by Calculated Risk on 11/12/2008 09:25:00 AM

Wednesday, November 12, 2008

Best Buy "rapid, seismic changes in consumer behavior"

"Since mid-September, rapid, seismic changes in consumer behavior have created the most difficult climate we've ever seen. Best Buy simply can't adjust fast enough to maintain our earnings momentum for this year."From WSJ: Sales Slump Pounds Best Buy

Brad Anderson, vice chairman and chief executive officer of Best Buy, Nov 12, 2008.

Best Buy Co. lowered its earnings outlook as the U.S. economic downturn has been quickly eroding sales at the consumer-electronics giant.Ouch.

...

Best Buy said sales at stores open at least a year slumped 7.6% last month following a 1.3% decline in September. As such, Best Buy now expects the measurement for the year ending Feb. 28 to fall 1% to 8%, with results for the last four months of the fiscal year -- which encompass the all-important holiday-shopping season -- potentially tumbling by between 5% to 15%. Best Buy had been expecting 2% to 3% growth in same-store sales for the year.

Tuesday, November 11, 2008

Apartment Market Weakens

by Calculated Risk on 11/11/2008 10:33:00 PM

From the National Multi Housing Council (NMHC): Weakening Economic Conditions Create Challenging Conditions For Apartment Sector, According to National Multi Housing Council Survey (hat tip Jon Lansner at the O.C. Register)

“Nine straight months of job losses have begun to cut into the demand for apartment residences,” said Mark Obrinsky, NMHC’s Vice President of Research and Chief Economist. “While favorable demographics and a lower homeownership rate will benefit the apartment industry over time, owners and managers will first have to work their way through the current economic downturn before the benefits of that increased demand are likely to show up. Until then, economic worry will cause some people to “double up” by moving in with a friend or returning to their parents’ house.”

The Market Tightness Index, which measures changes in occupancy rates and/or rents, dropped from 40 last quarter to 24. This was the fifth straight quarter in which the index has been below 50. (For all of the survey indexes, a reading above 50 indicates that, on balance, conditions are improving; a reading below 50 indicates that conditions are worsening; and a reading of 50 indicates that conditions are unchanged.)

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

As NMHC chief economist Obrinsky noted, it is common in a recession for apartment vacancies to rise, as households double up by moving in with a friend or family member. However an added factor in this recession is all the single family homes being offered as rentals. This is additional competition for apartments and might also be impacting demand for apartments.

Next Up: Bailout for U.S. Automakers

by Calculated Risk on 11/11/2008 08:51:00 PM

From Bloomberg: Pelosi Calls for `Emergency' Aid to U.S. Automakers

House Speaker Nancy Pelosi said she wants ``immediate action'' to give automakers additional aid ... The failure of ``one or more of the major American automobile manufacturers'' would have a ``devastating impact on our economy,'' Pelosi said in a statement ...Everyone wants a piece of the TARP.

She didn't specify the level of assistance she supports, but said it should come from the $700 billion Congress authorized the Treasury to use to help stabilize the financial services industry ... The three companies are seeking an additional $50 billion in federal loans

Hotel Occupancy Rates Expected to Decline Sharply

by Calculated Risk on 11/11/2008 05:01:00 PM

"In early October, we reported our third quarter earnings results and also provided observations about business for the rest of 2008 and into 2009. At that time, we expected business in late 2008 and 2009 to decline, but in just the last few weeks our business outlook has further weakened."From the USAToday: Most hotels likely to see occupancy rates fall next year

Bill Marriott, CEO Marriott Hotels (emphasis added)

In its 2009 forecast — completed in September, but revised after the stock market collapsed in October — PKF Consulting of Atlanta expects hotels to fill an average of just 58.3% of rooms, or a 4.4% drop in the occupancy expected this year. If true, that would be the worst occupancy rate at U.S. hotels since 1988, when Smith Travel Research started tracking the data.Restricting travel is a common response to a sudden slowdown in business. And along with falling demand, new investment in lodging is up over 200% from just two years ago! Falling demand and rising supply; a bad combination for the lodging and hotel construction businesses.

The current lowest occupancy rate, according to Smith Travel, was 59% in 2002 — the first full year after 9/11, the start of the Iraq war and the SARS epidemic. Separately, Smith Travel's revised forecast is for occupancy to drop 3.5% in 2009, to 59.1%.

"Toward the end of September, it was as if somebody, somewhere, hit the pause button," says Mark Woodworth, president of PKF Consulting.

FHFA Modification Program Details

by Calculated Risk on 11/11/2008 02:35:00 PM

Here is the press release from the FHFA. Note that this does not include principal reduction as a solution to create an affordable payment, and is limited to: "extending the term, reducing the interest rate, and forbearing interest".

