by Calculated Risk on 5/21/2009 04:00:00 PM

Thursday, May 21, 2009

Market and CAMELS

Here are a couple of market graphs from Doug (the 2nd one is new - the mega bear quartet in real prices), and an excerpt from CFO Magazine How Healthy Is Your Bank?

There was a significant bond sell-off today - probably because of concerns about the UK (and US) credit ratings.

| Click on graph for larger image in new window. The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

| The second graph compares four significant bear markets: the Dow during the Great Depression, the NASDAQ, the Nikkei, and the current S&P 500. This is inflation adjusted. See Doug's: "The Mega-Bear Quartet 2000" for a dicussion. |

Excerpt from CFO Magazine How Healthy Is Your Bank? (ht jb)

Evaluating a bank's health falls into two parts, says Mark J. Flannery, a finance professor at the University of Florida's Warrington College of Business Administration. One, how well capitalized is the bank — how much loss can it stand without failing? Two, what is the quality of its assets — how much loss risk is the bank exposed to?It is all about asset quality right now.

In the FDIC's eyes, a well-capitalized bank has a ratio of Tier 1 capital to total risk-weighted assets of at least 6% (analysts prefer to see 8%); a ratio of total capital to total risk-weighted assets of at least 10%; and a Tier 1 leverage ratio of at least 5%. ...

The trouble is, the risk-based capital ratios "don't work very well," says Frederick Cannon, chief equity strategist at Keefe Bruyette Woods, specialists in financial services. That's because the risk weightings that the government uses are out of date. For example, a mortgage-backed security is weighted at 20%, meaning that it requires one-fifth the capital of whole loans. "But some of those securities have declined in value a lot more than the values of whole loans," says Cannon. The option ARM, which "proved to be an absolutely horrible product in terms of performance," is weighted at 50%; "in hindsight it probably should have been weighted at 200%," he says. As for the leverage ratio, "it doesn't pay any attention to the composition of assets and their risk," says Flannery.

Many investors no longer trust the regulatory ratios. ... An officially well-capitalized bank may have a dangerously thin TCE ratio. Take Citigroup. At the end of December, the $1.9 trillion (in assets) bank holding company had a Tier 1 ratio of 11.9%, a total capital ratio of 15.7%, and a leverage ratio of 6.1%. ... But its TCE ratio was just 1.5%. ...

But the TCE ratio is not infallible. Right before Washington Mutual failed, its TCE ratio was 7.8%. For regulators and analysts, TCE is one more metric in the tool kit. That tool kit is typically based on CAMELS, the supervisory rating system that looks at a bank's capital, asset quality, management, earnings, liquidity, and sensitivity to market risk (hence the acronym). Earnings are always important, but "these days it's more about the 'C' and the 'A,'" says Valentin.

The "A" is a growing source of discomfort as the recession drags on. With growth slowing and unemployment rising, a broad swath of consumer and business loans is beginning to sour. "Most of the banks that have failed to date have had significant early credit-cycle exposure — subprime, option-ARM, residential construction loans," says Cannon. "We're starting to see significant deterioration in midcycle credit: prime mortgages, home-equity loans, some nonresidential construction. And there's increasing concern about late-cycle credit instruments such as commercial real-estate mortgages and commercial loans."

California Bay Area Home Sales: "Robust" and "Anemic"

by Calculated Risk on 5/21/2009 02:12:00 PM

The tale of two cities continues ...

From DataQuick: Bay Area home sales rise again; median price up slightly over March

Bay Area home sales posted a year-over-year gain for the eighth consecutive month in April, with robust sales in lower-cost inland areas once again compensating for anemic sales on the coast. ...Key points (worth repeating):

A total of 7,139 new and resale houses and condos closed escrow in the nine-county Bay Area last month. That was up 12.9 percent from 6,325 in March and up 13.1 percent from 6,310 in April 2008, according to MDA DataQuick of San Diego.

