by Calculated Risk on 2/12/2009 03:27:00 PM

Thursday, February 12, 2009

U.S. Considers Mortgage Subsidies for Some Homeowners

From Reuters: Obama eyes home loan subsidies in rescue plan: sources

The Obama administration is hammering out a program to subsidize mortgage payments for troubled homeowners who have gone through a standardized re-appraisal and affordability test ... Under the plan being mulled, homeowners would have to make a case of hardship to qualify for new loan terms.I need more details on the subsidies, but at least the dumb idea of buying down mortgage rates has apparently been shelved.

...

Housing policymakers weighed but have for now shelved one plan that would have seen the government stand behind low-cost mortgages of between 4 and 4.5 percent, sources said.

NY AG Cuomo Letter to Barney Frank on Merrill Bonuses

by Calculated Risk on 2/12/2009 01:31:00 PM

For those who haven't seen it, here is the letter Re: Merrill Lynch 2008 Bonuses (pdf)

The letter breaks down the timing and amounts of the bonuses.

"One disturbing question that must be answered is whether Merrill Lynch and Bank of America timed the bonuses in such a way as to force taxpayers to pay for them through the deal funding. We plan to require top officials at both Merrill Lynch and Bank of America to answer this question and to provide justifications for the massive bonuses they paid ahead of their massive losses....New York Attorney General Andrew Cuomo, Feb 10, 2009

What my Office has learned thus far concerning the allocation of the nearly $4 billion in Merrill Lynch bonuses is nothing short of staggering. Some analysts have wrongly claimed that individual bonuses were actually quite modest and thus legitimate because dividing the $3.6 billion over thousands upon thousands of employees results in relatively small amounts estimated at approximately $91,000 per employee. In fact, Merrill chose to do the opposite. While more than 39 thousand Merrill employees received bonuses from the pool, the vast majority of these funds were disproportionately distributed to a small number of individuals.

...

[T]hese payments and their curious timing raise serious questions as to whether the Merrill Lynch and Bank of America Boards of Directors were derelict in their duties and violated their fiduciary obligations. We will also continue to examine whether senior officials at both companies violated their own fiduciary obligations to shareholders. If they did, this raises additional serious issues with regard to the inappropriate use of taxpayer funds."

Fed Paper: Effective Practices in Crisis Resolution

by Calculated Risk on 2/12/2009 11:16:00 AM

Here is an interesting economic commentary from Cleveland Fed researchers O. Emre Ergungor and Kent Cherny: Effective Practices in Crisis Resolution and the Case of Sweden A few excerpt:

We maintain that the goal of any resolution strategy should be to transfer assets from failed financial institutions to institutions that can put the assets to their most efficient use, and at the least possible short and long-term costs to the taxpayer. As in most things, this is easier said than done. When faced with financial markets and institutions that appear to be spiraling out of control, regulators and policymakers often resort to blanket guarantees of uninsured deposits and other liabilities by providing unlimited liquidity to financial markets until the crisis dissipates.This is why the stress test must be completed quickly (30 days is probably sufficient), and the results should be made public. Last night I listed the three probable categories for the banks: 1) no assistance needed, 2) additional capital needed, and 3) Nationalization needed. I believe this should be fully disclosed and announced publicly in mid-March.

While blanket guarantees might be policymakers’ best choice given the urgency of bringing some calm to markets, history shows that such guarantees have their dangers: they bail out investors who should have done a better job at evaluating and managing their risks and disciplining financial institutions that were mismanaging their money.

...

Most important, according to Ergungor and Thomson, is that successful crisis resolutions have been characterized by transparency. When officials move to contain a financial crisis, their primary task is to identify which institutions are viable and which assets are good, and conversely which institutions are insolvent and which assets are bad. This triage and full disclosure of associated losses clears the uncertainty surrounding the financial institutions and makes it possible for the viable institutions to raise new funds from private investors or from the government if private sources are not available. Failing to acknowledge the true value of assets or the condition of troubled banks early on makes it easy for them to live on as propped up “zombies” (as happened in Japan during the 1990s)—healthy on paper but economically insolvent. Initial full disclosure avoids these situations, and improves efficiency during industry restructuring.

emphasis added

There is much more in the paper.

