by Calculated Risk on 12/30/2020 10:03:00 AM

Wednesday, December 30, 2020

NAR: Pending Home Sales Decrease 2.6% in November

From the NAR: Pending Home Sales Slide 2.6% in November

Pending home sales declined in November, according to the National Association of Realtors®. Month-over-month contract activity fell in each of the four major U.S. regions. However, compared to a year ago, all four areas achieved gains in pending home sales transactions.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 2.6% to 125.7 in November, the third straight month of decline. Year-over-year, contract signings climbed 16.4%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI slid 3.3% to 108.6 in November, a 15.3% increase from a year ago. In the Midwest, the index fell 3.1% to 115.9 last month, up 14.1% from November 2019.

Pending home sales in the South decreased 1.1% to an index of 150.0 in November, up 21.3% from November 2019. The index in the West fell 4.7% in November to 111.3, which is up 10.4% from a year ago.

emphasis added

Tuesday, December 29, 2020

Wednesday: Pending Home Sales

by Calculated Risk on 12/29/2020 09:15:00 PM

Wednesday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for December.

• At 10:00 AM, Pending Home Sales Index for November. The consensus is for a 0.2% increase in the index.

December 29 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 12/29/2020 07:12:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,236,471 test results reported over the last 24 hours.

There were 194,512 positive tests.

Almost 70,000 US deaths have been reported so far in December, far surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 15.7% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

Zillow Case-Shiller House Price Forecast: "Nothing Short of Remarkable", 9.5% YoY in November

by Calculated Risk on 12/29/2020 02:55:00 PM

The Case-Shiller house price indexes for October were released today. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: October Case-Shiller Results & November Forecast: Nothing Short of Remarkable

The path of home prices in recent months has been nothing short of remarkable. In many places across the country, and in the nation overall, home prices are growing by some measures at their fastest pace in decades. Record low mortgage rates, a wave of households aging into homeownership and a limited number of homes for sale all combined to stoke competition for houses and placed consistent upward pressure on prices for the better part of the last calendar year. These factors appear likely to remain in place in the near term, and an incrementally improving economy should encourage more buyers to enter the market. Taken together, this torrid pace of home price appreciation appears primed to continue well into 2021.

...

Monthly growth in November as reported by Case-Shiller is expected to slow slightly from October in all three main indices, while annual growth is expected to accelerate across the board. S&P Dow Jones Indices is expected to release data for the November S&P CoreLogic Case-Shiller Indices on Tuesday, January 26.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 9.5% in November, up from 8.4% in October.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 9.5% in November, up from 8.4% in October. The Zillow forecast is for the 20-City index to be up 8.9% YoY in November from 7.9% in October, and for the 10-City index to increase to be up 8.4% YoY compared to 7.5% YoY in October.

Real House Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/29/2020 12:05:00 PM

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 8.4% year-over-year in October

It has been over fourteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 24.3% above the previous bubble peak. However, in real terms, the National index (SA) is still about at the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 8% below the bubble peak.

The year-over-year growth in prices increased to 8.4% nationally.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $291,000 today adjusted for inflation (45%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

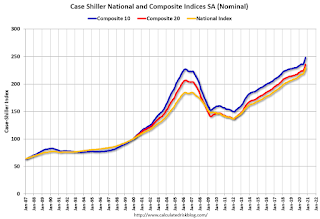

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to the bubble peak, and the Composite 20 index is back to early 2005.

In real terms, house prices are at 2005 levels.

Note that inflation was negative for a few months earlier this year, and that boosted real prices.

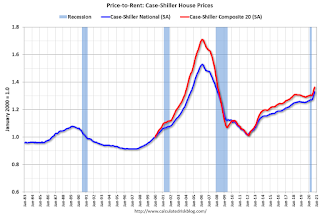

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio had been moving mostly sideways, but picked up recently.

On a price-to-rent basis, the Case-Shiller National index is back to September 2004 levels, and the Composite 20 index is back to March 2004 levels.

In real terms, prices are back to 2005 levels, and the price-to-rent ratio is back to 2004.

Question #8 for 2021: What will happen with house prices in 2021?

by Calculated Risk on 12/29/2020 11:13:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2021. I'm adding some thoughts, and maybe some predictions for each question.

8) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up around 8% to 9% in 2020. What will happen with house prices in 2021?

The following graph shows the year-over-year change through October 2020, in the seasonally adjusted Case-Shiller Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA is up 7.5% compared to October 2019. The Composite 20 SA is up 7.9% year-over-year.

The National index SA is up 8.4% year-over-year. Other house price indexes have indicated similar gains (see table below).

The YoY price increases in 2020 were the strongest since 2013.

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | October | 7.9% |

| Case-Shiller National | October | 8.4% |

| CoreLogic | October | 7.3% |

| FHFA House Price Index | October | 10.2% |

There are a wide range of price forecasts for 2021, from around 2% YoY growth to as much as 10%.

Here was Zillow's comment today on Case-Shiller:

"Record low mortgage rates, a wave of households aging into homeownership and a limited number of homes for sale all combined to stoke competition for houses and placed consistent upward pressure on prices for the better part of the last calendar year. These factors appear likely to remain in place in the near term, and an incrementally improving economy should encourage more buyers to enter the market. Taken together, this torrid pace of home price appreciation appears primed to continue well into 2021."Inventories will probably increase, especially in the 2nd half of 2021, but will most likely still be somewhat low historically. Also, prices tend to have momentum, so unless mortgage rates increase sharply (unlikely) or inventories rise quicker than expected, we should expect further price increases in 2021. Watching inventory will be important to adjust this forecast!

