

Retail Sales increase in November

by Calculated Risk on 12/11/2009 08:30:00 AM

On a monthly basis, retail sales increased 1.3% from October to November (seasonally adjusted), and sales are up 1.9% from November 2008.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

The red line shows retail sales ex-gasoline and shows there has been only a little increase in final demand. The second graph shows the year-over-year change in retail sales since 1993.

The second graph shows the year-over-year change in retail sales since 1993.

Retail sales increased by 1.9% on a YoY basis. The year-over-year comparisons are much easier now since retail sales collapsed in October 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $352.1 billion, an increase of 1.3 percent (±0.5%) from the previous month and 1.9 percent (±0.5%) above November 2008. Total sales for the September through November 2009 period were down 2.1 percent (±0.3%) from the same period a year ago. The September to October 2009 percent change was revised from +1.4 percent (±0.5%) to +1.1 percent (±0.2%).It appears retail sales have bottomed, and there might be a little pickup in final demand.

Thursday, December 10, 2009

WaPo: New TARP Rules to Aid Small Businesses?

by Calculated Risk on 12/10/2009 10:30:00 PM

From David Cho at the WaPo: Joblessness plan revamps rules on bank bailouts (ht Mr. Ridgeback goes to Washington)

The Obama administration is developing a major initiative to tackle ... unemployment by getting federal bailout funds into the hands of small businesses.Another SIV proposal, this time to lend TARP money that isn't ... uh, TARP money? Why does this remind me of Hank Paulson?

The proposal involves spinning off a new entity from the Troubled Assets Relief Program that could give banks access to the government money without restrictions, such as limits on executive pay, as long as they use it to make loans to small businesses. ... No dollar figures have yet been attached to the new small-business lending effort, which is still in development, the sources said.

... [a "special-purpose vehicle"] would be financed by rescue funds and would lend to banks that provide small-business loans. In theory, this structure would free banks of the TARP conditions because they would be getting the money from a separate entity. They could also avoid being labeled as a TARP recipient.

I'd definitely like to see the plan for the next stimulus package, instead of focusing on these contortions to get it funded.

Retail Sales: "Looks like the middle of August out there"

by Calculated Risk on 12/10/2009 08:19:00 PM

November retail sales will be released tomorrow morning, but December is apparently off to a slow start ...

From the WSJ: Sales Lull Has Retailers Worried

The first week of December, typically a lackluster time in the wake of Black Friday, was particularly slow. ... "After solid traffic the first couple of days, it looks like the middle of August out there," said Stephen Baker, vice president of industry analysis for retail watcher NPD Group.And on a key category: Videogames Sales Fall Again in November

Combined November videogame software and hardware revenue fell 7.6% from a year earlier to $2.69 billion, data tracker NPD said Thursday. But revenue from videogame sales fell a surprising 3.1% amid expectations of mild growth in the mid-single-digit percentage range.Without growth in consumer spending, the recovery will be sluggish at best.

HAMP Questions

by Calculated Risk on 12/10/2009 05:19:00 PM

If there were 143,276 cumulative HAMP trial modifications in June - and the maximum length of a trial was extended to five months - how come there were only 31,382 permanent mods and 30,650 disqualified modifications by the end of November?

What happened to the other 82,244 modifications? Have they been extended?

And of the 697,026 active trial modifications, are all the borrowers current? That data seems to be missing from this release (HAMP report here)

My understanding was the HAMP data would show how many trial modifications had started, and the redefault rate by month. That key data is still missing.

HAMP: 31,382 Permanent Mods

by Calculated Risk on 12/10/2009 02:48:00 PM

Update: Treasury link now working, graphic added.

From Diana Olick at CNBC: First Look: Inside The $75 Billion Plan to Save Housing

Of the 759,058 modifications started, 697,026 are still in the three month trial phase. ... Treasury reports that 31,382 trial modifications are now permanent. ... 30,650 modifications were disqualified.Olick has much more.

Click on graph for larger image in new window.

Click on graph for larger image in new window.That is about a 50% failure rate during the trial period - and only a fraction of the eligible borrowers even bother.

Here is the link at Treasury. See here for a list of reports.

Fed Q3 Flow of Funds Report

by Calculated Risk on 12/10/2009 11:59:00 AM

The Fed released the Q3 2009 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth is now off $11.9 Trillion from the peak in 2007, but up $4.9 trillion from the trough earlier this year. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then ... bubbles!  This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (of household real estate) was up to 38% from the all time low of 33.5% earlier this year. The increase was due to a slight increase in the value of household real estate and a decline in mortgage debt.