One of the questions is how big was the Swedish bubble?

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph (from the Cleveland Fed paper) shows that real estate prices more than doubled in the 1980s and then declined sharply in the bust. The price-to-rent ratio increased by about 40% before returning to normal.

And how does this compare to the U.S. housing bubble?

This graph shows the Case-Shiller National price index through Q3 2008 (most recent data, Q4 to be released later this month). This shows that prices double in the U.S. during the recent housing bubble.

This graph shows the Case-Shiller National price index through Q3 2008 (most recent data, Q4 to be released later this month). This shows that prices double in the U.S. during the recent housing bubble.This graph is in nominal terms as is the Swedish graph (not inflation adjusted). Note that prices in Sweden declined, but didn't fall to earlier levels.

Real prices, price-to-rent and price-to-income measures all probably provide better estimates of how far prices will fall.

On price-to-rent, here is a similar graph through Q3 2008 using the Case-Shiller National Home Price Index:

This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.Looking at the price-to-rent ratio based on the Case-Shiller index, the price-to-rent increased more in the U.S. than in Sweden, and the ratio still has to decline further (although we don't have the data yet, this ratio definitely declined further in Q4 2008).

Just to repeat, the key lesson in crisis resolution is transparency. I hope the results of the bank stress test will be made public, and the zombie banks clearly identified.

NAR: Distressed Sales Accounted for 45% of Q4 Activity

by Calculated Risk on 2/12/2009 10:44:00 AM

From the National Association of Realtors (NAR): 4th Quarter Metro Area Home Prices Down as Buyers Purchase Distressed Property

Distressed sales – foreclosures and short sales – accounted for 45 percent of transactions in the fourth quarter, dragging down the national median existing single-family price to $180,100, which is 12.4 percent below the fourth quarter of 2007 when conditions were more balanced; the median is where half sold for more and half sold for less.Median home prices are a poor measure of house price changes, especially right now since the mix of homes has shifted significantly to the low end. Repeat sales indexes are better measures of price changes.

The largest sales gain in the fourth quarter from a year earlier was in Nevada, up 133.7 percent, followed by California which rose 84.7 percent, Arizona, up 42.6 percent, and Florida with a 12.5 percent increase.Distressed sales are the market in many areas of California, Florida, Nevada and other bubble states.

“Once again, we see a pattern of strong sales gains, particularly in lower price homes, in areas with price declines resulting from foreclosures,” Yun said. “... in California and Florida ... distressed sales accounted for roughly two-third of all sales ...”

Unemployment Claims: 4 Week Average above 600 Thousand

by Calculated Risk on 2/12/2009 08:31:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 7, the advance figure for seasonally adjusted initial claims was 623,000, a decrease of 8,000 from the previous week's revised figure of 631,000. The 4-week moving average was 607,500, an increase of 24,000 from the previous week's revised average of 583,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 31 was 4,810,000, an increase of 11,000 from the preceding week's revised level of 4,799,000. The 4-week moving average was 4,745,250, an increase of 73,750 from the preceding week's revised average of 4,671,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 607,500, the highest since 1982.

Continued claims are now at 4.81 million - another new record - above the previous all time peak of 4.71 million in 1982.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

Another weak unemployment claims report ...

Retail Sales Increase Slightly in January

by Calculated Risk on 2/12/2009 08:30:00 AM

On a monthly basis, retail sales increased slightly from December to January (seasonally adjusted), but sales are off 10.6% from January 2008 (retail and food services decreased 9.7%).

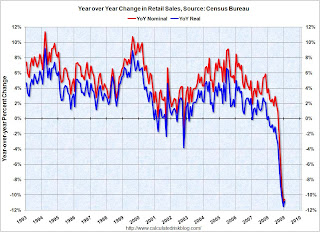

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (January PCE prices were estimated as the same as December).

Although the Census Bureau reported that nominal retail sales decreased 10.6% year-over-year (retail and food services decreased 9.7%), real retail sales declined by 10.9% (on a YoY basis). The YoY change decreased slightly from last month.

