by Calculated Risk on 12/31/2020 08:37:00 AM

Thursday, December 31, 2020

Weekly Initial Unemployment Claims decreased to 787,000

The DOL reported:

In the week ending December 26, the advance figure for seasonally adjusted initial claims was 787,000, a decrease of 19,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 803,000 to 806,000. The 4-week moving average was 836,750, an increase of 17,750 from the previous week's revised average. The previous week's average was revised up by 750 from 818,250 to 819,000.This does not include the 308,262 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 396,948 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 836,750.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 5,393,440 (SA) from 5,457,941 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 8,459,647 receiving Pandemic Unemployment Assistance (PUA) that decreased from 9,271,112 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

This was close to expectations.

Wednesday, December 30, 2020

December 30 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 12/30/2020 07:17:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,559,541 test results reported over the last 24 hours.

There were 224,638 positive tests.

Almost 74,000 US deaths have been reported so far in December, far surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 14.4% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

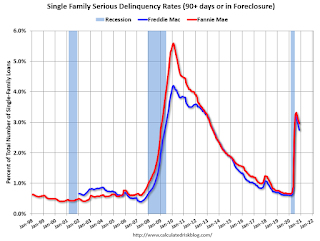

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in November

by Calculated Risk on 12/30/2020 05:25:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 2.96% in November, from 3.05% in October. The serious delinquency rate is up from 0.66% in November 2019.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 5.87% are seriously delinquent (up from 5.82% in October). For loans made in 2005 through 2008 (3% of portfolio), 10.00% are seriously delinquent (up from 9.84%), For recent loans, originated in 2009 through 2018 (95% of portfolio), 2.48% are seriously delinquent (down from 2.57%). So Fannie is still working through a few poor performing loans from the bubble years.

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.

Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

by Calculated Risk on 12/30/2020 12:51:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2021. I'm adding some thoughts, and maybe some predictions for each question.

6) Monetary Policy: The Fed cut rates to zero in 2020 in response to the pandemic, and has signaled they will be on hold for some time. Will the Fed raise rates in 2021? Will the Fed end - or taper - the asset purchase program?

In March, in response to the pandemic, the Fed cut rates to essentially zero:

"Effective March 23, 2020, the Federal Open Market Committee directs the Desk to undertake open market operations as necessary to maintain the federal funds rate in a target range of 0 to 1/4 percent."In addition, the Fed has been buying assets, from the December statement:

"the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee's maximum employment and price stability goals."An important point: The Fed will look through any blip in inflation in 2021 (there will be some weird distortions in the numbers).

emphasis added

| FOMC Members 2021 | FOMC Members 2022 | |

|---|---|---|

| No Change | 17 | 16 |

| One Rate Hike | 0 | 1 |

Clearly the main view of the FOMC is no change in policy in 2021.

the Fed explicitly intends to hold the size of purchase at or above the current pace until the Fed achieves clear further progress toward its economic objective. Note though that “further progress” is not complete progress. The Fed will pull back on the asset purchase program before raising interest rates. When and under what conditions? Powell declined to answer that question but did promise there would be advance notice. Look for that notice to begin next year if the economy looks to rebound strongly as expected by mid-2021.There will be no rate hike in 2021, and since I'm assuming the pandemic will subside by mid-year 2021, it seems likely the Fed will taper asset purchases sometime in the second half of 2021.

Here are the Ten Economic Questions for 2021 and a few predictions:

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

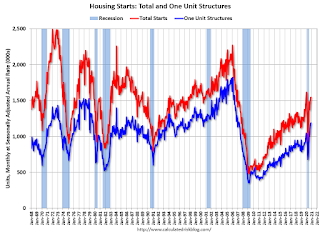

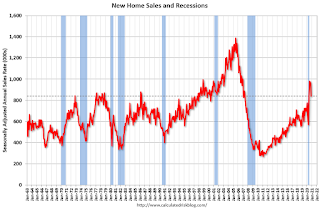

Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

by Calculated Risk on 12/30/2020 11:41:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2021. I'm adding some thoughts, and maybe some predictions for each question.

7) Residential Investment: Residential investment (RI) was solid in 2020, and housing was a strong sector during the pandemic. Through November, starts were up 7.0% year-over-year compared to the same period in 2019. New home sales were up 19.1% year--to-date through November. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2021? How about housing starts and new home sales in 2021?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2020:

Residential investment (RI) increased at a 59.3% annual rate in Q3. And RI, as percent of GDP, increased sharply in Q3.

Note that RI as a percent of GDP is still fairly low and not far above the lows of previous recessions.

The second graph shows total and single family housing starts through November 2020.

The second graph shows total and single family housing starts through November 2020.Starts, year-to-date, are up 7.0% compared to the same period in 2019. Note that starts were up solidly prior to the pandemic, and then bounced back strong.

Even after the significant increase over the last several years, and the solid increase in 2020, the approximately 1.38 million housing starts in 2020 will still be the 34th highest on an annual basis since the Census Bureau started tracking starts in 1959 (34 out of 62 total years - middle of the pack).

The third graph shows New Home Sales since 1963 through November 2020. The dashed line is the November sales rate.

The third graph shows New Home Sales since 1963 through November 2020. The dashed line is the November sales rate.New home sales in 2020, through November, were up 19.1% compared to the same period in 2019. This will be the strongest year for new home sales since 2006.