This is intended to help "thousands" (a drop in the bucket unless it is several hundred thousand), and seems to encourage homeowners to stop making payments until they are 90 days late.

Here are some excerpts:

Q: What is a streamlined modification?

A: A streamlined modification is a modification that requires less documentation and less processing. In this case, the streamlined modification seeks to create a monthly mortgage payment that is sustainable for troubled borrowers by targeting a benchmark ratio of housing payment to monthly gross household income.

Q: What is the benchmark ratio?

A: This is the first time the industry has agreed on an industry standard. The benchmark ratio for calculating the affordable payment is 38 percent of monthly gross household income. Once the affordable payment is determined, there are several steps the servicer can take to create that payment – extending the term, reducing the interest rate, and forbearing interest. In the event that the affordable payment is still beyond the borrower’s means, the borrower’s situation will be reviewed on a case-by-case basis using a cash flow budget.

Q: Why is it necessary?

A: With the rise in serious delinquencies and increasing number of loans in foreclosure, this program will help borrowers who have missed three or more payments, but want to keep their homes. Because the eligibility requirements and process are streamlined and consistent, the program will allow servicers to reach more borrowers more quickly.

Q: Who is eligible?

A: The highest risk borrower, who has missed three payments or more, owns and occupies the property as a primary residence, and has not filed bankruptcy. The loan is a Freddie Mac, Fannie Mae or portfolio loan with participating investors. To qualify for the streamlined modification, the borrower must certify that he or she experienced a hardship or change in financial circumstances, and did not purposely default to obtain a modification.

Q: Why must the borrower be 90 days delinquent? Why not earlier in the delinquency cycle?

A: This is a streamlined solution targeted to reach the most at risk borrower. For borrowers who do not qualify, other solutions are available. This in no way substitutes for the meaningful efforts by all servicers and investors that are currently in place. The 212,000 workouts reported by HOPE NOIW in September are testimony to that fact. We will continue to see those efforts produce meaningful results.

Q: How many people will this help?

A: While difficult to assess, it is clear delinquencies are predicted to continue well into 2009. Foreclosure estimates are significant. Having a streamlined approach will assist many borrowers who default and more quickly. We estimate this will ultimately help thousands of borrowers.

Q: How do borrowers apply?

A: To be considered for the program, a seriously delinquent borrower should contact his or her servicer and provide the requested information – monthly gross household income, association dues and fees, and a hardship statement.

Q: How do borrowers complete the modification process?

A: Upon receiving the Modification Agreement from the servicer, the borrower signs it and returns it with the 1st payment at the modified terms along with income verification. Once the borrower makes three payments at the modified terms and the account is current as of day 90 of the modified plan, the modification is complete.

Q: When will servicers start offering this program?

A: We expect that by December 15th, servicers will be positioned to work with eligible borrowers.

GSE Foreclosure News Conference

by Calculated Risk on 11/11/2008 02:02:00 PM

Now on CNBC ...

Here is the CNBC feed.

Fannie, Freddie to Present Loan Mod Plan at 2PM ET

by Calculated Risk on 11/11/2008 12:19:00 PM

From the WSJ: Fannie, Freddie Work on Mass Loan Modification Plan

Fannie Mae, Freddie Mac and U.S. officials are expected to announce plans Tuesday to speed up the modification of hundreds of thousands of loans ... The streamlined effort will target certain loans that are 90 days or more past due ... The program will aim to bring the ratio of mortgage payments for these homeowners to 38% of their income by modifying interest rates and in some cases forgiving portions of principal debt ...

The announcement is expected to come at a press conference at 2 p.m. at the Federal Housing Finance Agency ...

LIBOR Declines to 2.18%

by Calculated Risk on 11/11/2008 11:36:00 AM

From Bloomberg: Libor for Dollars Falls as Central Banks Provide Cash Funding

The London interbank offered rate, or Libor, that banks charge each other for three-month loans in dollars slid 6 basis points to 2.18 percent today, the 22nd consecutive decline and the lowest level since Oct. 29, 2004, according to British Bankers' Association data.The three-month LIBOR was at 2.24% yesterday and the rate peaked at 4.81875% on October 10th.

The U.S. bond market is closed today for Veterans Day so many of the other indicators are not available.

Toll: Record Low Homebuyer Demand

by Calculated Risk on 11/11/2008 10:01:00 AM

"Unfortunately, the preliminary signs of stability we had discussed in early September, during our 2008 third quarter earnings call, were upended by the past month's financial crisis. Results of this crisis -- accelerating fears of job losses, a large decline in consumer spending, a significant capital crunch, increased credit market disruption, and plummeting stock market values -- all contributed to drive our cancellations up to 233 units (about 30% of current-quarter-contracts, or 9% of beginning-quarter-backlog), and drive home buyer confidence and our traffic and demand down to record lows."From MarketWatch: Home builder says buyer traffic, demand plummet after financial crisis

Robert Toll, CEO Toll Brothers, Nov 11, 2008

Unfortunately, the preliminary signs of stability we had discussed in early September, during our 2008 third quarter earnings call, were upended by the past month's financial crisis," said Chief Executive Robert Toll in a prepared statement.Not surprising. Also the cancellation rate rose to 30%, far above Toll's historical average of 7%, but still below the record highs of recent years.

The crisis contributed to pushing up cancellations and drove homebuyer confidence and the company's traffic and demand to record lows, the CEO said, pointing to "accelerating fears of job losses, a large decline in consumer spending, a significant capital crunch, increased credit market disruption, and plummeting stock market values."

...

"Given the significant uncertainty surrounding sales paces, cancellation rates, market direction, unemployment trends and numerous other aspects of the overall economy, we are not comfortable offering delivery, revenue or earnings guidance for the coming year," said Chief Financial Officer Joel Rassman.

Downey Savings: "Substantial Doubt" About Survival

by Calculated Risk on 11/11/2008 09:51:00 AM

From Reuters: Option ARM specialist Downey Financial may fail

Downey Financial Corp ... one of the largest specialists in "option" adjustable-rate mortgages, said on Monday its survival was in doubt because it may fail to raise enough capital to satisfy its regulators.Something to watch this friday!

In its quarterly report filed with the U.S. Securities and Exchange Commission, Downey said there was "substantial doubt" about its ability and that of its banking unit "to continue as going concerns for a reasonable period of time."

Major Mall Owner Warns of Possible Default

by Calculated Risk on 11/11/2008 01:07:00 AM

From the WSJ: Mall Owner Is Warning of Default

Ailing mall owner General Growth Properties Inc. warned Monday in a government filing that its failure to refinance or extend $1 billion in debt due this month could trigger default on billions of dollars in debt and its ability to continue operations would be in "substantial doubt."From the GGP 10-Q on the economy:

...

General Growth has $900 million in debt coming due Nov. 28 on two luxury malls on the Las Vegas strip. It has another $58 million in bonds due on Dec. 1.

Deteriorating economic conditions will have an adverse affect on our revenues and available cash, and may also impair our ability to sell our properties.

General and retail economic conditions continue to weaken, and we expect this weakness to continue and worsen in 2009 as the economy enters a recessionary or near recessionary period. Consumer spending recently declined for the first time in 17 years, the unemployment rate is expected to rise, consumer confidence has decreased dramatically and the stock market remains extremely volatile. Given these expected economic conditions, we believe there is a significantly increased risk that the sales of stores operating in our centers will decrease, negatively affecting their ability to make minimum rent payments and increasing the risk of tenant bankruptcies. In addition to the direct adverse effect of tenant failures to pay minimum rents and tenant bankruptcies on our operations, these events also negatively affect our ability to attract and maintain minimum rent levels for new tenants. These circumstances negatively affect our revenues and available cash, and also reduce the value of our properties, reducing the likelihood that we would be able to sell such properties, on attractive terms or at all.

Monday, November 10, 2008

The UK Retail Recession

by Calculated Risk on 11/10/2008 08:49:00 PM

From the Financial Times: Plunge in UK retail sales and home deals (hat tip Jonathan)

High street sales suffered their sharpest annual fall in nearly four years in October and home purchases fell to a record low ... in a further sign of the UK economy’s deepening woes.In the U.S., the year-over-year change in nominal retail sales went negative in September. The following graph shows the year-over-year change in nominal and real U.S. retail sales since 1993.

...

The BRC report says total retail sales were 0.1 per cent below their October 2007 level ... “A fall in the value of total sales is extremely rare,” said Helen Dickinson, head of retail at the consultancy KPMG.

...

The housing picture is no better, according to the RICS. The average number of completed sales per surveyor fell to 10.9 over the past three months, the weakest sales record since the survey began in 1978.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The Census Bureau reported that nominal retail sales decreased 1.0% year-over-year (retail and food services decreased 1.0%) in Septebmer, and real retail sales (adjusting with PCE) declined by 4.3% on a YoY basis.

Retail sales for October will be reported on Friday, and based on retailer reports, the numbers will be ugly.

AmEx to Become Bank Holding Company

by Calculated Risk on 11/10/2008 06:56:00 PM

Fed Press Release:

The Federal Reserve Board on Monday announced its approval of the applications and notices under sections 3 and 4 of the Bank Holding Company Act by American Express Company and American Express Travel Related Services Company, Inc., both of New York, New York, to become bank holding companies on conversion of American Express Centurion Bank, Salt Lake City, Utah, to a bank, and to retain certain nonbanking subsidiaries, including American Express Bank, FSB, Salt Lake City, Utah.American Express has approximately $127 billion in consolidated assets, and becoming a bank holding company allows access to financing from the Federal Reserve for some of these assets. More details are in the Fed Order.

Fannie: $100 Billion May Not be Enough

by Calculated Risk on 11/10/2008 05:49:00 PM

From Bloomberg: Fannie Says $100 Billion Pledge From Treasury May Not Be Enough

Fannie Mae may need more than the $100 billion in funding pledged by the U.S. Treasury to stay afloat after reporting a record $29 billion loss and confronting more difficulty in issuing and refinancing debt.Here is the Fannie 10-Q filed with the SEC. This statement is under "Risks Relating to Our Business" and is not a prediction from Fannie, just a statement of a possible risk. The huge loss reported today was mostly because of a reduction in deferred tax assets.

``This commitment may not be sufficient to keep us in solvent condition or from being placed into receivership,'' if there are further ``substantial'' losses or if the company is unable to sell unsecured debt, Washington-based Fannie said in a filing today with the U.S. Securities and Exchange Commission.

Here are a few excerpts from the Fannie section on Housing and Economic Conditions:

Growth in U.S. residential mortgage debt outstanding slowed to an estimated annual rate of 2.0% based on the first six months of 2008, compared with an estimated annual rate of 8.3% based on the first six months of 2007, and is expected to continue to decline to a growth rate of about 0% in 2009.

We continue to expect that home prices will decline 7% to 9% on a national basis in 2008, and that home prices nationally will decline 15% to 19% from their peak in 2006 before they stabilize. Through September 30, 2008, home prices nationally have declined 10% from their peak in 2006. (Our estimates compare to approximately 12% to 16% for 2008, and 27% to 32% peak-to-trough, using the Case-Schiller index.) We currently expect home price declines at the top end of our estimated ranges. We also expect significant regional variation in these national home price decline percentages, with steeper declines in certain areas such as Florida, California, Nevada and Arizona. The deteriorating economic conditions and related government actions that occurred in the third quarter of 2008 have increased the uncertainty of future economic conditions, including home price movements. Therefore, while our peak-to-trough home price forecast is at the top end of the 15% to 19% range, there is increasing uncertainty about the actual amount of decline that will occur.So Fannie is expecting house price declines of around 32% using the Case-Shiller index.

Credit Crisis Indicators: Little Progress

by Calculated Risk on 11/10/2008 01:32:00 PM

A daily update ... day to day there has been little progress, but overall most indicators have improved since the crisis started.

As an example, the LIBOR is down sharply from 4.82% on Oct 10th to 2.24% today. And the TED spread is at 2.0% from 4.63%. The progress is slow, but there has been progress.

The London interbank offered rate, or Libor, that banks say they charge each other for such loans declined 5 basis points to 2.24 percent today, the lowest level since November 2004, the British Bankers' Association said.The three-month LIBOR was at 2.29% on Friday. The rate peaked at 4.81875% on Oct. 10. (Better)

With the effective Fed Funds rate at 0.23% (as of Friday), this is probably somewhat in the right range. At some point, I'd like to see the effective Fed funds rate close to the target rate (currently 1.0%).

The TED spread is around 2.0, but still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is about 0.5.

Here is a list of SFP sales. It has been a few days without an announcement from the Treasury... (no progress).

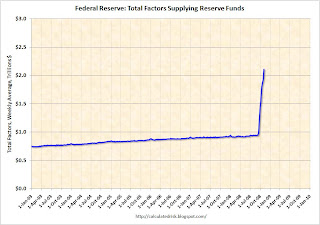

Click on graph for larger image in new window.

The Federal Reserve assets increased $105 billion last week to $2.075 trillion. Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

So far the Federal Reserve assets are still increasing rapidly. It will be a good sign - sometime in the future - when the Fed assets start to decline.

Graph from the Fed.

Graph from the Fed.This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.82% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. But it now sounds like the Fed might intervene in other companies and just the talk of possible Fed action is probably pushing down the A2/P2 rates. If the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is flat - so there is little progress today - and any progress is coming directly from Fed intervention and increases in the Fed balance sheet, so there is still a long way to go.