There is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $344.6 billion, an increase of 1.0 percent (±0.5%) from the previous month, but 9.7 percent (±0.7%) below January 2008. Total sales for the November 2008 through January 2009 period were down 9.5 percent (±0.5%) from the same period a year ago. The November to December 2008 percent change was revised from –2.7 percent (±0.5%) to –3.0 percent (±0.2%).One month does not make a trend change, and January retail sales are still over 2% below sales in Q4 - suggesting a further decline in Q1 PCE.

Stress Test: Almost 100 Regulators at Citigroup

by Calculated Risk on 2/12/2009 12:01:00 AM

From Eric Dash at the NY Times: Bank Test May Expand U.S. Regulators’ Role

Nearly 100 federal banking regulators descended on Citigroup in New York on Wednesday morning. Dozens more fanned out through Bank of America, JPMorgan Chase and other big banks across the nation.It sounds like the stress tests could be completed within "weeks" at some banks, and I think 30 days is sufficient for all 18 or so banks with $100 billion in assets.

...

[E]xams for 18 or so of the biggest banks are set to begin immediately, and the first results could arrive within weeks. They are not expected to be made public for every institution.

...

Regulators plan to assess the potential losses a bank could face over the next two years, rather than the typical one year ... They are also expected to look at banks’ exposure to derivatives and other assets normally carried off their balance sheets ... Their assumptions will be guided on a “worst case” basis.

The banks will probably fall into one of three categories:

1) No additional assistance required. These banks will definitely want this publicized!

2) The banks in between that will need additional capital. This is where the Capital Assistance Program comes in:

Capital Assistance Program: While banks will be encouraged to access private markets to raise any additional capital needed to establish this buffer, a financial institution that has undergone a comprehensive “stress test” will have access to a Treasury provided “capital buffer” to help absorb losses and serve as a bridge to receiving increased private capital. ... Firms will receive a preferred security investment from Treasury in convertible securities that they can convert into common equity if needed to preserve lending in a worse-than-expected economic environment. This convertible preferred security will carry a dividend to be specified later and a conversion price set at a modest discount from the prevailing level of the institution’s stock price as of February 9, 2009.3) Banks that will need to be nationalized or sold.

emphasis added

The NY Times article suggests that the results will not be made public for every institution, but that will just lead to rumors and speculation. It would be better to announce the category of all 18+ banks at the same time (in 30 days or so). At that time announce the capital infusions for the category 2 banks, and the nationalization of the category 3 banks.

The sooner the better, although March 12th works for me (30 days from Geithner's speech)! (update: I was just making up a date for fun - this isn't an announced date)

Wednesday, February 11, 2009

Viewing Problems Today and Congressional Video

by Calculated Risk on 2/11/2009 08:24:00 PM

I know a number of readers couldn't access the blog today. Please accept my apology for the inconvenience. This happened for anyone who was using the old blogspot address as a bookmark or an older link from another site.

Google is supposed to redirect that address to the new URL www.calculatedriskblog.com. The RSS feed also wasn't updating. That should all be fixed now too.

We had another display of pettifogging Congressmen today, but at least they provided some entertainment! Here is Congressman Mike Capuano venting (hat tip Nemo):

Stimulus: Homebuilder Tax Break "Sharply Curtailed"

by Calculated Risk on 2/11/2009 07:04:00 PM

More good news on the stimulus bill.

From the WSJ: Big Business Loses Out on Tax Break Under Stimulus Deal

A tax break sought by businesses that would allow unprofitable firms to recoup taxes paid in the past five years has been sharply curtailed ...I lobbied hard against both the homebuyer tax credit and the homebuilder tax break, and it looks like both provisions were scaled back sharply.

Sen. Baucus (D., Mont.) said House and Senate negotiators have agreed to limit the tax break to small businesses only. That means large manufacturers, retailers and homebuilders that lobbied for the provision would be shut out under a deal reached earlier today.

...