Here is a table showing housing starts and new home sales since 2005. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will increase further this cycle.

| Housing Starts and New Home Sales (000s) | ||||

|---|---|---|---|---|

| Housing Starts | Change | New Home Sales | Change | |

| 2005 | 2,068 | --- | 1,283 | --- |

| 2006 | 1,801 | -12.9% | 1,051 | -18.1% |

| 2007 | 1,355 | -24.8% | 776 | -26.2% |

| 2008 | 906 | -33.2% | 485 | -37.5% |

| 2009 | 554 | -38.8% | 375 | -22.7% |

| 2010 | 587 | 5.9% | 323 | -13.9% |

| 2011 | 609 | 3.7% | 306 | -5.3% |

| 2012 | 781 | 28.2% | 368 | 20.3% |

| 2013 | 925 | 18.5% | 429 | 16.6% |

| 2014 | 1,003 | 8.5% | 437 | 1.9% |

| 2015 | 1,112 | 10.8% | 501 | 14.6% |

| 2016 | 1,174 | 5.6% | 561 | 12.0% |

| 2017 | 1,203 | 2.5% | 613 | 9.3% |

| 2018 | 1,249 | 3.9% | 617 | 0.7% |

| 2019 | 1,290 | 3.2% | 683 | 10.7% |

| 20201 | 1,380 | 7.0% | 810 | 18.6% |

| 12020 estimated | ||||

Most analysts are looking for starts and new home sales to increase further in 2021. For example, Fannie Mae expects new home sales to increase to 872 thousand, and the MBA is forecasting 960 thousand in 2021.

Note that New Home sales have averaged 941 thousand over the last five months on seasonally adjust annual rate (SAAR) basis. So most forecasts are for sales to be relatively flat relative to the last five months.

My guess is starts will be up year-over-year in 2021 by high single digits. However, my guess is new home sales will soften in the second half of 2021 (based on my expectation of more existing home inventory), and will be up mid single digits (a decline from the sales rate over the last 5 months). It is even possible that sales will be flat to slightly down in 2021, but that will depend on inventory and the course of the pandemic.

Here are the Ten Economic Questions for 2021 and a few predictions:

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

NAR: Pending Home Sales Decrease 2.6% in November

by Calculated Risk on 12/30/2020 10:03:00 AM

From the NAR: Pending Home Sales Slide 2.6% in November

Pending home sales declined in November, according to the National Association of Realtors®. Month-over-month contract activity fell in each of the four major U.S. regions. However, compared to a year ago, all four areas achieved gains in pending home sales transactions.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 2.6% to 125.7 in November, the third straight month of decline. Year-over-year, contract signings climbed 16.4%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI slid 3.3% to 108.6 in November, a 15.3% increase from a year ago. In the Midwest, the index fell 3.1% to 115.9 last month, up 14.1% from November 2019.

Pending home sales in the South decreased 1.1% to an index of 150.0 in November, up 21.3% from November 2019. The index in the West fell 4.7% in November to 111.3, which is up 10.4% from a year ago.

emphasis added

Tuesday, December 29, 2020

Wednesday: Pending Home Sales

by Calculated Risk on 12/29/2020 09:15:00 PM

Wednesday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for December.

• At 10:00 AM, Pending Home Sales Index for November. The consensus is for a 0.2% increase in the index.

December 29 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 12/29/2020 07:12:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,236,471 test results reported over the last 24 hours.

There were 194,512 positive tests.

Almost 70,000 US deaths have been reported so far in December, far surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 15.7% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

Zillow Case-Shiller House Price Forecast: "Nothing Short of Remarkable", 9.5% YoY in November

by Calculated Risk on 12/29/2020 02:55:00 PM

The Case-Shiller house price indexes for October were released today. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: October Case-Shiller Results & November Forecast: Nothing Short of Remarkable

The path of home prices in recent months has been nothing short of remarkable. In many places across the country, and in the nation overall, home prices are growing by some measures at their fastest pace in decades. Record low mortgage rates, a wave of households aging into homeownership and a limited number of homes for sale all combined to stoke competition for houses and placed consistent upward pressure on prices for the better part of the last calendar year. These factors appear likely to remain in place in the near term, and an incrementally improving economy should encourage more buyers to enter the market. Taken together, this torrid pace of home price appreciation appears primed to continue well into 2021.

...

Monthly growth in November as reported by Case-Shiller is expected to slow slightly from October in all three main indices, while annual growth is expected to accelerate across the board. S&P Dow Jones Indices is expected to release data for the November S&P CoreLogic Case-Shiller Indices on Tuesday, January 26.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 9.5% in November, up from 8.4% in October.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 9.5% in November, up from 8.4% in October. The Zillow forecast is for the 20-City index to be up 8.9% YoY in November from 7.9% in October, and for the 10-City index to increase to be up 8.4% YoY compared to 7.5% YoY in October.

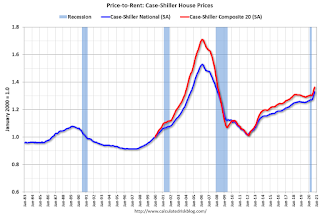

Real House Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/29/2020 12:05:00 PM

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 8.4% year-over-year in October

It has been over fourteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 24.3% above the previous bubble peak. However, in real terms, the National index (SA) is still about at the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 8% below the bubble peak.

The year-over-year growth in prices increased to 8.4% nationally.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $291,000 today adjusted for inflation (45%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to the bubble peak, and the Composite 20 index is back to early 2005.

In real terms, house prices are at 2005 levels.

Note that inflation was negative for a few months earlier this year, and that boosted real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio had been moving mostly sideways, but picked up recently.

On a price-to-rent basis, the Case-Shiller National index is back to September 2004 levels, and the Composite 20 index is back to March 2004 levels.

In real terms, prices are back to 2005 levels, and the price-to-rent ratio is back to 2004.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |