by Calculated Risk on 2/04/2009 10:03:00 AM

Wednesday, February 04, 2009

ISM Non-Manufacturing Index Shows Contraction

From the Institute for Supply Management: January 2009 Non-Manufacturing ISM Report On Business®

"The NMI (Non-Manufacturing Index) registered 42.9 percent in January, 2.8 percentage points higher than the seasonally adjusted 40.1 percent registered in December, indicating contraction in the non-manufacturing sector for the fourth consecutive month, but at a slightly slower rate. The Non-Manufacturing Business Activity Index increased 5.3 percentage points to 44.2 percent. The New Orders Index increased 2.7 percentage points to 41.6 percent, and the Employment Index decreased 0.1 percentage point to 34.4 percent. The Prices Index increased 6.4 percentage points to 42.5 percent in January, indicating a decrease in prices from December. According to the NMI, two non-manufacturing industries reported growth in January. Respondents are concerned about the global economy and the continued decline in business and spending."This is a weak report. The service sector is still contracting but at a slightly slower pace than in December. The employment numbers remain especially weak.

Corus: One-third of Outstanding Loans Nonperforming

by Calculated Risk on 2/04/2009 09:23:00 AM

From the WSJ: Condo King Corus Weighs Its Options (hat tip James)

Corus Bankshares ... reported a $260.7 million quarterly loss late Friday and said that more than one-third of its $4.1 billion in outstanding loans were nonperforming. Amid what it called a "precipitous decline" in property values, the Chicago lender also warned that banking regulators may soon strip Corus of its standing as a well-capitalized bank and impose higher cash requirements.Another candidate for Bank Failure Fridays. Corus is heavily exposed to condos and Construction & Development (C&D) loans. When the interest reserves run dry, these deals blow up. And down goes the lender ...

...

Corus is one of the few lenders to report that the Treasury Department intends to reject the bank's application for funds from the ... TARP.

...

While it has been clear for months that thousands of condo projects were doomed, the full impact on financial institutions is only now being felt. Construction loans were structured with "interest reserves," provisions that gave developers funds to pay interest until the projects were complete. Now that projects are completed and failing to sell, the loans are going into default.

...

Corus has about $2 billion in unfunded construction commitments and that in the event of a federal takeover, regulators wouldn't be obligated to fund these commitments.

Late Night Thread

by Calculated Risk on 2/04/2009 12:10:00 AM

An open thread and a few posts today you might want to read:

With graphs on the rental vacancy rate, homeowner vacancy rate, and homeownerhip rate.

The economic outlook is grim. The unemployment rate will rise all year, house prices will fall, commercial real estate (CRE) will get crushed ... but a few areas will probably finally hit bottom.

An update from bacon_dreamz. Check it out. And check out the map of where the Mortgage Pigs have gone!

Tuesday, February 03, 2009

Update: Tanta Scholarship Fund

by Calculated Risk on 2/03/2009 09:28:00 PM

A word from bacon_dreamz:

I would like to thank everyone for the very generous response we have received to Tanta’s memorial scholarship and bench fund at ISU. There have been a large number of donations totaling just over $20,000 to date, and all of them are very greatly appreciated. The bench has already been purchased and will be placed on the ISU campus this spring (where Tanta’s parents will be able to visit it whenever they like), and the scholarship itself is very nearly fully endowed, so I’m hopeful that the first award will be next spring.Note from CR: To be fully endowed, The Doris Dungey Endowed Scholarship Fund at Illinois State University needs another $1,500 or so (I've dropped a few bills in the kitty today).

Tanta’s family has been very touched by the kindness and generosity of everyone here (as have I), and I know they have found comfort in the fact that she touched so many lives so deeply. My sincerest thanks to all of you for helping to make this happen in her memory.

Tanta_Vive!

Donations can be made at the link below by entering "Doris Dungey Endowed Scholarship" in the Gift Designation box. Checks made out to the ISU Foundation with “Doris Dungey” in the memo can also be mailed to:

attention: Mary Rundus

Illinois State University, Campus Box 8000

Normal, IL 61790.

http://www.development.ilstu.edu/credit/credit.phtml?id=8000

Also here is map of where the Mortgage Pigs are (from Tanta's brother-in-law):

Click on graph for larger image in new window.

Click on graph for larger image in new window.No Pigs in Florida?

A special thanks to bacon_dreamz for setting up the Scholarship Fund.