Congressional tax estimators said it would have delivered as much as $67.5 billion in tax benefits to businesses this year and next. The provision would have allowed firms to convert 2009 and 2010 losses into tax refunds by carrying those losses back for five years to offset tax liability.

Housing Tax Credit: "Largely Dropped"

by Calculated Risk on 2/11/2009 04:50:00 PM

From Bloomberg: U.S. Lawmakers Agree on $789 Billion Stimulus Plan

Asked what a proposed $15,000 tax credit for homebuyers looks like in the compromise plan, Baucus laughed and said, “not much.” He said that proposal has largely been dropped, though he didn’t provide details.We still need the details on what "not much" means, but this is a little bit of good news.

Note: I'm still working on some Google technical issues. This includes the feed not working. Sorry for the inconvenience.

Martin Wolf: The New TARP Will Fail

by Calculated Risk on 2/11/2009 03:55:00 PM

Excerpts from Martin Wolf: Why Obama’s new Tarp will fail to rescue the banks

All along two contrasting views have been held on what ails the financial system. The first is that this is essentially a panic. The second is that this is a problem of insolvency.It is very important that the bank stress tests be completed quickly (within 30 days), and the results made public. This will help remove some of the uncertainty, and might make it clear whether or not the U.S. needs to preprivatize (a kinder term for nationalize) the banks.

Under the first view, the prices of a defined set of “toxic assets” have been driven below their long-run value ... The solution, many suggest, is for governments to make a market, buy assets or insure banks against losses. ...

Under the second view, a sizeable proportion of financial institutions are insolvent: their assets are, under plausible assumptions, worth less than their liabilities.

...

Personally, I have little doubt that the second view is correct and, as the world economy deteriorates, will become ever more so. But this is not the heart of the matter. That is whether, in the presence of such uncertainty, it can be right to base policy on hoping for the best. The answer is clear: rational policymakers must assume the worst. If this proved pessimistic, they would end up with an over-capitalised financial system. If the optimistic choice turned out to be wrong, they would have zombie banks and a discredited government. ...

Why then is the administration making what appears to be a blunder? It may be that it is hoping for the best. But it also seems it has set itself the wrong question. It has not asked what needs to be done to be sure of a solution. It has asked itself, instead, what is the best it can do given three arbitrary, self-imposed constraints: no nationalisation; no losses for bondholders; and no more money from Congress. Yet why does a new administration, confronting a huge crisis, not try to change the terms of debate? This timidity is depressing.

...

The correct advice remains the one the US gave the Japanese and others during the 1990s: admit reality, restructure banks and, above all, slay zombie institutions at once. ...

By asking the wrong question, Mr Obama is taking a huge gamble. ... He needs to rethink, if it is not already too late.

U.S. Budget Deficit: Heading for $1.6 Trillion

by Calculated Risk on 2/11/2009 02:06:00 PM

From MarketWatch: U.S. Jan. budget deficit $84.0 bln vs $17.8 surplus yr-ago

The government reported a deficit of $84.0 billion in January ... [compared to] a surplus of $17.84 billion in the same month one year ago. Lower corporate taxes are dragging receipts lower, while spending has jumped ... Experts are forecasting a deficit above $1.6 trillion in the fiscal year ending Sept. 30The CBO was projecting a deficit of $1.2 trillion before the Obama stimulus plan:

As for the startling [$1.2 trillion] estimate from the nonpartisan Congressional Budget Office, if it proves accurate, the budget deficit will be nearly two and a half times bigger than the previous record shortfall of $455 billion reached in 2008.And it is important to note that this is the unified budget deficit that includes the significant Social Security Insurance surplus. The General Fund deficit will be even worse.

The estimate was far higher than most other analysts have predicted. If combined with the gigantic stimulus package of tax cuts and new spending that Mr. Obama is preparing, which could amount to nearly $800 billion over two years, the shortfall this year could hit $1.6 trillion.