Here are the Ten Economic Questions for 2021 and a few predictions:

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

Case-Shiller: National House Price Index increased 8.4% year-over-year in October

by Calculated Risk on 12/29/2020 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P CoreLogic Case-Shiller Index Shows Annual Home Price Gains Soared to 7% in September

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported an 8.4% annual gain in October, up from 7.0% in the previous month. The 10-City Composite annual increase came in at 7.5%, up from 6.2% in the previous month. The 20-City Composite posted a 7.9% year-over-year gain, up from 6.6% in the previous month.

Phoenix, Seattle and San Diego continued to report the highest year-over-year gains among the 19 cities (excluding Detroit) in October. Phoenix led the way with a 12.7% year-over-year price increase, followed by Seattle with an 11.7% increase and San Diego with an 11.6% increase. All 19 cities reported higher price increases in the year ending October 2020 versus the year ending September 2020.

...

The National Index posted a 1.4% month-over-month increase, while the 10-City and 20-City Composites both posted increases of 1.4% and 1.3% respectively, before seasonal adjustment in October. After seasonal adjustment, the National Index posted a month-over-month increase of 1.7%, while the 10-City and 20-City Composites both posted increases of 1.6%. In October, all 19 cities (excluding Detroit) reported increases before and after seasonal adjustment.

“The surprising strength we noted in last month’s report continued into October’s home price data,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “The National Composite Index gained 8.4% relative to its level a year ago, accelerating from September’s 7.0% increase. The 10- and 20-City Composites (up 7.5% and 7.9%, respectively) also rose more rapidly in October than they had done in September. The housing market’s strength was once again broadly-based: all 19 cities for which we have October data rose, and all 19 gained more in the 12 months ended in October than they had gained in the 12 months ended in September.

“We’ve noted before that a trend of accelerating increases in the National Composite Index began in August 2019 but was interrupted in May and June, as COVID-related restrictions produced modestlydecelerating price gains. Since June, our monthly readings have shown accelerating growth in home prices, and October’s results emphatically emphasize that trend. The last time that the National Composite matched this month’s 8.4% growth rate was more than six and a half years ago, in March 2014. Although the full history of the pandemic’s impact on housing prices is yet to be written, the data from the last several months are consistent with the view that COVID has encouraged potential buyers to move from urban apartments to suburban homes. We’ll continue to monitor what the data can tell us about this question

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.6% in October (SA) from September.

The Composite 20 index is up 1.6% (SA) in October.

The National index is 24.3% above the bubble peak (SA), and up 1.7% (SA) in October. The National index is up 68% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 7.5% compared to October 2019. The Composite 20 SA is up 7.9% year-over-year.

The National index SA is up 8.4% year-over-year.

Note: According to the data, prices increased in 19 cities month-over-month seasonally adjusted.

Price increases were above expectations. I'll have more later.

Monday, December 28, 2020

Tuesday: Case-Shiller House Prices

by Calculated Risk on 12/28/2020 09:11:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: Uneventful Day Despite Covid Relief Bill

The big news at the end of last week was Trump's decision to veto the covid relief/spending bill. After he signed it last night, overnight markets began pointing toward higher rates. 10yr yields were roughly 3bps higher to start the day, but it was all downhill from there (in a good way). MBS led the charge early. Treasuries ultimately broke even ... [30 Year Mortgage Rate for Top Tier Scenarios: 2.79%].Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for October. The consensus is for a 7.2% year-over-year increase in the National index for October. Note that Zillow is forecasting Case-Shiller will report a 7.7% YoY increase in the National index.

December 28 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 12/28/2020 07:02:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,540,320 test results reported over the last 24 hours.

There were 162,190 positive tests.

Almost 67,000 US deaths have been reported so far in December, surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.5% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

by Calculated Risk on 12/28/2020 02:14:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2021. I'm adding some thoughts, and maybe some predictions for each question.

9) Housing Inventory: Housing inventory decreased sharply in 2020 to record lows. Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 (blue arrow on first graph below) helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see red arrow) helped me call the top for house prices in 2006.

Back in 2019, when several commentators were bearish on housing, I pointed out there was no sharp increase in housing inventory (like in 2005), and that was one of the reasons I remained optimistic on housing and the economy (correctly!).

This graph shows nationwide inventory for existing homes through November 2020.

Click on graph for larger image.

Click on graph for larger image.According to the NAR, inventory decreased to 1.28 million in November from 1.42 million in October. And inventory in November was down from 1.64 million in November 2019.

Note that inventory was already pretty low in 2017, 2018 and 2019. Prior to 2020, two of the key reasons inventory was low:

1) A large number of single family home and condos were converted to rental units. In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors. Most of these rental conversions were at the lower end, and that limited the supply for first time buyers.

2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80). The leading edge of the boomers are now turning 76 or so, and the boomers selling will probably gradually increase over the next 10 years.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory was down 22% year-over-year in November compared to November 2019. Months of supply decreased to 2.3 months in November (an all time low).

In 2020, inventory really declined due to a combination of potential sellers keeping their properties off the market during a pandemic, and a pickup in buying due to record low mortgage rates, a move away from multi-family rentals and strong second home buying (to escape the high-density cities).

And at the same time, demographics are now favorable for home buying (a large cohort has moved into the peak home buying years).

First, making the assumption that the pandemic will be mostly over by mid-2021, we can make a few general predictions:

1. Potential sellers will be more willing to list their homes in the Summer and the second half of 2021 (and allow strangers into their homes).

2. The move away from dense cities will slow and maybe end. What makes cities attractive (jobs, cultural events and other entertainment), hasn't been available during the pandemic. That will change when the pandemic ends, and cities will be attractive again. Of course, the trends toward remote working, online shopping and home entertainment will likely continue, and this will allow some people to live anywhere.

Here are the Ten Economic Questions for 2021 and a few predictions:

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?