Note: approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 38% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased in Q3 because of an increase in real estate values.

Mortgage debt declined by $70 billion - but will have to decline substantially (as a percent of GDP) to reach more normal levels.

Hotel RevPAR off 11.9%

by Calculated Risk on 12/10/2009 11:16:00 AM

From HotelNewsNow.com: Luxury leads occupancy increases for second week in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 4.9 percent to end the week at 47.6 percent, average daily rate dropped 7.3 percent to US$96.25, and revenue per available room decreased 11.9 percent to US$45.86.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was later in 2008 and 2009, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

This is a two year slump for the hotel industry. Although occupancy is off 4.9% compared to 2008, occupancy is off about 17% compared to the same week in 2006.

Leisure travel (weekend occupancy) is off only about 2% compared to the same week in 2008, but business travel (weekday occupancy) is off more suggesting no pickup in business travel - see the graph in the HotelNewsNow report.

Trade Deficit Declines in October

by Calculated Risk on 12/10/2009 08:59:00 AM

The Census Bureau reports:

The ... total October exports of $136.8 billion and imports of $169.8 billion resulted in a goods and services deficit of $32.9 billion, down from $35.7 billion in September, revised. October exports were $3.5 billion more than September exports of $133.4 billion. October imports were $0.7 billion more than September imports of $169.0billion.

Click on graph for larger image.

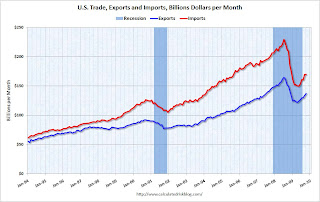

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through October 2009.

Imports and exports increased in October. On a year-over-year basis, exports are off 9% and imports are off 19%.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices decreased slightly to $67.39 in October - still up more than 50% from the prices in February (at $39.22) - and the decline followed seven consecutive monthly increases in the price of oil.

Oil import volumes dropped sharply in October, and the decline in oil imports was the major contributor to decrease in the trade deficit.

Weekly Initial Unemployment Claims Increase to 474,000

by Calculated Risk on 12/10/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 5, the advance figure for seasonally adjusted initial claims was 474,000, an increase of 17,000 from the previous week's unrevised figure of 457,000. The 4-week moving average was 473,750, a decrease of 7,750 from the previous week's revised average of 481,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 28 was 5,157,000, a decrease of 303,000 from the preceding week's revised level of 5,460,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 7,750 to 473,750. This is the lowest level since October 2008.

Although falling, the level of the 4 week average is still high, suggesting continuing job losses.

"Toxic Titles"

by Calculated Risk on 12/10/2009 12:17:00 AM

See update below for an earlier use of "toxic titles".

Just another addition to the crisis lexicon ... "toxic titles" ... from Fed Governor Elizabeth Duke: Keys to Successful Neighborhood Stabilization (ht Brian)

Communities with weak underlying economies are characterized by a long trend of population loss, gradual impoverishment, and strained municipal resources. For cities like Cleveland, Detroit, and Indianapolis the increase in foreclosures over the last few years has exacerbated a pre-existing vacancy problem. The increased rates of foreclosures and the related economic downturn have hastened a cycle of decreasing property values. Declines in state and local property and sales tax revenues result in even more vacant homes and deteriorating neighborhoods.I've seen toxic titles before in downturns with properties listed for $1 and still no takers ...

Many community organizations and homeowners have been frustrated by the difficulties of working with mortgage lenders and servicers, and these problems are even more exaggerated in weaker market cities. In the most devastated neighborhoods, some lenders do not even complete the foreclosure process or record the outcome of foreclosure sales because the cost of foreclosing exceeds the value of the property. Anecdotal evidence suggests that these "toxic titles" have placed significant numbers of properties in a difficult state of legal limbo.

UPDATE: Here is an earlier use of "toxic titles" from an article by Mary Kane in Jan 2008: ‘Toxic Titles’ Haunt Cities in Mortgage Meltdown

'Walkaways wind up with “toxic titles,’’ [Kermit Lind, a Cleveland law professor who specializes in housing cases] says. The mortgage company retains a lien, or a charge, on the house, but the borrower still is considered the owner. The property sits in limbo, with the mortgage usually exceeding what it would sell for, because of its decline. If the city has to tear it down, it adds its own $8,000 to $10,000 demolition lien. Not surprisingly, potential buyers aren’t exactly lining up. Non-profit neighborhood groups that could fix up the property face long and expensive legal battles to claim it.