Report: Stimulus Agreement Reached

by Calculated Risk on 2/11/2009 11:20:00 AM

Update: CNBC: Tentative Accord Reached On Smaller Stimulus Plan

The White House and key congressional negotiators have tentatively settled on a $790 billion price tag for President Barack Obama's economic recovery plan, Democratic aides on Capitol Hill said.Update: WSJ: Deal Nears on Stimulus Plan

The aides said one way negotiators are trimming the measure's cost below the $838 billion plan that passed the Senate Tuesday is to pare back Obama's signature "Making Work Pay" tax credit for 95 percent of workers.

This should be cut to $400 a year instead of $500. A married couple would get $800 instead of the $1,000 initially proposed by Obama.

Under the framework coming together, lawmakers would trim the cost of Senate-approved tax cuts intended to spur auto and home sales, but would preserve a measure intended to shield millions of middle-income Americans from the alternative minimum tax, a levy originally designed to hit the wealthy.One headlines says "reach", the other "near" ... It sounds like a deal is close, and the stimulus package will likely be smaller than either the House or Senate versions.

Among other things, a signature Obama tax cut—the payroll tax holiday for workers –would be scaled back, under the framework being negotiated.

Commercial Mortgage Applications Off 80 Percent in Q4

by Calculated Risk on 2/11/2009 09:30:00 AM

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Mortgage Bankers Association Commercial/Multifamily Mortgage Originations index since 2001.

From the Mortgage Bankers Association (MBA): Commercial/Multifamily Mortgage Originations Down 80% from Q4 2007 in MBA Survey (hat tip Robert)

Commercial and multifamily mortgage loan originations dropped in the fourth quarter, according to the Mortgage Bankers Association's (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. Fourth quarter originations were 80 percent lower than during the same period last year. The year-over-year decrease was seen across all property types and investor groups.For more details, here is the quarterly report.

"Commercial and multifamily mortgage lending slowed to a trickle in the fourth quarter," said Jamie Woodwell, Vice President of Commercial Real Estate Research at the Mortgage Bankers Association. "Origination levels in the fourth quarter were 80 percent below last year's fourth quarter, and originations for all of 2008 were down approximately 60 percent from 2007 levels. Between the worsening economy and the continued credit crunch, lenders are extremely cautious about lending and borrowers are likely to hold onto the assets and the loans they already have."

Decreases in total commercial/multifamily mortgage originations continued to be led by a drop in commercial mortgage-backed security (CMBS) conduit loans and loans for commercial bank portfolios. ...

The decrease in commercial/multifamily lending activity during the fourth quarter was driven by decreases in originations for all property types. When compared to the fourth quarter of 2007, the overall 80 percent decrease included a 99 percent decrease in loans for hotel properties, an 82 percent decrease in loans for retail properties, a 76 percent decrease in loans for industrial properties, a 72 percent decrease in loans for office properties, a 62 percent decrease in multifamily property loans, and a 47 percent decrease in health care property loans.

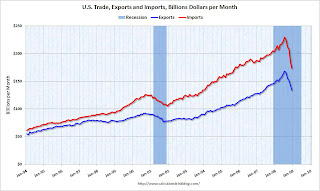

U.S. Trade: Exports and Imports Decline Sharply

by Calculated Risk on 2/11/2009 08:36:00 AM

The big trade story is the continuing sharp decline in both imports and exports.

The Census Bureau reports:

[T]otal December exports of $133.8 billion and imports of $173.7 billion resulted in a goods and services deficit of $39.9 billion, down from $41.6 billion in November, revised. December exports were $8.5 billion less than November exports of $142.3 billion. December imports were $10.2 billion less than November imports of $183.9 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through December 2008. The recent rapid decline in foreign trade continued in December. Note that a large portion of the decline in imports is related to the fall in oil prices - but not all.

The second graph shows the U.S. trade deficit, both with and without petroleum through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices fell to $49.93 in December, although import quantities increased in December - so the petroleum deficit only declined slightly. Import oil prices will probably fall further in January.

Excluding petroleum, the trade deficit has been falling since early 2006. The rebalancing of trade continues, although the sharp declines in both imports and exports is very concerning.

Credit Suisse: $5.2 billion Loss

by Calculated Risk on 2/11/2009 02:12:00 AM

From Bloomberg: Credit Suisse Reports SF6.02 Billion Loss on Trading

Credit Suisse Group AG, Switzerland’s second-biggest bank, reported a 6.02 billion Swiss-franc ($5.2 billion) fourth-quarter loss on wrong-way trading bets and costs tied to cutting jobs and selling part of its fund unit.Another visit to the confessional.

...

“We have had a strong start to 2009 and were profitable across all divisions year to date,” [Chief Executive Officer Brady] Dougan said in a statement. “We have positioned our businesses to be less susceptible to negative market trends if they persist in the coming months.”

Tuesday, February 10, 2009

Stimulus Package: The Negotiations Begin

by Calculated Risk on 2/10/2009 09:10:00 PM

The House and Senate stimulus bills are significantly different, and finding a compromise will probably be difficult.

From the WSJ: Obama Seeks to Restore Spending to Stimulus Plan

The White House is seeking to restore funding cut by the Senate for schools, health insurance and computerizing health records as the economic-stimulus plan heads for a final round of negotiations in Congress this week.The $35 billion tax credit is probably the least useful provision in the Senate stimulus bill.

...

To make room for added spending, the White House, joined by House Democratic leaders, is pressing to scale back certain Senate-passed tax breaks, including ... an $11.5 billion proposal to give car buyers a tax deduction covering local sales taxes and interest on auto loans, and a $35 billion proposal to create a new tax credit for home purchases.

Here is one of my posts on this provision: The Homebuyer Tax Credit

And here is Professor Kash Mansori on the impact of the tax credit on house prices: Will a Home Purchase Tax Credit Help Boost House Prices?

This tax credit will not stabilize house prices, has very limited stimulative impact, and it will mostly go to home buyers who would buy anyway. Hopefully it will be removed in conference.

Obama on Nationalization

by Calculated Risk on 2/10/2009 05:34:00 PM

Terry Moran at ABC News interviewed President Obama today (airs tonight). Here are some excerpts: (hat tip Paul Kedrosky)

TERRY MORAN: There are a lot of economists who look at these banks and they say all that garbage that's in them renders them essentially insolvent. Why not just nationalize the banks?Kedrosky comments:

PRESIDENT OBAMA: Well, you know, it's interesting. There are two countries who have gone through some big financial crises over the last decade or two. One was Japan, which never really acknowledged the scale and magnitude of the problems in their banking system and that resulted in what's called "The Lost Decade." They kept on trying to paper over the problems. The markets sort of stayed up because the Japanese government kept on pumping money in. But, eventually, nothing happened and they didn't see any growth whatsoever.

Sweden, on the other hand, had a problem like this. They took over the banks, nationalized them, got rid of the bad assets, resold the banks and, a couple years later, they were going again. So you'd think looking at it, Sweden looks like a good model. Here's the problem; Sweden had like five banks. [LAUGHS] We've got thousands of banks. You know, the scale of the U.S. economy and the capital markets are so vast and the problems in terms of managing and overseeing anything of that scale, I think, would -- our assessment was that it wouldn't make sense. And we also have different traditions in this country.

Obviously, Sweden has a different set of cultures in terms of how the government relates to markets and America's different. And we want to retain a strong sense of that private capital fulfilling the core -- core investment needs of this country.

And so, what we've tried to do is to apply some of the tough love that's going to be necessary, but do it in a way that's also recognizing we've got big private capital markets and ultimately that's going to be the key to getting credit flowing again.

[S]aying that Sweden had five banks and the U.S. has thousands, so nationalization can’t happen here, is misleading. It ignores the relative GDPs of the two countries. ...[and] the problem is chiefly in the six largest U.S. banks ...On the issue of "cultural differences" between the U.S. and Sweden, I've joked that we should call taking over the banks "preprivatization" to avoid the stigma of "nationalization".

But stop and think about what Obama is saying. We know the correct answer, but we are afraid to do it - because of our "culture" - so we are going to follow the Japanese plan.

We should definitely stress test the banks. My suggestion: announce when this will be complete (within 30 days), make the results public, and preprivatize the insolvent ones.