Last month’s sales were the second-lowest for an April since 1995 and were 23.2 percent below the average April sales total back to 1988, when DataQuick’s statistics begin.

Foreclosure resales – homes sold in April that had been foreclosed on in the prior 12 months – accounted for 47.4 percent of Bay Area resales. That was down from 50.2 percent in March and 52.0 percent in February. Last month’s figure was the lowest since foreclosure resales were 46.8 percent of existing home sales last November.

A lower concentration of discounted foreclosure resales in the statistics is one reason the median sale price has recently begun to more or less flatten, or at least erode more slowly, in many markets.

...

Home sales in many high-end areas, especially on the coast, remain at record or near-record-low levels.

In lower-cost communities, first-time buyers have turned to government-insured FHA mortgages, which represented a record 26 percent of all Bay Area home purchase loans in April, up from 3.2 percent a year ago. The combination of FHA financing, steep home price declines and low mortgage rates have fueled record or near-record-high sales this spring in many of the Bay Area’s most affordable, foreclosure-heavy communities.

...

Foreclosure activity remains at historically high levels ...

emphasis added

Hotel RevPAR Off 21.4% Year-over-year

by Calculated Risk on 5/21/2009 11:38:00 AM

Note: HotelNewsNow has a free hotel related newsletter available here. This week they have an update on the Yellowstone Club vs. Credit Suisse case.

And on occupancy and RevPAR from HotelNewsNow.com: STR reports U.S. data for week ending 16 May

In year-over-year measurements, the industry’s occupancy fell 12.6 percent to end the week at 57.8 percent. Average daily rate dropped 10.0 percent to finish the week at US$98.33. Revenue per available room for the week decreased 21.4 percent to finish at US$56.84.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.3% from the same period in 2008.

The average daily rate is down 10.0%, so RevPAR is off 21.4% from the same week last year.

Philly Fed: Continued Manufacturing Weakness in May

by Calculated Risk on 5/21/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector continued to show weakness in May ... Although the indexes for general activity, shipments, and employment improved, the index for new orders declined slightly. ... Most of the survey's broad indicators of future activity improved notably again this month, suggesting that the region's manufacturing executives are more optimistic that a recovery will occur over the next six months.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -24.4 in April to -22.6 this month. Although an indication of continued overall decline, this reading is the index's highest since last September; it has now edged higher for three consecutive months. Still, the index has been negative for 17 of the past 18 months, a span that corresponds to the current recession.

...

Broad indicators of future activity showed improvement again this month. The future general activity index remained positive for the fifth consecutive month and increased 11 points, from 36.2 in April to 47.5. The index has now increased 33 points in the past two months (see Chart).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 17 of the past 18 months, a span that corresponds to the current recession."

Unemployment Claims: Continued Claims at Record 6.66 Million

by Calculated Risk on 5/21/2009 08:34:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 16, the advance figure for seasonally adjusted initial claims was 631,000, a decrease of 12,000 from the previous week's revised figure of 643,000. The 4-week moving average was 628,500, a decrease of 3,500 from the previous week's revised average of 632,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 9 was 6,662,000, an increase of 75,000 from the preceding week's revised level of 6,587,000.

Click on graph for larger image in new window.

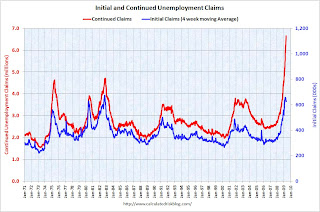

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four-week moving average is at 628,500, off 30,250 from the peak 6 weeks ago.

Continued claims are now at 6.66 million - an all time record.

Typically the four-week average peaks near the end of a recession. There is a reasonable chance that claims have peaked for this cycle, but it is still too early to be sure, and if so, continued claims should peak soon.

The level of initial claims (631 thousand) is still very high, indicating significant weakness in the job market.

Wednesday, May 20, 2009

Report: BofA Wants to Repay TARP in 2009

by Calculated Risk on 5/20/2009 11:46:00 PM

From the Financial Times: BofA seeks to repay $45bn by end of year

Bank of America wants to pay back $45bn in bail-out funds by the end of the year, in a faster-than-expected move made possible by an accelerated programme to raise capital.Stop laughing!

BofA is on track to raise more than $35bn in capital by the end of September...

People familiar with the bank’s plans say negotiations to sell some of BofA’s non-core assets are under way and, if the asset sales occur in the next few months, the bank will be able to fulfil its stress-test obligations and pay back Tarp funds from its $173bn cash reserves.

Plenty of info today:

best to all.

Residential Rental Market and Inflation

by Calculated Risk on 5/20/2009 08:15:00 PM

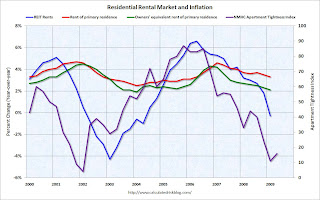

Goldman Sachs tracks the rents at a large number of apartment REITs - and rents are now falling (excerpted from research report with permission):

REITs tend to adjust more rapidly to changing market conditions than the typical landlord, so changes in their behavior are useful signals of turns in the market ... Public REITs typically report the rent increases they have achieved on a year-over-year, comparable-unit basis with each quarterly filing. ... [the tracked] REITS managed 300,000 units that were comparable to the year-before period in the first quarter of 2009 ... In the first quarter of 2009, the major REITs collectively reported an outright decline in rents for the first time since 2004.Goldman notes that declining rents for REITS typically lead declines in the CPI measures of rent: Owners' equivalent rent of primary residence (OER) and Rent of primary residence.

The following graph shows the year-over-year (YoY) in the REIT rents (from Goldman), Owners' equivalent rent of primary residence and Rent of primary residence (both from the BLS). The Apartment Tightness Index from the National Multi Housing Council is on the right Y-axis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows that the Apartment Tightness Index leads REIT rents, and that the BLS measures of rent follow.

This suggests further declines in the YoY REIT rents, and future disinflation for the BLS measures of rent.

This is important for house prices too. With falling rents, house prices need to fall further to bring the house price-to-rent ratio back to historical levels.

Pension Benefit Guaranty Corporation Deficit Increases

by Calculated Risk on 5/20/2009 06:28:00 PM

From Eric Lipton at the NY Times: Bankruptcies Swell Deficit at Pension Agency to $33.5 Billion

The deficit at the federal agency that guarantees pensions for 44 million Americans more than doubled in the last six months to a record high, reaching $33.5 billion ...Here is the PBGC statement: PBGC Deficit Climbs to $33.5 Billion at Mid-Year, Snowbarger to Tell Senate Panel

The Pension Benefit Guaranty Corporation, as of October, had faced a shortfall of $11 billion. But the combined effect of lower interest rates, losses on its investment portfolio and the increase in the number of companies filing for bankruptcy protection resulted in a deepening of its estimated deficit, officials said Wednesday.

...

With the bankruptcy of Chrysler and a possible similar move by General Motors, the agency is facing a record surge in demand. The new deficit estimate takes into account both pensions it has taken over in the last six months, and others it believes it will have to assume control of soon.

The $22.5 billion deficit increase was due primarily to about $11 billion in completed and probable pension plan terminations; about $7 billion resulting from a decrease in the interest factor used to value liabilities; about $3 billion in investment losses; and about $2 billion in actuarial charges.Last year the PBGC voted to allow equity investments, but luckily the entire portfolio wasn't moved into equities - and they only lost $3 billion on their $56 billion asset portfolio.

Snowbarger notes that as of April 30, the PBGC’s investment portfolio consisted of 30 percent equities, 68 percent bonds, and less than 2 percent alternatives, such as private equity and real estate. All the agency’s alternative investments have been inherited from failed pension plans.

Unfortunately there is much more to come:

The PBGC is closely monitoring companies in the auto manufacturing and auto supply industries. According to PBGC estimates, auto sector pensions are underfunded by about $77 billion, of which $42 billion would be guaranteed in the event of plan termination. The pension insurer also faces increased exposure from weak companies across all sectors of the economy, including retail, financial services and health care.With companies moving away from defined benefit plans, there will be fewer companies paying for insurance in the future - so the PBGC will probably have to be bailed out.

Market Précis

by Calculated Risk on 5/20/2009 04:00:00 PM

By popular demand ...

| Click on graph for larger image in new window. The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

| The second graph compares four significant bear markets: the Dow during the Great Depression, the NASDAQ, the Nikkei, and the current S&P 500. See Doug's: "The Mega-Bear Quartet and L-Shaped Recoveries". |

| The third graph shows the S&P 500 since 1990. The dashed line is the closing price today. The market is only off 42% from the peak. |  |

FOMC Minutes for April

by Calculated Risk on 5/20/2009 02:01:00 PM

From the Fed: Minutes of the Federal Open Market Committee April 28-29, 2009

Some FOMC members suggested buying more Treasury securities:

Members also agreed that it would be appropriate to continue making purchases in accordance with the amounts that had previously been announced—that is, up to $1.25 trillion of agency MBS and up to $200 billion of agency debt by the end of this year, and up to $300 billion of Treasury securities by autumn. Some members noted that a further increase in the total amount of purchases might well be warranted at some point to spur a more rapid pace of recovery; all members concurred with waiting to see how the economy and financial conditions respond to the policy actions already in train before deciding whether to adjust the size or timing of asset purchases. The Committee reaffirmed the need to monitor carefully the size and composition of the Federal Reserve’s balance sheet in light of economic and financial developments.The economic projections are near the end. Although the Fed lowered their economic outlook (compared to January), they are still fairly optimistic. As an example, the central tendency for GDP growth in 2010 is 2% to 3%, not far below trend growth, and above trend growth in 2011 (3.5% to 4.8% central tendency of projections). The Fed is also optimistic about the unemployment rate peaking below 10% later this year or in early 2010. In January, the members saw unemployment peaking in 2009, and the central tendency for unemployment was 8.5% to 8.8% in 2009 - we are already at 8.9% in April!

emphasis added

D.O.T.: U.S. Vehicle Miles off 1.2% YoY in March

by Calculated Risk on 5/20/2009 01:32:00 PM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by -1.2% (-3.1 billion vehicle miles) for March 2009 as compared with March 2008. Travel for the month is estimated to be 245.1 billion vehicle miles.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.3% Year-over-year (YoY); the decline in miles driven was worse than during the early '70s and 1979-1980 oil crisis. However miles driven - compared to the same month of 2008 - has only been off about 1% for the last couple months.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in March 2009 were 1.2% less than in March 2008.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. Although this data isn't seasonally adjusted, it appears that miles driven has stabilized.

Geithner: PPIP to Start by Early July

by Calculated Risk on 5/20/2009 11:42:00 AM

From Bloomberg: Geithner Says Toxic-Asset Plan to Start in Six Weeks

Treasury Secretary Timothy Geithner said he expects a pair of government programs to help banks remove their distressed assets will start by early July ...Here is Geithner's prepared statement.

The Treasury’s Public-Private Investment Program will use $75 billion to $100 billion of government funds to finance sales of as much as $1 trillion in distressed mortgage-backed securities and other assets.

New Mortgage Loan Reset / Recast Chart

by Calculated Risk on 5/20/2009 09:44:00 AM

Matt Padilla at the O.C. Register presents a new reset / recast chart from Credit Suisse: Loan reset threat looms till 2012 Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans.

Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans.

As Tanta noted: "Reset" refers to a rate change. "Recast" refers to a payment change.

Resets are not a huge problem as long as interest rates stay low, but recasts could be significant.

Note that Wells Fargo expects only a small percentage of their $115 billion "pick-a-pay" Option ARM portfolio they acquired via Wachovia (originally from World Savings / Golden West) to recast by 2012 (because Golden West had very generous NegAM terms). I'm not sure how that fits with this chart.

Architecture Billings Index Steady in April

by Calculated Risk on 5/20/2009 09:00:00 AM

From the AIA: Architecture Billings Index Points to Possible Economic Improvement

After an eight-point jump in March, the Architecture Billings Index (ABI) fell less than a full point in April. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the April ABI rating was 42.8, down from the 43.7 mark in March. This was the first time since August and September 2008 that the index was above 40 for consecutive months, but the score still indicates an overall decline in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry score was 56.8.

“The most encouraging part of this news is that this is the second month with very strong inquiries for new projects. A growing number of architecture firms report potential projects arising from federal stimulus funds,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Still, too many architects are continuing to report difficult conditions to feel confident that the economic landscape for the construction industry will improve very quickly. What these figures mean is that we could be seeing things turn around over a period of several months.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index is still below 50 indicating falling demand.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). So there will probably be further dramatic declines in CRE investment later this year.

Back in 2005, Kermit Baker and Diego Saltes of the American Institute of

Architects wrote a white paper: Architecture Billings as a Leading Indicator of Construction

The following graph is an update from their paper.

This graph suggests the non-residential construction collapse will be very sharp, and although there isn't enough data to know if this is predictive of the percentage decline in spending, it does suggest a possible year-over-year decline of perhaps 20% to 30% in non-residential construction spending.

GMAC to Receive $7.5 Billion from Treasury

by Calculated Risk on 5/20/2009 08:32:00 AM

From the Detroit News: Feds to inject $7.5B more into GMAC (ht jb)

The Treasury Department is preparing to announce as early as today that it will invest an additional $7.5 billion in GMAC LLC in a deal that could allow the U.S. government to hold a majority stake in the Detroit-based auto finance company.The Stress Test results showed GMAC needs another $11.5 billion in capital, so there is probably more coming.

Tuesday, May 19, 2009

Japan’s GDP Declines at 15.2% Annual Rate

by Calculated Risk on 5/19/2009 11:11:00 PM

From Bloomberg: Japan’s Economy Shrank Record 15.2% Last Quarter (ht creditcriminalslovetarp, Angry Saver, and others)

Japan’s economy shrank at a record 15.2 percent annual pace last quarter as exports collapsed and consumers and businesses cut spending.

The contraction followed a revised fourth-quarter drop of 14.4 percent ...

Exports plunged an unprecedented 26 percent last quarter ...

Home Depot on Housing Market

by Calculated Risk on 5/19/2009 07:51:00 PM

From the Financial Times: Home Depot chief warns on US housing

Growing optimism over the US housing market may be premature, a leading retailer warned on Tuesday.Now that the foreclosure moratorium is over, the pace of foreclosures is picking up again. And, according to Mr. Blake, this will probably impact the home improvement companies.

...

"We are concerned about the accelerating rates of foreclosures, particularly in the western part of the country,” [Frank Blake, chief executive of Home Depot] said, noting that one out of every 54 homes in California was in foreclosure.

Mr Blake said that a slowing foreclosure rate in California during the fourth quarter had led to an improvement in regional store sales but the trend had then reversed as foreclosure rates rose again in the first quarter.

The shift “provides a cautionary note on signalling a recovery prematurely”, he said. “Before we see real improvement we believe we need to see sustainable deceleration in foreclosures.”

Median Price Mix Example

by Calculated Risk on 5/19/2009 05:35:00 PM

The following table shows how the mix of units can skew the median price. This is just an example (not based on actual data).

In this example, from 2002 to 2005 low priced homes doubled in price, and high priced homes increased by two-thirds. The mix remained the same (50 units of each), and the median price increased 75%.

| Item | 2002 | 2005 | 2007 | 2009 | 2010 |

|---|---|---|---|---|---|

| Low Price | $100 | $200 | $200 | $100 | $100 |

| High Price | $300 | $500 | $500 | $400 | $300 |

| Low End Units Sold | 50 | 50 | 40 | 40 | 20 |

| High End Units Sold | 50 | 50 | 50 | 10 | 30 |

| Median Price | $200 | $350 | $500 | $100 | $300 |

| Change in Low Price | -- | 100% | none | -50% | none |

| Change in High Price | -- | 67% | none | -20% | -25% |

| Change in Median Price | -- | 75% | 43% | -80% | 200% |

Now look at what happened in 2007. Since subprime imploded first, the number of units sold at the low end decreased to 40 from 50. Everything else stayed the same - and just the change in the mix (higher percentage of high end homes) pushed up the median price! Note that the median price (light blue) increased WITHOUT any actual prices increasing. This happened at the beginning of the housing bust in many areas.

In the period I marked as 2009, the low end prices have fallen all the way back to 2002 prices. However the high end prices have only fallen 20%. The low end is seeing fairly high activity (40 units), but at the high end sales activity has collapsed (10 units). Look at the median price (in orange) - it has fallen more than the prices have declined for even the low end!

And finally, in 2010, prices fall further at the high end - and have stabilized at the low end. As prices fall, the volume picks up at the high end. And what happens to the median price? It increases by 200% (marked in red)!

UPDATE: Oops - I used average instead of median a couple of places (sorry - technical problems today),

This illustrates why we need to be very careful with median prices (like from NAR, DataQuick or other sources). The mix can distort the price, and I expect to read about median prices increasing later this year or in 2010, even though actual prices are still falling!

Market and GM Update

by Calculated Risk on 5/19/2009 04:01:00 PM

From Reuters: GM Bankruptcy Would Include Quick Sale to Feds

If General Motors files for bankruptcy ... plans include a quick sale of the automaker's healthy assets to a new company owned by the U.S. government, a source familiar with the situation said Tuesday.

...the plan also called for the government to forgive the bulk of $15.4 billion worth of emergency loans that the U.S. has already provided to GM.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is still the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990. The dashed line is the closing price today.

The market is only off 42% from the peak.

SoCal House Sales: "Hot Inland, Cool on Coast"

by Calculated Risk on 5/19/2009 02:46:00 PM

Note: I think California data provides an overview of the key dynamics in the housing market.

From DataQuick: Southland home sales hot inland, cool on coast; median price dips

Southern California homes sold at a faster pace than a year ago for the 10th consecutive month in April as first-time buyers and investors continued to target distressed inland properties. ...Key points:

A total of 20,514 new and resale houses and condos closed escrow in the six-county Southland last month. That was up 5.2 percent from 19,506 in March and up 31.4 percent from 15,615 a year ago ... Last month’s sales were the highest for that month since April 2006, when 27,114 homes sold, but were 18.2 percent below the average April sales total since 1988, when DataQuick’s statistics begin.

Foreclosure resales – homes sold in April that had been foreclosed on in the prior 12 months – accounted for 53.6 percent of all Southland resales last month. It was the seventh consecutive month in which post-foreclosure properties made up more than half of all resales.

The deep discounts associated with foreclosures have created stiff competition for builders, who last month sold the lowest number of newly constructed homes for an April since at least 1988.

At the same time, the number of single-family houses that resold last month was at record or near-record-high levels for an April in many of the more affordable, foreclosure-heavy inland markets. They included Palmdale, Lancaster, Moreno Valley, Perris, Indio, San Jacinto, Lake Elsinore and Victorville.

The sales picture was dramatically different in many older, high-end communities closer to the coast, where foreclosures and deep discounts are less common. Sales of existing houses remained at or near record lows for an April in markets such as Beverly Hills, Malibu, Palos Verdes Peninsula, Manhattan Beach and Pacific Palisades.