For much more on Tanta - tributes, charities, her writing - please see Tanta: In Memoriam

All my to best to everyone, CR

Looking for the Sun

by Calculated Risk on 2/03/2009 06:47:00 PM

2009 will be a grim economic year. The unemployment rate will rise all year, house prices will fall, commercial real estate (CRE) will get crushed ... but there might be a few rays of sunshine too.

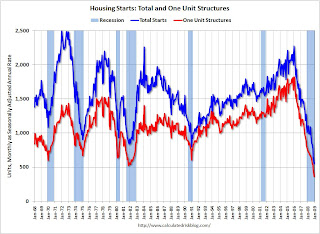

Look at these three charts of Cliff Diving: Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly vehicle sales (autos and trucks) as reported by the BEA at a Seasonally Adjusted Annual Rate (SAAR).

Based on the sales reports today from Ford, GM, Toyota and Chrysler, it looks like vehicle sales were below 10 million units (SAAR) for the first time since the early '80s. My estimate is vehicle sales were at a 9.2 million SAAR in January. Ouch! The second cliff diving graph shows New Home Sales for the last 45 years.

The second cliff diving graph shows New Home Sales for the last 45 years.

Sales of new one-family houses in December 2008 were at 331 thousand (SAAR). This is the lowest level ever recorded by the Census Bureau (data collection started in 1963).

And the third graph shows total and single family housing starts since 1959.  Total starts were at 550 thousand (SAAR) in December, by far the lowest level since the Census Bureau began tracking housing starts in 1959. Single-family starts were at 398 thousand in December; also the lowest level ever recorded (since 1959). Single-family permits were at 363 thousand in November, suggesting single family starts may fall even further next month!

Total starts were at 550 thousand (SAAR) in December, by far the lowest level since the Census Bureau began tracking housing starts in 1959. Single-family starts were at 398 thousand in December; also the lowest level ever recorded (since 1959). Single-family permits were at 363 thousand in November, suggesting single family starts may fall even further next month!

And none of this data is adjusted for changes in population.

No sunshine here. But wait ... we all know this cliff diving will stop sometime, and probably not at zero.

First, look at auto sales ... This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

The estimated ratio for January is 27 years, by far the highest ever. The actual in December was close to 24 years. This is an unsustainable level, and the ratio will probably decline over the next few years. This could happen with vehicles being removed from the fleet, but more likely because of an increase in sales. (For more analysis, see: Vehicle Sales)

This suggests vehicle sales have fallen too far. And if vehicle sales just stablize, the auto companies can stop laying off workers, and the drag on GDP will stop.

New home sales is a little more difficult because of the huge overhang of excess inventory that needs to be worked off. But some people will always buy new homes, and we can be pretty sure that sales won't fall another 270 thousand in 2009 (like in 2008), because that would put sales at 60 thousand SAAR in December 2009. That is not going to happen.

So, at the least, the pace of decline in new home sales will slow in 2009. More likely sales will find a bottom - to the surprise of many.

And we know for certain that single family starts will not fall as far in 2009 as in 2008, because starts can't go negative! So, once again, the pace of decline will at least slow. And more likely starts will find a bottom too (although any rebound will be weak because of the excess inventory problem).

Even though most of the economic news will be ugly in 2009, my guess is all three of these series will find a bottom (or at least the pace of decline will slow significantly). This means that the drag on employment in these industries, and the drag on GDP, will slow or stop.

These will be rays of sunshine in a very dark season. That doesn't mean a thaw, but it will be a beginning ...

Markopolos's Testimony to Congress on Madoff and the SEC

by Calculated Risk on 2/03/2009 06:17:00 PM

Harry Markopolos will testify before Congress tomorrow regarding his many attempts to get the SEC to investigage Madoff.

From the WSJ: Madoff Whistle-Blower Cites 'Abject Failure' by Regulatory Agencies

Harry Markopolos, an independent fraud investigator, said in more than 300 pages of testimony before a House committee that he was repeatedly ignored or given the brush-off by SEC officials.Here is Markopolos' prepared testimony. Fascinating reading.

...

In the documents provided to the committee, he describes his efforts, which began as early as 1999, like a military intelligence operation. Mr. Markopolos said he and his team of investigators collected "intelligence reports from field" operatives and developed networks of contacts to provide information on Mr. Madoff's operation and the feeder funds that allegedly contributed to the Ponzi scheme.

The Residential Rental Market Update

by Calculated Risk on 2/03/2009 03:01:00 PM

Last month I provided an overview of the Residential Rental Market. Here is an update based on the Q4 2008 housing data from the Census Bureau.