Retail: Quotes of the Day

by Calculated Risk on 11/10/2008 12:34:00 PM

A couple of great quotes:

"There's a new realization that holding a gift card from a troubled retailer is like having a bank account without FDIC insurance."From the LA Times: Gift card holders may be out of luck in retail bankruptcies. Gift card buyers beware ...

Jerry Hirsch writing in the LA Times

Note that the Circuit City bankruptcy is somewhat unusual in that most retailers file for bankruptcy after the holiday season. Bloomberg had an article about this last week: `Tis the Season for Retailer Visions of Liquidations

In the last quarter century, about a fifth of large retailers that went bankrupt, including RH Macy & Co. Inc. and FAO Schwarz, did so in January, using holiday sales cash to jump-start reorganizations or finance liquidations.And the second quote of the day:

...

From 1980 to 2008, of the 105 large public retailers that filed for bankruptcy with assets of more then $100 million, only seven did so in December ... That was less than half the 18 that did so in January --the most popular filing month for large retailers ...

This bankruptcy season is different. ...

"Confidence has deteriorated so badly that merchants and bankers don't even believe in Santa Claus any more."Maybe this year is a little different than normal with more bankruptcies before the holidays, but I expect to see more retailer bankruptcies in early 2009.

Martin Zohn, a bankruptcy lawyer in New York, from Bloomberg article.

Fed and Treasury announce restructuring of AIG financial support

by Calculated Risk on 11/10/2008 09:33:00 AM

The Federal Reserve Board and the U.S. Treasury on Monday announced the restructuring of the government's financial support to the American International Group (AIG) in order to keep the company strong and facilitate its ability to complete its restructuring process successfully. These new measures establish a more durable capital structure, resolve liquidity issues, facilitate AIG's execution of its plan to sell certain of its businesses in an orderly manner, promote market stability, and protect the interests of the U.S. government and taxpayers.Plus some new credit facilities from the Fed.

Equity Purchase

The U.S. Treasury on Monday announced that it will purchase $40 billion of newly issued AIG preferred shares under the Troubled Asset Relief Program. This purchase will allow the Federal Reserve to reduce from $85 billion to $60 billion the total amount available under the credit facility established by the Federal Reserve Bank of New York (New York Fed) on September 16, 2008.

In one new facility, the New York Fed will lend up to $22.5 billion to a newly formed limited liability company (LLC) to fund the LLC’s purchase of residential mortgage-backed securities from AIG's U.S. securities lending collateral portfolio. ... As a result, the $37.8 billion securities lending facility established by the New York Fed on October 8, 2008, will be repaid and terminated.

...

In the second new facility, the New York Fed will lend up to $30 billion to a newly formed LLC to fund the LLC's purchase of multi-sector collateralized debt obligations (CDOs) on which AIG Financial Products has written credit default swap (CDS) contracts.

Circuit City Files Bankruptcy

by Calculated Risk on 11/10/2008 09:18:00 AM

From the WSJ: Circuit City Files for Bankruptcy

Troubled electronics retailer Circuit City Stores Inc. filed for Chapter 11 bankruptcy Monday in an effort to stay ahead of lenders owed $898 million.There is a good chance that Circuit City will be gone in January - another serious blow for mall owners.

...

The lenders have agreed to loan Circuit City $1.1 billion to keep the retailer's doors open through the holiday season.

Larger Bailout for AIG

by Calculated Risk on 11/10/2008 12:28:00 AM

From the NY Times: A.I.G. May Get More in Bailout

The Treasury Department and the Federal Reserve were near a deal to abandon the initial bailout plan and invest another $40 billion in the company ... When the restructured deal is complete, taxpayers will have invested and lent a total of $150 billion to A.I.G., the most the government has ever directed to a single private enterprise. ... The revised deal, which may be announced as early as Monday morning ...What a mess ...

Sunday, November 09, 2008

"A microcosm" of CRE in New York

by Calculated Risk on 11/09/2008 07:24:00 PM

Charles Bagli at the NY Times provides some details for one building in New York: Market’s Collapse Echoes in a Manhattan Tower

The first sign of trouble came over the summer when iStar Financial, a real estate finance company, decided not to move into the 100,000 square feet of space ...Sublease space really hurt the NY office market in previous downturns, and it appears to be happening again.

Several weeks later, Metropolitan Life Insurance ... quietly began shopping for tenants to sublease 100,000 square feet ...

And last month, Centerline Capital Group, a suddenly struggling commercial property finance and investment company, confirmed that it would not be moving into its 100,000 square feet ...

The companies signed leases for as much as $132 a square foot ... many brokers say they would be lucky to get $95 a square foot today.