Wednesday, December 09, 2009

The Rentership Society

by Calculated Risk on 12/09/2009 09:09:00 PM

Mark Whitehouse writes about the advantages of renting in the WSJ: American Dream 2: Default, Then Rent (ht Pat)

Whitehouse describes one former homeowner with a monthly income of $8,300. He was paying $4,800 a month on his home and he was basically working to pay his mortgage. He was really a "debt owner" since the home was worth far less than the amount owed. He now rents a similar home for $2,200 a month and is enjoying life:

[H]e now has the wherewithal to do things he couldn't when he was stretching to pay the mortgage. He recently went to concerts by Rob Thomas and Mat Kearney. He also kept his black BMW 6 Series coupe, which has payments of about $700 a month.This is one of the tragedies of the housing bubble - it encouraged people to become homeowners before they were really ready and also encouraged them to buy too much home (58% DTI for the mortgage is definitely "house poor"). Many of these people will not buy again for years, if ever.

"I don't know if I'll buy another house again, because it's such a huge headache," he says.

The article also mentions the "stealth stimulus" from all the delinquencies:

For the 4.8 million U.S. households that ... haven't paid their mortgages in at least three months, the added cash flow could amount to about $5 billion a month ... "It's a stealth stimulus," says Christopher Thornberg of Beacon Economics ...

Subprime Home Invasion

by Calculated Risk on 12/09/2009 07:04:00 PM

From KTLA: Home of Subprime Lender Targeted by Violent Robbers (ht WestSac_grrl)

Three suspects are under arrest after a violent home invasion robbery in a gated Newport Beach community ... The home is owned by Daniel Sadek, a prominent former subprime lender.There is no evidence of a connection to the collapse of Quick Loan.

...

Police did not immediately know whether the men who invaded Sadek's home were collecting on a debt or were there to rob him. They were taking cash and jewelry ...

Sadek made and lost a fortune in the subprime mortgage business. Quick Loan Funding, which he founded in 2002, wrote about $4 billion in subprime mortgages before it collapsed in 2007

The house was the scene of a fire two weeks ago.

CNBC: Citi to Repay TARP

by Calculated Risk on 12/09/2009 03:53:00 PM

From Maria Bartiromo at CNBC: Citi Plans to Repay TARP Via Stock Offering: Sources

Citigroup plans to pay back some of the $45 billion in TARP money it received last year by raising capital through a stock offering, CNBC has learned.Are the regulators sure they have enough capital?

An announcement could come as early as Thursday.

Expected Mortgage Rates

by Calculated Risk on 12/09/2009 03:02:00 PM

With the Ten Year Treasury yield at 3.42%, I was wondering what that would mean for mortgage rates. Click on graph for larger image.

Click on graph for larger image.

This graph is from Political Calculations: Predicting Mortgage Rates and Treasury Yields (based on one of my posts).

Using their calculator and a Ten Year Yield of 3.42%, we would expect the 30 year Freddie Mac fixed mortgage rate to be around 5.38%. Of course it is lower than expected - as it has been from most of the year - and some of the difference from the expected rate is probably due to the Fed's MBS purchases (also prepayment speed is a factor - and also just randomness).

The following table shows the difference between the expected and actual rate for the last 6 months. This suggests that mortgage rates will rise about 30 to 50 bps relative to the Ten Year Treasury yield when the Fed stops buying MBS.

| Ten Year Treasury Yield | Expected Mortgage Rate | Freddie Mac Mortgage Rate | Spread | |

|---|---|---|---|---|

| May | 3.28% | 5.28% | 4.86% | 0.42% |

| June | 3.71% | 5.59% | 5.42% | 0.17% |

| July | 3.54% | 5.46% | 5.22% | 0.24% |

| Aug | 3.58% | 5.49% | 5.19% | 0.30% |

| Sep | 3.39% | 5.36% | 5.06% | 0.30% |

| Oct | 3.37% | 5.34% | 4.95% | 0.39% |

| Nov | 3.40% | 5.36% | 4.88% | 0.48% |

| Average | 0.33% |

Volcker to Bankers: "Wake up, gentlemen"

by Calculated Risk on 12/09/2009 12:40:00 PM

“Has there been one financial leader to say this is really excessive? Wake up, gentlemen. Your response, I can only say, has been inadequate.”From The Times: ‘Wake up, gentlemen’, world’s top bankers warned by former Fed chairman Volcker

Paul Volcker, former Fed Chairman, Dec 8, 2009

“I wish someone would give me one shred of neutral evidence that financial innovation has led to economic growth — one shred of evidence,” said Mr Volcker ... He said that financial services in the United States had increased its share of value added from 2 per cent to 6.5 per cent, but he asked: “Is that a reflection of your financial innovation, or just a reflection of what you’re paid?”And from the Telegraph: Ex-Fed chief Paul Volcker's 'telling' words on derivatives industry

"You can innovate as much as you like, but do it within a structure that doesn't put the whole economy at risk."

...

Mr Volcker argued that banks did have a vital role to play as holders of deposits and providers of credit. This importance meant it was correct that they should be "regulated on one side and protected on the other". He said riskier financial activities should be limited to hedge funds to whom society could say: "If you fail, fail. I'm not going to help you. Your stock is gone, creditors are at risk, but no one else is affected."

Rail Traffic in November

by Calculated Risk on 12/09/2009 09:27:00 AM

From the Association of American Railroads: Rail Time Indicators Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows U.S. average weekly rail carloads. This can be a little misleading because the data is impacted by the Thanksgiving holiday, and most of the decline is in coal. (see the notes below)

From AAR:

• In November 2009, U.S. freight railroads originated 1,089,077 carloads, an average of 272,269 carloads per week. That’s down 8.2%, or 96,900 carloads, from November 2008’s 1,185,977 carloads (when the weekly average was 296,494 carloads) and down 17.4% from November 2007’s 1,318,023 total (a weekly average of 329,506 carloads).The AAR report has a number of other graphs for various sectors like autos and housing. As an example they compare U.S. Housing Starts with U.S. and Canadian Rail Carloads of Lumber, Wood & Forest Products.

• Coal had 78,535 fewer carloads in November 2009 than November 2008, accounting for most of the 96,900 total carload decline for the month.

• U.S. intermodal traffic (which isn’t included in carload figures) totaled 794,184 trailers and containers in November 2009, an average of 198,546 per week. That’s down 6.7% from November 2008 (when the weekly average was 212,879 units) and down

14.1% from November 2007, when the weekly average was 231,124.

• Freight railroading is a 24/7/365-days a year business, but Thanksgiving week is always one of the lowest-volume weeks of the year and therefore holds down the November average.

• If Thanksgiving week were excluded, November would have been the highest volume month for U.S. railroads since November 2008 for both carload and intermodal traffic.

MBA: Mortgage Refinance Applications Increase

by Calculated Risk on 12/09/2009 08:46:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 8.5 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 11.1 percent from the previous week and the seasonally adjusted Purchase Index increased 4.0 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.88 percent from 4.79 percent, with points increasing to 1.17 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This ends a six week run of declining 30-year fixed rates which may have triggered the increase in refinance applications.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

In the past, the MBA index was somewhat predictive of future sales, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining.

Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase. However - even with the increase in the purchase index this week - the recent plunge in the purchase index is probably worth watching.

Tuesday, December 08, 2009

BLS: Near Record Low Labor Turnover

by Calculated Risk on 12/08/2009 11:59:00 PM

From the BLS: Job Openings and Labor Turnover Summary

There were 2.5 million job openings on the last business day of October 2009, the U.S. Bureau of Labor Statistics reported today. The job openings rate was unchanged over the month at 1.9 percent. The openings rate has held relatively steady since March 2009. The hires rate (3.0 percent) and the separations rate (3.2 percent) were essentially unchanged and remained low.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people. See Jobs and the Unemployment Rate for a comparison of the two surveys.

The following graph shows job openings (yellow line), hires (blue Line), Quits (green bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and green added together equals total separations.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (blue line) and separations (red and green together) are pretty close each month. When the blue line is above total separations, the economy is adding net jobs, when the blue line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 3.966 million hires in October, and 4.203 million separations, or 237 thousand net jobs lost.

I'm not sure if openings are predictive of future hires (the data set is limited), but openings near a series low can't be a positive. Separations have declined sharply, with fewer quits and layoffs, but hiring has not picked up. And quits at a series low suggests those that are employed were holding on to their current jobs in October.