See this earlier post for graphs of the homeownership rate, and homeowner and rental vacancy rates.

The supply of rental units has been surging: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been almost 4.1 million units added to the rental inventory. Note: please see caution on using this data - this number is probably too high, but the concepts are the same even with a lower increase.

This increase in units almost offset the recent strong migration from ownership to renting, so the rental vacancy rate has only declined slightly (from a peak of 10.4% in 2004 to 10.1% in the most recent quarter).

Where did these approximately 4.1 rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.05 million units completed as 'built for rent' since Q2 2004. Although we don't have the Q4 2008 data yet, we know completions were pretty low in Q4, so this means that another 3.0 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

Although there are several factors increasing the supply, I believe the main factors are a surge in REO sales to cash flow investors, and frustrated sellers putting their homes up for lease. This is increasing the supply of rental properties, and is finally pushing down rents in many areas.

A caution on Housing Vacancies and Homeownership report

by Calculated Risk on 2/03/2009 02:59:00 PM

This morning the Census Bureau released the Housing Vacancies and Homeownership for Q4 2008. This is a very useful report, and earlier I posted graphs of the decline in the homeownership rate, and changes in the homeowner and rental vacancy rates.

Nerd alert: I've mentioned this before, but as a reminder readers should use caution when using the Estimates of the Housing Inventory. The homeownership and vacancy rates come from a survey of a sample of households, but the inventory data is based on two year old housing unit controls. See the discussion at the bottom of Table 4. Estimates of the Total Housing Inventory

The totals shown above have a two-year time lag (4Q2007 uses 2005 housing unit controls from Population Division, which are projected forward and 4Q2008 uses 2006 housing unit controls from Population Division which are projected forward).We can clearly see the inventory increases are too high for 2007 and 2008. First, the inventory each year increases by the number of housing units completed, minus scrappage and net manufactured homes added (a few scrapped housing units may be rehab'd, but that is minor).

The Census data shows inventory increased by 1.998 million in 2007, and 2.191 million in 2008. These numbers are based on two year old housing unit controls and are clearly way too high. Total completions in 2007 were 1.502 million (plus 95 thousand manufactured homes) and completions were 1.116 million in 2008. Add in some scrappage, and the housing inventory probably increased by less than 1 million in 2008 (less than half the amount the Census Bureau reported this morning).

This is just a reminder that users should use caution when using the inventory numbers.

GM sales fall 48.9%, Toyota Off 32%

by Calculated Risk on 2/03/2009 01:51:00 PM

UPDATE: MarketWatch headline: Chrysler U.S. sales down 54.8% to 62,157 vehicles in January

MarketWatch headline: GM U.S. sales fall 48.9% to 128,198 units in January

From the WSJ: Ford's Sales Fall 40%, Toyota's Drop 32%

Toyota Motor Corp. reported a 32% drop, as the Japanese company sold 117,287 vehicles in the U.S. last month. Its passenger-car sales dropped to 67,263 from 94,586, while its light-truck sales fell to 50,024 from 77,263.Chrysler usually reports last, and they have seen the largest sales declines recently (53% year over year in December).

The good news is auto sales have to be closer to the bottom than the top!

Ford sales fall 42.1% in January

by Calculated Risk on 2/03/2009 12:12:00 PM

From MarketWatch: Ford posts 42.1% drop in January U.S. sales

Ford Motor Co. on Tuesday reported a 42.1% decline in January U.S. sales to 90,596 cars and trucks, down from 156,391 vehicles a year earlier.This is worse than the 32.4% year over year decline Ford reported in December, and the 31.5% decline reported in November.

GM, Toyota and Chrysler report later today.

Fed: Extends Loan Programs because of "Continuing substantial strains"

by Calculated Risk on 2/03/2009 12:03:00 PM

The Federal Reserve on Tuesday announced the extension through October 30, 2009, of its existing liquidity programs that were scheduled to expire on April 30, 2009. The Board of Governors and the Federal Open Market Committee (FOMC) took these actions in light of continuing substantial strains in many financial markets.

The Board of Governors approved the extension through October 30 of the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF), the Commercial Paper Funding Facility (CPFF), the Money Market Investor Funding Facility (MMIFF), the Primary Dealer Credit Facility (PDCF), and the Term Securities Lending Facility (TSLF). The FOMC also took action to extend the TSLF, which is established under the joint authority of the Board and the FOMC.