Update: Roubini: It Is Time to Nationalize Insolvent Banking Systems. Excerpt:

[W]hy is the US government temporizing and avoiding doing the right thing, i.e. take over the insolvent banks? There are two reasons. First, there is still some small hope and a small probability that the economy will recover sooner than expected, that expected credit losses will be smaller than expected and that the current approach of recapping the banks and somehow working out the bad assets will work in due time. Second, taking over the banks – call is nationalization or, in a more politically correct way, “receivership” – is a radical action that requires most banks be clearly beyond pale and insolvent to be undertaken. Today Citi and Bank of America clearly look like near-insolvent and ready to be taken over but JPMorgan and Wells Fargo do not yet. But with the sharp rise in delinquencies and charge-off rates that we are experiencing now on mortgages, commercial real estate and consumer credit in a matter of six to twelve months even JPMorgan and Wells will likely look as near-insolvent (as suggested by Chris Whalen, one of the leading independent analysts of the banking system).

Thus, if the government were to take over only Citi and Bank of America today (and wipe out common and preferred shareholders and also force unsecured creditors to take a haircut) a panic may ensue ... Instead if, as likely, the current fudging strategy - of temporizing and hoping that things will improve for the economy and the banks - does not work and in 6-12 months most banks (the major four and the a good part of the remaining regional banks) all look like clearly insolvent you can then take them all over, wipe out common shareholders and preferred shareholders and even force unsecured creditors to accept losses ( in the form of a conversion of debt into equity and/or haircut on the face value of their bond claims) as the losses will be so large that not treating such unsecured creditors would be fiscally too expensive.

So, the current strategy – Plan A - may not work and the Plan B (or better Plan N for nationalization) may end up the way to go later this year. Wasting another 6-12 months to do the right thing may be a mistake but the political constrains facing the new administration – and the remaining small probability that the current strategy may by some miracle or luck work – suggest that Plan A should be first exhausted before there is a move to Plan N. Wasting another 6-12 months may risk turning a U-shaped recession into an L-shaped near depression but currently Plan N is not yet politically feasible.

Cliff Diving: U.S. Stocks

by Calculated Risk on 2/10/2009 03:56:00 PM

Update: This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". There is much more at the site. Click on graph for updated image in new window.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Investors didn't think much of Secretary Geithner's outline of a bailout (we can't really call it a plan).

DOW off 386 points or so ...

S&P 500 off 43 points (almost 5%)

NASDAQ off 67 points (about 4%)

Another day of Cliff Diving.

A suggestion for Balance Sheet Transparency and Disclosure

by Calculated Risk on 2/10/2009 01:53:00 PM

One of the key elements of the Financial Stability Plan is to build "Financial Stability Trust" by conducting "A Comprehensive Stress Test for Major Banks" and providing investors and the public "Increased Balance Sheet Transparency and Disclosure".

Although lacking in details, this is a very good idea. A few suggestions:

Here is the table JPM provided:

Click on chart for larger image in new window.

Click on chart for larger image in new window.JPM presented the WaMu losses from three scenarios: a base case (with national prices falling 25% peak to trough), a deeper recession (28% decline), and a severe recession (37% decline).

Although unemployment will probably exceed the JPM severe recession scenario of 8% - the point is investors now know that! We can see that in the severe recession, JPM expected national house prices to decline 37% and 54% in California. This would lead to an estimate $54 billion in additional losses.

Note: the toxic assets are frequently described as difficult to value, but the real problem is forecasting future defaults. This is why providing different scenarios for the stress test makes sense. No one has a crystal ball. For mortgage related assets, defaults correlate well with house price declines - so the JPM method is very useful. For other assets (like automobiles), unemployment is a better measure.

A table like this would allow investors and the public to understand which institutions are insolvent under different scenarios, and then provide a guide for the Capital Assistance Program (aka more capital injections). If a bank is massively insolvent, then the next step would be preprivatization. At least we would all know.

If JPM could put this data together in fairly short order, the other institutions - under the supervision of the government - could provide this data within 30 days. One of the key roles for the government would be to make sure the analysis is consistent between institutions: same scenarios, same defaults per house price declines, same results for similar securities.