In addition, to address continued pressures in global U.S. dollar funding markets, the temporary reciprocal currency arrangements (swap lines) between the Federal Reserve and other central banks have been extended to October 30.

emphasis added

Q4: Homeownership Rate Declines to 2000 Level

by Calculated Risk on 2/03/2009 10:01:00 AM

So much for the homeownership gains of the last 8+ years. Gone.

This morning the Census Bureau reported the homeownership and vacancy rates for Q4 2008. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate decreased slightly to 67.5% and is now back to the levels of late 2000.

Note: graph starts at 60% to better show the change.

The homeowner vacancy rate was 2.9% in Q4 2008. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

This leaves the homeowner vacancy rate almost 1.2% above normal, and with approximately 75 million homeowner occupied homes; this gives about 900 thousand excess vacant homes.

The rental vacancy rate increased slightly to 10.1% in Q4 2008, from 9.9% in Q3.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.1% to 8%, there would be 2.1% X 40 million units or about 820,000 units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.1% to 8%, there would be 2.1% X 40 million units or about 820,000 units absorbed.

This would suggest there are about 820 thousand excess rental units in the U.S.

There are also approximately 150 thousand excess new homes above the normal inventory level (for home builders) - plus some uncounted condos.

If we add this up, 820 thousand excess rental units, 900 thousand excess vacant homes, and 150 thousand excess new home inventory, this gives about 1.87 million excess housing units in the U.S. that need to be absorbed over the next few years. (Note: this data is noisy, so it's hard to compare numbers quarter to quarter, but this is probably a reasonable approximation).

These excess units will keep pressure on housing starts and prices for some time.

I'll have some more later today ...

Pending Home Sales Index Increases in December

by Calculated Risk on 2/03/2009 10:00:00 AM

From the NAR: Pending Home Sales Show Healthy Gain

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in December, rose 6.3 percent to 87.7 from an upwardly revised reading of 82.5 in November, and is 2.1 percent higher than December 2007 when it was 85.9.Last month the Pending Home Sales Index declined, suggesting a decline in existing home sales for January. This report suggests a rebound in February - but also note Yun's comment - most of this rebound will be in areas with significant foreclosure resales.

...

Lawrence Yun, NAR chief economist, said the index shows a modest rebound. “The monthly gain in pending home sales, spurred by buyers responding to lower home prices and mortgage interest rates, more than offset an index decline in the previous month,” he said. “The biggest gains were in areas with the biggest improvements in affordability.”

emphasis added

Note: Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so the December report suggests existing home sales will increase from January to February.

More on the Inland Empire Bust

by Calculated Risk on 2/03/2009 09:28:00 AM

From the LA Times: Boom in Inland Empire industrial space is beginning to go bust

As the regional economy continues to sputter, vacancy rates are beginning to climb at warehouses and distribution centers for industrial goods, putting the already hard-hit Inland Empire at further risk of decline and threatening facilities in Los Angeles and Orange counties as well.The area is being hit hard by the housing bust - and now by the declines in trade and retail.

After years of high occupancy and rapid construction of cargo hubs, immense spaces are now standing empty. Some fell victim to the collapse of retailers such as Mervyns and Wickes Furniture; others are vacant because the huge national falloff in demand for consumer goods has meant fewer imports and less need for storing and shipping them.

...

Industrial vacancy in the Inland Empire doubled in the last year, from 6.2% in the fourth quarter of 2007 to 12.4% at the end of 2008, according to figures just released by brokerage Cushman & Wakefield.

Australia A$42 billion Stimulus Plan

by Calculated Risk on 2/03/2009 01:29:00 AM

From Bloomberg: Australia’s Dollar Strengthens After Rate Cut, Stimulus Plan

[T]he government said it will spend A$42 billion ($26.7 billion) on grants and infrastructure to counter the impact of the global financial crisis. The Reserve Bank of Australia lowered its benchmark rate 1 percentage point to 3.25 percent, two hours after the stimulus package was announced.This is about 4% of GDP, or the equivalent of close to a $600 billion stimulus for the U.S. (as percent of GDP). Although Australia had a housing bubble, they also had a budget surplus and a trade surplus - so I think they are in a stronger position than the U.S. or the U.K.

...

Australia’s stimulus package includes A$12.7 billion in grants to families and low-income earners and A$28.8 billion for infrastructure. It will help send the nation’s budget into a A$22.5 billion deficit, the first shortfall since fiscal 2001-02.

Monday, February 02, 2009

FDIC seeks to Increase Treasury Borrowing Limit

by Calculated Risk on 2/02/2009 09:10:00 PM

This should come as no surprise ...

From Reuters: FDIC seeks to triple Treasury Dept borrowing power

The Federal Deposit Insurance Corp is seeking to more than triple its credit line with the U.S. Treasury Department to $100 billion ... The FDIC and Congress are working to boost the agency's current $30 billion borrowing power ..."No immediate need". Famous last words.

The move comes as the FDIC's deposit insurance fund has shrunk due to a significant uptick in bank failures over the past year. The insurance fund's value dropped 24 percent in the 2008 third quarter to $34.6 billion.

...

"They have no immediate need for it, but they just want to make sure they're not constrained in the decision by a lack of the insurance fund," [U.S. Rep. Barney Frank, chairman of the House Financial Services Committee] told reporters ...

20 Million Migrant Worker Jobs Lost in China

by Calculated Risk on 2/02/2009 07:38:00 PM

This is a pretty stunning number ...

From the NY Times: Joblessness Jumps Sharply Among China’s Migrants

About 20 million of the total estimated 130 million migrant workers, whose cheap labor underpins China’s manufacturing sector, have been forced to return to rural areas because of lack of work, according to a survey conducted by the Agriculture Ministry that was cited at a briefing.

In late December, employment officials estimated that at least 10 million migrant workers had lost their jobs in the third quarter of 2008 as waves of factories and businesses shut their doors.

Fed: Lending Standards Tighten, Loan Demand Weakens in January

by Calculated Risk on 2/02/2009 03:26:00 PM

From the Fed: The January 2009 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the January survey, the net fractions of respondents that reported having tightened their lending policies on all major loan categories over the previous three months stayed very elevated. Relative to the October survey, these net fractions generally edged down slightly or remained unchanged. Respondents indicated that demand for loans from both businesses and households continued to weaken, on balance, over the survey period.

In response to the special questions on commercial real estate lending, significant net fractions of both foreign and domestic institutions reported having tightened over the past year all loan policies about which they were queried. At the same time, about 15 percent of domestic banks, on net, indicated that the shutdown of the securitization market for commercial mortgage-backed securities (CMBS) since the middle of 2008 has led to an increase in the extension of new commercial real estate loans at their bank.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of an imminent slump in CRE investment.

More charts here for residential mortgage, consumer loans and C&I.

Q4: Office, Mall and Lodging Investment

by Calculated Risk on 2/02/2009 02:38:00 PM

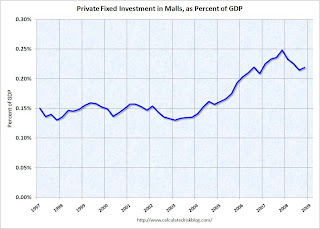

Let's start with a stunning graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging (based on data from the BEA) as a percent of GDP. The recent boom in lodging investment has been stunning. Lodging investment is now at 0.34% of GDP - an all time high - but all evidence suggests this investment is about to decline sharply.

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation. Investment in multimerchandise shopping structures (malls) increased slightly in Q4 2008, after peaking in Q4 2007.

Investment in multimerchandise shopping structures (malls) increased slightly in Q4 2008, after peaking in Q4 2007.

This is probably due to builders finishing projects or perhaps the numbers will be revised downwards. But it does appear new mall construction is about to stop.

As David Simon, Chief Executive Officer or Simon Property Group, the largest U.S. shopping mall owner said last week:

"The new development business is dead for a decade. Maybe it’s eight years. Maybe it’s not completely dead. Maybe I’m over-dramatizing it for effect."

The third graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q4 2008. With the office vacancy rate rising sharply, office investment will probably decline all this year.

The third graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q4 2008. With the office vacancy rate rising sharply, office investment will probably decline all this year.Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

I expect investment in all three categories - malls, lodging and offices - to decline sharply in 2009.

Macy's Cut 7,000 Jobs, Reduces Capital Spending Plans Again

by Calculated Risk on 2/02/2009 01:30:00 PM

From MarketWatch: Macy's cutting 4% of workforce, quarterly dividend

Macy's ... said Monday ... it will slash 7,000 jobs [and] reduced its 2009 capital expenditures budget to about $450 million ...It was just last November that Macy's cut their 2009 capital spending plans from $1 billion to $550 to $600 million. From an 8-K SEC filing in November 2008:

"In recognition of the weak economy, we reduced our budget for 2009 capital expenditures from approximately $1 billion to a range of $550 million to $600 million, compared with approximately $950 million in 2008."

Terry J. Lundgren, Macy's, Nov 12, 2008